- Home

- »

- Drilling & Extraction Equipments

- »

-

Piling Machine Market Size, Share & Growth Report, 2030GVR Report cover

![Piling Machine Market Size, Share & Trends Report]()

Piling Machine Market Size, Share & Trends Analysis Report By Product (Impact Hammer, Vibratory Drivers), By Piling Method (Impact Driven, Drilled Percussive, Rotary Bored), By Region And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-479-6

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Piling Machine Market Size & Trends

The global piling machine market size was valued at USD 5.06 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030. The escalating demand for piling machines has primarily been propelled by the swift expansion of global infrastructure development. Governments and private enterprises are making substantial investments in diverse construction endeavors. With urbanization steadily on the rise, the need for top-tier infrastructure is growing, consequently driving the market. The piling machine industry is strongly influenced by renewable energy projects, which encompass a diverse range of endeavors focused on tapping into sustainable energy sources like wind, solar, and geothermal power.

According to the International Trade Administration (ITA), there is a remarkable surge expected in global renewable capacity additions, with an increase of 107 gigawatts (GW) projected for 2023. This remarkable surge in renewable energy capacity is being propelled by the increasing support of policies favoring renewables, growing concerns about energy security, and the rising competitiveness of renewable energy compared to fossil fuel alternatives.

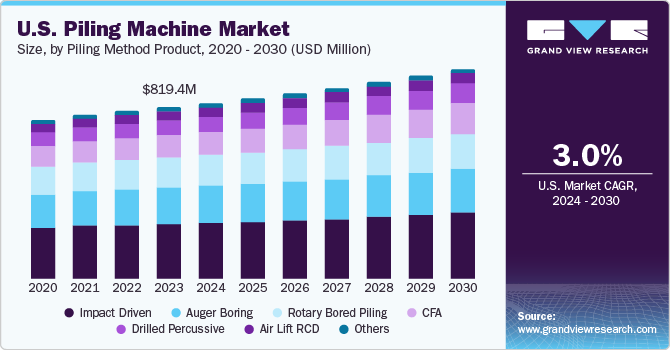

In the U.S., the growth of the construction industry is a key factor contributing to the demand for piling machines. According to the U.S. Census Bureau, the total construction spending (residential and non-residential) in the country grew by 3.5% in June 2023 on a y-o-y basis. Furthermore, government efforts toward bringing semiconductor production back to the U.S. have accelerated the construction of factories. For instance, the USD 1.20 billion Bipartisan Infrastructure Bill passed through the US Senate includes USD 550 billion in new spending on infrastructure. This particular bill is anticipated to boost the construction output in the U.S. in 2022 and 2023 and will further drive the infrastructure and construction activities.

Furthermore, construction plays a significant role in the U.S. economy. As of the 1st quarter of 2023, there were over 919,000 construction establishments in the country, as reported by Oxford Economics Analytics. According to the International Monetary Fund (IMF), the U.S. economy represents around 20% of the total global output. The U.S. economy features a technologically advanced and highly developed service sector, which accounts for approximately 80% of its output. The residential construction sector in the U.S. witnessed a boom in the last few years with single-family dwellings being the key growth contributor.

Piling machines are sophisticated pieces of heavy machinery that require complex engineering and precision manufacturing. They must be capable of exerting enormous force to drive piles deep into the ground effectively. This complexity adds to the cost of their design, development, and manufacturing. In addition, piling machines are built to withstand significant wear and tear, as they are often used in demanding construction environments. They are constructed using high-quality materials, such as heavy-duty steel and durable components, which can be expensive. The high cost of piling machines is anticipated to hinder market growth in the coming years.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to rapid technological advancements. Further, the market players have been undertaking strategic initiatives in order to cater to rising demand for piling machines by joint venture, product innovation, and research & development activities. For instance, BSP TEX launched Mk.3s RICs and accessories, such as drill tools, MX45-8 mast, and vibroflot. These products are used for a wide range of applications such as soil mixing and stone columns.

The market is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. Mergers and acquisitions are undertaken to improve reach of their products in the market, by making these products & services available to end users over diverse geographical areas. For instance, Junttan Oy completed the acquisition of Canadian Pile Driving Equipment, Inc., a Canada-based authorized distributor of Junttan Oy since 2007. Through this acquisition, the company strengthened its position in North America.

Regulations play a crucial role in shaping the landscape of the market. It influences the product development, safety standards, and market access. Market players are increasingly prioritizing sustainability by opting for carbon-efficient processes to manufacture the equipment used in carbon deposition. By embracing sustainable operations, manufacturers are able to not only contribute to environmental conservation but also improve their brand positioning and market penetration rate.

Product Insights

Piling rigs segment led the market and accounted for 41.1% of the global piling machine market in 2023, and expected to grow at a significant CAGR over the forecast period. According to a policy paper of the UK government published in 2019, the infrastructure pipeline, including both public and private sectors, accounts for an investment over USD 656.1 billion planned during the period 2020-2030. Out of this, USD 50 billion will be spent on affordable housing. Moreover, according to a news article published by Travel in 2021, the Saudi government has been working on 15 mega projects related to infrastructure, such as the Journey through Time and Qiddiya. With all these developments, the demand for piling rigs in the global market is anticipated to rise in the coming years to construct transportation structures, infrastructure buildings, and water treatment plants.

The impact hammer segment is likely to grow at the second-highest pace over the forecast period. Impact hammers are used in the construction of residential, commercial, and industrial buildings to create a stable foundation for the structure. According to the U.S. Department of Housing and Urban Development and the U.S. Census Bureau's August 2023 report, a total of 1,543,000 building permits have been issued to construct new residential buildings, which is a 6.9% month-on-month growth as compared to the preceding month of July. Hence, with the growth in demand for residential housing, the demand for impact hammers is expected to rise.

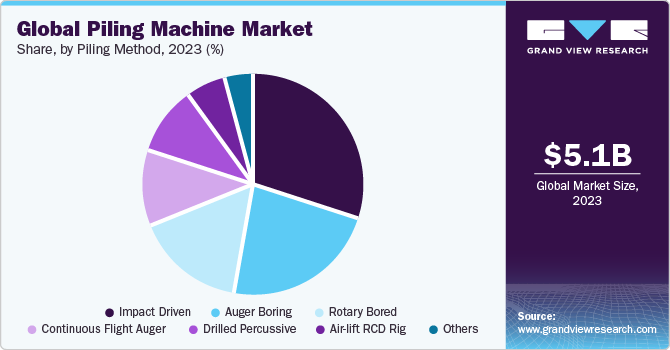

Piling Method Insights

The impact-driven segment accounted for the largest market revenue share in 2023 for the global piling machine industry. The impact pile driving method involves forcing a pile into the ground using the impact force. This impact force can be generated through a hydraulic hammer. The piles used are made up of steel, precast concrete, and timber. These piles can be placed as a single length or spliced for extremely deep piles. Generally, the energy source for the impact-driven piling is hydraulic, hence it is able to transfer more compressive forces. Due to this, impact driving method is generally used for piling very deep and very large piling elements.

The continuous flight auger is likely to witness the highest CAGR over the forecast period. Continuous-flight auger (CFA) utilizes a hollow central pipe with a continuous blade assembled on its surface, which helps in removing debris from the hole. The growing application of CFA in urban construction sites on account of low vibrations caused during the process is expected to fuel its segment demand over the forecast period. The CFA technique is suitable for construction projects with unstable soil conditions, especially in sites located near existing buildings, on account of its ability to generate low noise and vibrations. Due to these factors, the demand for continuous flight auger method is likely to remain high over the forecast period.

Regional Insights

Asia Pacific dominated the market in 2023 and expected to grow at 5.0% CAGR over the forecast period. The economies in the region are anticipated to flourish over the forecast period on account of the massive investments by governments for the development of public infrastructure and the expansion of the residential construction industry, which is expected to benefit the market in Asia Pacific. Furthermore, the region is expected to account for USD 2.5 trillion of growth in construction output from 2020 to 2030, growing by over 50% to become a USD 7.4 trillion market by 2030, according to the Oxford Economies 2021 report. These aforementioned factors are anticipated to propel the demand for piling machines over the forecast period.

The Europe market accounted for the second largest market share in 2023. The growth of the market in Europe is expected to be significantly driven in the coming years by its flourishing residential sector owing to the increasing immigration rate in the region. In addition, surging investments in the development of civil engineering structures are expected to increase the demand for piling machines in Europe over the forecast period. The rise in the number of skyscrapers being constructed due to the scarcity of commercial land and the development of improved architectural technologies are expected to fuel the demand for piling machines in the region in the coming years, thereby leading to the growth of the market in Europe.

Key Companies & Market Share Insights

Some of the key players operating in the market include as Liebherr-International Deutschland GmbH, Sany Group, XCMG Group, Epiroc AB, and BAUER Group.

-

BAUER Group is a provider of products, equipment, and services related to ground and groundwater. It operates through three segments, namely Equipment, Construction, and Resources. Equipment segment offers equipment for foundation engineering as well as mining, exploration, and extraction of natural resources. Construction segment provides foundation engineering services as well as carries out excavation work and ground improvements across the globe. The BAUER Group focuses on products and services in areas of environmental, water, and natural resources through Resources operating segment. BAUER Aktiengesellschaft is the parent company of the BAUER Group and is listed on the German stock exchange. The company is represented by 22 subsidiaries, over 600 service stations, and over 350 accredited sales partners.

-

Liebherr--International Deutschland GmbH has 50 years of experience in design, manufacturing, and servicing mining equipment. The company is also engaged in offering services such as renting construction machinery, offering used machines, procurement & logistics, telemetry, Liebherr Reman program, offering operating fluids for machines, and offering space parts. It also had more than 40 production facilities and 13 product segments. Moreover, it has 140 companies spread across various continents in the world. Liebherr--International Deutschland GmbH is a diversified equipment manufacturing company consisting of ten divisions with a wide product range. The ten product divisions include refrigeration & freezing, mining, mobile and crawler cranes, construction machines, material handling, maritime cranes, aerospace, and transportation systems, gear technology and automation systems, components, and hotels. Under the mining product category, the company offers mining equipment such as mining excavators, trucks, dozers, and draglines.

WATSON DRILL RIG, Beijing SINOVO International (SINOVO Heavy Industry Co., Ltd.), International Construction Equipment, Kejr, Inc. are some of the emerging market participants in the market.

-

International Construction Equipment is engaged in the manufacturing of drilling and pile-driving equipment, primarily catering to North America. The company has a wide range of products including hydraulic impact hammers, diesel impact hammers, excavator-mounted vibratory hammers, clamps & clamping systems, vibratory drivers and extractors, leads & spotters, and other deep foundation equipment. In addition, it provides its equipment on a rental basis as per the customer’s budget or job requirements. Apart from 14 locations in the U.S. and Canada, the company also operates centers in China, Singapore, and South America.

-

The Kejr, Inc. is an original equipment manufacturer and service provider of drilling machines and tools. It has a skilled set of craftsmen and designers working toward providing the best drilling equipment and subsurface probing equipment. These products are known for extracting high-quality groundwater, soil, and rock samples in an efficient manner. The company also provides tools for applications in soil gas sampling, geotechnical sampling, electrical conductivity, groundwater sampling, injection, and grouting.

Key Piling Machine Companies:

- Casagrande S.p.a

- WATSON DRILL RIG

- BSP TEX

- BAUER Group

- TONTI TRADING S.R.L.

- Beijing SINOVO International (SINOVO Heavy Industry Co., Ltd.)

- International Construction Equipment

- ABI Maschinenfabrik und Vertriebsgesellschaft mbH

- Epiroc AB

- Fundex Equipment

- Dieseko Group

- MKT Manufacturing Inc.

- IQIP

- XCMG Group

- Junttan Oy

- Sany Group

- Liebherr-International Deutschland GmbH

- Soilmec S.p.A

- Changsha Tianwei Engineering Machinery Manufacturing Co., Ltd

- Kejr, Inc.

Recent Developments

- In June 2023, Epiroc AB introduced its flagship construction drill rig SmartROC T25 R in June 2023, a smart rig for smarter operations. Moreover, the rig has various significant characteristics, such as a large coverage area, great trainability, application diversity, and a smart Rig Control System that reduces the rig's environmental impact.

- In September 2022, the company launched the Hydrohammer IQ Series. The IQ Series can drive piles constantly with a 100% energy capacity, or it can be enhanced to produce a maximum power of 120% over a set length of time, depending on soil conditions.

Piling Machine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5,244.0 million

Revenue forecast in 2030

USD 6.71 billion

Growth rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, piling method, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Scandinavia; Russia; China; India; Brazil; UAE; Qatar; Saudi Arabia

Key companies profiled

Casagrande S.p.a,; WATSON DRILL RIG; BSP TEX; BAUER Group; TONTI TRADING S.R.L.; Beijing SINOVO International (SINOVO Heavy Industry Co., Ltd.); International Construction Equipment; ABI Maschinenfabrik und Vertriebsgesellschaft mbH; Epiroc AB; Fundex Equipment; Dieseko Group; MKT Manufacturing Inc.; IQIP; XCMG Group; Junttan Oy; Sany Group; Liebherr-International Deutschland GmbH; Soilmec S.p.A; Changsha Tianwei Engineering Machinery Manufacturing Co., Ltd; Kejr, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

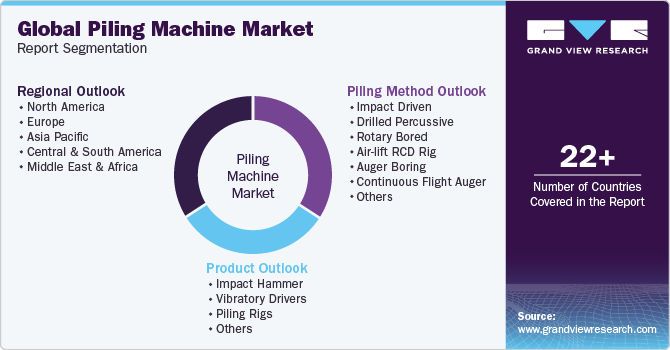

Global Piling Machine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the piling machine market report based on product, piling method, and region.

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Impact Hammer

-

Vibratory Drivers

-

Piling Rigs

-

Others

-

-

Piling Method Outlook (Revenue, USD Million; 2018 - 2030)

-

Impact Driven

-

Drilled Percussive

-

Rotary Bored

-

Air-lift RCD Rig

-

Auger Boring

-

Continuous Flight Auger

-

Others

-

-

Region Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Scandinavia

-

Russia

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global piling machine market size was estimated at USD 5.06 billion in 2023 and is expected to be USD 5,244.0 million in 2024.

b. The global piling machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.2% from 2024 to 2030 to reach USD 6.71 billion by 2030.

b. Asia Pacific region dominated the market in 2023 by accounting for a share of 42.0% of the market. The demand for the piling machine technique in the region is driven by growing infrastructure sector, and adoption of rapid urbanization initiatives by emerging countries.

b. Some of the key players operating in the Piling Machine Market include Casagrande S.p.a, WATSON DRILL RIG, BSP TEX, BAUER Group, TONTI TRADING S.R.L., Beijing SINOVO International (SINOVO Heavy Industry Co., Ltd.), International Construction Equipment, ABI Maschinenfabrik und Vertriebsgesellschaft mbH, Epiroc AB, Fundex Equipment, Dieseko Group, MKT Manufacturing Inc., IQIP, XCMG Group, Junttan Oy, Sany Group, Liebherr-International Deutschland GmbH, Soilmec S.p.A, Changsha Tianwei Engineering Machinery Manufacturing Co., Ltd, Kejr, Inc.

b. The market is anticipated to be driven by infrastructure development to improve the urban infrastructure. Further, rising investment in residential, commercial, and commercial construction projects is likely to drive the market over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."