- Home

- »

- Plastics, Polymers & Resins

- »

-

Polycarbonate Market Size, Share & Trends Report, 2030GVR Report cover

![Polycarbonate Market Size, Share & Trends Report]()

Polycarbonate Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Automotive & Transportation, Electrical & Electronics, Construction, Packaging, Consumer Goods), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-269-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polycarbonate Market Summary

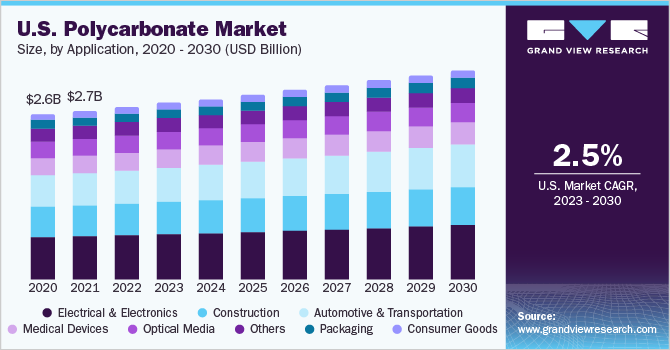

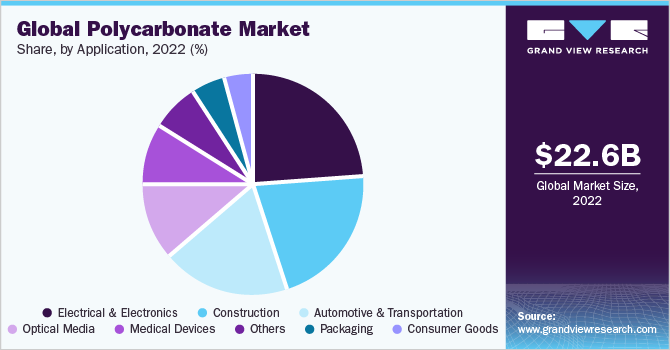

The global polycarbonate market size was estimated at USD 22,594.10 million in 2022 and is projected to reach USD 29,714.83 million by 2030, growing at a CAGR of 3.5% from 2023 to 2030. The global polycarbonate market size was valued at USD 22,594.10 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.5% from 2023 to 2030. The resin finds applications across a wide range of industries, including automotive & transportation, consumer goods, construction, packaging, and medical devices.

Key Market Trends & Insights

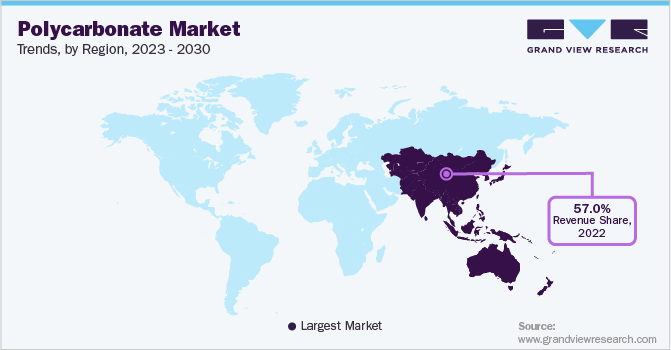

- Asia Pacific dominated the market and accounted for more than 57.0% share of global revenue in 2022.

- In China, the polycarbonate industry value in the construction segment is expected to reach USD 1.93 billion by 2024.

- By application, the electrical & electronics segment held a share of more than 24.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 22,594.10 Million

- 2030 Projected Market Size: USD 29,714.83 Million

- CAGR (2023-2030): 3.5%

- Asia Pacific: Largest market in 2022

In recent years, the industry has seen enormous demand from car manufacturers as a result of rules encouraging vehicle weight reduction and the subsequent, increased use of plastics. The U.S. polycarbonate industry is expected to rise significantly over the forecast period. Polycarbonate resins are highly blended with other polymers such as ABS and are often used in the fabrication of automotive components.

The greater processing ability of PC resins using foam molding, injection molding, extrusion, and vacuum forming has enabled end-users to explore further options for resin usage. Niche application areas such as safety equipment and industrial machinery are likely to gain demand in the future.

Regulations have a significant impact on industry dynamics and application trends. Regulations aimed at the reduction of plastic trash and its disposal by the US government have resulted in a higher emphasis on recycling practices. Due to the recyclable nature of resins, this trend is predicted to play a key part in strengthening polycarbonate's role as a substitute for plastic.

Application Insights

The electrical & electronics segment held a share of more than 24.0% in 2022 and is expected to maintain a healthy growth rate over the forecast period. Polycarbonates are widely utilized in the electrical and electronics industries to manufacture a wide range of corresponding equipment. Switching relays, LCD sections, sensor parts, cell phones, connections, and computers are some of the most commonly used parts due to their minimal weight and significant strength. Due to the high efficiency of polycarbonates as thermal insulators, they are commonly used for wire insulation in the electrical and electronics sectors.

The packaging application category is likely to present the most growth potential for polycarbonate compounding, as the product's steam and dry heat resilience has been critical in replacing other thermosets and glass materials. Automotive is one of the major application markets for plastics, which is anticipated to provide growth opportunities for polycarbonate compounds. As a substitute for glass, PC compounds are laminated to produce bullet-proof windows and are conventionally used in headlamps.

Polycarbonate demand in electrical and automotive applications has increased significantly in recent years. The product is easily moldable and flexible. Hence, it is ideal for thermoforming applications. Some plastic compounds are resistant and durable, while others are optically transparent, making them easy to manufacture. Furthermore, rising expenditure on public infrastructure, particularly metro-rail, and greenfield airports, will increase demand for PC resins in construction and mass transportation systems.

In recent years, several Asian countries such as China, India, Indonesia, Thailand, and Korea have established themselves as regional manufacturing hubs for passenger automobiles and two-wheelers. High demand for premium passenger automobiles in the region has attracted investments from American and European businesses such as Ford; General Motors; and Volkswagen.

Regional Insights

Asia Pacific dominated the market and accounted for more than 57.0% share of global revenue in 2022. The high share is attributable to the availability of raw materials in abundance and the availability of low-cost labor, which is attracting manufacturers from various industries. These manufacturers continue to set up their production facilities in the Asia Pacific region to derive increased benefits.

In China, the polycarbonate industry value in the construction segment is expected to reach USD 1.93 billion by 2024. A non-aggressive monetary approach by the country's central bank is likely to ease liquidity, favoring investments in new housing starts.

The Italian construction industry is expected to grow on account of favorable government policies for foreign direct investment (FDI) in the manufacturing sector. Furthermore, government initiatives for investments in energy and residential & commercial construction projects are expected to fuel the demand for polycarbonate during the forecast period. The growth of the construction and real estate sectors in the country is likely to augment the demand for furniture, thereby propelling the market growth for polycarbonate during the projection period.

Key Companies & Market Share Insights

The polycarbonate industry is highly competitive, thanks to the presence of major industries across the globe. These main companies exhibit a concentrated presence and are fiercely competitive. Some prominent players in the global polycarbonate market include:

-

Covestro

-

SABIC

-

Lotte Chem

-

Teijin Industries

-

Mitsubishi Engineering Plastics Corp.

-

Trinseo

-

Idemitsu Kosan Co. Ltd.

-

Lone Star Chemical

-

Chi Mei Corporation

-

Entec Polymers

-

RTP Company

-

LG Chem

Polycarbonate Market Report Scope

Report Attribute

Details

Market size volume in 2023

USD 23,361.25 million

Volume forecast in 2030

USD 29,714.83 million

Growth rate

CAGR of 3.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kiloton, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Volume forecast & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, region

Region scope

North America; Europe; Asia Pacific; Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Germany; France; Italy; Russia; Spain; China; India; Japan; South Korea; Taiwan; Brazil; Mexico; Saudi Arabia

Key companies profiled

Covestro; SABIC; Lotte Chem; Teijin Industries; Mitsubishi Engineering Plastics Corp.; Trinseo; Idemitsu Kosan Co. Ltd.; Lone Star Chemical; Chi Mei Corporation; Entec Polymers; RTP Company; LG Chem

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polycarbonate Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global polycarbonate market report based on application and region:

-

Application Outlook (Volume, Kiloton; Revenue, USD Billion, 2018 - 2030)

-

Automotive & Transportation

-

Electrical & Electronics

-

Construction

-

Packaging

-

Consumer Goods

-

Optical Media

-

Medical Devices

-

Others

-

-

Regional Outlook (Volume, Kiloton; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Central & South America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global polycarbonate market size was estimated at USD 22,594.10 million in 2022 and is expected to reach USD 23,361.25 million in 2023.

b. The global polycarbonate market is expected to grow at a compound annual growth rate of 3.5% from 2023 to 2030 to reach USD 29,714.83 million by 2030.

b. Electrical & Electronics segment dominated the polycarbonate market with a share of 24.24% in 2022. This is attributable to rising demand in application such as power housings, connectors, household appliances and battery boxes.

b. Some key players operating in the polycarbonate market include SABIC, Bayer, Teijin, Chi Mei Corp., Idemitsu Kosan, Mitsubishi Engineering Plastics Corp., Trinseo S.A., LG Chemicals, RTP Company, and Lotte Chemical.

b. Key factors that are driving the polycarbonate market growth include rising demand from applications such as safety equipment, industrial machinery, and automotive components.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.