- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Phenolic Resins Market Size & Share Analysis Report, 2030GVR Report cover

![Phenolic Resins Market Size, Share & Trends Report]()

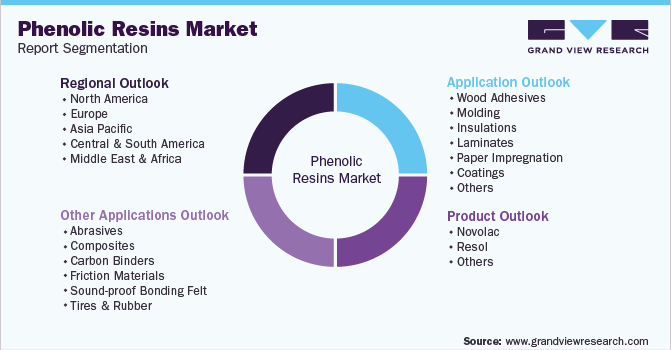

Phenolic Resins Market Size, Share & Trends Analysis Report By Product (Novolac, Resol), By Application (Wood Adhesives, Molding, Insulations, Laminates), By Other Applications, By Region, and Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-271-6

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2019 - 2021

- Industry: Bulk Chemicals

Report Overview

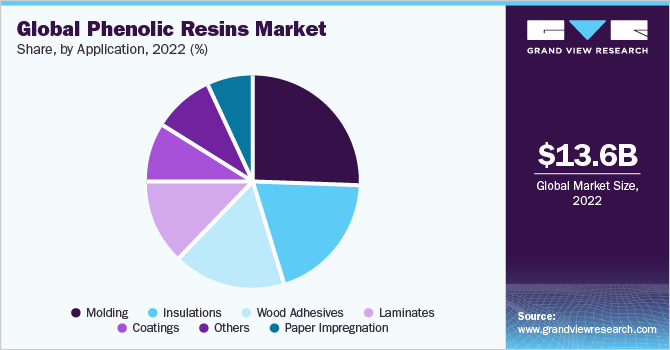

The global phenolic resins market size was estimated to be USD 13.6 billion in 2022 and is anticipated to witness a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. Phenolic resins are commonly used to across applications including wood adhesives, molding, insulations, laminates, paper impregnation, coatings, and other applications such as abrasives, composites, carbon binders, friction materials, sound-roof bonding felt, and tires & rubbers. The growth in domestic manufacturing of wood-based cabinets, furniture, wall panels, and associated construction materials along with increasing residential housing utilizing similar engineered wood products are likely to present lucrative opportunities for phenolic resins during the forecast period.

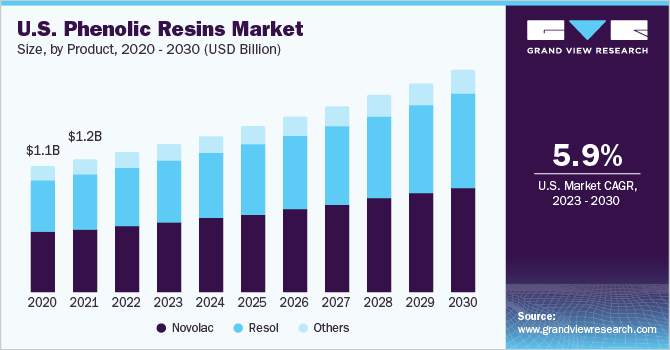

The U.S. dominated the market in North America and is expected to grow at a significant rate owing to the surging demand for phenolic resins from various application industries such as construction, automotive, and electrical & electronics. Additionally, increasing construction expenditure by the country’s government, along with rising demand for electric vehicles, the market is anticipated to propel during the forecast period across the country.

Phenolic resins across the automotive industry are essential for attaining lightweight vehicles, fuel efficiency, increased safety, emission reduction, insulation, and flexibility & creativity across the automotive design. Hence, the demand for phenolic resins in automobile applications has surged significantly in the past few years and is expected to follow similar trends in the coming years.

Product Insights

Novolac resin dominated the phenolic resin market with a market share of more than 25.0% in terms of revenue in 2022. Novolac resin, a type of phenolic resin offers excellent impact resistance, high strength, fire resistance, thermal resistance, chemical resistance, thermal stability, flexibility, surface hardness, electrical insulating properties, and lightweight, making it ideal for the production of automotive components such as suspension, seats, bottom plates, tires, brake pistons, brake block & pads, brake linings, and clutch facing.

On a contrary, resol phenolic resin can be processed using thermoplastic processing methods including alkaline catalysts and formaldehyde. In addition, these resins are self-curing due to the presence of reactive side groups, hence it is suitable for applications including coatings, molding compounds, wood-working adhesives, insulation, and others owing to its high impact resistance and serviceability.

Liquid resol phenolic resins are highly resistant towards dust and other airborne particles, hence are suitable for manufacturing of friction mixes further used for the manufacturing of disc brake pads and drum linings. Furthermore, due to its properties of non-reactivity, it is ideal for manufacturing internal protective coatings for canned food, tanks, and drums. In contrast, solid resol phenolic resins are compatible with most of the available solvents, offering a versatile solution for various types of inner coatings.

Other phenolic resins include modified resins, spray-dried resins, cyanate ester resins, and benzoxazine resins. Spray drying produces resins in particulate form. These particles are hygroscopic owing to their high caustic content but are sinter-resistant when kept dry. The principal application of these types of products is wood binding, especially in wafer board applications.

Application Insights

Molding application segment dominated the phenolic resin market with a market share of more than 25.0% in terms of revenue in 2022. Phenolic resins are versatile polymers used across a variety of industrial and consumer applications such as wood binders, paper, abrasives, and friction materials. Wood adhesives are utilized in plywood, particleboard, wafer board (WB), high-density fiberboard (HDF), oriented strand board (OSB), and medium-density fiberboard (MDF) owing to their excellent bonding properties.

In addition, phenolic resins exhibit superior water dilutibility, low free monomers, and excellent moisture resistance, which make them suitable for various applications such as containers, concrete forms, kitchen & bathroom cabinets, and interior parts in transportation & foundry patterns.

Phenolic molding compounds are used across applications such as oil pump housing, intake manifolds, valve blocks, and other automotive components including air condition systems and turbochargers. These aforementioned applications utilize phenolic resins due to their high heat resistance, chemical resistance, and overall enhanced dimensional accuracy and stability.

Phenolic insulation is produced by mixing of phenolic resin and high solids with a surface acting agents. Phenolic insulation products exhibit upright insulating properties, which are highly effective compared to other contrast insulation materials. These products are lightweight and easy to transport, handle, and install.

Phenolic laminates are produced by saturating one or more layer of base materials including paper, carbon or fiberglass with phenolic resins and further laminating the resin-saturated base material under pressure and heat. They are extremely versatile on account of their unusual combination of properties such as lightweight, structural strength, and moisture resistance. In addition, their high dielectric strength makes them easy to punch and shear for various electrical applications.

Regional Insights

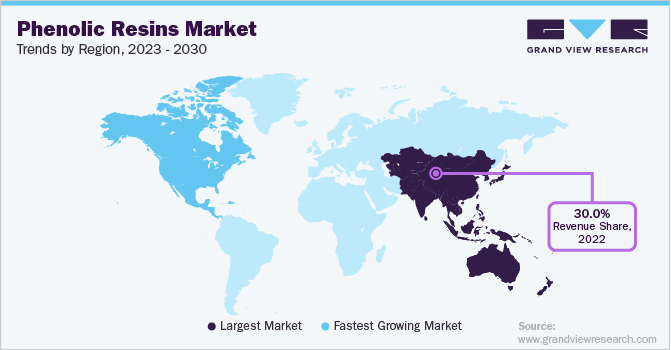

Asia Pacific dominated the global phenolic resins market in 2022 with a market share of more than 30.0% and is expected to witness significant growth over the forecast period owing to the strong economic development coupled with substantial investment in various industries including automotive, building & construction, electrical & electronics, and others.

Furthermore, escalating construction activities, rapidly growing demand for residential as well as commercial spaces from middle-class populations, couple with surged disposable income, and increasing demand for automotive including electric vehicle are anticipated to aid the demand for phenolic resins across emerging countries such as India, Japan, and South Korea over the forecast period.

Rapid construction and infrastructure development in the U.S. and Mexico are anticipated to augment the demand for phenolic resins in North America over the forecast period. Construction industry in North America is expected to witness significant growth over the coming years owing to the high demand for non-residential construction projects such as hospitals, commercial buildings, and colleges.

Moreover, the demand for compact fuel-efficient vehicles in Europe has witnessed a rise owing to a surge in gasoline and diesel prices and the tax imposed on the purchase of fossil fuel-based vehicles in the region. This has forced consumers in Europe to consider compact vehicles that provide better fuel efficiency than large-sized vehicles. Since phenolic resins are widely used in molding applications to develop automotive seats, bottom plates, and suspensions, the increasing adoption of compact vehicles in the region is expected to positively impact the growth of phenolic resins market in Europe from 2023 to 2030.

The emergence of construction companies in Chile and Peru is expected to create growth potential for the phenolic resins market in the region over the forecast period. The region is characterized by the presence of several foreign automotive manufacturers such as BMW, Ford, General Motors, Honda, Hyundai, Mahindra, Mercedes-Benz, Mitsubishi, Nissan, Renault, Suzuki, Toyota, Volvo, and Volkswagen, which is anticipated to drive the demand for phenolic-based products in automotive moldings & coatings over the forecast period.

Key Companies & Market Share Insights

The market is additionally influenced with the presence of a few medium and small regional players. Global players are in intense competition with each other as well as with regional players with strong distribution networks and good knowledge about phenolic resin suppliers and related regulations.

Companies in the market compete on the basis of product quality. Leading market players compete on the basis of their product development capabilities and new technologies used in product formulations. For instance, in July 2022, DIC Corporation acquired Guangdong TOD New Material Co., Ltd. a Chinese coating resin manufacturer. This acquisition will help DIC Corporation to expand its phenolic resins capacity by operating in near full production capacity in Asia. Some of the prominent companies in the global phenolic resins market are:

-

DIC CORPORATION

-

Kolon Industries, Inc.

-

Sumitomo Bakelite Co., Ltd.

-

Hexcel Corporation

-

Georgia-Pacific Chemicals

-

KRATON CORPORATION

-

Hexion

-

Bostik, Inc.

-

SI Group, Inc.

Phenolic Resins Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 14.3 billion

Revenue forecast in 2030

USD 20.8 billion

Growth rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2019 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, other applications, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; U.K.; France, Italy; China; India; Japan; Brazil; Argentina; GCC Countries; and South Africa

Key companies profiled

DIC CORPORATION; Kolon Industries, Inc.; Sumitomo Bakelite Co. Ltd.; Hexcel Corporation; Georgia-Pacific Chemicals; KRATON CORPORATION; Hexion; Bostik, Inc.; SI Group, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Phenolic Resins Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2030. For this study, Grand View Research has segmented the phenolic resins market report based on product, application, other applications, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Novolac

-

Resol

-

Liquid Resol Resin

-

Solid Resol Resin

-

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Wood Adhesives

-

Molding

-

Molding Compounds

-

Shell Molding

-

Coated Foundry Sand

-

-

-

Insulations

-

Laminates

-

Paper Impregnation

-

Coatings

-

Others

-

-

Other Applications Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Abrasives

-

Composites

-

Carbon Binders

-

Friction Materials

-

Sound-proof Bonding Felt

-

Tires & Rubber

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global phenolic resins market size was estimated at USD 13.6 billion in 2022 and is expected to reach USD 14.3 billion in 2023.

b. The global phenolic resins market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 20.8 billion by 2030.

b. The Asia Pacific dominated the phenolic resins market with a share of 30.67% in 2022, owing to the rapid expansion of end-use industries such as consumer goods, automotive, construction, and aerospace across the region.

b. Some key players operating in the phenolic resins market include DIC CORPORATION, Kolon Industries, Inc., Sumitomo Bakelite Co., Ltd., Hexcel Corporation, Georgia-Pacific Chemicals, KRATON CORPORATION, Hexion, and Bostik, Inc.

b. Key factors that are driving the phenolic resins market growth include rising demand for insulation & engineered wood products and growing demand from plywood industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."