- Home

- »

- Renewable Energy

- »

-

Renewable Energy Market Size, Share, Industry Report, 2033GVR Report cover

![Renewable Energy Market Size, Share & Trends Report]()

Renewable Energy Market (2026 - 2033) Size, Share & Trends Analysis Report By Source (Bioenergy, Hydropower, Wind Power, Solar Energy), End Use (Industrial, Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-975-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Renewable Energy Market Summary

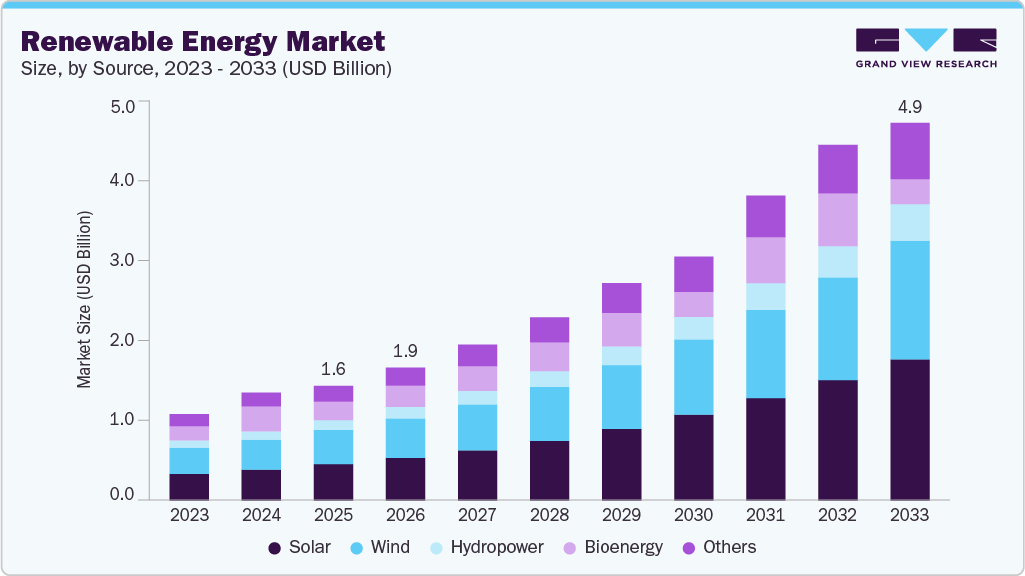

The global renewable energy market size was estimated at USD 1,602 billion in 2025 and is projected to reach USD 4,860.85 billion by 2033, growing at a CAGR of 14.7% from 2026 to 2033. The global shift toward low-carbon energy alternatives and increasingly stringent environmental regulations across developed economies continue to be significant growth catalysts for the renewable energy sector.

Key Market Trends & Insights

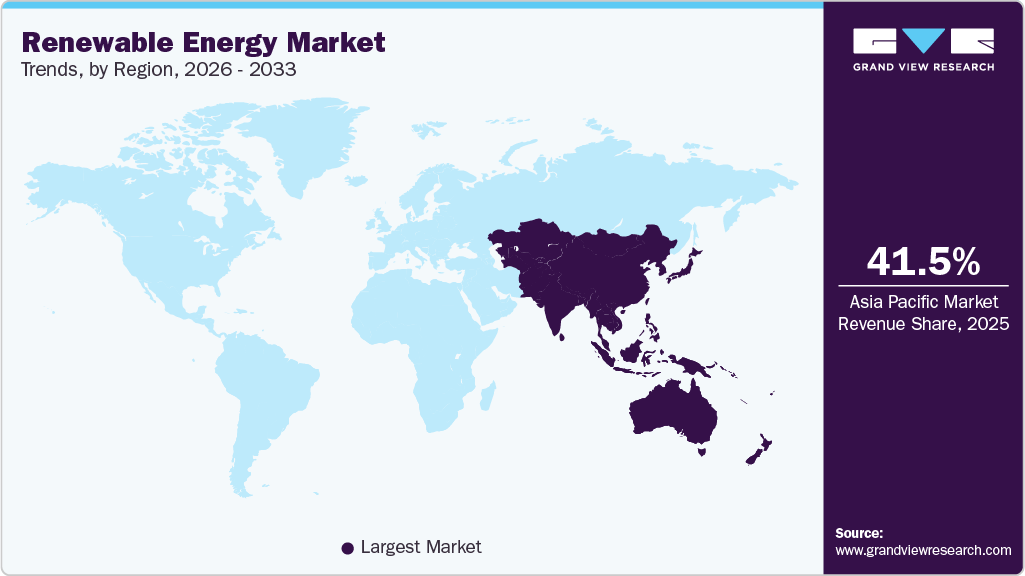

- Asia Pacific dominated the global renewable energy market with the largest revenue share of 41.51% in 2025.

- The renewable energy industry in the U.S. continuously expand rapidly over the forecast period.

- By source, the solar segment led the market with the largest revenue share of 31.61% in 2025.

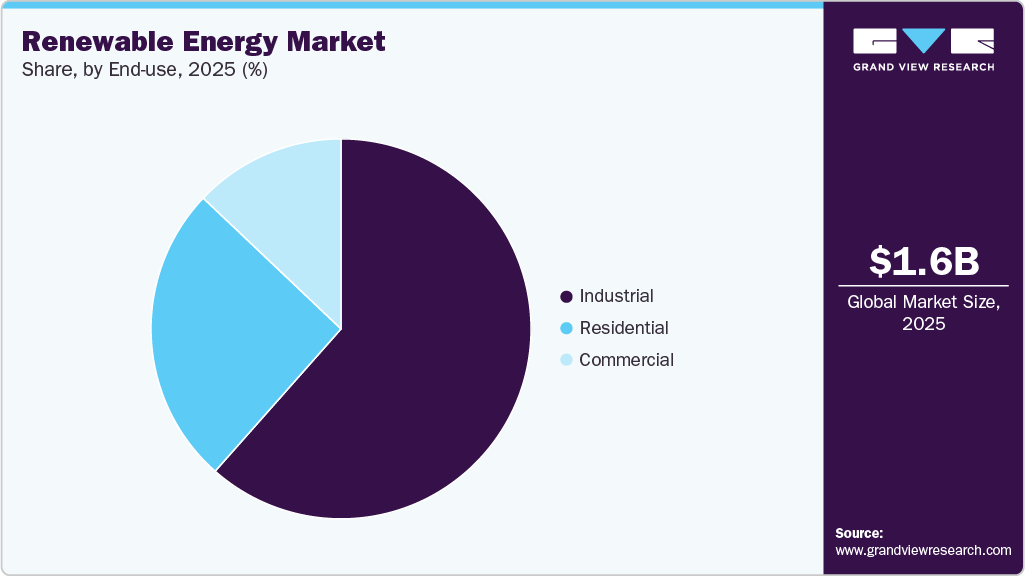

- By end use, the industrial segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1,602 Billion

- 2033 Projected Market Size: USD 4,860.85 Billion

- CAGR (2026-2033): 14.7%

- Asia Pacific: Largest market in 2025

Over the past few years, the power generation industry has witnessed a steady increase in renewable energy capacity additions, primarily driven by heightened environmental awareness and growing pressure to mitigate the effects of greenhouse gas (GHG) emissions. This has led to a rapid expansion of solar and wind power projects across key markets, solidifying their role as dominant forces in the global energy mix.In the United States, renewable energy growth is underpinned by favorable government policies and an abundant supply of renewable feedstock, particularly biomass. The number of renewable power facilities has continued to climb in response to federal and state-level emission mandates. The country’s power generation landscape is transitioning, with natural gas and renewable sources increasingly replacing coal-fired generation. Furthermore, rising electricity distribution costs, recurring grid disruptions, and government-backed incentives for hydropower deployment will likely accelerate the adoption of decentralized renewable systems. These developments are poised to drive further market demand over the coming years.

Germany remains one of the most prominent markets for renewable energy in Europe. In recent years, the country has actively invested in alternative energy technologies to reduce its dependence on fossil fuels and enhance national energy security. These investments have been instrumental in accelerating the growth of solar power generation. With the ongoing expansion of the domestic solar industry, Germany is expected to contribute significantly to regional renewable market growth throughout the forecast period.

Solar power is a sustainable and clean energy source, enabling energy independence and reducing reliance on imported fuels. It also offers multiple long-term benefits, such as flood management, clean water supply, irrigation support, and stable, low-cost electricity generation, while being more resilient than many conventional energy systems.

Drivers, Opportunities & Restraints

The global renewable energy industry is primarily driven by the urgent need to reduce greenhouse gas emissions, diversify energy sources, and ensure long-term energy security. International climate accords and national net-zero commitments have led governments to implement aggressive renewable energy targets and introduce favorable policies, including feed-in tariffs, tax incentives, and green bonds. Simultaneously, declining costs of solar photovoltaic, wind turbines, and battery storage technologies have made renewable energy more economically viable. The rising demand for sustainable electricity across residential, commercial, and industrial sectors supports the large-scale deployment of renewables.

Opportunities are rapidly evolving across the renewable energy landscape. Technological innovations such as bifacial solar modules, floating wind farms, and hybrid renewable systems are unlocking new levels of efficiency and grid integration. The growing focus on decentralized energy systems, rural electrification programs, and cross-border renewable power trade expands access to clean energy in emerging markets. Corporate sustainability goals and power purchase agreements (PPAs) also significantly accelerate renewable capacity additions. However, challenges persist. The intermittent nature of renewable sources, inadequate energy storage capacity, and limited transmission infrastructure in certain regions hinder seamless adoption. Moreover, policy volatility, land acquisition hurdles, and financing risks for large-scale renewable projects remain key barriers to sustained market growth.

Source Insights

The solar segment led the market with the largest revenue share of 31.61% in 2025. It is also expected to maintain a strong growth trajectory throughout the forecast period. As one of the most scalable and rapidly deployable renewable technologies, solar power is pivotal in enhancing energy access, reducing emissions, and diversifying power generation sources. Its ability to generate clean electricity at both utility and distributed scales makes it a cornerstone of global renewable energy strategies, particularly in regions with high solar irradiance and favorable policy frameworks.

Solar power enables greater renewable integration through net metering, rooftop installations, and hybrid systems that pair with energy storage for improved reliability. It supports job creation, rural electrification, and energy independence, especially in developing and energy-insecure regions. The segment’s momentum is reinforced by declining photovoltaic (PV) module costs, advances in panel efficiency, and robust government incentives such as feed-in tariffs and investment tax credits. As nations accelerate the decarbonization of power systems, solar energy’s flexibility, short development timelines, and minimal environmental impact position as a leading driver of market expansion.

End Use Insights

The industrial segment led the market with the largest revenue share of 61.36% in 2025. This dominance is driven by the rising integration of renewable energy solutions across manufacturing plants, processing units, and large-scale industrial facilities. Industries increasingly turn to on-site solar PV installations, biomass systems, and wind turbines to meet sustainability targets, reduce operational costs, and ensure a reliable power supply. The shift is further supported by energy-intensive sectors seeking to decarbonize operations amid growing pressure from regulatory bodies, investors, and consumers.

With energy efficiency and emissions reduction becoming strategic priorities, industrial users are investing in clean energy infrastructure, power purchase agreements (PPAs), and hybrid renewable systems integrated with battery storage. For example, many industrial zones deploy solar microgrids and wind farms to reduce reliance on grid electricity and fossil fuels. These solutions enhance energy resilience and contribute to long-term cost savings. As industrial energy demand grows due to automation, electrification of machinery, and digital manufacturing trends, the segment is expected to remain a key driver of renewable energy adoption globally throughout the forecast period.

Regional Insights

The renewable energy market in North America is anticipated to grow at a substantial CAGR during the forecast period. Large-scale investments in renewable energy infrastructure and an accelerated push for clean power generation drive the North American market. The region is witnessing a steady shift from conventional fossil fuel-based systems toward a more sustainable and diversified energy portfolio. This momentum is fueled by the growing deployment of utility-scale solar farms, wind parks, and hydropower upgrades, supported by federal and state-level clean energy mandates, tax incentives, and carbon reduction targets. Grid modernization efforts and distributed system expansion are also contributing to the market’s long-term growth.

Policy-driven reforms, corporate decarbonization goals, and technological advancements bolster renewable energy adoption in the United States and Canada. Solar and wind remain the dominant segments, while investments in energy storage and community-based renewable projects continue to rise. Government support for rural electrification, net metering programs, and incentives for residential and commercial solar installations are expanding market reach. With an increased focus on energy independence, emissions reduction, and climate resilience, North America is expected to retain a substantial share of the global market throughout the forecast period.

U.S. Renewable Energy Market Trends

The renewable energy market in the U.S. continues to expand rapidly, supported by strong federal policies, state-level clean energy mandates, and rising corporate sustainability commitments. The Inflation Reduction Act and other legislative measures have created a favorable investment climate for solar, wind, and battery storage projects. With increasing pressure to decarbonize the power sector and modernize aging grid infrastructure, the U.S. is accelerating the shift from fossil fuels toward cleaner, more resilient energy systems. Utility-scale solar and onshore wind remain the dominant technologies, while community solar and distributed generation are also gaining ground.

The electrification of transportation, the rising residential and commercial adoption of rooftop solar panels, and the growth of energy storage systems further reinforce renewable energy deployment across the country. The U.S. also invests heavily in offshore wind development and green hydrogen pilot projects, especially along the East Coast and Gulf of Mexico. Grid upgrades, tax credits, and interconnection reforms are facilitating the integration of renewables into the national energy mix. With robust public-private collaboration, advanced R&D, and expanding clean energy employment, the U.S. is expected to remain one of the largest and most dynamic markets for renewable energy globally over the forecast period.

Asia Pacific Renewable Energy Market Trends

Asia Pacific dominated the global renewable energy market with the largest revenue share of 41.51% in 2025 and is expected to grow at the fastest CAGR during the forecast period. The region continues to lead the global renewable energy landscape, driven by rapid capacity additions, strong policy support, and large-scale investments in solar, wind, hydropower, and biomass projects. Countries such as China, India, Japan, and South Korea are aggressively pursuing clean energy expansion as part of their national climate commitments and long-term energy security strategies. Massive growth in urban populations, rising electricity demand, and the need to reduce dependence on imported fossil fuels are accelerating the transition toward renewable sources across the region.

Governments across the Asia Pacific are implementing favorable policy instruments, including feed-in tariffs, green auctions, and renewable portfolio standards, to stimulate market growth. The region also benefits from robust manufacturing ecosystems-particularly in China and India-which enable cost-efficient deployment of solar panels, wind turbines, and battery storage units. Furthermore, investments in smart grid technologies and cross-border power connectivity are enhancing system flexibility and integration of renewables. With its blend of policy ambition, industrial capacity, and rising demand for sustainable energy, the Asia Pacific will remain dominant in the global market throughout the forecast period.

Europe Renewable Energy Market Trends

The renewable energy market in Europe is propelled by the region’s strong regulatory commitment to achieving climate neutrality and its ambitious targets under initiatives like the European Green Deal and REPowerEU. Europe continues to lead in scaling up renewable energy generation by phasing out fossil fuels and prioritizing investments in wind, solar, hydropower, and green hydrogen. The shift is reinforced by sector-wide electrification, particularly in transportation, heating, and industrial applications, supported by energy efficiency mandates and principles of a circular economy.

Efforts to enhance energy security and reduce reliance on imported fossil fuels are driving the adoption of decentralized renewable systems and smart grid integration across the region. Europe’s mature policy environment, advanced infrastructure, and strong collaboration between public and private sectors enable the rapid deployment of utility-scale renewable projects. Offshore wind and distributed solar installations are seeing record growth. With robust support mechanisms, digital energy platforms, and increased consumer awareness, Europe is expected to remain a global frontrunner in renewable energy adoption over the forecast period.

Latin America Renewable Energy Market Trends

The renewable energy market in Latin America is gaining momentum as countries intensify efforts to expand clean energy capacity and meet long-term sustainability targets. Key markets, such as Brazil, Mexico, and Chile, are leading the charge by investing in solar, wind, and hydropower infrastructure to diversify their electricity mix, reduce greenhouse gas emissions, and enhance grid resilience. Surging electricity demand, driven by rapid urbanization, industrial growth, and rising energy consumption, continues to push both the public and private sectors toward renewable energy adoption.

The region’s vast natural resources, high solar irradiance, and favorable wind corridors make it an ideal landscape for renewable energy development. In addition, decentralized energy systems are increasingly deployed to enhance energy access in remote and underserved communities. Regulatory reforms, concessional financing from international development institutions, and strong public-private collaboration further accelerate market expansion. With growing regional commitment to climate action and energy equity, Latin America is expected to remain a high-potential market for renewable energy through the forecast period.

Middle East & Africa Renewable Energy Market Trends

The renewable energy market in the Middle East and Africa is expanding steadily as countries strive to reduce their dependence on fossil fuels and transition to more sustainable power sources. With vast solar resources, high wind potential, and a rising need for energy access, particularly in remote and underserved regions, the region is making significant strides in renewable energy deployment. Leading economies, such as Saudi Arabia, the UAE, Egypt, and South Africa, are spearheading the shift through national strategies to scale up clean energy infrastructure and modernize their electric grids.

Strategic initiatives, such as Saudi Arabia’s Vision 2030 and the UAE’s Net Zero by 2050 roadmap, are accelerating investment in utility-scale solar parks, wind farms, and emerging hydrogen projects. In Sub-Saharan Africa, the focus remains on off-grid and mini-grid systems to address rural electrification challenges and improve energy resilience. International climate funding, development bank support, and cross-sector partnerships facilitate these transitions. As renewable energy becomes increasingly central to national development and climate agendas, the MEA region is poised to become a significant contributor to the global market.

Key Renewable Energy Company Insights

Some of the key players operating in the renewable energy industry include Acciona S.A., General Electric, Tata Power, ABB Ltd., and Schneider Electric among others. These companies are making significant investments in research and development, as well as in large-scale renewable infrastructure projects, to accelerate global decarbonization efforts.

Key Renewable Energy Companies:

The following are the leading companies in the renewable energy market. These companies collectively hold the largest market share and dictate industry trends.

- Acciona S.A.

- General Electric

- Enel S.p.A.

- Tata Power

- Innergex Renewable Energy Inc.

- Suzlon Energy Ltd.

- Invenergy LLC

- ABB Ltd.

- Siemens Gamesa Renewable Energy, S.A.

- Xcel Energy Inc.

- Schneider Electric

Recent Developments

- In March 2025, Iberdrola S.A. announced the commissioning of a 500 MW solar photovoltaic plant in Extremadura, Spain-one of the largest in Europe. The “Solara Ultra” project is expected to generate clean electricity for over 250,000 households annually while avoiding nearly 300,000 metric tons of CO₂ emissions per year.

Renewable Energy Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1,859.4 billion

Revenue forecast in 2033

USD 4,860.85 billion

Growth rate

CAGR of 14.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Source, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Acciona S.A.; General Electric; Enel S.p.A.; Tata Power; Innergex Renewable Energy Inc.; Suzlon Energy Ltd.; Invenergy LLC; ABB Ltd.; Siemens Gamesa Renewable Energy; S.A.; Xcel Energy Inc.; Schneider Electric

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Renewable Energy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global renewable energy market report based on the product, application and region.

-

Source Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hydropower

-

Wind

-

Solar

-

Bioenergy

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global renewable energy market size was estimated at USD 1,602 billion in 2025 and is expected to reach USD 1,859.4 billion in 2026.

b. The global renewable energy market is expected to grow at a compound annual growth rate of 14.7% from 2026 to 2033 to reach USD 4,860.85 billion by 2033.

b. Some of the key players operating in the renewable energy market include Acciona S.A., General Electric, Tata Power, ABB Ltd., and Schneider Electric among others.

b. The key factors driving the renewable energy market include increasing global energy demand, growing environmental concerns, and strong policy support for clean energy adoption. Falling technology costs, solar and wind efficiency advancements, and government incentives such as tax credits and feed-in tariffs are accelerating the shift toward sustainable power sources across residential, commercial, and industrial sectors.

b. Based on the source segment, Solar held the largest revenue share of 31.61% in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.