- Home

- »

- Medical Devices

- »

-

Ophthalmic Lasers Market Size, Share, Industry Report 2030GVR Report cover

![Ophthalmic Lasers Market Size, Share & Trends Report]()

Ophthalmic Lasers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Diode, Femtosecond), By Application (Glaucoma, Cataract Removal, Diabetic Retinopathy, AMD), By End Use, And Segment Forecasts

- Report ID: GVR-1-68038-810-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ophthalmic Lasers Market Size & Trends

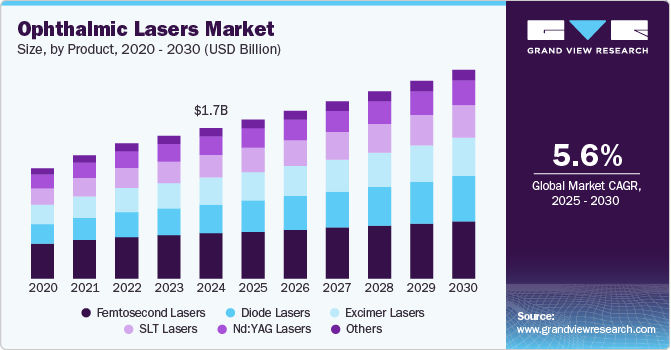

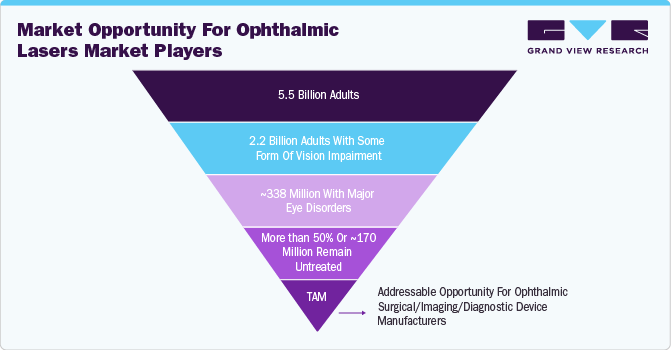

The global ophthalmic lasers market size was estimated at USD 1.7 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2030. The increasing occurrence of ophthalmic disorders is fueling market growth. For example, the World Health Organization (WHO) reports that about 2.2 billion people globally suffer from near or far vision impairments. Refractive errors and cataracts are the main culprits behind these vision issues. Furthermore, vision impairments impose a substantial financial strain, with the estimated annual global cost of lost productivity reaching USD 411 billion.

There is a growing prevalence of ophthalmic disorders such as cataracts, glaucoma, refractive errors, age-related macular degeneration (AMD), diabetic retinopathy, and other retinal disorders. Among these, cataracts, glaucoma, AMD, and diabetic retinopathy are some of the most prevalent and severe ophthalmic disorders, significantly contributing to visual impairment and blindness on a global scale. Cataract accounts for nearly half of global blindness cases, while glaucoma impacts millions without noticeable early symptoms until significant vision loss occurs. Similarly, AMD primarily affects older people and is a leading cause of central vision loss. At the same time, diabetic retinopathy, a complication of diabetes, threatens vision due to damage to the blood vessels in the retina.

A significant portion of this burden could be prevented or treated with early diagnosis and appropriate medical interventions. However, with the aging global population, the number of people suffering from these conditions is expected to rise. As the elderly population grows, their susceptibility to age-related ophthalmic disorders increases.

Growing awareness regarding the importance of maintaining optimal eye health and adhering to regular eye check-ups has impelled the demand for ophthalmic lasers. People now recognize the early signs of eye problems, prompting them to seek help and treatment earlier. This increased understanding not only helps individuals get timely treatment. For instance, Johnson & Johnson launched a program called “Vision Made Possible” in October 2023, aiming to educate people about eye health, such as childhood myopia, presbyopia, and cataracts. These efforts show a growing focus on taking proactive steps for better eye health, which means more chances for improving eye health through accessible treatments.

In addition, lifestyle changes have led to a rise in diseases such as diabetes and hypertension, which are linked to visual impairment. According to the IDF Diabetes Atlas, around 589 million adults had diabetes in 2023, representing 1 in 10 people, which is projected to increase to 634 million by 2030 and 783 million by 2045. This increase in diabetes cases heightens the risk of glaucoma in many patients. It has created a greater need for convenient and effective ophthalmic devices and procedures, thus driving market demand.

Technological advancements in laser technology have driven the growth in the ophthalmic laser market, revolutionizing how eye conditions are diagnosed and treated. Innovations such as femtosecond lasers, which enable ultra-precise, bladeless surgical procedures, have transformed cataract and refractive surgeries by enhancing accuracy and recovery and minimizing complications. Excimer lasers have further advanced refractive error correction with customizable treatments like wavefront-guided LASIK, offering highly personalized vision solutions. In addition, doped lasers become essential in managing glaucoma and retinal disorders due to their efficiency, cost-effectiveness, and versatility. These advancements improve surgical outcomes and expand their range of treatable eye conditions, driving the demand for advanced ophthalmic laser devices worldwide.

In February 2025, Alcon, Inc. introduced the Voyager direct selective laser trabeculoplasty (DSLT) device. This innovative device streamlines the workflow by delivering 120 laser pulses without requiring a gonio lens or manual aiming. It is now available in the U.S. for commercial use, catering to around 5 million Americans diagnosed with eye conditions glaucoma.

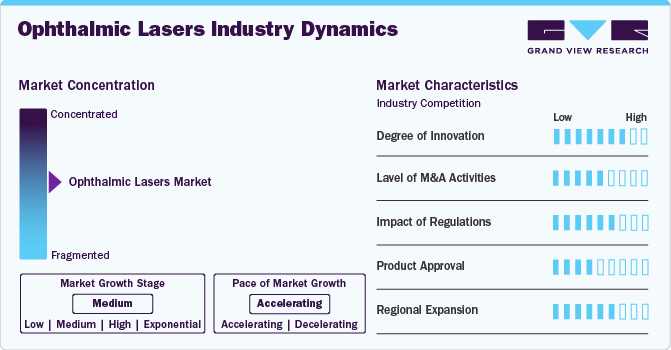

Market Concentration & Characteristics

The ophthalmic lasers industry is moderately concentrated, dominated by key players like Alcon, Lumenis, Carl Zeiss Meditec, and NIDEK. These companies hold significant market share due to their advanced technologies, global presence, and strong distribution networks. The industry is characterized by high entry barriers, driven by stringent regulatory requirements, complex R&D processes, and significant capital investment. Continuous innovation, particularly in femtosecond and excimer lasers, shapes competitive dynamics. Demand is fueled by the rising prevalence of eye disorders like cataracts, glaucoma, and diabetic retinopathy, alongside the growing elderly population and increasing adoption of minimally invasive ophthalmic procedures worldwide.

The ophthalmic lasers industry is characterized by high innovation, with companies consistently developing products that enhance efficiency and safety. For instance, the introduction of wavefront-guided LASIK, laser-assisted cataract surgery, and minimally invasive treatments reflect the industry’s shift towards more personalized and effective treatments. Such technological advances are expected to propel market growth.

Stringent regulations ensure rigorous testing and approval processes for ophthalmic devices, minimizing risks and protecting patient safety. This nurtures trust in the industry and encourages widespread acceptance of safe, effective technologies. Regulatory bodies like the FDA in the U.S. and the MHRA in the UK provide transparency in device approval processes and hold manufacturers accountable for product safety and efficacy. This builds trust and promotes ethical practices in the industry.

Mergers and acquisitions in the ophthalmological lasers industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies are leveraging M&A activities to innovate and offer advanced solutions that meet the evolving needs of healthcare professionals. For instance, in July 2024, Alcon, Inc. acquired BELKIN Vision. This acquisition includes BELKIN’s Direct Selective Laser Trabeculoplasty (DSLT) technology, which helped in expanding Alcon’s glaucoma portfolio with a first-line therapy.

In the ophthalmic lasers industry, product substitutes include traditional surgical procedures, pharmaceutical therapies, and emerging non-laser technologies. For conditions such as glaucoma and diabetic retinopathy, eye drops, or anti-VEGF injections can serve as alternatives. Manual cataract surgery may replace femtosecond laser-assisted methods in cost-sensitive settings. In addition, newer imaging-guided treatments or microinvasive surgical devices (MIGS) pose competitive pressure. These substitutes may offer lower upfront costs or simpler infrastructure requirements, especially in developing regions. However, laser-based procedures remain favored for their precision, speed, and minimally invasive nature, maintaining strong demand despite the presence of these alternatives. Innovation continues to reduce substitution threats.

The ophthalmic lasers market is experiencing dynamic regional expansion, driven by increasing healthcare investments, rising prevalence of eye disorders, and growing awareness about advanced eye care. Regional expansion in the ophthalmic laser industry involves penetrating new geographical markets to broaden the customer base and increase market share. Moreover, regional expansion involves conducting market research to understand different markets' unique needs and challenges. By expanding into new regions, companies aim to capitalize on growth opportunities, strengthen their competitive position, and achieve sustainable business growth in the ophthalmological lasers market. For instance, the 2023 Asia Pacific Academy of Ophthalmology (APAO) meeting highlighted the importance of reconnection and collaboration among professionals in the region, fostering advancements in ophthalmic devices.

Product Insights

The femtosecond lasers segment accounted for the largest market share of 30.1% in 2024. Femtosecond lasers emit ultra-short light pulses, allowing for highly accurate tissue cutting with minimal damage to surrounding structures. This precision is particularly beneficial in refractive surgeries such as LASIK, where precise corneal flap creation is critical for optimal vision correction. The largest revenue share is due to factors such as the number of people affected by refractive errors. These devices are also increasingly used during cataract surgeries. For instance, in June 2023, MKS Instruments, Inc. introduced the Spectra-Physics IceFyre FS femtosecond laser, which delivered exceptional performance and flexibility, and a wide range of repetition rates.

The Diode lasers segment is expected to grow at a CAGR of 7.8% over the forecast period. This growth is driven by their effectiveness, safety profile, and rising prevalence of glaucoma worldwide. Furthermore, their wide range of applications, targeted treatment options, and minimally invasive approach affect market growth. Diode lasers are a type of solid-state laser that use semiconductor materials as the laser medium.

Application Insights

The refractive error corrections segment accounted for the largest market share, 22.2%, in 2024. This segment is influenced by the growing number of refractive errors in both children and adults. For example, in March 2023, Johnson & Johnson Vision obtained CE Mark approval for the ELITA Femtosecond Laser System. This system allows surgeons to carry out refractive corrections on myopic patients using the SILK or Smooth Incision Lenticule Keratomileusis technique procedure. In addition, the rising use of femtosecond lasers in refractive surgery has bolstered the segment's growth.

The cataract removal segment shows the fastest CAGR of 7.5% over the forecast period. This is due to the growing number of cataract removal surgeries taking place worldwide. Cataract is a common problem among the geriatric population and might lead to blindness if not given immediate medical attention.

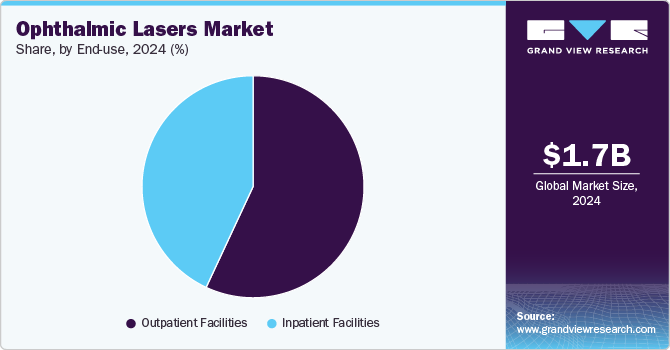

End-use Insights

The outpatient facilities segment accounted for the largest revenue share, 56.9%, in 2024. Outpatient clinics provide several factors that align with the evolving healthcare trends and patient preferences. Firstly, there is a growing demand for minimally invasive and same-day ophthalmic procedures, such as cataract surgeries, LASIK, and diagnostic imaging, which are ideally suited to the outpatient setting. Advancements in laser technologies have led to procedures that are minimally invasive, require shorter recovery times, and can be performed on an outpatient basis, making them more convenient and cost-effective for patients. For instance, in October 2024, at the American Academy of Ophthalmology (AAO) meeting, Carl Zeiss AG announced innovations, such as ZEISS VisioGen, which is an AI-driven solution designed to enhance patient communication, streamline clinic operations, and advance their outpatient ophthalmic care.

The inpatient facilities segment is expected to account for a significant market share in the ophthalmic lasers market. Some of the factors driving the growth include rising prevalence of chronic eye conditions such as diabetic retinopathy, glaucoma, and age-related macular degeneration, which often require advanced laser treatments performed in hospital settings. According to the Macular Degeneration Research, a part of the BrightFocus Foundation Program states that approximately 20 million adults in the U.S. are living with at least one form of age-related macular degeneration. In addition, the increasing availability of technologically advanced laser systems in inpatient facilities enhances the accuracy and outcomes of procedures, encouraging more referrals to these centers. Reimbursement policies and healthcare infrastructure also significantly impact this segment, as favorable insurance coverage and well-equipped hospitals support patient access to inpatient laser treatments.

Regional Insights

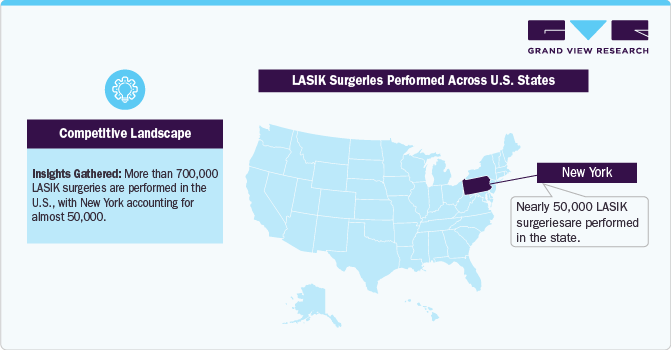

The North American ophthalmic lasers market dominated the global market and accounted for a 31.5% revenue share in 2024. Key factors contributing to the growth include numerous key players, a well-established healthcare infrastructure, growing awareness regarding eye care, and the increasing prevalence of ophthalmic disorders, such as cataracts, AMD, and glaucoma. To meet this rising demand, manufacturers are expected to intensify their investments in research and development (R&D), focusing on innovations of advanced ophthalmic devices that enhance ocular health and patient quality of life.

U.S. Ophthalmic Lasers Market Trends

The ophthalmic lasers market in the U.S. held a significant share of North America's market in 2024. U.S. has a well-developed healthcare system with advanced diagnostic and treatment facilities. The country's increasing number of ocular diseases is anticipated to fuel market growth. The U.S. Centers for Disease Control and Prevention (CDC) states that refractive errors-including myopia, presbyopia, and astigmatism-are the most common eye conditions country. It is estimated that 11 million Americans aged 12 and older could benefit from proper refractive corrections to improve their vision. Furthermore, approximately 12 million people aged 40 and above in the U.S. are affected by vision impairment, according to the CDC. This growing number of cases is thus creating significant opportunities for adopting ophthalmic devices to diagnose, treat, and manage these disorders.

Europe Ophthalmic Lasers Market Trends

The European ophthalmic lasers market is witnessing growth fueled by technological advancements, the quality of healthcare infrastructure, and the rising incidence of ophthalmic procedures. The UK, France, Germany, Italy, and Spain are some of the major markets in this region. The increasing prevalence of various ophthalmic disorders largely drives the growth in this region. With well-established healthcare systems across European countries, there is a notable demand for advanced and high-quality medical equipment and a growing awareness of eye care, which is expected to increase the demand for these devices and technologies in the European market.

The UK ophthalmic lasers market is one of the key markets in the region. As the need for optical care services continues to grow, the demand for modern and efficient equipment is anticipated to surge. It caters to a wide range of eye conditions through advanced laser technologies, including excimer lasers for refractive surgeries, femtosecond lasers for precise corneal flap creation and cataract procedures, and YAG lasers for glaucoma and posterior capsule opacification treatments. Major players like Johnson & Johnson Vision Care, Alcon, Carl Zeiss Meditec, Bausch & Lomb, and Nidek dominate the market, driving innovations and expanding access to advanced eye care.

France's ophthalmic lasers industry is expected to grow over the forecast period. Several people of older age are susceptible to certain ophthalmic conditions, such as cataracts, diabetic retinopathy, and AMD, which can lead to severe vision impairment or blindness if not diagnosed and treated properly. Ophthalmic lasers play a crucial role in early detection, diagnosis, and ongoing management of these diseases. They also offer detailed visualization of the retina to help ophthalmologists provide timely and accurate diagnoses.

The ophthalmic lasers market in Germany is projected to expand in the forecast period due to the rising number of healthcare professionals and increasing healthcare expenditure. Germany’s strong healthcare infrastructure and investment in medical technology drive the adoption of innovative solutions. Government initiatives, funding, and collaborations support the development and integration of cutting-edge technologies. For instance, SCHWIND eye-tech Solutions GmbH, a manufacturer of products supporting the treatment of corneal diseases, received funding from the German Federal Ministry of Education and Research to give people the opportunity of laser vision correction.

Asia Pacific Ophthalmic Lasers Market Trends

The ophthalmic lasers market in the Asia Pacific region is expected to grow at the fastest rate during the forecast period. China and Japan are poised to lead the Asia Pacific market in the upcoming period. Further, the rising prevalence of cataract removal surgeries in developing countries such as India and increasing awareness levels for the prevention of blindness are also motivating the market's high growth.

Japan's ophthalmic lasers market is expected to grow the fastest. The rising geriatric population, coupled with their susceptibility to eye disorders, is a major driver for the market. For instance, the World Economic Forum reported over 10% of individuals aged 80 and above in Japan in 2023. The increasing demand for precise diagnostic tools, fueled by Japan’s aging demographic, is complemented by government support for enhanced healthcare infrastructure and early detection. The success of this innovation promotes further research and investment, leading to broader adoption and availability of advanced ophthalmic devices across Japan.

China's ophthalmic laser industry is projected to grow throughout the forecast period. The expanding healthcare infrastructure, increasing healthcare workforce, and well-established medical facilities in China are expected to fuel market growth in the future. In addition, rising government support for companies is boosting market development. For example, in February 2025, Carl Zeiss Meditec AG received approval from the National Medical Products Administration (NMPA) in China for its Visumax 800 femtosecond laser with SMILE pro software. This approval will broaden the company’s access to small incision lenticule extraction (SMILE) procedures using its femtosecond laser Asia.

India's ophthalmic lasers market is expected to grow over the forecast period. The growing financial burden highlights the increasing need for advanced eye care solutions, driving demand for ophthalmic devices. The need for effective diagnostic tools to manage and prevent visual impairment can spur investment in ophthalmic technologies, expanding the market and promoting the development of innovative eye care solutions in India.

Latin America Ophthalmic Lasers Trends

The ophthalmic lasers market in Latin America is driven by the increasing prevalence of eye disorders, a heightened focus on R&D in medical devices, the rapid adoption of advanced healthcare technologies, and a growing geriatric population. For instance, in June 2022, Norlase, Inc., an ophthalmic company developing next-generation laser solutions, announced its distributor partnerships in Latin America.

Middle East & Africa Ophthalmic Lasers Market Trends

The Middle East and Africa ophthalmic lasers market is driven by rising cases of cataracts, diabetic retinopathy, and glaucoma, along with expanding access to advanced eye care. Increasing government investments and growing private eye clinics are boosting laser adoption, particularly in Gulf nations, Egypt, and South Africa.

The ophthalmic lasers market in Saudi Arabia is anticipated to expand in the forecast period. Saudi Arabia’s Vision 2030 initiative, focusing on socioeconomic transformation and healthcare infrastructure development, is poised to boost the ophthalmic devices market. The initiative includes investments in new hospitals, healthcare facilities, and advanced medical technologies essential for complex surgeries.

Key Ophthalmic Lasers Company Insights

The ophthalmic lasers market is highly competitive, with key players such as Alcon Laboratories, Inc., Carl Zeiss Meditec AG, and Bausch & Lomb Incorporated holding significant positions.

The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion for serving the unmet needs of their customers.

Key Ophthalmic Lasers Companies:

The following are the leading companies in the ophthalmic lasers market. These companies collectively hold the largest market share and dictate industry trends.

- Alcon Laboratories, Inc.

- Carl Zeiss Meditec AG

- Ellex Medical Lasers Limited

- Abbott Medical Optics, Inc.

- Bausch & Lomb Incorporated

- Topcon Corporation

- IRIDEX Corporation

- Lumenis

- Ziemer Ophthalmic Systems AG

- NIDEK Co., Ltd.

Recent Developments

-

In August 2024, Meridian Medical received FDA approval for the MR Q laser family, including the fully integrated ND: YAG laser MR Q, MR Q SLT, and MR Q Supine U.S.

-

In January 2024, Iridex Corporation introduced the Iridex 532 and Iridex 577 laser platforms in the U.S. These products utilize various treatment modes, such as continuous-wave and the exclusive MicroPulse technology developed by Iridex, along with a user-friendly touchscreen for enhanced clinical control options.

Ophthalmic Lasers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.81 billion

Revenue forecast in 2030

USD 2.37 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and end use

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Alcon Laboratories, Inc.; Carl Zeiss Meditec AG; Ellex Medical Lasers Limited; Abbott Medical Optics, Inc.; Bausch & Lomb Incorporated; Topcon Corporation; IRIDEX Corporation; Lumenis; Ziemer Ophthalmic Systems AG; NIDEK Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmic Lasers Market Report Segmentation

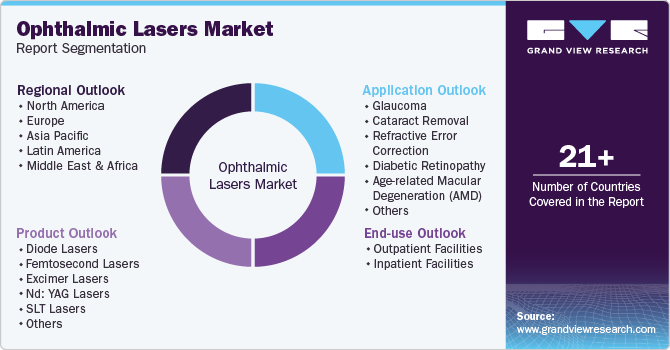

This report forecasts country-level revenue growth and analyzes the latest industry trends and opportunities in each sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the ophthalmic lasers market report on the basis of product, application, end use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diode Lasers

-

Femtosecond Lasers

-

Excimer Lasers

-

Nd: YAG Lasers

-

SLT Lasers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Glaucoma

-

Cataract Removal

-

Refractive Error Correction

-

Diabetic Retinopathy

-

Age-related Macular Degeneration (AMD)

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Outpatient Facilities

-

Inpatient Facilities

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ophthalmic lasers market was estimated at USD 1.71 billion in 2024 and is expected to reach USD 1.81 billion in 2025.

b. The global ophthalmic lasers market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2030, reaching USD 2.37 billion by 2030.

b. North America dominated the ophthalmic lasers market, with a share of 31.5% in 2024. This is attributable to the presence of advanced healthcare infrastructure and the growing prevalence of ophthalmic disorders.

b. Some key players operating in the ophthalmic lasers market include Alcon Laboratories, Inc., Carl Zeiss Meditec AG, Ellex Medical Lasers Limited, Abbott Medical Optics, Inc., Bausch & Lomb Incorporated, Topcon Corporation, IRIDEX Corporation, Lumenis, Ziemer Ophthalmic Systems AG, and NIDEK Co., Ltd.

b. Key factors that are driving the market growth include rising prevalence of ophthalmic disorders, increasing geriatric population, and introduction of technologically advanced products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.