- Home

- »

- Healthcare IT

- »

-

Pharmacy Automation Devices Market Size Report, 2030GVR Report cover

![Pharmacy Automation Devices Market Size, Share & Trends Report]()

Pharmacy Automation Devices Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Medication Dispensing Systems, Automated Medication Compounding Systems), By End-use (Outpatient Pharmacies), By Region, And Segment Forecasts

- Report ID: 978-1-68038-239-6

- Number of Report Pages: 161

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmacy Automation Devices Market Summary

The global pharmacy automation devices market size was estimated at USD 5.5 billion in 2022 and is projected to reach USD 11.6 billion by 2030, growing at a CAGR of 9.9% from 2023 to 2030. This can be attributed to the rising global disease burden and the increasing use of prescription medications.

Key Market Trends & Insights

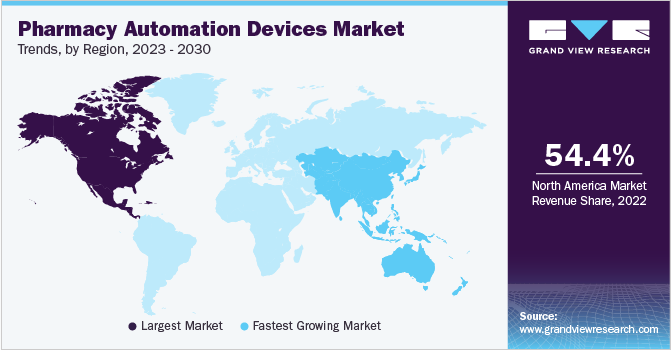

- In terms of region, North America was the largest revenue generating market in 2022.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- In terms of product, the medication dispensing systems segment accounted for the largest share of 24.6% in 2022.

- The automated medication compounding systems segment is expected to witness the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 5.5 Billion

- 2030 Projected Market Size: USD 11.6 Billion

- CAGR (2023-2030): 9.9%

- North America: Largest market in 2022

For instance, as per the tracking poll of KFF in 2022, during the period of September to October 2021, about 62% of people in the U.S. were taking prescription medicine. This rise in the number of prescriptions is driving demand for automation technology to help reduce medication errors and enable faster prescription dispensing. Moreover, pharmacy automation devices help prevent product contamination and errors, thereby reducing the risk of liabilities & increasing patient safety. These devices also reduce medication wastage, reducing costs in the long run. For instance, according to Omnicell Inc., pharmacy automation resulted in zero drug wastage and reduced pharmacy checks by 90%. Hence, through automation, pharmacists can spend more time on patient care.

Digitizing processes and improving workflow are helping the end-users better manage costs and improve efficiency across the continuum of care, driving better outcomes & performance and allowing them to reallocate time to focus on patient care. For instance, in March 2020, Swisslog Healthcare announced the launch of Meds-to-Beds program, an initiative to provide hospital outpatient pharmacy services at the time of discharge by partnering with PipelineRx and Savioke. This, in turn, is anticipated to drive the adoption of pharmacy automation to simplify tasks by limiting unnecessary human intervention while adhering to social distancing norms.

In addition, in March 2022 Walgreens Boots Alliance launched 22 micro-fulfillment centers in the U.S. that used robots to fill customers' prescriptions, reflecting changes in the role of stores and pharmacists. Each robot can fill 300 prescriptions in an hour, which is equivalent to what a typical Walgreens pharmacy with a few staff members may fill in a day. Thus, technological advancements in pharmacy automation are anticipated to drive market growth in the coming years.

The COVID-19 pandemic had a high impact on the market. Many pharmacy automation device companies witnessed a decrease in sales revenue during the COVID-19 pandemic. Additionally, the pandemic has exposed gaps and challenges across the pharmacy supply chain, making more sophisticated automation and intelligence capabilities critical to effectively manage medications in the post-COVID world in the coming years. According to a study conducted by the National Community Pharmacists Association in April 2020, around 90% of community pharmacies were applying for small business federal aid under the CARES Act to assist them during this phase.

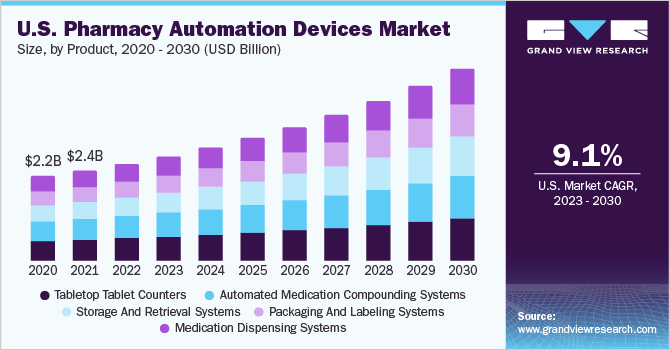

Product Insights

Based on product, the pharmacy automation devices market has been segmented into medication dispensing systems, packaging and labeling systems, storage and retrieval systems, automated medication compounding systems, and tabletop tablet counters. The medication dispensing systems segment accounted for the largest market share of 24.6% in 2022. This can be attributed to the stringent government policies regarding medication, and dispensing errors are creating pressure on healthcare institutes and pharmacists to include various medication dispensing systems for improving patient care services.

Key players such as Swisslog Healthcare offer UniPick, an automated medication dispensing system that efficiently, swiftly, and accurately handles the drug dispensing process for outpatient pharmacies. Its dispensing features help in increasing productivity, reducing medication errors, and providing more time for counseling patients on medication administration, which, in turn, benefits in boosting the overall hospital's revenue, thereby driving market growth.

The automated medication compounding systems segment is expected to witness the fastest growth during the forecast period, owing to growing pressure on pharmacies due to reimbursement reductions in pharmacies and the rapidly rising cost of drugs. This leads to an insufficient supply chain and a lack of inventory management, which is boosting the market demand for automated dispensing systems.

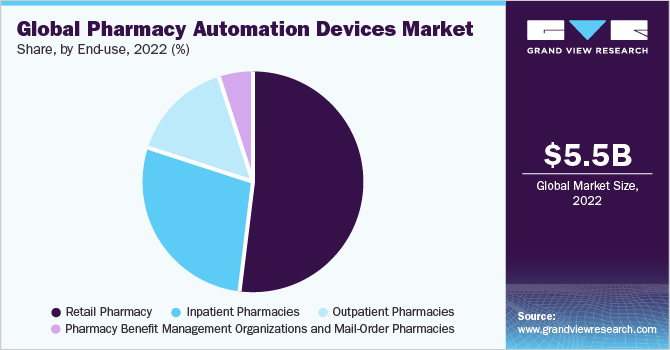

End Use Insights

Based on end-use, the market for pharmacy automation devices has been segmented into retail pharmacy, inpatient pharmacies, outpatient pharmacies, pharmacy benefit management organizations, and mail-order pharmacies. The retail pharmacy segment accounted for the largest market share of 51.7% in 2022. This can be attributed to increasing applications of pharmacy automation in the prescription filling, cutting down on costs and errors, inventory tracking, and streamlining operations, which are further driving the growth of these solutions in the retail pharmacies.

Furthermore, automated robotic storage and retrieval systems offered by RxSafe such as, RxSafe 1800, allows retail pharmacies to experience speed, space savings, accuracy, and convenience delivered by the combination of real-time inventory tracking, prescription dispensing, and optimization of workflow.

The outpatient pharmacies segment is expected to witness the fastest growth during the forecast period, owing to the incorporation of automation technology in outpatient pharmacies which helps in reducing medication errors along with increasing operational efficiency in hospitals and other healthcare systems. For instance, PillPick automated packaging and dispensing system offered by Swisslog Healthcare supports hospital pharmacies in eliminating medication errors, increasing picking, packaging, and dispensing efficiency, and improving patient safety.

Region Insights

Based on region, North America accounted for the largest market share of 54.4% in 2022. This can be attributed to technological advancements in medication management in pharmacy and healthcare settings, which are expected to drive the demand for pharmacy automation devices industry in region. For instance, in January 2021, Walgreens Boots Alliance, a leader in wholesale and retail pharmacy, automated dispensing devices, and digital health platforms, made a major investment in iA to expand the development of pharmacy automation solutions for the benefit of the pharmaceutical industry.

The Strategic Research Agenda is focused on the strategic objectives of the European robotics community to flourish as a highly growing automation market in Europe. Another initiative undertaken by the robotics Public Private Partnership (PPP) was the encouragement of disruptive robotic technology through research & innovation and raising awareness about robotics in less-developed countries of Europe. This initiative was aimed at implementing robotic strategies in Europe.

The Asia Pacific region is expected to witness the fastest growth during the forecast period. Rapid adoption of automation solutions, investments in the adoption of healthcare IT infrastructure, and high healthcare spending are factors contributing to the growth of the market for pharmacy automation devices. Moreover, initiatives by public and private bodies to reduce medication errors are likely to drive market growth in Asia Pacific.

Key Companies & Market Share Insights

Strategic partnerships, major investments in research, and development of new products or product modifications are among the key strategies adopted by market players to gain a competitive edge in the market. In March 2022, Swisslog Healthcare partnered with TriaTech Medical Systems, offered MedSMART, a range of automated dispensing cabinets to various healthcare centers in Europe. Some prominent players in the global pharmacy automation devices market include:

-

Amerisource Bergen Corporation

-

Accu-Chart Plus Healthcare Systems, Inc.

-

Omnicell, Inc.

-

McKesson Corporation

-

Pearson Medical Technologies

-

Baxter

-

Talyst, LLC (Swisslog Healthcare)

-

Scriptpro LLC

-

Fulcrum Pharmacy Management, Inc.

-

Health Robotics S.R.L.

-

Medacist Solutions Group, LLC

-

Aesynt, Inc

-

Pyxis Corporation (Becton Dickinson and Company)

-

Kirby Lester (Acquired by Capsa Healthcare)

-

Cerner Oracle

-

Forhealth Technologies (Baxter International Inc.)

-

iA

-

ARxIUM

-

Touchpoint Medical

-

Deenova S.R.L

-

Parata Systems, LLC (Becton Dickinson and Company)

-

Swisslog Healthcare

-

Yuyama Co. Ltd/Yuyama MFG Co. Ltd

-

CareFusion (Becton Dickinson and Company)

Pharmacy Automation Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.0 billion

Revenue forecast in 2030

USD 11.6 billion

Growth Rate

CAGR of 9.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD billion/million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Counry scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Switzerland, Austria; Russia; Belgium; Netherlands; China; India; Japan; Australia; Thailand; South Korea; Singapore; Hong Kong; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Qatar

Key companies profiled

Amerisource Bergen Corporation; Accu-Chart Plus; Healthcare Systems, Inc.; Omnicell, Inc.; McKesson Corporation; Pearson Medical Technologies; Baxter; Talyst, LLC; Scriptpro LLC; Fulcrum Pharmacy Management, Inc.; Health Robotics S.R.L.; Medacist Solutions Group, LLC; Aesynt, Inc; Pyxis Corporation; Kirby Lester; Cerner Oracle; Forhealth Technologies iA; ARxIUM; Touchpoint Medical; Deenova S.R.L Parata Systems, LLC; Swisslog Healthcare; Yuyama Co. Ltd/Yuyama MFG Co. Ltd; CareFusion

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

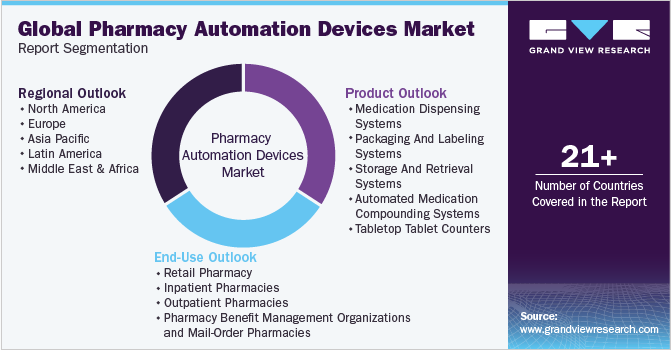

Global Pharmacy Automation Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmacy automation devices market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Medication Dispensing Systems

-

Robots/Robotic Automated Dispensing Systems

-

Carousels

-

Automated Dispensing Cabinets

-

-

Packaging And Labeling Systems

-

Storage And Retrieval Systems

-

Automated Medication Compounding Systems

-

Tabletop Tablet Counters

-

-

End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail Pharmacy

-

Inpatient Pharmacies

-

Outpatient Pharmacies

-

Pharmacy Benefit Management Organizations and Mail-Order Pharmacies

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Austria

-

Switzerland

-

Denmark

-

Sweden

-

Norway

-

Belgium

-

Netherlands

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Singapore

-

South Korea

-

Hong Kong

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global pharmacy automation devices market size was estimated at USD 5.5 billion in 2022 and is expected to reach USD 6.0 billion in 2023.

b. The global pharmacy automation devices market is expected to register a compound annual growth rate of 9.9% from 2023 to 2030 to reach USD 11.6 billion by 2030.

b. North America dominated the pharmacy automation devices market with a market share of 54.4% in 2022. The developed healthcare system, advancements in patient management as well as hospital management systems are some of the key drivers for the growth of the market.

b. Some key players operating in the pharmacy automation devices market include Amerisource Bergen Corporation; Accu Chart Plus Healthcare Systems, Inc.; Omnicell, Inc.; McKesson Corporation; Pearson Medical Technologies, LLC; Baxter; Talyst, LLC; ScriptPro, LLC; CareFusion (Becton Dickinson And Company); Medacist Solutions Group, LLC; Kirby Lester; Cerner Corporation; iA, ARxIUM; TouchPoint Medical; Deenova S.R.L; Parata Systems, LLC; Swisslog Healthcare; and Yuyama Co. Ltd.

b. Key factors that are driving the pharmacy automation devices market growth include needing to reduce medicine wastage as well as proper management of medications and prescriptions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.