- Home

- »

- Consumer F&B

- »

-

Frozen Food Market Size & Share, Industry Report, 2030GVR Report cover

![Frozen Food Market Size, Share & Trends Report]()

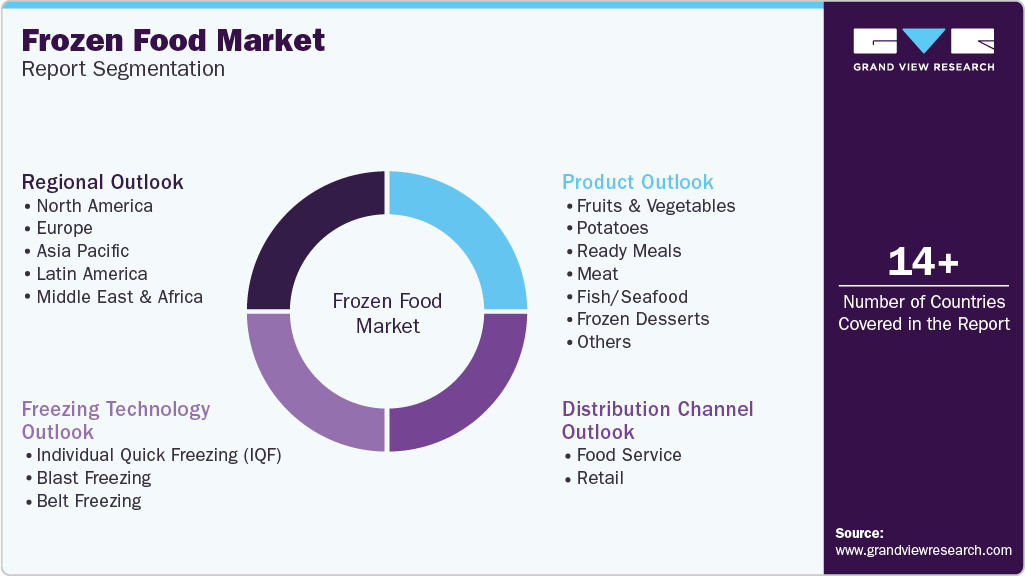

Frozen Food Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Fruits & Vegetables, Frozen Desserts), By Freezing Technology (IQF, Blast Freezing), By Distribution Channel (Food Service), By Region, And Segment Forecasts

- Report ID: 978-1-68038-280-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Frozen Food Market Summary

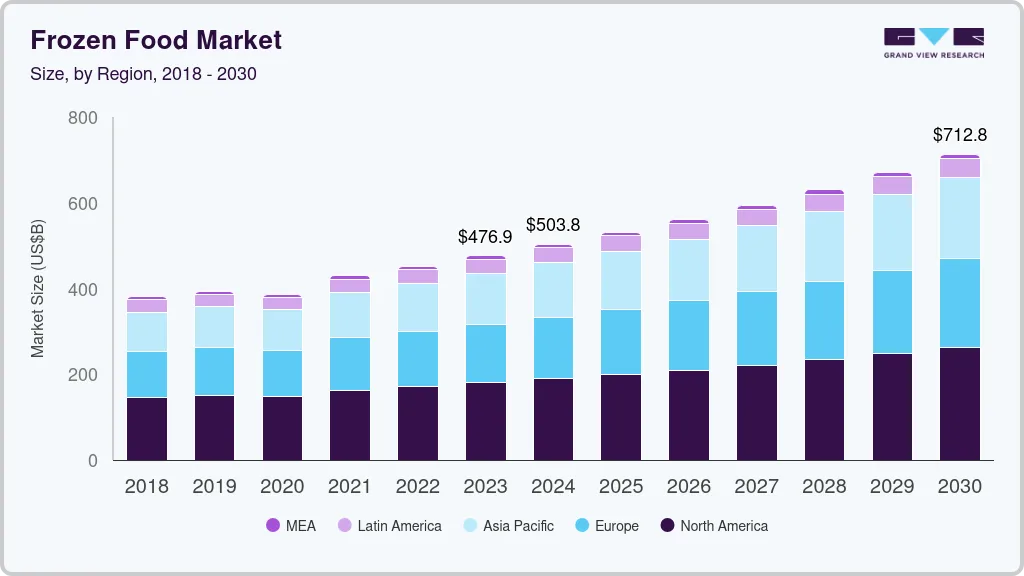

The global frozen food market size was valued at USD 503.75 billion in 2024 and is projected to reach USD 712.76 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. The increasing popularity of shelf-stable foods among consumers on a global level is expected to boost industry growth over the next few years.

Key Market Trends & Insights

- North American frozen food dominated the global market with the largest revenue share of 37.6% in 2024.

- The frozen food market in the U.S. led the North American market and held the largest revenue share in 2024.

- Based on product, frozen desserts led the market and accounted for the largest revenue share of 23.1% in 2024.

- In terms of freezing technology, blast freezing segment led the market and held the largest revenue share of 53.2% in 2024.

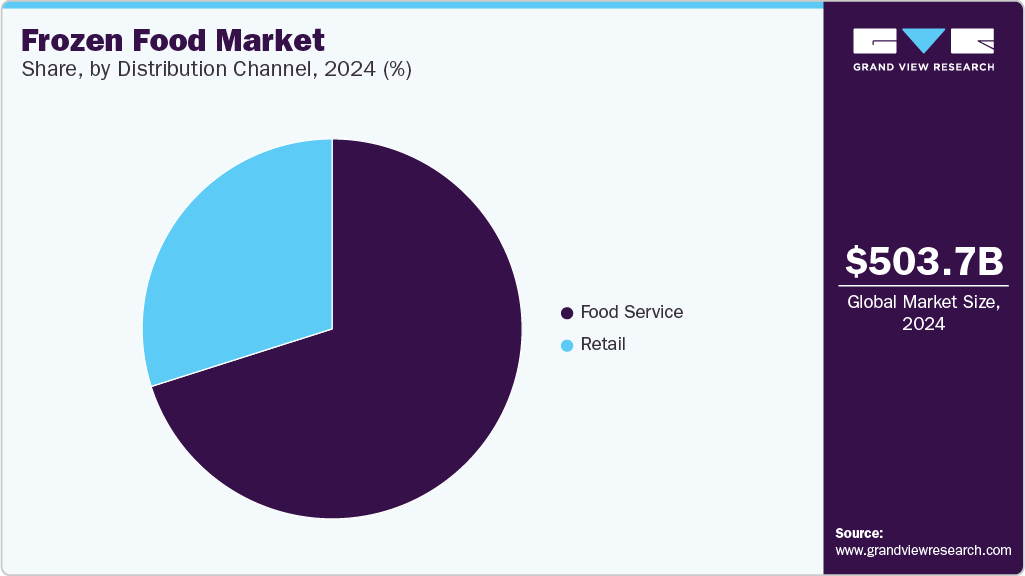

- Based on distribution channel, the Foodservice held the dominant position in the market, with the largest revenue share of 70.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 503.75 billion

- 2030 Projected Market Size: USD 712.76 billion

- CAGR (2025-2030): 6.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, rising demand for convenience, especially among urban populations and working professionals, has fueled the popularity of ready-to-eat and ready-to-cook options. Furthermore, the expansion of online grocery platforms and changing dietary habits, including the preference for plant-based and clean-label products, further boost market growth. The rising prevalence of gluten-free dietary lifestyles among consumers will boost the market for gluten-free ready meals due to various health benefits offered by these products. For instance, in March 2022, Halo Top, an ice cream brand from Wells Enterprises, Inc., launched a line of fruity frozen desserts with new sorbet pints. These products are available in three flavors: raspberry, mango, and strawberry. In addition, these products are made from real fruits, with less sugar & calories, vegan-certified, and gluten-free. A rise in the trend of healthy eating among buyers will further integrate well for the industry expansion.

The growing penetration of online platforms is one of the major frozen market strategies of the companies. For instance, in March 2022, GoodPop frozen pops launched a United States Department of Agriculture (USDA) certified organic pops that are 100% fruit juice-based and made with no added sugar. The pops will be available in a pack of six in three flavors: orange, cherry, and grape. These products will be available at GoodPop’s online shop across the U.S. beginning in April. Hence, initiatives like these will propel market growth in the coming years.

The increasing employment rate of women has been witnessed globally in recent years. With a rise in the number of employed women, it becomes significantly difficult for them to cook meals, which results in consuming frozen ready meals. All these factors collectively drive industry growth. Popular products in the segment include chicken pies, mini cottage pie, smoked haddock kedgeree, and broccoli & cheddar bake.

Moreover, the trend of stay-at-home across the globe during the COVID-19 pandemic shifted consumer preferences to ready-to-eat (RTE) food and frozen products, as they can be stored for a longer duration. In January 2022, Unilever launched 19 new frozen treats across its iconic brands, including Klondike, Breyers, Magnum ice cream, and Talenti Gelato & Sorbetto.

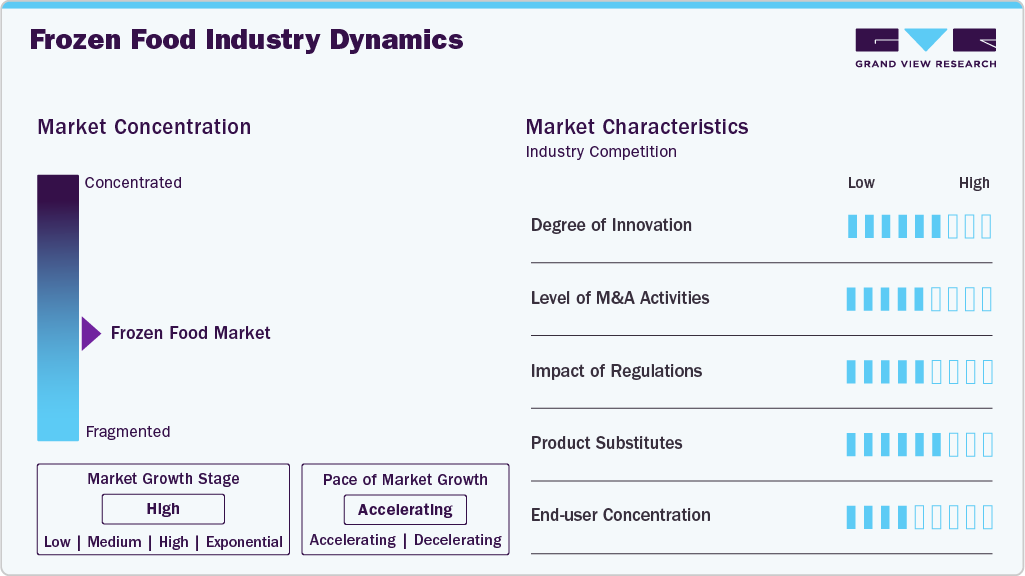

Market Concentration & Characteristics

The degree of innovation in this market has significantly increased in recent years, with companies introducing new products and enhancing existing offerings to meet evolving consumer demands. Innovations range from developing healthier, organic, and natural frozen food options to integrating advanced freezing technologies to preserve nutritional value and taste.

The frozen food market has experienced significant M&As, driven by the pursuit of expansion, diversification, and market consolidation. Large food corporations have sought to strengthen their positions and product portfolios by acquiring smaller, specialized companies to capitalize on emerging consumer trends and preferences.

Regulations play a crucial role in shaping the market, influencing aspects, such as product safety, labeling requirements, and environmental sustainability. Stringent food safety regulations necessitate compliance with standards for handling, processing, and storage of frozen food products, ensuring consumer health and confidence. In addition, labeling regulations, including ingredient transparency and nutritional information, impact consumer perception and purchasing decisions.

Product substitutes in this market include fresh produce, canned goods, and RTE meals. Fresh produce offers a natural alternative to frozen fruits and vegetables, positioned as a healthier, albeit shorter shelf-life option. Canned goods, such as soups and vegetables, provide convenient, long-lasting alternatives to frozen products. In addition, the RTE meal sector, encompassing fast food and meal kits, offers consumers immediate consumption options that compete with frozen dinners.

Product Insights

Frozen desserts led the market and accounted for the largest revenue share of 23.1% in 2024, primarily driven by rising consumer demand for convenient, indulgent treats with diverse and innovative flavors. Increasing health awareness has boosted interest in low-fat, dairy-free, and low-sugar options. In addition, premiumization and sustainability efforts in ingredients and packaging attract more buyers. Furthermore, the market benefits from urbanization, busy lifestyles, and advances in freezing technology that enhance quality and shelf life. Moreover, the expanding retail and online channels further support market growth worldwide.

The fruits & vegetables segment is expected to grow at a CAGR of 7.9% over the forecast period. Consumers are shifting to these products as they do not need peeling, washing, or chopping. Bloated stomach and diarrhea are caused by eating infected or unclean food. In line with this, manufacturers are launching unique product variants, incorporating herbs and spices from local produce, to widen their portfolio and attract a large consumer base. In January 2021, Mother Dairy launched two new frozen vegetables under the Safal brand, including Drumsticks and Cut Okra.

The ready meals segment held a considerable share in 2024 due to pre-dominant consumption of ready meals among working-class people around the globe. According to an article published in BioMed Central (BMC) February 2020, nearly 36% of U.S. adults reported consumption of RTE meals. Furthermore, the segment is expected to grow due to new product launches. For instance, in September 2021, China’s HEROTEIN launched sixteen RTE plant-based meat meals, including various types of chicken and beef. The entire range is fully plant-based and will be distributed across China.

Freezing Technology Insights

Blast freezing segment led the market and held the largest revenue share of 53.2% in 2024. This growth is attributed to enabling rapid freezing of large food volumes, which preserves texture, flavor, and nutritional value while minimizing ice crystal formation and cellular damage. In addition, this technology significantly reduces the risk of bacterial growth, extends shelf life, and maintains food safety, making it ideal for meats, seafood, produce, and prepared meals. Furthermore, its efficiency in handling bulk quantities and maintaining product quality supports increased productivity and waste reduction for commercial food businesses worldwide.

The individual quick freezing (IQF) technology segment is expected to grow at the fastest CAGR of 6.7% over the forecast period, owing to its versatility, which supports a wide range of products, from fruits and vegetables to seafood and meats, while its speed minimizes microbial growth and spoilage. In addition, fast freezing individual pieces of food, ensuring each retains its original texture, shape, and nutritional content after thawing, also contributes to the market growth. Furthermore, the extended shelf life and superior quality appeal to consumers and food service providers seeking convenience and freshness, driving the segment’s growth in the global market.

Distribution Channel Insights

Foodservice held the dominant position in the market, with the largest revenue share of 70.1% in 2024, driven by enabling quick-service restaurants, hotels, and catering businesses to meet high customer demand with consistent quality and taste efficiently. Frozen ingredients help reduce food waste, streamline inventory management, and ensure menu availability year-round. The convenience and extended shelf life of frozen products allow food service providers to offer a wider variety of dishes while maintaining operational efficiency, supporting the expansion of frozen food usage across diverse hospitality and institutional settings.

The retail distribution channel is expected to grow at a CAGR of 6.4% from 2025 to 2030, driven by expanding product visibility and accessibility through supermarkets, hypermarkets, and convenience stores. In addition, enhanced retail infrastructure, attractive in-store displays, and wide product assortments encourage impulse purchases and cater to diverse consumer preferences. The proliferation of organized retail, especially in emerging markets, supports broader distribution and availability of frozen foods. Furthermore, retailers are also responding to health and wellness trends by stocking organic, plant-based, and clean-label frozen products, further boosting consumer interest and market expansion.

Regional Insights

North American frozen food dominated the global market with the largest revenue share of 37.6% in 2024. The growing popularity of frozen foods among consumers in this region, especially among millennials, due to single-serving options and ease of preparation, is expected to drive market growth. In addition, key manufacturers leverage innovation in product offerings, such as plant-based and clean-label frozen foods, to attract diverse consumer segments. Furthermore, the presence of well-established brands and increasing demand for quick, nutritious options further stimulate market expansion.

U.S. Frozen Food Market Trends

The frozen food market in the U.S. led the North American market and held the largest revenue share in 2024. As a result of the increasing consumer focus on healthier eating habits, there is a demand for frozen foods that are perceived as nutritious, natural, and free from additives. In addition, the rise of e-commerce platforms and grocery delivery services has made it simpler for busy consumers to purchase frozen foods, benefiting from detailed product information, reviews, and promotions in the country.

Asia Pacific Frozen Food Market Trends

Asia Pacific frozen food market is expected to register the fastest CAGR of 6.9% from 2025 to 2030. The increasing availability of frozen products that are high in protein, low in calories & fats, and address specific dietary requirements, such as dairy-free, vegan, sugar-free, gluten-free, and plant-based products, will boost regional market growth. In June 2021, Tyson Foods announced the launch of its first plant-based frozen food line in Asia-Pacific under the First Pride brand.

The frozen food market in China dominated the Asia Pacific market with the largest revenue share in 2024, driven by urbanization, busy lifestyles, and the need for convenient meal options. Furthermore, rising disposable incomes enable consumers to spend more on premium and health-focused frozen products. Moreover, improved cold chain logistics and the widespread use of e-commerce platforms make frozen foods more accessible. The increasing participation of women in the workforce further accelerates demand for time-saving frozen meals.

The frozen food market in India is mainly driven by the rapid urbanization and an increase in dual-income households, which have led to busier lifestyles, driving the demand for convenient and time-saving meal options, which frozen foods provide. India frozen food market analysis by segment includes the products such as fruits & vegetables, potatoes, ready meals, meat, fish/seafood, and distribution channels.

Europe Frozen Food Market Trends

Europe's frozen food market is expected to grow significantly over the forecast period, due to changing lifestyles that drive demand for convenient meal options, the introduction of healthier and more diverse frozen food products to cater to consumer preferences, and sustainable practices within the industry. In addition, high demand for convenience foods, a well-established cold chain network, and strong consumer trust in product safety and quality. Countries such as Germany, the UK, and France are major contributors, with consumers seeking traditional and innovative frozen meal solutions.

The growth of the frozen food market in the UK can be attributed to manufacturers' introduction of new and innovative frozen food products, including gourmet options and international cuisines, in response to changing consumer preferences.

Key Frozen Food Company Insights

The market is highly fragmented with a large number of global players. Some of the key players in the industry are Unilever PLC, Nestlé S.A., General Mills, Inc., Nomad Foods Ltd., Tyson Foods Inc., Conagra Brands Inc., Wawona Frozen Foods, Bellisio Parent, LLC, The Kellogg Company, and The Kraft Heinz Company. The market players face strong competition, especially from the top manufacturers of this market, as they have a large consumer base.

-

General Mills, Inc. manufactures and markets a wide range of frozen food products, including frozen baked goods, ready meals, and snacks. The company’s frozen food segment features well-known brands such as Pillsbury, Totino’s, and Häagen-Dazs (outside the U.S. and Canada), offering items like frozen multigrain wraps, pizzas, and desserts.

-

Nomad Foods Ltd. produces markets, and distributes a broad portfolio of branded frozen foods. Its product range includes frozen fish, vegetables, poultry, meat products, ready meals, and bakery goods, sold under brands like Birds Eye, Findus, Iglo, Aunt Bessie’s, and Goodfella’s.

Key Frozen Food Companies:

The following are the leading companies in the frozen food market. These companies collectively hold the largest market share and dictate industry trends.

- Unilever PLC

- Nestlé S.A.

- General Mills, Inc.

- Nomad Foods Ltd.

- Tyson Foods Inc.

- Conagra Brands Inc.

- Wawona Frozen Foods

- Bellisio Parent, LLC

- The Kellogg Company

- The Kraft Heinz Company

Recent Developments

-

In March 2024, BigBasket launched a new frozen food brand called Precia in partnership with celebrity chef Sanjeev Kapoor. The brand introduces a range of frozen food products, including frozen vegetables, snacks, and sweets.

-

In July 2023, Conagra Brands, Inc. revealed over 50 new products spanning their frozen, grocery, and snacks divisions. Conagra's frozen meal portfolio has a wide variety of flavors and price points available across their brands and entrees.

-

In April 2023, Nestlé and PAI Partners formed a joint venture dedicated to Nestlé’s frozen food pizza business in Europe. It is anticipated to create a player in dynamic and competitive category.

Frozen Food Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 531.46 billion

Revenue forecast in 2030

USD 712.76 billion

Growth Rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, freezing technology, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, China, India, Japan, Australia & New Zealand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Unilever PLC; Nestlé S.A.; General Mills, Inc.; Nomad Foods Ltd.; Tyson Foods Inc.; Conagra Brands Inc.; Wawona Frozen Foods; Bellisio Parent, LLC; The Kellogg Company; The Kraft Heinz Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Frozen Food Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global frozen food market report based on product, freezing technology, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruits & Vegetables

-

Fruits

-

Berries

-

Tropical Fruits

-

Citrus Fruits

-

Grapes

-

Stone Fruits

-

Others

-

-

Vegetables

-

Peas

-

Broccoli

-

Cauliflower

-

Carrot

-

Bell Paper

-

Beans

-

Mushroom

-

Avocado

-

Corn

-

Others

-

-

-

Potatoes

-

Ready Meals

-

Meat

-

Fish/Seafood

-

Frozen Desserts

-

Bakery Products

-

Others

-

-

Freezing Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual Quick Freezing (IQF)

-

Blast Freezing

-

Belt Freezing

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Service

-

Retail

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.