- Home

- »

- Conventional Energy

- »

-

Oil Storage Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Oil Storage Market Size, Share & Trends Report]()

Oil Storage Market Size, Share & Trends Analysis Report By Application (Aviation Fuel, Middle Distillates, Crude Oil, Gasoline), By Product (Open Top, Fixed Roof, Floating Roof), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-1-68038-132-0

- Number of Pages: 73

- Format: Electronic (PDF)

- Historical Range: 2019 - 2020

- Industry: Energy & Power

Report Overview

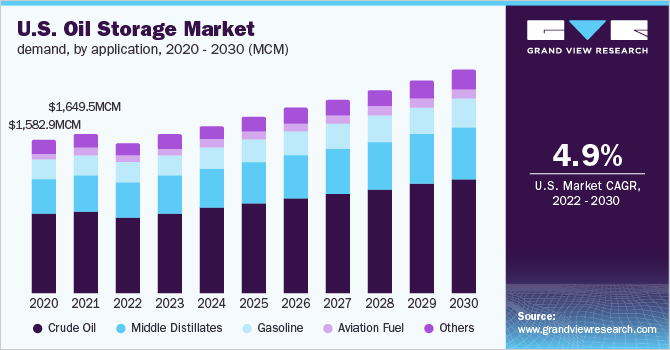

The global oil storage market volume was estimated at 1,649.5 MCM in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 4.98% from 2022 to 2030. Increasing oil & gas production activities along with the growing demand for crude oil in several end-use sectors are expected to drive the market over the forecast period.Suppliers are expanding their infrastructure and inventories owing to the rising crude oil demand and to store crude oil in large quantities. In addition, fluctuating crude oil prices have resulted in oil-importing countries safeguarding their energy security through enhanced oil storage.

Moreover, the growing trend for strategic petroleum reserves across several countries is bound to positively influence the industry landscape. The U.S. held the largest share of the North America regional market in 2021. Oil storage is a part of the midstream sector of the oil industry. Growing demand for high storage capacities and rising oil production are the major factors expected to drive the market during the forecast period. Furthermore, increasing government initiatives for the storage of oil to protect the national economy during energy crises and to reduce the Greenhouse Gas (GHG) emissions are expected to drive the market growth.

However, high investment and maintenance costsmay hamper the market growth. The oil storage capacity in Canada is significantly lower than that in the U.S. since most of its capacity addition has been introduced in the past few years. Moreover, most of the oil production from Western Canada is exported to the U.S. and stored at mega-terminals.The U.S. market is estimated to witness prominent growth because of the continuous rise in the exploration of unconventional oil & gas resources. The storage facilities are mainly present in the Gulf Coast region as it is a key exporting area for crude oil and houses major refining facilities.Crude oil supply outpaced crude oil demand due to the COVID-19 pandemic.

Hence, resulted in an increasing share of oil storage capacity across several countries, thus propelling the market demand over the forecast period. However, stringent regulations associated with oil stockpiling in below and above-ground tank installations are expected to hamper the industry growth.For instance, the Water Environment Regulations 2006 (Scotland) and Control of Pollution Regulations 2001 (England) are some of the key legislations requiring market participants’ adherence in Europe. In addition, storage equipment vendors are investing in advanced technologies used for fabricating steel tanks to prevent any oil leakages during storage.

Application Insights

On the basis of applications, the global market has been further segmented into crude oil, middle distillates, gasoline, aviation fuel, and others. The crude oil segment dominated the global market in 2021 and accounted for the maximum share of more than 51.00% of the overall volume share. Rising crude oil production and declining demand from downstream and midstream sectors are expected to enhance crude oil storage over the forecast period. According to U.S. Energy Information Administration, in June 2020, commercial crude oil inventories in the U.S. utilized 62% of the total storage capacity available.Middle distillates accounted for the second-largest market share in 2021.

The growth can be ascribed to the increase in advanced refining facilities and the high demand for low-sulfur distillates. Growing refining investments across AsiaPacific countries are expected to result in the installation of up-gradation units, which enhance the productivity of middle distillates, thereby boosting its storage market growth. Gasoline is anticipated to be the fastest-growing segment on account of its usage as an automobile fuel due to its high combustion energy. It is further used in construction, forestry, landscaping, and farming equipment. However, the growing number of Electric Vehicles (EVs) is expected to hamper the market growth shortly.

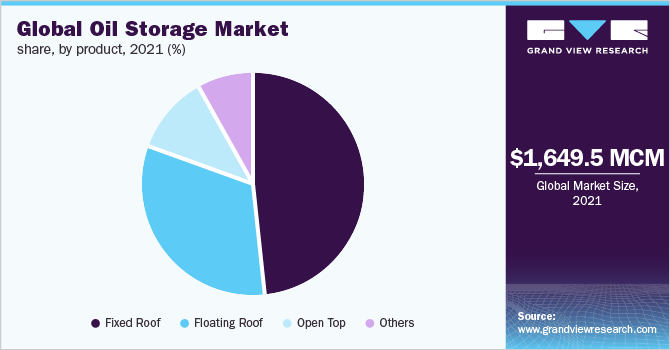

Product Insights

On the basis of products, the global market has been further categorized into fixed roofs, floating roofs, open-top, and others. The fixed roof oil storage segment dominated the global market in 2021 and accounted for the largest share of more than 48.00% of the global volume. The growing penetration of the segment can be credited to the high degree of containment of fixed roof oil storage that minimizes the risks of a fire incident. Moreover, declining installation costs related to fixed-roof design are expected to further boost the demand for these products.

The open tank storage is prone to fire incidents and product contamination, thereby generally used to store liquids with negligible evaporative losses. The floating roof oil storage segment is anticipated to register the fastest growth rate during the forecast period. The growth can be attributed to the efficient design of the floating roof, which helps in minimizing the evaporative losses and corrosion. In addition, rising demand for storage of medium and low flash point hydrocarbons is anticipated to propel the segment growth over the forecast period.

Regional Insights

The Middle East and Africa region dominated the market in 2021 and accounted for the largest share of more than 34.5% of the global volume. Efficient refinery throughput and proliferating oil production are estimated to drive themarket in countries, such as UAE, Saudi Arabia, and Kuwait. The demand for petroleum and distillates in the commercial and industrial sectors is expected to further drive the storage tank demand across the region.North America occupied a significant share in the global market in 2021 and accounted for the second-largest volume share in 2021 owing to the growing requirement for oil stockpiling across the region.

Rising exploration and production activities associated with shale gas reserves directly influence the global market demand. In addition, the presence of a major U.S. strategic petroleum reserve is anticipated to bolster the regional market growth further. Asia Pacific is estimated to witness the fastest CAGR over the forecast period, with China accounting for the largest market share. The growing oil and gas demand from major economies of the Asia Pacific region, including China and India, and rising investments in offshore and onshore operations are projected to drive the market across the region.

Key Companies & Market Share Insights

The oil storage market is consolidated with the presence of experienced and multinational players. Industry participants are investing in research and development activities to manufacture technologically advanced storage tanks.Oil storage tank owners are required to operate in strict compliance with the regulations. For instance, in the past ten years, tank owners have mainly undertaken replacement operations for the aging tanks. The 10-year regulatory window is a general timeframe for the warranties placed on different tanks. Some of the prominent players operating in the global oil storage market are:

-

VTTI

-

Royal Vopak

-

Oiltanking GmbH

-

Buckeye Partners, LP

-

Containment Solutions, Inc.

-

Shawcor

-

Belco

-

CST Industries

-

Superior Tank Co., Inc.

-

DELTA OIL TANKING BV

Oil storage Market Report Scope

Report Attribute

Details

Market volume in 2022

1,553.8 MCM

Volume forecast in 2030

2,292.9 MCM

Growth rate

CAGR of 4.98% from 2022 to 2030

Base year for estimation

2021

Historical data

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in MCM and CAGR from 2022 to 2030

Report coverage

Volume forecast,capacity forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia;The Netherlands; Belgium; China; Indonesia; Malaysia; Australia; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

VTTI; Royal Vopak; Oiltanking GmbH; Buckeye Partners, LP; Containment Solutions, Inc.; Shawcor; Belco; CST Industries; Superior Tank Co., Inc.;DeltaOil Tanking BV

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented the globaloil storage market report based on product, application, and region:

-

Application Outlook (Volume, Million cubic meters, 2019 - 2030)

-

Crude Oil

-

Middle Distillates

-

Gasoline

-

Aviation Fuel

-

Others

-

-

Product Outlook (Volume, Million cubic meters, 2019 - 2030)

-

Open Top

-

Fixed Roof

-

Floating Roof

-

Others

-

-

Regional Outlook (Volume, Million cubic meters, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

Russia

-

Netherlands

-

Belgium

-

Asia Pacific

-

China

-

Indonesia

-

Malaysia

-

Australia

-

Central & South America

-

Brazil

-

Argentina

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Frequently Asked Questions About This Report

b. The global oil storage market size was estimated at 1649.5 million cubic meters in 2021 and is expected to reach 1553.8 million cubic meters in 2022.

b. The global oil storage market is expected to witness a compound annual growth rate of 4.9% from 2022 to 2030 to reach 2292.9 million cubic meters by 2030.

b. The crude oil segment occupied the largest market share of 51.0% in 2021. Rising production of crude oil along with declining demand from downstream and midstream sectors are expected to enhance crude oil storage over the forecast period. According to U.S. Energy Information Administration, in June 2020, commercial crude oil inventories in the U.S. utilized 62% of the total storage capacity available.

b. Some key players operating in the oil storage market VTTI, Royal Vopak, Oiltanking GmbH, Buckeye Partners, L.P., Containment Solutions, Inc., Shawcor, Belco, CST Industries, Superior Tank Co., Inc., and DELTA OIL TANKING BV.

b. Key factors that are driving the oil storage market growth include Increasing oil & gas production activities along with growing demand for crude oil in several end-use sectors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."