- Home

- »

- Specialty Polymers

- »

-

Polyolefin Shrink Film Market Size And Share Report, 2030GVR Report cover

![Polyolefin Shrink Film Market Size, Share & Trends Report]()

Polyolefin Shrink Film Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (General and Cross-linked), By End Use (Food and Beverage, Industrial Packaging, Pharmaceutical), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-620-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyolefin Shrink Film Market Size & Trends

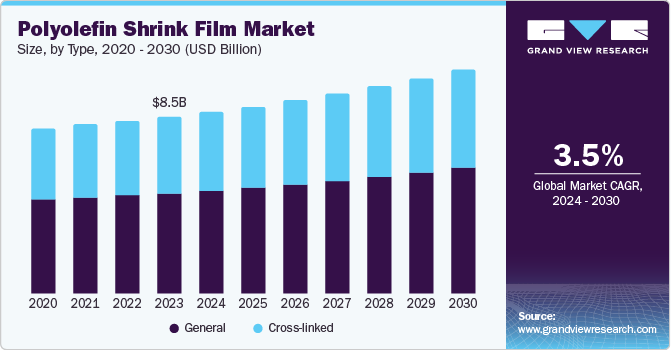

The global polyolefin shrink film market size was valued at USD8.54 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.5% from 2024 to 2030. The increasing penetration of the product in the food, consumer goods, industrial packaging, pharmaceuticals, and beverage application owing to the improved characteristics of the product is expected to drive demand over the forecast period. The market is expected to witness significant growth owing to the increasing technological innovations and improved formulations about the product. Innovative cross-link technology provides the product with high tensile strength, durable heat sealing, and enhanced shrink ability which is expected to be a key aspect driving the market growth.

Polyolefin is preferred over the shrink firms made by other substances owing to the physical and chemical properties such as availability, clarities, variety of thickness, strength, and shrink ratio. Due to the various applications of these shrink films in the food and beverages industry, the demand for polyolefin shrink films is increasing. These films can also be molded into various shapes and sizes for different purposes such as storage, transportation of edible items, and packaging, owing to these various characteristics of the product driving the market.

The polyolefin films are approved by the Food and Drug Administration for direct food contact; therefore, these are used for wrapping edible and non-edible items. Polyolefins are popular due to their low odor after sealing, greater flexibility, and higher seal strength.

The alternatives available for the plastic are expected to be major factors hindering the growth of the polyolefin shrink films market. The cost of shrink plastic films and the cost associated with the tools used for it is much more than the regular plastic films used for packaging, this limits the demand for the shrink film. The growing environmental awareness is expected to create a large number of opportunities for the biodegradable shrink film market.

The food and beverage industry are a major consumer of POF shrink films due to the growing demand for packaged foods, including fresh produce and ready-to-eat meals. Consumers are increasingly concerned about product safety and hygiene. Shrink films offer a barrier against contaminants, preserving product integrity. POF shrink films are widely used for packaging toys, electronics, and household items due to their aesthetic appeal and protective qualities.

The surge in online shopping has led to a significant increase in the need for efficient and protective packaging solutions. Shrink films provide excellent product protection during transit, reducing damage and returns. Continuous advancements in cross-linking technology have improved the physical properties of POF films, leading to enhanced performance features such as better heat sealing, higher impact resistance, and increased shrink ability.

Type Insights

General POF shrink films dominated the market with 56.8% of revenue share in 2023. This is due to their cost-effectiveness, good optical properties, and high shrinkage rates. These films offer a balance of performance and price, making them suitable for a wide range of applications. The increasing demand for affordable packaging solutions across various industries, coupled with the growing focus on efficient packaging processes, is driving the growth of general POF shrink films.

Cross-linked POF shrink films are anticipated to witness the significant CAGR of 3.7% over the forecast period. This upward trend is due to their superior properties such as higher clarity, improved puncture resistance, and better sealing capabilities. These films offer enhanced product protection and presentation, making them ideal for applications that require high-performance packaging. The rising consumer preference for visually appealing and high-quality products, along with the increasing emphasis on product safety and integrity, is fuelling the demand for cross-linked POF shrink films.

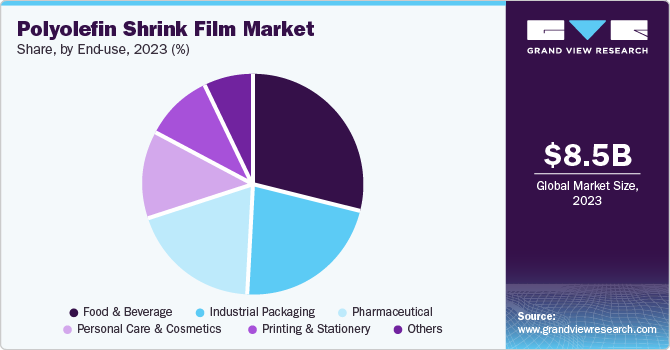

End Use Insights

The food and beverage segment accounted for the largest market revenue share of 28.7% in 2023. The increasing consumer preference for packaged foods, driven by convenience and hygiene concerns, has led to a surge in demand for effective packaging solutions. POF shrink films provide an excellent barrier against moisture, oxygen, and contaminants, thereby extending shelf life and maintaining product freshness.As e-commerce continues to expand within the food sector, the need for durable and lightweight packaging solutions further propels the adoption of POF shrink films.

The industrial packaging segment is projected to grow at a CAGR of 3.7% over the forecast period. Industries such as electronics, pharmaceuticals, and consumer goods increasingly rely on robust packaging solutions that can withstand harsh handling conditions while ensuring product integrity. POF shrink films offer superior puncture resistance and clarity, making them ideal for bundling multiple items together securely without compromising visibility.

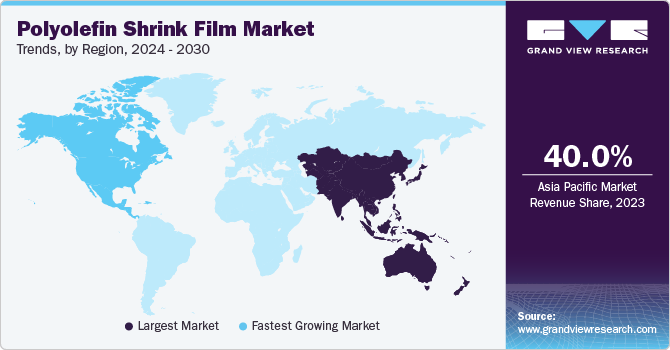

Regional Insights

The North America polyolefin shrink film market is anticipated to grow at a CAGR of 3.6% during the forecast period. It is attributable to robust e-commerce industry, a strong focus on food safety, and the prevalence of advanced packaging technologies is propelling market expansion. The region's well-established supply chain infrastructure, coupled with the increasing demand for convenient and secure packaging solutions, has further fuelled the growth of the POF shrink film market in North America.

U.S. Polyolefin Shrink Film Market Trends

The U.S. polyolefin shrink film market held a dominant position in 2023. The country's large population, high disposable income, and the presence of major retail and food and beverage companies is propelling the market expansion.

Europe Polyolefin Shrink Film Market Trends

The Europe polyolefin shrink film market was identified as a lucrative region in 2023 driven by e-commerce sector, a strong emphasis on sustainability, and stringent food safety regulations. The region's developed packaging industry, coupled with a growing consumer preference for convenient and high-quality products, has created a favourable environment for the growth of POF shrink films.

The UK polyolefin shrink film market held a substantial market share in 2023. The increasing demand for efficient packaging solutions across various industries, combined with the country's emphasis on sustainability, has driven the adoption of POF shrink films in the UK.

Asia Pacific Polyolefin Shrink Film Market Trends

Asia Pacific market dominated the marketwith 40.0% of revenue share in 2023. The market is expected to grow during the forecast period due to the rapid industrialization, urbanization, and rising disposable incomes. The region's burgeoning e-commerce sector, coupled with the growing demand for packaged food and consumer goods, has significantly boosted the consumption of POF shrink films.

The China polyolefin shrink film market held largest share in 2023. The country’s massive population, rapid economic growth, and a thriving manufacturing sector are fuelling the market growth. Furthermore, the country's expanding food and beverage industry, coupled with the increasing adoption of e-commerce, has created a robust demand for POF shrink films.

Key Polyolefin Shrink Film Company Insights

Some key companies in polyolefin shrink film market include Exxon Mobil Corporation, DM PACK SRL, Vibgyor International, Amcor Plc, Allen Plastic Industries Co., Ltd., Sigma Plastics Group and others.

-

Vibgyor International a is a prominent Indian manufacturer, supplier, and exporter of high-quality packaging equipment and materials. The company offers an extensive array of products designed to meet diverse packaging needs. This includes carton strapping machines, hot melt applicators, shrink wrapping systems, liquid nitrogen dosers, conveyors, and automated weighing solutions.

Key Polyolefin Shrink Film Companies:

The following are the leading companies in the polyolefin shrink film market. These companies collectively hold the largest market share and dictate industry trends.

- Exxon Mobil Corporation

- DM PACK SRL

- Vibgyor International

- Plásticos Retráctiles, S.L.

- Amcor Plc

- Berry Global Inc.

- Allen Plastic Industries Co., Ltd.

- FlexiPack

- SABIC

- Sigma Plastics Group

Recent Developments

-

In August 2024, Amcor Plc announced that it signed an agreement to acquire Phoenix Flexibles. The acquisition will enhance the capacity of Amcor in Indian market.

-

In March 2024, ExxonMobil Asia Pacific Research & Development Co., Ltd (ExxonMobil) and Shantou Mingca Packaging Co Ltd introduced double bubble Polyethylene-based Shrink Film (PEF) solution, the next gen of Polyolefin Shrink Film (POF) that can be used for the packaging of household, electronics, personal care products, food, medicines, books & magazines, toys and plastic utensils.

Polyolefin Shrink Film Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.77 billion

Revenue forecast in 2030

USD 10.82 billion

Growth Rate

CAGR of 3.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilo Tons, Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, End Use, and Region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, The Netherlands, Denmark, Sweden, Norway, China, Japan, India, Indonesia, South Korea, Thailand, Australia, Argentina, Brazil, Saudi Arabia, UAE, South Africa

Key companies profiled

Exxon Mobil Corporation, DM PACK SRL, Vibgyor International, Plásticos Retráctiles, S.L., Amcor Plc, Berry Global Inc. , Allen Plastic Industries Co., Ltd., FlexiPack, SABIC, Sigma Plastics Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyolefin Shrink Film Market Report Segmentation

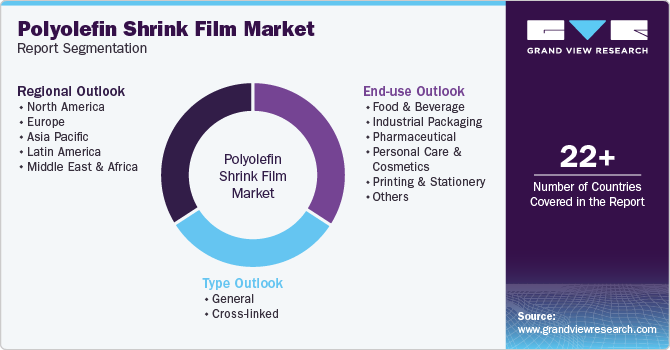

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyolefin shrink film market report based on type, end use, and region.

-

Type Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

General

-

Cross-linked

-

-

End Use Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

Food and Beverage

-

Industrial Packaging

-

Pharmaceutical

-

Personal Care and Cosmetics

-

Printing and Stationery

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

Indonesia

-

-

Latin America

-

Argentina

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.