- Home

- »

- Petrochemicals

- »

-

Petrochemical Market Size & Share, Industry Report, 2030GVR Report cover

![Petrochemical Market Size, Share & Trend Report]()

Petrochemical Market (2025 - 2030) Size, Share & Trend Analysis Report By Product (Ethylene, Propylene, Butadiene, Benzene, Xylene, Toluene, Methanol), By Region (North America, Europe, Asia Pacific, Latin America, Middle East), And Segment Forecasts

- Report ID: 978-1-68038-560-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Petrochemical Market Summary

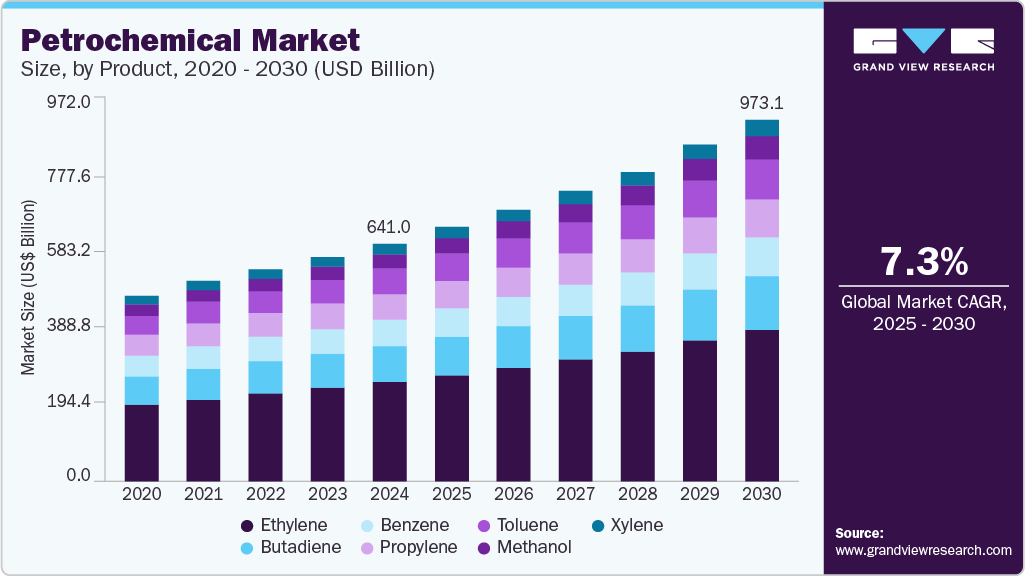

The global petrochemicals market size was estimated at USD 641.01 million in 2024 and is projected to reach USD 973.10 million by 2030, growing at a CAGR of 7.3% from 2025 to 2030. The global petrochemical market is primarily driven by the rising demand for plastics.

Key Market Trends & Insights

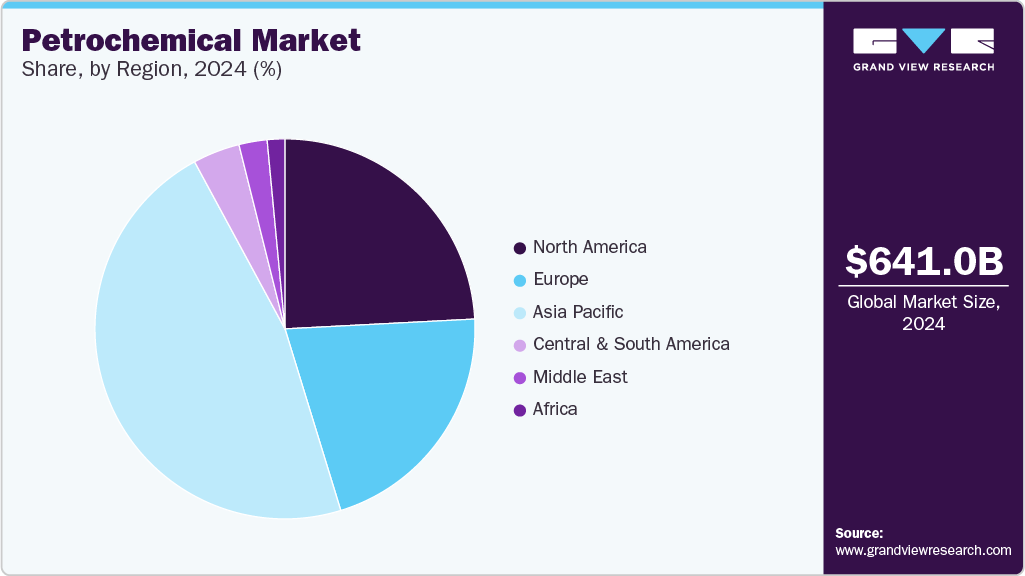

- Asia Pacific held the largest market share 46.9% in 2024 the global petrochemical market due to its rapidly expanding industrial base.

- China held over 35.4% revenue share of the overall Asia Pacific petrochemical market in 2024.

- Based on product, ethylene segment is anticipated to hold the largest market share during forecast period.

Market Size & Forecast

- 2024 Market Size: USD 641.01 Million

- 2030 Projected Market Size: USD 973.10 Million

- CAGR (2025-2030): 7.3%

- Asia Pacific: Largest market in 2024

Synthetic fibers, and industrial chemicals across key end-use industries such as packaging, automotive, construction, and consumer goods. Additionally, the availability of low-cost feedstock’s, particularly in regions like North America and the Middle East, has enhanced production economics, prompting significant capacity expansions and strategic investments.The petrochemical market encompasses the production, distribution, and application of chemical products derived primarily from petroleum and natural gas. These chemicals, including ethylene, propylene, benzene, toluene, xylene, methanol, and butadiene, serve as essential building blocks for a wide range of downstream products. The market plays a critical role within the broader chemical industry, driven by its deep integration into manufacturing, transportation, infrastructure, and consumer goods sectors globally.

Petrochemical are vital to the modern economy, as they form the foundation for countless products such as plastics, synthetic rubber, fertilizers, solvents, textiles, detergents, and pharmaceuticals. Their versatility and cost-effectiveness make them indispensable in supporting industrialization, technological advancement, and urban development. As global consumption patterns evolve, the strategic importance of Petrochemical continues to grow, especially in enabling innovations in packaging, mobility, energy storage, and sustainable materials.

Drivers, Opportunities & Restraints

The petrochemical market is fundamentally propelled by the increasing demand from various end use industries, such as packaging, automotive, construction, and consumer goods, fueled by rapid urbanization and industrial growth worldwide. Additionally, the availability of abundant and cost-competitive feedstocks-particularly natural gas liquids in North America and crude oil derivatives in the Middle East-has significantly improved production economics, incentivizing capacity expansions and technological advancements. The growing emphasis on lightweight and high-performance materials further fuels the need for petrochemical derivatives, reinforcing sustained market growth.

Despite its robust growth trajectory, the petrochemical market faces notable challenges including price volatility in crude oil and natural gas, which directly impact feedstock costs and profit margins. Increasing regulatory scrutiny concerning environmental impact, greenhouse gas emissions, and plastic waste management is imposing stricter compliance requirements and operational costs. Moreover, the rise of bio-based alternatives and intensified focus on circular economy models are creating competitive pressure on traditional petrochemical producers, potentially limiting market expansion.

The petrochemical sector stands at the cusp of transformative opportunities driven by innovations in green chemistry and sustainable production methods, including chemical recycling and bio-based feedstocks such as bio-ethylene and green methanol. Emerging markets in Asia-Pacific, the Middle East, and Africa present significant growth potential due to expanding industrial bases and infrastructure development. Furthermore, digitalization and Industry 4.0 adoption within petrochemical manufacturing offer pathways to enhance operational efficiency, reduce costs, and improve environmental performance, thereby unlocking new avenues for value creation.

Product Insights

The ethylene segment is anticipated to hold the largest market share in the petrochemical market by product during the forecast period due to its extensive application base and high-volume consumption across multiple end-use industries. Ethylene is a key feedstock in the production of polyethylene (HDPE, LDPE, LLDPE), ethylene oxide, ethylene dichloride, and other essential chemicals used in packaging, construction materials, automotive components, textiles, and consumer goods. The rising global demand for lightweight, durable, and cost-effective packaging materials-especially in the food and e-commerce sectors-continues to fuel the consumption of polyethylene, which in turn drives the dominance of ethylene in the overall market.

Additionally, ethylene production has become increasingly cost-effective in regions with abundant feedstocks such as ethane from shale gas in North America and naphtha in the Middle East, enabling large-scale investments and capacity expansions. Technological advancements in steam cracking and the emergence of integrated petrochemical complexes have further optimized ethylene output. With the global push for industrialization, urban infrastructure development, and consumer product manufacturing, ethylene’s versatility and strong demand fundamentals position it as the most commercially significant product within the petrochemical value chain, supporting its leading market share through the forecast period.

The ethylene segment held the largest market share in the petrochemical market, owing to its critical role as a foundational building block for high-demand derivatives such as polyethylene, ethylene oxide, and ethylene dichloride. These downstream products are widely used across key industries, including packaging, construction, automotive, and consumer goods. The surge in global demand for lightweight, durable, and cost-effective materials, particularly in food packaging and industrial applications, continues to drive ethylene consumption. Moreover, cost advantages derived from abundant feedstocks like ethane in North America and naphtha in the Middle East have spurred capacity expansions and technological innovation in ethylene production, reinforcing its dominance within the global petrochemical value chain.

Regional Insights

Asia Pacific held the largest market share 46.9% in 2024 the global petrochemical market due to its rapidly expanding industrial base, high population density, and strong demand from end use sectors such as packaging, automotive, construction, and textiles. Countries like China, India, Australia, and Japan are major manufacturing hubs, driving significant consumption of petrochemical derivatives. Additionally, the region benefits from favorable government policies, growing foreign direct investment, and the presence of large-scale, cost-efficient production facilities. Strategic integration of petrochemical complexes with refineries and the growing adoption of advanced technologies further enhances regional competitiveness, solidifying Asia Pacific’s leadership in the global market.

China Petrochemical Market Trends

China petrochemical market holds the largest market share in the Asia Pacific region due to its strong manufacturing infrastructure, extensive domestic demand, and strategic government support for industrial growth. The country is home to numerous large-scale, integrated petrochemical complexes, enabling cost-efficient production and economies of scale.

North America Petrochemical Market Trends

petrochemicals market in North America held the second largest market share in the global petrochemical market primarily due to its access to abundant and low-cost shale gas, which serves as a competitive feedstock for ethylene and other petrochemical production. The region, particularly the United States, has witnessed significant investments in new and expanded petrochemical facilities along the Gulf Coast, driven by favorable energy economics and export-oriented growth strategies. Strong demand from the packaging, automotive, and construction sectors, along with technological advancements and well-established supply chain infrastructure, further contribute to North America’s prominent position in the global market.

U.S. Petrochemical Market Trends

The US held the largest market share in the North American petrochemical market due to its abundant shale gas reserves, which provide a cost-effective and reliable feedstock for large-scale petrochemical production. The country has established itself as a global export hub, supported by robust infrastructure, advanced manufacturing capabilities, and strategic investments in ethylene, propylene, and methanol capacity.

Europe Petrochemical Market Trends

Europe is anticipated to witness a CAGR of 6.5% over the forecasted period. This is attributed due to the ongoing recovery of the overall manufacturing sector from the global pandemic in Europe coupled with the addition to oil & gas capacity in the region is anticipated to drive the industry’s growth. Western Europe is anticipated to witness stagnant growth owing to market saturation. Increasing ethylene production in key countries, such as Germany, France, and the UK, of the region has led to a surged demand for petrochemical from manufacturers to produce various industrial chemicals.

Latin America Petrochemical Market Trends

In Latin America, the petrochemical market is experiencing moderate growth, driven by industrial development and increasing demand for plastics, fertilizers, and synthetic materials across sectors such as agriculture, packaging, and construction. Brazil and Argentina serve as key production hubs, supported by domestic feedstock availability and expanding downstream industries. However, the market’s growth is tempered by infrastructure limitations, economic volatility, and regulatory challenges in certain countries, which may impact large-scale investments and operational efficiency.

Middle East Petrochemical Market Trends

The Middle East petrochemical market is witnessing steady growth, fueled by abundant hydrocarbon reserves, low production costs, and strong government support for downstream diversification. Countries like Saudi Arabia, the UAE, and Qatar are investing heavily in integrated petrochemical complexes to enhance value addition and reduce dependence on crude oil exports. Additionally, strategic partnerships with global players and expanding export capacities are positioning the region as a key supplier to international markets, particularly in Asia and Europe.

Key Petrochemical Company Insights

Some of the key players operating in the market include SABIC, ExxonMobil Corporation, and BASF SE.

-

SABIC, a global leader in petrochemical, emphasizes a diversified product portfolio ranging from basic chemicals to specialty products. It focuses on innovation, sustainability, and operational excellence. SABIC often invests in R&D to enhance product quality, efficiency, and explore eco-friendly alternatives.

-

ExxonMobil is a leading player in the petrochemical industry, focusing on integrated downstream operations. Its strategy involves technological innovation, cost leadership, and a commitment to sustainability. ExxonMobil continuously invests in advanced technologies to improve efficiency and reduce environmental impact.

Key Petrochemical Companies:

The following are the leading companies in the petrochemical market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Chevron Corporation

- China National Petroleum Corporation (CNPC)

- China Petrochemical Corporation

- ExxonMobil Corporation

- INEOS Group Ltd.

- LyondellBasell Industries Holdings B.V.

- Royal Dutch Shell PLC

- SABIC

- Dow

Recent Developments

-

In November 2023, Dow announced invest of USD 8.9 billion for a net-zero petrochemical plant project in Alberta's Industrial Heartland, Canada. It is projected to produce around 3 million tons of low-emission ethylene and polyethylene derivatives. The construction of the project is set to start construction in 2024.

-

In July 2023, SABIC introduced its latest PCR-based NORYLTM portfolio to reduce carbon footprint by incorporating bio-based and recycled materials in petrochemical products, a step for making the chemical sector environment friendly.

Petrochemical Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 685.47 billion

Revenue forecast in 2030

USD 973.10 billion

Growth rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion, Volume in Million tons and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East; Africa

Country scope

US; Canada; Mexico; Germany; UK; Italy; Netherlands; Belgium; France; Russia; China; India; Japan; Malaysia; Indonesia; Vietnam; Australia; New Zealand; Brazil; Argentina; Columbia; Peru; Saudi Arabia; Iran; Oman; UAE; Qatar; Kuwait; South Africa; Angola; Nigeria

Key companies profiled

BASF SE; Chevron Corporation; China National Petroleum Corporation (CNPC); China Petrochemical Corporation; ExxonMobil Corporation; INEOS Group Ltd.; LyondellBasell Industries Holdings B.V.; Royal Dutch Shell PLC; SABIC; Dow

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Petrochemical Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global petrochemical market report based on product and region.

-

Product Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Ethylene

-

Propylene

-

Butadiene

-

Benzene

-

Xylene

-

Toluene

-

Methanol

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Belgium

-

Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Malaysia

-

Indonesia

-

Vietnam

-

Australia

-

New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

Columbia

-

Peru

-

-

Middle East

-

Saudi Arabia

-

Iran

-

Oman

-

UAE

-

Qatar

-

Kuwait

-

-

Africa

-

South Africa

-

Angola

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global petrochemical market size was estimated at USD 641.07 million in 2024 and is expected to reach USD 685.47 million in 2025.

b. The global petrochemical market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 973.1 million by 2030.

b. The Asia Pacific dominated the petrochemicals market with a share of over 46.9% in 2024. This is attributable to favorable regulatory policies in the Asia Pacific and focuses on the development of the manufacturing sector.

b. Some key players operating in the petrochemical market include BASF SE, British Petroleum Plc, Chevron Corporation, China National Petroleum Corporation (CNPC), China Petrochemical Corporation (SINOPEC), ExxonMobil Corporation, INEOS Group Ltd., LyondellBasell Industries Inc., Royal Dutch Shell PLC, and SABIC.

b. Key factors that are driving the petrochemicals market growth include rising demand for downstream products from end-use industries and capacity additions in the base chemical industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.