- Home

- »

- Medical Devices

- »

-

Orthopedic Bone Cement Market Size & Share Report, 2030GVR Report cover

![Orthopedic Bone Cement Market Size, Share & Trends Report]()

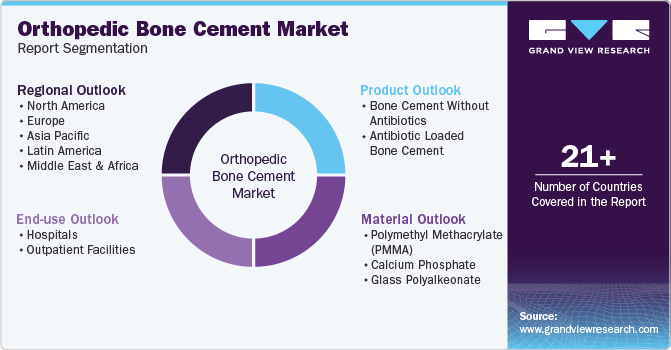

Orthopedic Bone Cement Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Calcium Phosphate, Glass Polyalkeonate), By Product, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-918-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Orthopedic Bone Cement Market Summary

The global orthopedic bone cement market size was estimated at USD 646.0 million in 2023 and is projected to reach USD 975.7 million by 2030, growing at a CAGR of 5.5% from 2024 to 2030. The rising number of joint replacement surgeries fueled by an aging population, the growing prevalence of osteoporosis, and rising trauma cases are anticipated to increase demand for orthopedic bone cement.

Key Market Trends & Insights

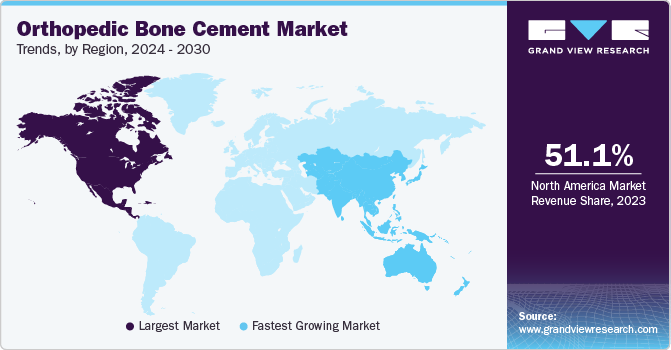

- In terms of region, The North America orthopedic bone cement market dominated and accounted for the largest global revenue share of 51.1%.

- The U.S. orthopedic bone cement market in the held the largest share in 2023

- In terms of material, The polymethyl methacrylate (PMMA) segment dominated the market with a revenue share of 73.1% in 2023.

- In terms of product, The antibiotic-loaded bone cement (ALBC) segment dominated the market with a revenue share of 56.4% in 2023.

- In terms of end use, The hospitals segment dominated the market in 2023 with a revenue share of 50.1%.

Market Size & Forecast

- 2023 Market Size: USD 646.0 Million

- 2030 Projected Market Size: USD 975.7 Million

- CAGR (2024-2030): 5.5%

- North America: Largest market in 2023

For instance, according to the International Osteoporosis Foundation, it is estimated that 200 million women are affected by osteoporosis. The prevalence varies with age, affecting about 66% of women aged 90, 40% of women aged 80, 20% of women aged 70, and 10% of women aged 60.

Moreover, the increasing number of sport-related injuries such as hip, knee, and shoulder fractures and a rising number of orthopedic surgeries drive the market growth. For instance, according to the National Safety Council in the U.S., 3.7 million people were affected by some sport-related injuries in 2023. These injuries are as follows,

Sport

Injuries

Exercise, Exercise Equipment

482,886

Bicycles & Accessories

405,688

Basketball

332,391

Football

263,585

Skateboards, Scooters, Hoverboards

221,313

Soccer

212,423

Swimming, Pools, Equipment

166,011

Baseball, Softball

139,940

Trampolines

111,212

Lacrosse, Rugby, Misc. Ball Games

72,096

Golf

67,488

Volleyball

54,904

Hockey

40,948

The market is expected to experience further growth due to an increasing number of road accidents. For instance, according to NHTSA’s National Center for Statistics and Analysis report published by the U.S. Department of Transportation, around 2.38 million individuals were injured in 2022 due to motor vehicle crashes, and 2.50 million in 2021. Thus, such a rise in road accidents increases the chances of multiple bone fractures, boosting the market growth.

Physicians are the actual customers of medical devices who decide on the material to be used during surgery. The growing number of physicians is expected to increase the customer pool for orthopedic bone cement manufacturers, leading to overall market growth. An increasing number of orthopedic surgeries are expected to drive demand for the bone cement market. For instance, according to data published by Regenexx in July 2021, 7 million orthopedic surgeries are performed in the U.S. annually. Bone cement is now widely used in joint and fracture repair surgeries instead of traditional devices such as screws and wire. The increasing use of bone cement by physicians is anticipated to boost market growth over the forecast period.

Market Concentration & Characteristics

The market for orthopedic bone cement is characterized by a high degree of innovation due to advancements in materials science and surgical techniques. For example, the University of Bath, in collaboration with Summit Medical, is conducting research on the development of bone cement delivery and mixing systems for use in total joint replacement surgery.

The market is characterized by a medium level of merger and acquisition (M&A) activity. These M&As facilitate distribution channels and enable companies to accelerate product development.

Regulations play an important role in shaping the market and ensuring the safety, efficacy, and quality of the product. The FDA has issued an order to reclassify polymethylmethacrylate (PMMA) bone cement from class III (requiring premarket approval) to class II (subject to special controls). This document was developed to facilitate this reclassification. Once reclassified, this device is designed to secure metallic or polymer prosthetic implants to the living bone for knee, hip, and other joint arthroplasty procedures.

Several market players are expanding their business by launching new products to expand their product portfolio. Rising product launches create more opportunities for market players. For instance, in August 2024, Heraeus Medical, a provider of bone cement, introduced COPAL G+V dual antibiotic-loaded bone cement for infection management.

Material Insights

The polymethyl methacrylate (PMMA) segment dominated the market with a revenue share of 73.1% in 2023 and is anticipated to witness the fastest CAGR over the forecast period owing to rising research activities and investments. For instance, in January 2022, SetBone Medical Ltd., manufacturer of bone cement, which is used for orthopedic procedures and treatment of spinal vertebrae fractures, raised a funding of USD 1.6 million to develop and offer superior solutions to patients suffering from vertebral compression fractures. Moreover, PMMA is used in the surgical fixation of artificial joints. Its primary function is to transfer forces from bone to prosthesis.

The calcium phosphate segment is anticipated to witness significant growth over the forecast period. The increasing incidence of fractures among the aging population and the rise in product launches are expected to boost market growth. For instance, in July 2022, curasan AG, a Germany-based company and provider of bone cement, expanded its portfolio with the launch of CERASORB CPC Bone Void Fillers (Calcium Phosphate Cement) for trauma, orthopedic, and maxillofacial surgery. It is a biocompatible, osteoconductive, synthetic, and bioresorbable mineral bone cement composed of phosphate salts and calcium finely dispersed in a biocompatible oil phase.

Product Insights

The antibiotic-loaded bone cement (ALBC) segment dominated the market with a revenue share of 56.4% in 2023 and is expected to witness the fastest CAGR over the forecast period. ALBC enables high concentrations of antibiotics at the surgical site by reducing systemic side effects and increasing the antibiotic concentration at the operative site. Currently, the U.S. FDA has approved gentamicin, vancomycin, clindamycin, and tobramycin antibiotic-loaded bone cement. For example, Heraeus Medical GmbH, a manufacturer of bone cement, offers COPAL G+C, a high-viscosity bone cement with Clindamycin and Gentamicin.

The bone cement without antibiotics segment is anticipated to witness significant growth over the forecast period. For example, Tecres S.p.A. offers Cemex Isoplastic, a high-viscosity bone cement without antibiotics, which is especially used for cementing the knee and the acetabulum. Similarly, Heraeus Medical GmbH, a manufacturer of bone cement, offers PALACOS R, a high-viscosity bone cement without antibiotics, which is specially used for attaching partial or total joint endoprostheses in bone.

End-use Insights

The hospitals segment dominated the market in 2023 with a revenue share of 50.1%. The large patient pool catered to hospitals, their dominance in emerging and low-income countries, and the rise in the number of orthopedic surgeons and hospitals providing orthopedic surgeries are anticipated to fuel the segment's growth. As of August 2023, there are 1148 hospitals in the UK, including 218 private and 930 NHS hospitals. Moreover, 2,654 orthopedic and trauma surgeons are currently working in the NHS in the UK.

The outpatient facilities segment is anticipated to register the fastest CAGR over the forecast period. Outpatient facilities provide a convenient and easily accessible option for patients requiring minor orthopedic procedures without needing prolonged hospital stays. As the trend towards ambulatory care continues to grow, outpatient facilities are becoming increasingly popular for patients seeking quicker recovery times and reduced healthcare costs associated with inpatient hospital stays.

Regional Insights

The North America orthopedic bone cement market dominated globally in 2023 and accounted for the largest global revenue share of 51.1%. This large share is attributed to increased musculoskeletal disorders, such as rheumatoid arthritis and osteoarthritis. In addition, the presence of reimbursement policies and the well-established healthcare infrastructure further stimulate market growth. Moreover, the growing emphasis on minimally invasive surgeries and the increasing geriatric population in the region are anticipated to drive market growth.

U.S. Orthopedic Bone Cement Market Trends

The U.S. orthopedic bone cement market in the held the largest share in 2023, owing to the local presence of several key players with an established distribution channel. Favorable reimbursement policies for orthopedic surgical procedures in the U.S. are another factor responsible for the market's dominance. In April 2023, Abyrx Inc. received additional approvals from the Food and Drug Administration (FDA) for MONTAGE Settable, Resorbable Bone Putty for cranial bone cement and bone void filler.

Europe Orthopedic Bone Cement Market Trends

Europe orthopedic bone cement market is anticipated to register a considerable CAGR during the forecast period. The growing patient pool due to medical tourism and a strong distribution network of manufacturers is expected to drive growth in Europe. Favorable healthcare policies can also be attributed to the growing demand over the forecast period.

Germany orthopedic bone cement market is anticipated to register a considerable growth rate during the forecast period. The increasing number of road accidents in the country contributes to the increased demand for orthopedic bone cement. For instance, according to Statistisches Bundesamt (Destatis), around 21,600 people were injured in road traffic accidents in Germany in 2023.

The UK orthopedic bone cement market is anticipated to register the fastest CAGR during the forecast period. The UK's National Health Service (NHS) offers universal healthcare coverage, ensuring access to orthopedic procedures for all residents, which stimulates market growth. In addition, the growing prevalence of orthopedic conditions boosts market growth. For instance, according to the National Institute for Health and Care Excellence, around 3.6 women and 1.5 men develop rheumatoid arthritis per 10,000 people per year in the UK.

Asia Pacific Orthopedic Bone Cement Market Trends

The orthopedic bone cement market in the Asia Pacific region is anticipated to register the fastest CAGR during the forecast period, owing to the rising prevalence of orthopedic conditions such as osteoarthritis and rheumatoid arthritis due to lifestyle changes and an aging population. This region is anticipated to exhibit enormous growth due to growing medical tourism, increasing per capita income, increasing healthcare spending by the government, and raising awareness.In May 2022, Granulab, a subsidiary of KPower, launched Malaysia’s Halal-certified synthetic bone cement PrsteomaxTM, which is calcium phosphate-based.

The Japan orthopedic bone cement market is anticipated to register the fastest CAGR during the forecast period. Technologically advanced healthcare systems, with a strong focus on innovation and the launch of new products, are propelling market growth. In addition, with an aging population, there is a growing need for orthopedic treatments to address age-related conditions, boosting market growth.

Key Orthopedic Bone Cement Company Insights

Key participants in the market are focusing on devising innovative business growth strategies in the form of partnerships & collaborations, product portfolio expansions, geographical expansions, and mergers & acquisitions.

Key Orthopedic Bone Cement Companies:

The following are the leading companies in the orthopedic bone cement market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker

- Zimmer Biomet

- DePuy Synthes

- Smith & Nephew

- DJO Global Inc. (Enovis)

- Arthrex Inc.

- Tecres S.p.A. (Demetra Holding S.p.A.)

- Heraeus Medical GmbH

- Cardinal Health

Recent Developments

-

In January 2024, Enovis acquired LimaCorporate S.p.A., an orthopedic company. This strategic move enhances Enovis' standing in the global orthopedic reconstruction market by integrating Lima's proven surgical solutions and technologies into its portfolio.

Orthopedic Bone Cement Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 706.4 million

Revenue forecast in 2030

USD 975.7 million

Growth Rate

CAGR of 5.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, Italy, France, Norway, Denmark, Sweden, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Stryker, Zimmer Biomet, DePuy Synthes, Smith & Nephew, DJO Global Inc. (Enovis), Arthrex Inc., Tecres S.p.A. (Demetra Holding S.p.A.), Heraeus Medical GmbH, Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Orthopedic Bone Cement Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global orthopedic bone cement market report based on product, material, end-use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymethyl Methacrylate (PMMA)

-

Calcium Phosphate

-

Glass Polyalkeonate

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone Cement Without Antibiotics

-

Antibiotic Loaded Bone Cement

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global orthopedic bone cement market size was estimated at USD 646.0 million in 2023 and is expected to reach USD 706.4 million in 2024.

b. The global orthopedic bone cement market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 975.7 million by 2030.

b. The hospital's segment dominated the orthopedic bone cement market with a share of 50.1% in 2023. This is attributable to the large patient pool catered to by the hospitals and their dominance in emerging and low-income countries.

b. Some key players operating in the orthopedic bone cement market include Stryker Corporation; Zimmer Biomet; DePuy Synthes; and Smith & Nephew, Inc.

b. Key factors that are driving the market growth include growing number of joint replacement surgeries fueled by ageing population and rising trauma cases, the increasing number of products launched and industry consolidation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.