- Home

- »

- Agrochemicals & Fertilizers

- »

-

Phosphoric Acid Market Size & Share, Industry Report, 2040GVR Report cover

![Phosphoric Acid Market Size, Share & Trends Report]()

Phosphoric Acid Market (2023 - 2040) Size, Share & Trends Analysis Report By Application (DAP, MAP, TSP), By Region (North America, Europe, Latin America, Middle East, Africa), And Segment Forecasts

- Report ID: GVR-4-68038-620-2

- Number of Report Pages: 92

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Phosphoric Acid Market Summary

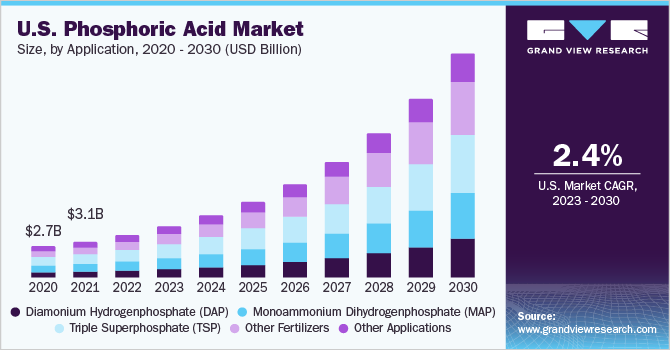

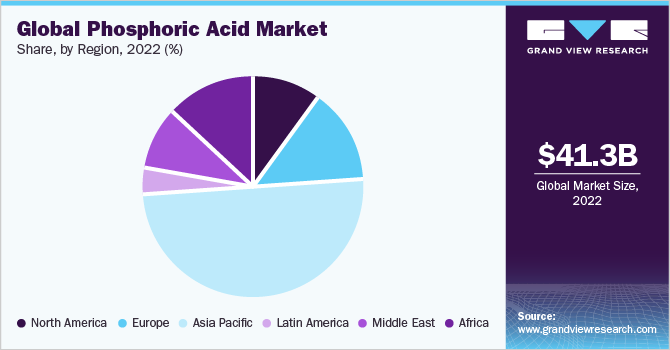

The global phosphoric acid market size was estimated at USD 41.26 billion in 2022 and is projected to reach USD 87.06 billion by 2040, growing at a CAGR of 4.2% from 2023 to 2040. Generally, phospheric acid is highly used for the production of phosphate fertilizers, such as Mono-Ammonium Phosphate (MAP) and Diammonium Phosphate (DAP), driving the market growth over the forecast period.

Key Market Trends & Insights

- Asia Pacific dominated the phosphoric acid market with a revenue share of 49.5% in 2022.

- By application, the Diamonium Hydrogenphosphate (DAP) led the market with a revenue share of over 33.0% in 2022.

- By application, the Monoammonium Dihydrogenphosphate (MAP) segment is projected to register the fastest CAGR from 2023 to 2040.

Market Size & Forecast

- 2022 Market Size: USD 41.26 Billion

- 2040 Projected Market Size: USD 87.06 Billion

- CAGR (2023-2040): 4.2%

- Asia Pacific: Largest market in 2022

Globally, it is the second-largest consumed inorganic acid after sulfuric acid. It is industrially produced in three grades with different concentration levels as per its end use. The three grades include food grade, agriculture grade, and industrial grade. Agriculture grade phosphoric acid leads the global market, in terms of value as well as volume, owing to its high usage in the manufacturing of fertilizers.

The U.S. has one of the dominating agrochemical industries in North America. It is home to various fertilizer manufacturing companies including BASF SE, Fertilizer Canada, Yara, and others. Agriculture is a major industry in the country which is also a net exporter of food. Agriculture is carried out in every state, and it ranges from small-scale producers to large-scale commercial farms. The growing inclination of farmers towards the cultivation of maize is likely to bolster the demand for phosphatic fertilizers and thereby phosphoric acid in the country.

The rapid growth in agricultural output in China and the economic progress of the country has propelled the demand for phosphate fertilizers. This, in turn, has resulted in a rise in the domestic production and consumption of the product in the nation. However, owing to stringent government regulations, the production is anticipated to register moderate growth rate over the forecast period. On the contrary, in India, the chemical is anticipated to register significant growth, both in terms of production as well as consumption. Moreover, an increase in agricultural activities and the growing exports of fertilizers are expected to have a positive impact on production.

The constant ongoing debate over food safety with respect to crop yield and efficient cultivation of crops also has a positive impact on the market. However, problems arising due to the over usage of phosphate and nitrogen-based synthetic products have led to the development of sustainable options, such as micronutrients and organic chemicals. Development of such bio-based products has ushered in a greater emphasis on their competitiveness against conventional fertilizers available in the market today. This, in turn, will have a negative influence on market growth.

The product demand in the developed countries of North America and Asia Pacific has reached a maturity phase, generating a moderate growth for the chemical. However, increasing agricultural activities and favorable government regulations in the developing countries of Asia Pacific, Latin America, and the Middle East & Africa have fostered the production and demand.

Furthermore, the projected average global economic growth of 3.52% annually is likely to lead to a significant reduction and elimination of poverty in developing countries by 2050, and at the same time per capita incomes are projected to grow significantly. Currently, Asia Pacific dominates the agricultural industry and has a maximum consumption of fertilizers. This is mainly owing to the availability of fertile lands, huge population, suitable weather conditions, and large exports from developing countries.

Growing population has also led to a decline in arable land and hence there is a requirement for quick growing chemicals. This is one of the prime reasons triggering the usage of synthetic chemicals over natural or bio-based ones. The U.S. is one of the dominant agrochemical industries of North America and is home to different fertilizer manufacturing companies.

Application Insights

Diamonium Hydrogenphosphate (DAP) dominated the market with a revenue share of more than 33.0% in 2022.This growth is attributable to increasing demand for DAP fertilizers from the agricultural industry worldwide. China is the leading manufacturer in the world followed by the U.S., Russia, Brazil, and Morocco. It comprises of high nutrient value and has therefore been a popular choice among the farming community worldwide. On an average, DAP production of 1 ton requires 0.4 tons of sulfur to dissolve 1.5 to 2 tons of phosphate rock, and around 0.2 tons of ammonia.

From pricing standpoint of DAP, it largely depends on the fluctuation in price and availability of these feedstocks, coupled with transportation charges and handling & storage costing. The Monoammonium Dihydrogenphosphate (MAP) segment is projected to register the fastest CAGR from 2020 to 2027. China is the largest MAP consuming country. The largest MAP exporting countries are Morocco, China, Russia, and the U.S.; while the largest importing countries include Brazil followed by U.S., Canada, and Australia due to their growing agricultural activities over the past two decades.

The fastest growth of mono ammonium phosphate is attributed to its constituents (nitrogen & phosphorus), which are highly essential components. Due to the water solubility properties, the product mixes readily in moist soil, and universally the product is applied under the surface of the soil in the proximity of plant roots to attain optimum efficiency in terms of plant growth. Apart from the product’s application as a fertilizer, it is also commonly utilized in formulating fire extinguishers, which are widely utilized across all institutions globally as fire prevention safety protocol.

Regional Insights

Asia Pacific region dominated the market with a revenue share of 49.5% in 2022. The region is estimated to retain its dominant position throughout the forecast years owing to high phosphate rock reserves in China, which is also a major producer. The country also has a high production of phosphate fertilizers and yellow phosphorus. However, in recent years the country has witnessed a decline in the product demand owing to the stringent regulations on the usage of phosphate fertilizers.

Aditya Birla Grasun Chemicals Limited (ABGCL) is the leading manufacturer of food-grade phosphoric acid, which is broadly manufactured by the thermal process. The changing lifestyle and economic growth are anticipated to drive the market for packaged food and bakery products, benefiting the food-grade phosphoric acid demand. However, the current chemical industry in China is under high scrutiny from the regional government to protect environmental degradation as well as due to the recent COVID-19 outbreak.

Such factors have resulted in the shutdown of some chemical manufacturing plants, such as the discontinuation of the phosphoric acid plants in Sichuan Province as well as across all major chemical manufacturing sites in the country for the first quarter of 2020. Furthermore, in terms of volume, APAC and African countries are anticipated to reflect substantial growth due to increasing food demand. South Africa is one of the key markets for the product in the Africa region, as the country is observed to face turbulence in crop production due to fluctuating weather conditions.

About 14% of total South African territory receives sufficient rainfall to suffice crop growth, and subsequently, only 10% or less of this land is utilized for farming practices. However, even though the cultivable land availability in the country is low, the overall agriculture output annually meets the local food demand due to the extensive use of synthetic fertilizers and other chemically-derived crop care products.

Key Companies & Market Share Insights

The global industry is concentrated on the presence of multiple million-dollar companies. There are multiple mergers & acquisitions, joint ventures and other alliances formed globally in the industry by most of these companies. For Instance, in July 2022, Ineos Group Ltd. signed three deals with SINOPEC of a value of USD 7 billion to expand its chemical production approach. Moreover, in January 2022, SABIC has completed its transformation process and launched a full-fledged dedicated agri-nutrients company to ensure sustainable business growth in agricultural sector and to provide an end-to-end agricultural solution. This strategic movement is anticipated to upward the production for phosphoric acid in SABIC. The constantly evolving industry has led to several other such strategic initiatives undertaken by key producers to increase their market share. Some prominent players in the global phosphoric acid market include:

-

The Mosaic Company

-

PJSC PhosAgro

-

Nutrien

-

IFFCO

-

EuroChem Group AG

-

Prayon Group

-

Israel Chemical Ltd.

-

Yara International

-

OCP S.A.

-

Aditya Birla Group

Phosphoric Acid Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 42.67 billion

Revenue forecast in 2040

USD 87.06 billion

Growth Rate

CAGR of 4.2% from 2023 to 2040

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2040

Quantitative units

Revenue in USD million, volume in kilotons and CAGR from 2023 to 2040

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East; Africa

Country scope

U.S.; Canada; Germany; Belgium.; France; Russia; Spain; China; India; Japan; Indonesia; Thailand; Vietnam; Brazil; Mexico; Peru; Argentina; Chile; Saudi Arabia; Israel; Jordan; Turkey; Egypt; Morocco; South Africa; Tunisia; Senegal

Key companies profiled

The Mosaic Company; PJSC PhosAgro; Nutrien; IFFCO; EuroChem Group AG; Prayon Group; Israel Chemical Ltd.; Yara International; OCP S.A.; Aditya Birla Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Phosphoric Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2040. For the purpose of this study, Grand View Research has segmented the global phosphoric acid market report based on application and region:

-

Application Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2040)

-

Diamonium Hydrogenphosphate (DAP)

-

Monoammonium Dihydrogenphosphate (MAP)

-

Triple Superphosphate (TSP)

-

Other Fertilizers

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2040)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

Belgium

-

France

-

Russia

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Thailand

-

Vietnam

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Peru

-

Chile

-

-

Middle East

-

Saudi Arabia

-

Israel

-

Jordan

-

Turkey

-

-

Africa

-

Egypt

-

Morocco

-

South Africa

-

Tunisia

-

Senegal

-

-

Frequently Asked Questions About This Report

b. The global phosphoric acid market size was estimated at USD 41.26 billion in 2022 and is expected to reach USD 42.67 billion in 2023.

b. The global phosphoric acid market is expected to grow at a compound annual growth rate of 4.2% from 2023 to 2040 to reach USD 87.06 billion by 2040.

b. Asia Pacific was the largest market for phosphoric acid with a global share of 49.5% in 2022. This is attributable to high phosphate rock reserves in China, which is also a major producer of phosphoric acid.

b. Some key players operating in the phosphoric acid market include The Mosaic Company, OCP S.A., Yara International, Prayon Group, Nutrien, PJSC PhosAgro, Aditya Birla Group, and Israel Chemicals Limited.

b. Key factors that are driving the market growth include increasing production of phosphate fertilizers such as mono-ammonium phosphate (MAP) and diammonium phosphate (DAP).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.