- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyvinyl Chloride Market Size, Share, Industry Report, 2030GVR Report cover

![Polyvinyl Chloride Market Size, Share & Trend Report]()

Polyvinyl Chloride Market (And Segment Forecasts 2024 - 2030) Size, Share & Trend Analysis Report By Type (Rigid PVC, Flexible PVC), By End-use (Building & Construction, Automotive, Electrical, Footwear), By Region (North America, Europe, Asia Pacific)

- Report ID: 978-1-68038-235-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyvinyl Chloride Market Summary

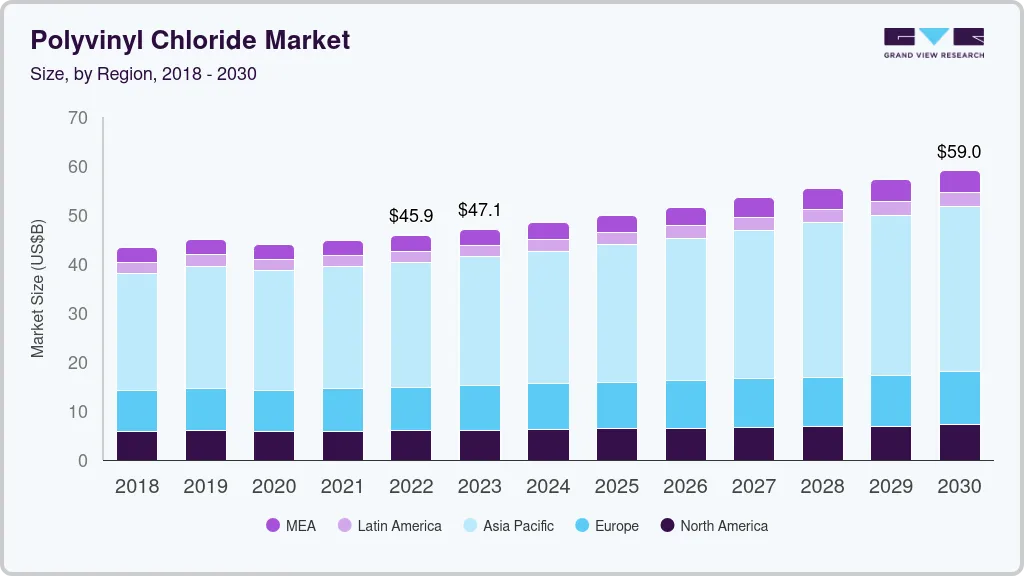

The global polyvinyl chloride market size was estimated at USD 8.54 billion in 2023 and is projected to reach USD 10.82 billion by 2030, growing at a CAGR of 3.6% from 2024 to 2030. As urbanization continues to accelerate, particularly in emerging economies such as India and Japan, the market witnessed a significant demand for durable and cost-effective construction materials.

Key Market Trends & Insights

- The Asia Pacific polyvinyl chloride market secured the dominant market share of 34.1% in 2023.

- The China polyvinyl chloride market dominated the Asia Pacific market in 2023.

- By type, rigid PVC segment dominated the market with a 43.2% share in 2023.

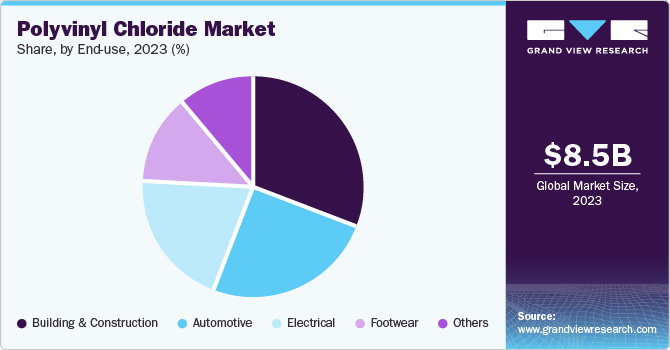

- By end use, the building and construction segment registered for the largest market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.54 Billion

- 2030 Projected Market Size: USD 10.82 Billion

- CAGR (2024-2030): 3.6%

- Asia Pacific: Largest market in 2023

PVC, known for its versatility and durability, has been extensively used in building and construction applications such as pipes, fittings, window frames, and flooring.

PVC’s properties, such as its flexibility, durability, and resistance to chemicals, make it an ideal material for medical applications. It is widely used in the production of medical devices including blood bags, IV containers, and tubing. The ongoing advancements in healthcare infrastructure and the increasing prevalence of chronic diseases have significantly driven the demand for medical-grade PVC products.

In addition, the packaging industry is a substantial contributor to the polyvinyl chloride (PVC) market. The material’s excellent barrier properties, durability, and versatility make it suitable for a wide range of packaging applications. It is used in the production of bottles, blister packs, and shrink wraps. The increasing demand for packaged goods, driven by changing consumer lifestyles and the growth of e-commerce has boosted the need for PVC packaging solutions.

Moreover, technological advancements and innovations in PVC production processes have further driven market growth. Manufacturers have continuously invested in research and development to improve the properties of PVC and expand its applications. Innovations such as the development of high-performance PVC grades and the incorporation of advanced additives have enhanced the material’s performance and broadened its usage across various industries.

Furthermore, environmental considerations are also influencing the PVC market. The development of bio-based plasticizers and the recyclability of PVC are gaining traction as manufacturers and consumers become more environmentally conscious. Bio-based plasticizers, derived from renewable resources, are being used to enhance the flexibility of PVC films and sheets, aligning with the trend towards sustainable and eco-friendly products.

Type Insights

Rigid PVC dominated the market with a 43.2% share in 2023 and is expected to retain its dominance over the forecast period. Rigid PVC, known for its high strength, durability, and resistance to environmental degradation, is extensively used in the construction industry. Infrastructure development projects in emerging countries, including residential, commercial, and industrial buildings, rely heavily on rigid PVC for applications such as pipes, window frames, and doors due to its cost-effectiveness and long lifespan. Moreover, these polymers are highly valued for their recyclability, aligning with global trends toward sustainability. Manufacturers have increasingly focused on producing eco-friendly PVC products, thereby boosting the market. In addition, advancements in PVC production technologies have led to the development of high-performance rigid PVC grades that offer enhanced properties such as improved impact resistance and weatherability.

Flexible PVC is expected to emerge as the fastest-growing segment during the forecast period. The anticipated growth can be attributed to the material’s increasing demand in the packaging industry. Flexible PVC’s properties, such as clarity, flexibility, and resistance to moisture and chemicals, make it ideal for packaging applications. It is widely used in the production of shrink wraps, blister packs, and flexible films. The increasing consumer preference for packaged goods, driven by changing lifestyles and the growth of e-commerce, has considerably propelled the demand for flexible PVC packaging solutions. In addition, flexible PVC is highly preferred for construction applications such as floorings, wall coverings, and roofing membranes. Its durability, ease of installation, and low maintenance requirements make it a preferred choice for construction materials.

End-use Insights

The building and construction segment registered for the largest market revenue share in 2023 due to the ongoing urbanization and infrastructure development, particularly in emerging economies. Polyvinyl chloride (PVC) with its versatility, durability, affordability, and user-friendly nature is widely used in the construction sector as a durable and cost-effective material. For instance, PVC pipes shield electrical wiring from harm and external elements and are commonly used for both surface-mounted and hidden electrical setups. PVC roofing membranes are utilized on roofs that are flat or have a low slope. These barriers offer great water resistance and are capable of enduring severe weather. Their reflective properties make them energy efficient. Furthermore, the renovation and maintenance of existing infrastructure have further contributed to the demand for PVC for its ease of installation and cost-effectiveness.

The automotive sector is projected to grow at a CAGR of 3.7% over the forecast period due to the increasing production and sales of vehicles worldwide. With the robust expansion in the automotive industry, the market witnessed a heightened demand for materials that offer durability and versatility. Polyvinyl Chloride (PVC) is extensively used in automotive applications such as dashboards, door panels, seat covers, and wiring harnesses due to its excellent mechanical properties and ease of processing. In addition, EV manufacturers have increasingly sought lightweight materials to enhance vehicle efficiency and range. The increasing focus on vehicle safety and comfort has further driven the demand for high-quality interior materials.

Regional Insights

The Asia Pacific polyvinyl chloride market secured the dominant market share of 34.1% in 2023 due to the rapid urbanization and infrastructure development in the region. Countries including China and India have experienced significant growth in construction activities, leading to a high demand for durable and cost-effective construction materials.In addition, the rising use of PVC in place of traditional construction materials including concrete, metal, and wood in different applications for its affordability and long-lasting properties has fueled the market growth.

China Polyvinyl Chloride Market Trends

The China polyvinyl chloride market dominated the Asia Pacific market in 2023. China being one of the most urbanized countries with massive development on infrastructure has significantly driven the demand for PVC products, particularly in the construction industry. These PVC products include pipes, fittings, profiles, and flooring and are common in civil construction. The manufacturing industries have grown over the years hence boosting the consumption of PVC.

Europe Polyvinyl Chloride Market Trends

The polyvinyl chloride market in Europe was identified as a lucrative region with a 23.7% share in 2023 owing to the robust demand from the construction sector. As urbanization and infrastructure development continue to expand, particularly in countries including Germany and France, the market is expected to grow due to the significant need for durable, cost-effective, and versatile construction materials. PVC, known for its excellent durability, weather resistance, and low maintenance, is extensively used in various applications such as pipes, window frames, and flooring.

North America Polyvinyl Chloride Market Trends

The North America polyvinyl chloride market held 20.4% of the global revenue share in 2023 owing to the growing emphasis on improving the energy efficiency of buildings using superior insulation materials. The increasing development of different industrial facilities has driven the market's expansion. In addition, the healthcare industry has widely utilized PVC's ability to work well with the body and its simple sterilization process, integrating it into products including tubes, blood containers, and medical equipment.

U.S. Polyvinyl Chloride Market Trends

The U.S. polyvinyl chloride market is expected to be driven by the expanding automotive industry over the forecast period. With the increasing production of vehicles, the market witnessed a growing demand for materials that can enhance vehicle performance and safety. PVC is used in various automotive components, including interior door panels, seat coverings, and wiring harnesses. In addition, PVC’s properties, such as its flexibility, durability, and resistance to chemicals, make it an ideal material for medical applications. The ongoing advancements in healthcare infrastructure and the increasing prevalence of chronic diseases have driven the demand for medical-grade PVC products.

Key Polyvinyl Chloride Company Insights

The global polyvinyl chloride industry is highly competitive and fairly concentrated featuring key market participants such as Formosa Plastics Corporation, U.S.A., Dupont, LG Chem, and others. These companies have primarily focused on product launches with significant investment in research and development activities, acquisitions, and mergers.

-

Formosa Plastics Corporation, U.S.A. produces and sells raw materials for plastic production. The company offers a range of products including PVC resins, VCM, flake caustic soda, caustic soda, hydrochloric acid, HDPE, EVA/LDPE, and LLDPE.

-

Finolex Industries Ltd. offers offers a diverse product portfolio that includes PVC-U pipes, CPVC pipes, and fittings. These products are widely used in various applications such as plumbing, sanitation, and irrigation. In addition to its manufacturing capabilities, Finolex Industries places a strong emphasis on sustainability and corporate social responsibility (CSR).

Key Polyvinyl Chloride Companies:

The following are the leading companies in the polyvinyl chloride market. These companies collectively hold the largest market share and dictate industry trends.

- Formosa Plastics Corporation, U.S.A.

- Dupont

- LG Chem

- Shin-Etsu Chemical Co., Ltd.

- Westlake Corporation

- Celanese Corporation

- Avient Corporation

- Covestro AG

- Entec Polymers

- Sterling Plastics, Inc.

- Finolex Industries Ltd.

Recent Developments

-

In July 2024, Formosa Plastics Corporation, U.S.A. announced the company’s expansion of PVC facility in Baton Rouge, Louisiana. This will have a significant impact on increasing the capability of the facility, enabling more effectively respond to the increasing needs of the customers. The improvement will allow for dealing with increased production capacities and overseeing high-demand periods effectively.

-

In May 2024, Westlake Corporation announced its intention to construct a build PVCO pipe facility at its manufacturing location in Wichita Falls, Texas. The expansion of the facility represents a major step in Westlake's dedication to expanding, innovating, and creating jobs in the area.

-

In April 2024, Delrin, a leading industrial polymer company, announced strategic new partnerships with Channel Prime Alliance and Entec. Under this collaboration, both companies aim to distribute all grades of Delrin products to customers across North America.

Polyvinyl Chloride Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.77 billion

Revenue forecast in 2030

USD 10.82 billion

Growth rate

CAGR of 3.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

type, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Netherlands, Denmark, Sweden, Norway, China, Japan, India, South Korea, Indonesia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, and South Africa

Key companies profiled

Formosa Plastics Corporation, U.S.A.; Dupont; LG Chem; Shin-Etsu Chemical Co., Ltd.; Westlake Corporation; Celanese Corporation; Avient Corporation; Covestro AG; Entec Polymers; Sterling Plastics, Inc.; Finolex Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyvinyl Chloride Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyvinyl chloride market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Rigid PVC

-

Flexible PVC

-

Others

-

-

End Use Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Building & Construction

-

Automotive

-

Electrical

-

Footwear

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.