Market Size & Trends

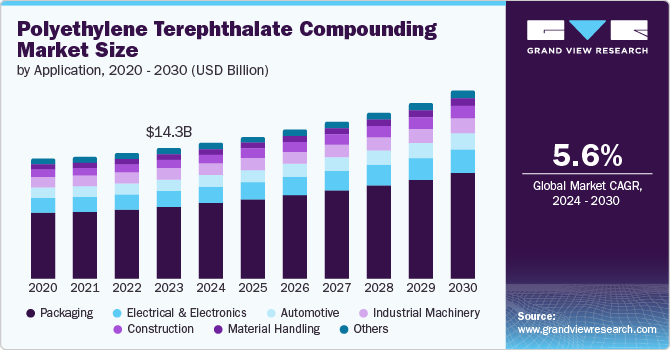

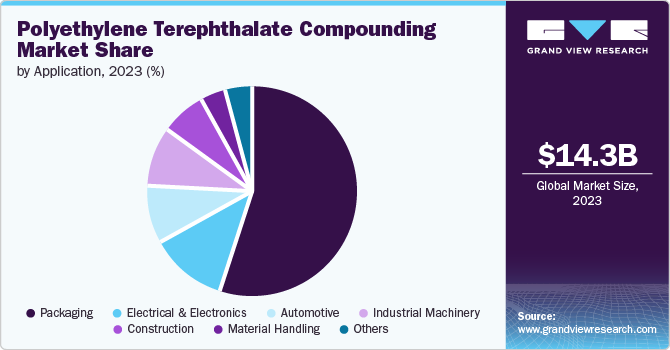

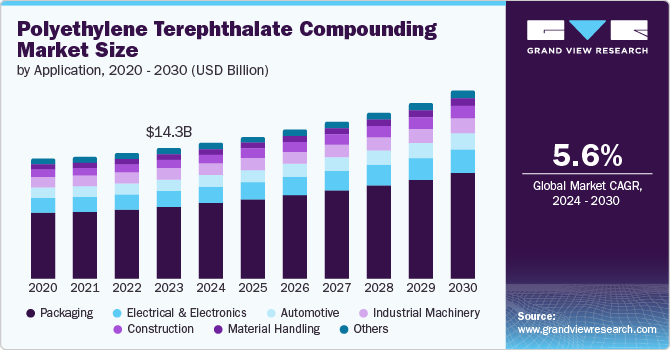

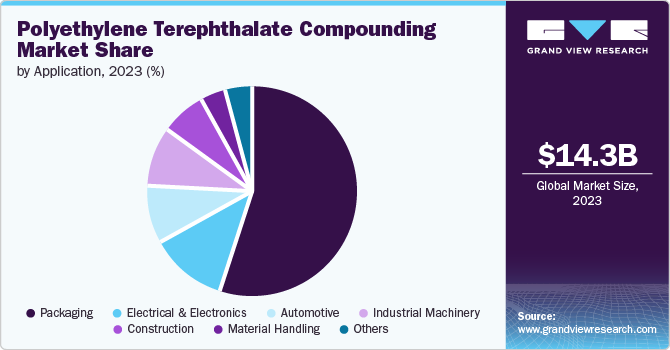

The global polyethylene terephthalate (PET) compounding market was valued at USD 14.30 billion in 2023 and is expected to grow at a CAGR of 5.6% from 2024 to 2030. This projected growth can be credited to the material’s extensive use in product packaging for versatility and cost-effectiveness. The market witnessed a corresponding surge due to the increasing packaging applications in the food & beverage industry. PET compounds were extensively applied to retain food freshness, provide effective insulation, and remain stable during transportation.

Moreover, PET compounds act as a safer alternative to glass for product storage, as they do not break or suffer damage. This appropriately caters to the rising demand for water bottles, which is projected to continue as a key market driver. PET compounding bottles are lightweight, easier to handle, non-breakable, and can be resealed. Additionally, these compounding materials are highly recyclable. They are widely favored as an ideal alternative for single-use plastics with reduced environmental impact.

Furthermore, PET compounding involves combining PET with various additives and modifiers to achieve specific qualities. Different levels of polymerization are used for various applications. For instance, as PET compounds are cost-effective, corrosion-resistant, and durable, they have become suitable for pipe fittings and infrastructure development. Additionally, the PET compounding market caters to various applications, including industrial machinery, electrical and electronics, automotive, construction, and material handling, contributing to overall market growth.

Application Insights

The packaging industry accounted for the largest market share with 55.4% in 2023. This is attributable to the widespread applications of PET compounds in bottles, jars, and containers. The food and beverage sector particularly prefers these materials for maintaining food freshness and dimension stability during transportation. Manufacturers favor PET compounds due to their versatility, cost-effectiveness, and suitability for various packaging needs. Moreover, the increasing global population and income levels have resulted in the demand for packaged goods for convenience. PET packaging caters to this demand by offering lightweight, durable, and convenient solutions.

The electrical & electronics sector is anticipated to grow substantially over the forecast period as the industry experiences robust growth due to emerging technologies. PET compounding films with superior insulation, and mechanical and electrical properties are widely applied in electronic components, displays, and insulation materials. In addition, PET’s non-reactive nature and lightweight properties make it a preferred choice for electrical conduits, cable insulation, and structural components. This has further driven its adoption in the industry.

Regional Insights

The North America PET compounding market held the dominant market share of 18.4% in 2023. This can be attributed to the increasing demand for PET compounds in the packaging industry. The region’s growing demand for packaged food has augmented the growth of PET compounds, used for bottles, jars, and containers. Their versatility, cost-effectiveness, and suitability drive expansive adoption.

U.S. Polyethylene Terephthalate Compounding Market Trends

The PET compounding market in the U.S. witnessed increased demand for high-performance PET compounds that offer enhanced properties including strength, durability, and chemical resistance. Advancements in compounding technologies enable manufacturers to tailor PET compounds for specific applications, driving their adoption across automotive, electronics, and consumer goods industries. The material’s clear, lightweight, and chemically inert properties make it ideal for packaging and structural applications.

Asia Pacific Polyethylene Terephthalate Compounding Market Trends

The Asia Pacific PET compounding market accounted for 45.3% of the market share in 2023. The packaging industry has significantly propelled the demand for PET compounds in the APAC region. The market witnessed a heavy reliance on packaging food and beverages due to its cleanliness, strength, lightweight nature, and ability to retain freshness to cater to urban consumers. Furthermore, as technological advancements continue, the demand for PET compounds in this industry grows, particularly in China and India.

Europe Polyethylene Terephthalate Compounding Market Trends

The Europe PET compounding market held a market share of 21.6% in 2023 owing to the rapid expansion of the electrical and electronics industry. Manufacturers increasingly applied PET films in electrical components for their high insulation, mechanical, and electrical properties. Moreover, environmental awareness in the region has considerably driven the adoption of sustainable materials including PET compounds that are recyclable and non-toxic.

Key Polyethylene Terephthalate Compounding Company Insights

The PET compounding market exhibits significant fragmentation, with a multitude of both small and large-scale companies. Key industry players include Alfa Chemistry, Dow Chemical Company, SABIC, Sinopec, DuPont, and SRP Plastics. These players invest significantly in strategic partnerships, R&D efforts with acquisitions and mergers, and product development.

-

DuPont is an industrial chemicals manufacturer that deals with the production of chemicals, plastics, and solutions for biosciences and the energy sector. The company is responsible for the development of several unique polymers such as mylar, kevlar, nylon, and sorona.

-

Alfa Chemistry is a global Contract Research Organization (CRO) specializing in organic, material, and medicinal chemistry. The company provides an extensive range of chemicals for research and development, including building blocks, custom-made intermediates, carbohydrates, heterocyclic compounds, chiral compounds, fine chemicals, and environmental remediation products.

Key Polyethylene Terephthalate Compounding Companies:

The following are the leading companies in the polyethylene terephthalate compounding market. These companies collectively hold the largest market share and dictate industry trends.

- Alfa Chemistry

- Alpek S.A.B. de C.V.

- China Petrochemical Corporation (Sinopec)

- China Resources (Holdings) Co., Ltd.

- DuPont de Nemours Inc.

- Far Eastern New Century Corporation (FENC)

- Indorama Ventures Public Company Limited

- Jiangsu Sanfangxiang Group Co., Ltd.

- LOTTE Chemical Corporation

- Reliance Industries Ltd. (RIL)

- Saudi Basic Industries Corporation (SABIC)

- SK Inc.

Recent Development

-

In May 2023, SABIC introduced the LNP ELCRIN WF0051iQ compound, which incorporates thin-wall, non-brominated/non-chlorinated flame retardance (FR). This latest addition to SABIC’s sustainable iQ resins is specifically designed for electrical applications. By utilizing post-consumer polyethylene terephthalate (PET) water bottles, chemically upcycled into polybutylene terephthalate (PBT) resin, SABIC further promotes sustainability.

Polyethylene Terephthalate Compounding Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 14.93 billion

|

|

Revenue forecast in 2030

|

USD 20.67 billion

|

|

Growth rate

|

CAGR of 5.6% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Kuwait, Saudi Arabia, UAE

|

|

Key companies profiled

|

Alfa Chemistry; Alpek S.A.B. de C.V.; China Petrochemical Corporation (Sinopec); China Resources (Holdings) Co., Ltd.; DuPont de Nemours Inc.; Far Eastern New Century Corporation (FENC); Indorama Ventures Public Company Limited; Jiangsu Sanfangxiang Group Co., Ltd.; LOTTE Chemical Corporation; Reliance Industries Ltd. (RIL); Saudi Basic Industries Corporation (SABIC); SK Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Polyethylene Terephthalate Compounding Market Report Segmentation

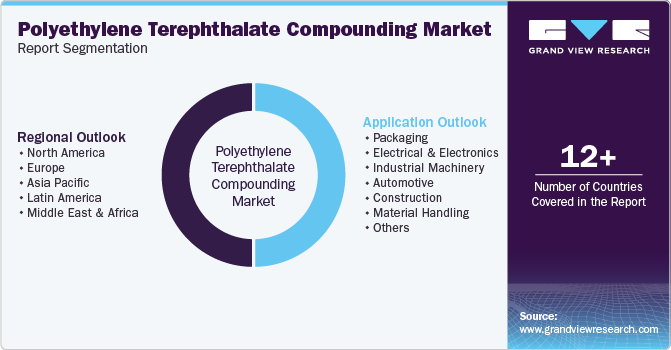

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyethylene terephthalate (PET) compounding market report based on application and region:

-

Application Outlook (Volume in Kilotons, Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Electrical & Electronics

-

Industrial Machinery

-

Automotive

-

Construction

-

Material Handling

-

Others

-

Regional Outlook (Volume in Kilotons, Revenue, USD Million, 2018 - 2030)