- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Prepared Flour Mixes Market Size, Share & Growth Report, 2030GVR Report cover

![Prepared Flour Mixes Market Size, Share & Trends Report]()

Prepared Flour Mixes Market Size, Share & Trends Analysis Report By Product (Batter Mix, Bread Mix, Pastry Mix), By Application (Food Processing Industry, Bakery Shop, Household), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68038-774-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

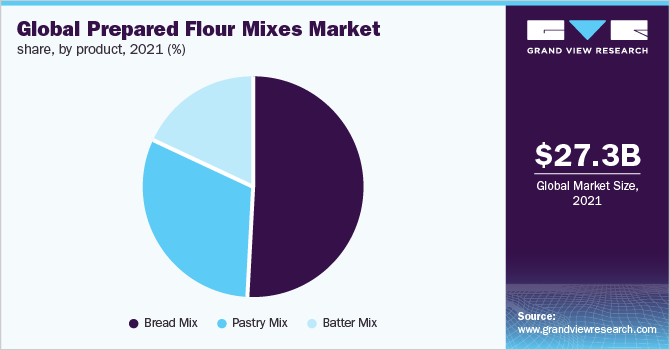

The global prepared flour mixes market size was valued at USD 27.28 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2022 to 2030. The growing urban population and demand for bakery products are expected to be key factors driving the industry growth over the forecast period. The benefits associated with the product, such as ease of use, time-efficient preparation, result consistency, and longer shelf life, as compared to the traditional formulas are supporting its growth in the global industry. The continuously increasing working hours are bolstering the demand for ready-to-cook flour mixes as they save kitchen time. This is a prominent factor projected to support the industry growth over the forecast period.

Prepared flour mixes are a mixture of various ingredients, such as flour, liquid, leavening agents, shortening, sugar, salt, spices, and flavorings. These readymade flour mixes are formulated to prepare specific types of products, such as quick bread, yeast bread, cakes, cookies, pasta, and pastries. The rising awareness regarding the importance of healthy eating habits is supporting the product demand. The rising demand for whole grains and wheat-based bread due to their protein and fiber content will drive industry growth.

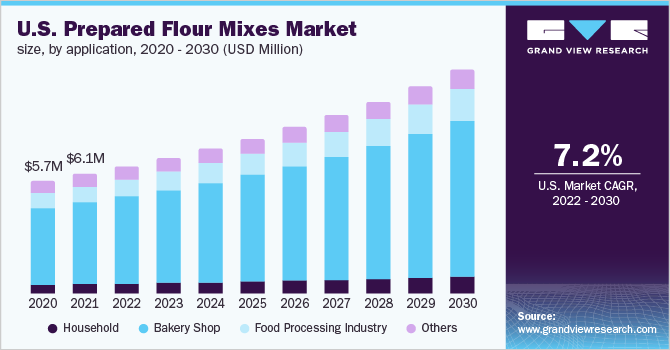

The U.S. dominated the regional market of North America and the country is also projected to maintain its dominance throughout the forecast period. The high demand for bakery products in the country is the major factor supporting the growth. Continuously bolstering the application of these mixes in the bakery industry is supporting its growth in the market. For instance, Bunge North America, Inc. offers a wide range of prepared flours or premix products including rich creme cake mix (chocolate and vanilla), pudding cake mix, and red velvet cake mix among others. Many other players are offering a wide range of products in their respective markets, which is a prominent factor driving product demand.

Product Insights

The bread mix segment dominated the global industry in 2021 and accounted for the maximum share of more than 50.80% of the overall revenue. The segment is projected to maintain its dominance throughout the forecast timeframe. Bread mix is a perfect alternative to bread flour because it is already blended with the correct proportion of ingredients, such as salt and sugar, thus only needs the addition of yeast and water to prepare the bread. Such bread mixes ensure the quality of bread by an unprofessional cook. The advantages offered by bread mixes like a wide variety, consistent quality, optimal use of flour, ease of use, and speedy production are also bolstering segment growth.

The emerging applications of bread in daily meals will further drive the segment's growth. Functional bread is multigrain, low-carb, and high-fiber, which is also projected to drive the segment growth over the forecast period. The rapid growth in the HoReCa sector, which is a collaborative term used for hotels, restaurants, and cafés is further projected to drive growth over the forecast period. Manufacturers are targeting this sector to gain significant profits from the recent growth of the sector. The bakery industry is gaining significant growth after the pandemic due to high demand as a result of lockdowns and restrictions on social gatherings.

These rules and regulations have changed the eating habits of a significant amount of people across the globe, which is further supporting segmental growth. The pastry mix segment is expected to witness the fastest CAGR from 2022 to 2030. A significant increase in demand for parties across bakeries and QuickServiceRestaurants(QSRs) is expected to drive the segment growth over the forecast period. In addition, the availability of a wide range of products, in terms of flavors, colors, and nutritional benefits, is another major factor supporting the demand for prepared pastry flour mixes, especially in restaurants, bakeries, and cafes.

Application Insights

The bakery shop application segment accounted for the maximum revenue share of more than 67.40% in 2021. The segment is projected to maintain its dominance throughout the forecast period. The increasing demand for bakery products, such as bread, cakes, pastries, and muffins, is supporting the segment's growth. The wide variety of flavors for cakes, pastries, and muffins is bolstering its demand in the market. The household segment is also experiencing rapid growth owing to a significant increase in baking at home during the pandemic. During nationwide lockdowns, people started experimenting with new ideas in the kitchen owing to the limitations on the outside food items.

These social distancing rules and the closure of hotels, restaurants, cafés, and bakeries have given growth to the in-house cooking of cakes, pastries, pancakes, cookies, and many more, which has bolstered the demand for prepared flour mixes across the household application segment. According to the Institute of Food Technologists, Chicago, the most common recipes searched on the internet in 2020 included banana bread, pancakes, pizza dough, brownies, crepes, meatloaf, french toast, lasagna, and cheesecake. According to another research done by Kansas State University specialists, 70% of American homes have become the central food preparation spot for 80% of meals in October 2020.

However, in 2019, only 30% of U.S. households were preparing 80% of meals at home. The food processing industry segment is projected to exhibit the fastest CAGR over the forecast period. Increasing demand for packaged food products, which includes waffles, doughnuts, pancake rolls, and others, is further supporting the segment's growth. The continuous automation of the food process industry is further supporting the demand for prepared flour mixes as they can be used in automated machinery for preparing final products.

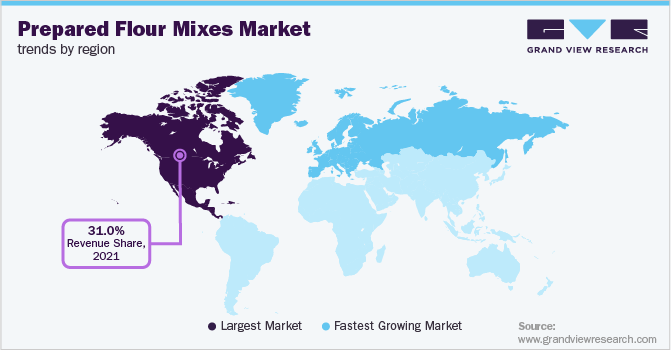

Regional Insights

North America led the global industry in 2021 and accounted for the maximum share of more than 31.00% of the overall revenue. The region’s growth can be attributed to the high demand for prepared flour mixes in the U.S. market. The region is projected to maintain its dominance throughout the forecast period. The demand for wholesale baking industry mixes in the American market is experiencing continuous growth owing to the rising consumption of bakery products. According to the American Bakers Association (ABA), the baking industry in America employs almost 800,000 skilled individuals, generates over USD 44 billion in direct wages, and has an overall economic impact of over USD 154 billion.

Europe is the second-largest region and is also likely to exhibit significant growth over the estimated timeframe. A significant trend toward freshly baked products along with the growing popularity of specialist bread in the region is supporting the regional market growth. In addition, the demand for bakery products that are clean label, vegan or plant-based, and are more sustainably sourced is increasing among consumers, further supporting the region’s growth. Consumers in the Europe region prefer enhanced nutritional benefits from baked goods and products that support in maintaining healthy immune systems and gut health. According to a report published by Tate & Lyle in 2020 on the European bakery industry, Germany, France, Spain, and the U.K. are the significant bakery markets in the region.

The survey participants including 400 senior bakery industry professionals stated that reduced sugar and calorie products are the biggest driver of business growth in the region. Asia Pacific is estimated to register the fastest CAGR over the forecast period. Major companies supporting regional growth include China, Japan, India, Malaysia, and Australia. China led the regional market in 2021. The expanding outdoor eating habits in the emerging economies of the region are primarily supporting its growth. The increasing trend of celebrations has bolstered the demand for cakes, pastries, and muffins, which has supported the bakery application growth in the regional market.

Key Companies & Market Share Insights

Key players are increasingly emphasizing the production of more healthy products along with sustainable production to attract health and environment-conscious customer base and improve brand position. For instance, in March 2022, SwissBake celebrated its 10 years of innovation in bakery and culinary ingredients. The company has 350 products in its portfolio and serves 16 international markets. Its growth is primarily happening with big clients like Taj, The Park, and Hyatt, along with more than 3000 clients including star hotels, industrial bakers, cafes, QSRs, and fine dining restaurants among others. Some of the key companies operating in the global prepared flour mixes market include:

-

ADM

-

Lesaffre

-

Bakels Group

-

PURATOS

-

Associated British Foods plc

-

Allied Pinnacle Pty. Ltd.

-

Intermix

-

Rich Products Corp.

-

Nisshin Seifun Group Inc.

-

Yihai Kerry

-

Nitto-fuji International Vietnam Co., Ltd.

-

Pondan (PPMI)

-

Interflour Group Pte. Ltd.

Prepared Flour Mixes Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 29.23 billion

Revenue forecast in 2030

USD 54.34 billion

Growth rate

CAGR of 8.0% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2022 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Spain; China; India; Japan; Australia; Brazil; Argentina; South Africa

Key companies profiled

ADM; Lesaffre; Bakels Group; Associated British Foods plc; Allied Pinnacle Pty. Ltd.; Intermix; Rich Products Corp.; Nisshin Seifun Group Inc.; Puratos; Yihai Kerry; Nitto-Fuji International VietnamCo., Ltd.; Pondan (PPMI); Interflour Group Pte Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Prepared Flour Mixes Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global prepared flour mixes market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Bread Mix

-

Pastry Mix

-

Batter Mix

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Household

-

Bakery Shop

-

Food Processing Industry

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the prepared flour mixes market include ADM, Lesaffre, Bakels Group, Associated British Foods plc, Allied Pinnacle Pty Ltd, Intermix, Rich Products Corporation, Nisshin Seifun Group Inc., PURATOS, Yihai Kerry, NITTO-FUJI INTERNATIONAL VIETNAM CO., LTD., Pondan (PPMI), Interflour Group Pte Ltd.

b. The key factors that are driving the prepared flour mixes market include the increasing number of consumers moving away from sweeteners, preservatives, and artificial ingredients is resulting in the producers focusing on emerging or producing prepared flavor mixes using natural or organic ingredients.

b. The global prepared flour mixes market size was estimated at USD 27.28 billion in 2021 and is expected to reach USD 29.23 billion in 2022.

b. The global prepared flour mixes market is expected to grow at a compound annual growth rate of 8.0% from 2022 to 2030 to reach USD 54.34 billion by 2030.

b. Bread mix dominated the prepared flour mixes market with a share of over 50% in 2019, on account of the growing per capita consumption of bakery products such as bread, cakes, and rolls among customers under distinguished demographics strongly sustain by its extensive price range and convenience is one of the significant factors propelling the bread mixes product globally.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."