- Home

- »

- Consumer F&B

- »

-

North America Fruits & Vegetables Market Size Report, 2030GVR Report cover

![North America Fruits & Vegetables Market Size, Share & Trends Report]()

North America Fruits & Vegetables Market Size, Share & Trends Analysis Report By Product (Fresh Fruits & Vegetables, Dried Fruits & Vegetables), By Distribution Channel (Specialty Stores, Online), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-141-6

- Number of Report Pages: 93

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Market Size & Trends

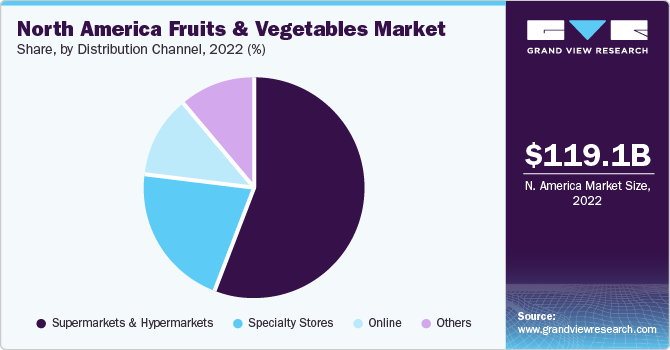

The North America fruits & vegetables market size was estimated at USD 119.08 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. Consumers are spending an increasing amount of time and money on their health while looking to integrate fresh & exotic fruits and vegetables for healthy diet practices. Moreover, health-conscious people are preferring to buy locally sourced, organic fruits and vegetables and are willing to pay a premium price. This has led to a strong demand for fruits & vegetables in North America. Online grocery shopping & delivery services have further driven product purchases, thus driving market growth.

Consumers, particularly working professionals and millennials, are opting for online grocery shopping in North America, owing to the various advantages of this mode, such as convenience and doorstep delivery. Online grocery purchase allows customers to order fresh produce from their homes, avoiding the need for time-consuming trips to physical grocery stores. This particularly appeals to older adults with mobility issues, who prefer avoiding crowded shopping environments.

Moreover, the rising popularity of trendy diets and superfoods has driven the consumption of fruits and vegetables. Their popularity has vastly impacted the consumption patterns of fruits and vegetables in the North American region. Consumers are increasingly focusing on their health and well-being and thus adopting dietary patterns that highlight the significance of nutrient-rich plant-based foods.

Superfoods such as kale, avocados, blueberries, and acai berries, known for their strong nutritional profiles, have become dietary staples. Moreover, diverse diet trends, such as plant-based and Mediterranean diets, emphasize the pivotal role of fruits and vegetables in improving health and preventing diseases.

Consumers in the United States are increasingly prioritizing fresh fruit and vegetable intake as they dedicate more resources to maintain a healthy lifestyle. Millennials remain the dominant purchasers of vegetables and fruits in the U.S., on account of their extensive online presence. Online retailers are using tactics such as cashback incentives and discounts to appeal to this demographic, a trend that is expected to persist in the near future.

Furthermore, there has been a substantial shift among consumers toward fresh, health-conscious food choices, owing to the escalating obesity rates in the region and a rising awareness regarding the benefits of nutritious diets. Younger age groups are particularly inclined toward trendy diet patterns such as raw food and paleo, which place a strong emphasis on the health advantages of consuming fresh produce.

In 2022, as per the International Food Information Council, around 52% of Americans followed a specific diet pattern, which was a significant increase from 2021. This increased adoption of specific diets and eating patterns in the country signifies a growing awareness of the importance of food in health and well-being. This awareness is expected to continue driving the demand for fruits and vegetables in the region, as consumers understand their importance in achieving various health-related goals.

Distribution Channel Insights

In terms of distribution channel, the supermarkets & hypermarkets segment accounted for the highest market share of 55.7% in 2022 in the North American market for fruits & vegetables. Several factors drive consumer preference for their fruit and vegetable buying behavior at hypermarkets and supermarkets. These include pricing, convenience, brand recognition, and product availability. Hypermarkets and supermarkets provide a comprehensive shopping experience, enabling consumers to search for a variety of products, including fruits and vegetables, all in one location.

The online segment is anticipated to register the fastest CAGR of 6.0% over the forecast period. Online platforms play a vital role in offering consumers access to a variety of vegetables and fruits, including seasonal and specialty products that might not be available readily in local stores. The importance of online purchases became even more apparent during the outbreak of COVID-19, which led to temporary and permanent closure of physical distribution channels. However, the sale of fruits and vegetables through online modes such as e-commerce portals and online grocery stores experienced a notable surge in and after 2020.

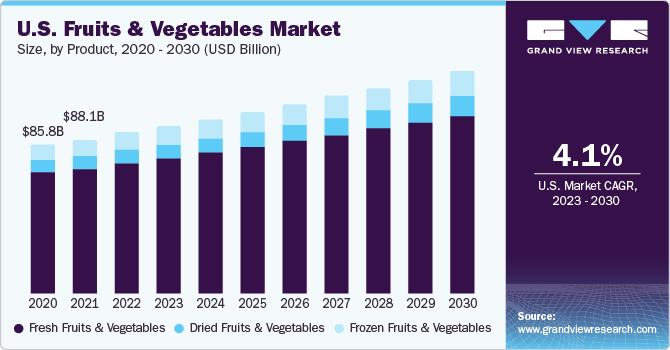

Product Insights

Based on product, the fresh fruits & vegetables segment accounted for the highest revenue share of 80.8% in 2022 in the North American market. The availability of these products faced challenges during the pandemic due to logistical and transport restrictions. There was a concurrent growth in demand for fresh fruits and vegetables. This demand was driven by consumers who, in response to the pandemic, increased their focus on maintaining a healthy diet and incorporating more fresh produce into their food patterns, opting for these products over processed or frozen foods.

The dried fruits & vegetables segment is expected to expand at the fastest CAGR of 6.8% through 2030. The rising popularity of plant-based diets has significantly contributed to segment growth. As per an article from the Alliance for Science, as of January 2022, around 10% of American adults aged 18 years and older identified as vegetarian or vegan. This shift in dietary preferences has led many consumers to reduce their meat consumption and seek alternative sources of nutrition and protein. Dried vegetables and fruits have emerged as a quick and cost-effective way to incorporate plant-based protein and essential nutrients into meals.

Regional Insights

The United States dominated the regional market with a revenue share of 78.0% in 2022. There has been a noticeable shift among consumers toward health-conscious and fresh food choices, owing to the rising obesity rates and awareness regarding the benefits of nutritious diets in the country. Younger demographics are particularly inclined toward popular diet patterns such as raw food and paleo, which place a strong emphasis on the health advantages of consuming fresh produce.

For instance, to support the state's agricultural industry, Georgia has established several initiatives and programs to help farmers improve their operations and boost their profitability. An example is the Georgia Grown program of the Georgia Department of Agriculture, which promotes locally grown produce and other agricultural items, and other marketing efforts by the department.

However, Canada is expected to grow at a CAGR of 6.7% from 2023 to 2030. The Canadian fresh fruits and vegetables market has experienced strong growth, mainly aided by the surge in healthier eating habits among consumers in the country. This rise in health consciousness serves as a significant driver of market expansion in Canada.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Brand share analysis indicates that key market players are focusing on strategies such as new product launches, partnerships, mergers & acquisitions, and others. Some of the initiatives include:

-

In January 2023, Dole Food Company, Inc. introduced a sweeter, juicier, and more aromatic golden pineapple, addressing consumer demand for an improved pineapple consumption experience. The pineapples are available at select supermarkets in the U.S. and Canada. The new fruit is sustainably grown in Costa Rica and has the perfect balance of sweet and tart sensations.

-

In January 2023, Dole Food Company, Inc. announced that some of its subsidiaries had entered into an agreement to sell Dole’s Fresh Vegetables Division to an affiliate of Fresh Express Incorporated, a wholly-owned subsidiary of Chiquita Holdings. The division comprises operations related to the processing and sale of whole produce like iceberg, romaine, leaf lettuces, cauliflower, broccoli, celery, asparagus, artichokes, green onions, sprouts, radishes, and cabbage, as well as salads.

Key North America Fruits & Vegetables Companies:

- Dole Food Company, Inc.

- Sysco Corp.

- Chiquita Brands International, Inc

- Tanimura & Antle Fresh Foods Inc.

- General Mills, Inc.

- C.H. Robinson Worldwide, Inc.

- Fresh Del Monte Produce, Inc.

- Nestlé

- Sunkist Growers, Inc.

North America Fruits & Vegetables Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 123.59 billion

Revenue forecast in 2030

USD 171.48 billion

Growth rate

CAGR of 4.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Dole Food Company, Inc.; Sysco Corp.; Chiquita Brands International, Inc.; Tanimura & Antle Fresh Foods Inc.; General Mills, Inc.; C.H. Robinson Worldwide, Inc.; Fresh Del Monte Produce, Inc.; Nestlé; Sunkist Growers, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Fruits & Vegetables Market Report Segmentation

This report forecasts revenue growth at regional, country & state levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the North America fruits & vegetables market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Fresh Fruits & vegetables

-

Dried Fruits & Vegetables

-

Frozen Fruits & Vegetables

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Northeast

-

Southeast

-

Florida

-

Georgia

-

Tennessee

-

North Carolina

-

Louisiana

-

-

Southwest

-

West

-

Midwest

-

-

Canada

-

-

Frequently Asked Questions About This Report

b. Fresh fruits & vegetables held a market share of 80.82% in 2022 in the North America fruits and vegetables market. The availability of these products faced challenges due to logistical and transport restrictions, there was a concurrent surge in demand for fresh fruits and vegetables. This increase in demand was driven by consumers who, in response to the pandemic, heightened their focus on maintaining a healthy diet and incorporating more fresh produce into their meals, opting for these options over processed or frozen foods.

b. Some key players operating in white North America fruits & vegetables market are Associated British Food plc, Leiber, Lallemand, Inc, Archer Daniels Midland Company, Chr. Hansen Holding A/S, Shandong Bio Sunkeen Co., Ltd., Lesaffre Group, White Labs, Angel Yeast Co., Ltd., HEBEI TOMATO INDUSTRY CO LTD..

b. Brewer's yeast is rich in essential nutrients like B vitamins, protein, and minerals, making it a valuable addition to various food products, including bread, nutritional supplements, and savory snacks. As consumers become increasingly health-conscious and seek products with added nutritional value, the demand for brewer's yeast as a natural source of nutrients has surged.

b. The North America fruits & vegetables size was estimated at USD 119.08 billion in 2022 and is expected to reach USD 123.59 billion in 2023.

b. North America fruits & vegetables is expected to grow at a compounded growth rate of 4.7% from 2023 to 2030 to reach USD 171.48 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."