- Home

- »

- Plastics, Polymers & Resins

- »

-

North America PVC Films Market Size & Share Report, 2030GVR Report cover

![North America PVC Films Market Size, Share & Trends Report]()

North America PVC Films Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (Calendering, Extrusion), By Product (Rigid PVC Films, Monomeric Flexible PVC Films), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-809-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

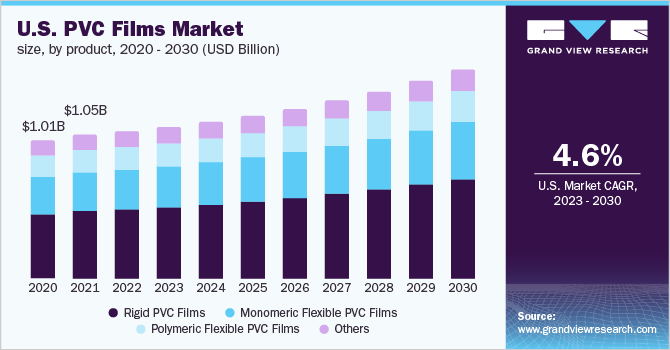

The North America PVC films market size was valued at USD 2.37 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2030. The rising demand for polyvinyl chloride films in various end-use industries including packaging, medical, and construction materials is expected to drive the PVC films industry in the region over the forecast period.

Polyvinyl Chloride (PVC) is used in a wide range of products, including pipes and fittings, films and sheets, wires and cables, bottles, profiles, hoses, and tubings. Additionally, polyvinyl chloride is used for specific wrappings like the packaging of tools, medical equipment, bottle sleeves, and the wrapping of valuable items like electronics. The demand for polyvinyl chloride is projected to rise owing to the growth of the plastic industry, resulting in the growth of the PVC films industry in the region.

The U.S. dominated the North America PVC films industry in 2022, accounting for more than 45.0% of the market share, in terms of revenue. The rising demand for polyvinyl chloride films in medical products for manufacturing capsules, tablets, drainage bags, and other medical equipment primarily drives the market. The demand for plastics in various products, including packaging, construction, electrical & electronics, automotive, agriculture, and consumer goods, is expected to grow in the coming years.

Additionally, the demand for polyvinyl chloride films in packaging is expected to shift toward food packaging products, owing to the increasing demand for takeaways and online food service due to the change in consumer perceptions post-pandemic. The stockpile and panic purchase of food, groceries, and other homecare necessities are further expected to accentuate the aforementioned trend in the U.S. Furthermore, the demand for polyvinyl chloride films in premium goods and non-food packaging is expected to rise significantly, as supermarkets and convenience stores open up once again.

Product Insights

The rigid PVC films segment dominated the North America PVC films industry and accounted for more than 47.0% of the total market share, in terms of revenue, in 2022. The growth is attributed to the rising product demand in packaging, adhesive tapes, and decorative industries. Commercially, rigid PVC films are sold in various grades depending on the end-use industry. Various products include printing, stationery, and freezer, among others.

Rigid PVC films offer properties such as excellent thermostability and high clarity and are available in a wide range of thicknesses. The films are easy to use, affordable, and highly adaptable. Rigid PVC films are highly transparent, which makes them suitable for use in construction materials such as transparent partitions for clean rooms, corrugated panels, and industrial flat plates, among others.

Monomeric films consist of short-chain plasticizers. The short chains do not bind very well into the film and tend to drift out of the film, thereby making it brittle. Commercially, these films are sold in various thicknesses ranging from 3 to 4 Mils (70 to 80 microns) as well as in matte and gloss finishes. The price of these films is lower as compared to polymeric flexible PVC films.

Polymeric flexible PVC films consist of long-chain plasticizers that bind well into the film. The bond, thus, inhibits the migration of plasticizers. Generally, polymeric films are softer than monomeric films and vary in thickness. The thickness of polymeric films ranges from 2.5 to 3.5 Mils (60 to 80 microns). As compared to monomeric films, these films exhibit more stability and shrink approximately 50% less than the monomeric range. Therefore, polymeric films are utilized for indoor as well as outdoor products in glass as anti-glare, anti-reflection, and others.

End-use Insights

Packaging dominated the end-use segment with more than 37% of the total market share, in terms of revenue, in 2022. This significant share is attributable to its application in the packaging of food & beverages, most commonly for developing wraps for fresh foods as well as ready-to-eat products. Non-food & beverage packaging includes the packaging of retail and consumer goods.

The food industry accounts for a significant share of the packaging market worldwide. The demand for PVC film-based packaging is high for ready-to-eat packages, which include cereals, fresh meat products, smoked fish, desserts, sandwiches, and cheese, among others. Rapid urbanization, increased demand from consumers working from home during the pandemic, and a quickening pace of life have augmented the demand for packaged food, which, in turn, is expected to have a positive impact on the market.

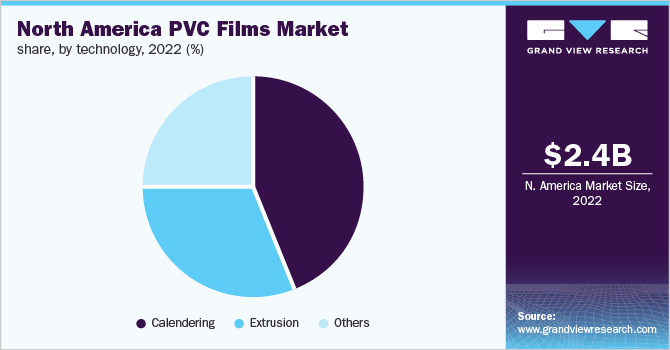

Technology Insights

Calendering dominated the product segment in the North America PVC films industry and accounted for more than 44.00% of the total market share, in terms of revenue, in 2022. This significant share is attributable to the rising demand for developing film and sheet products with distinct qualities. The process enables the use of various specialty surface treatments of the film or sheet, including embossing, enhancing the physical properties, and in-line lamination. The calendared material exhibits product uniformity, higher tensile properties, and unusually close gauge control when compared with extruded films.

The use of calendering technology allows cost-effective production as well as generates high-yield output, ultimately leading to the development of economically feasible products. However, the process does not prove to be economically viable when used in short-run production, which proves to be a major restraint for segment growth.

The extrusion process involves the conversion of raw & mixed plastic compound into molten form passing through a heated barrel with the help of a spiral-shaped screw. The extrusion process offers various advantages such as excellent dimensional stability in both extrusion and cross-web directions, along with improved flat laying qualities and fast changes of extrusion shapes useful for smaller production quantities.

Country Insights

The U.S. dominated the market and accounted for more than 45.0% share of regional revenue in 2022. The rising demand for PVC films in medical products for manufacturing capsules, tablets, drainage bags, and other medical equipment primarily drives the market. The demand for plastics in various products, including packaging, construction, electrical & electronics, automotive, agriculture, and consumer goods, is expected to grow after the current pandemic ends. The U.S. PVC films market is expected to witness slower growth as there is limited cross-border trade between the countries on account of the COVID-19 pandemic.

The building & construction end-use industry in Canada is creating a positive growth opportunity. The low cost associated with manufacturing facility set-up and availability of low-cost labor compared to that of the U.S. is grabbing the attention of manufacturers to set up their plants in Canada. Additionally, the government of Canada is investing in infrastructure development projects, which are anticipated to propel the growth of the construction industry, thereby driving the demand for PVC films over the forecast period.

In terms of 2020 volume, Mexico produced 13.4 million kilotons of packaging materials and containers worth USD 19 billion. The packaging industry is one of the major contributing industries in Mexico, which is expected to drive the demand for PVC films in retail packaging, food & beverage packaging, and consumer goods packaging over the forecast period.

Key Companies & Market Share Insights

The key players operating in the North America PVC Films industry include LG Chemicals, Asahi Kasei Corporation, CHIMEI, Formosa Plastics Corporation, KUMHO PETROCHEMICAL, SABIC, Trinseo, INEOS, Styrolution Group GmbH, BASF SE, and DuPont, and others. Additionally, there is a notable presence of a few medium and small regional players. Major players are continuously working on developing polymers for the production of ABS owing to the rising demand for PVC films from the appliances and automotive industries.

A majority of the global companies are expected to increase their polymer offerings in Asia Pacific, Central & South America, and the Middle East & Africa, owing to the high market growth potential in these regions, given the expansion of the North American PVC films industry. Some prominent players operating in the North America PVC films market include:

-

Pactiv LLC

-

Tekra, LLC

-

Presco

-

Teknor Apex

-

Achilles USA, Inc.

-

Formosa Plastics Corporation

-

Shin-Etsu Chemical Co. Ltd

-

Westlake Chemical Corporation

-

Occidental Petroleum Corporation

-

Orbia (Mexichem SAB de CV)

-

INEOS

-

PKN ORLEN

-

Roscom Inc.

-

BENVIC

-

Rainmaker Polymers LLC

North America PVC Films Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.44 billion

Revenue forecast in 2030

USD 3.32 billion

Growth Rate

CAGR of 4.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 – 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, product, end-use, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

Pactiv LLC; Tekra, LLC; Presco; Teknor Apex; Achilles USA, Inc.; Formosa Plastics Corporation; Shin-Etsu Chemical Co. Ltd; Westlake Chemical Corporation; Occidental Petroleum Corporation; Orbia (Mexichem SAB de CV); INEOS; PKN ORLEN; Roscom Inc.; BENVIC; Rainmaker Polymers LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America PVC Films Market Segmentation

This report forecasts volume and revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America PVC films market report based on technology, product, end-use, and region:

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Calendering

-

Extrusion

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Rigid PVC Films

-

Transparent

-

Non Transparent

-

-

Monomeric Flexible PVC Films

-

Polymeric Flexible PVC Films

-

Others

-

-

End-Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Food & Beverage Packaging

-

Fresh Food Products

-

Ready-to-Eat Food Products

-

-

Non-Food Beverage Packaging

-

Retail Packaging

-

Consumer goods packaging

-

Others

-

-

-

Medical

-

Printing

-

Building Materials

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America PVC films market size was estimated at USD 2.37 billion in 2022 and is expected to reach USD 2.44 billion in 2023.

b. The North America PVC films market is expected to grow at a compound annual growth rate of 4.5% from 2023 to 2030 to reach USD 3.32 billion by 2030.

b. U.S. dominated the North America PVC films market with a share of 45.5% in 2022. This is attributable to the rising demand for PVC films in medical applications for manufacturing capsules, tablets, drainage bags, and other medical equipment.

b. Some of the key players operating in the North America PVC films market include LG Chemicals, Asahi Kasei Corporation, CHIMEI, Formosa Plastics Corporation, KUMHO PETROCHEMICAL, and SABIC

b. Key factors driving the North America PVC films market growth include the rising demand for polyvinyl chloride films in the various end-use industries including packaging, medical, and construction materials coupled with favorable regulations related to the use of sustainable plastic product.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.