- Home

- »

- Consumer F&B

- »

-

Bakery Products Market Size & Share, Industry Report, 2030GVR Report cover

![Bakery Products Market Size, Share & Trends Report]()

Bakery Products Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Breads & Rolls, Cakes & Pastries, Cookies, Tortillas, Pretzels,), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-229-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bakery Products Market Summary

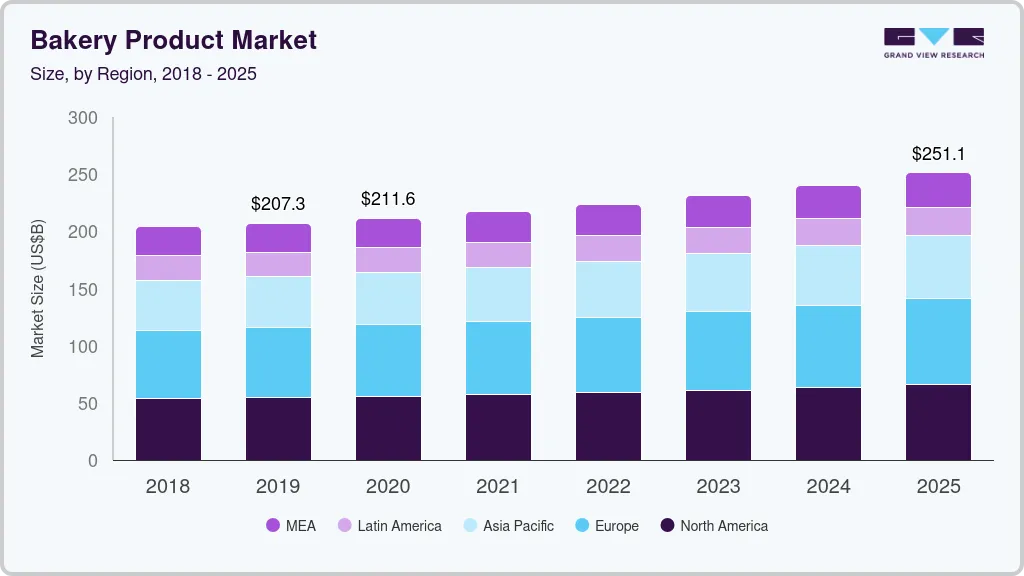

The global bakery products market size was valued at USD 495.6 billion in 2023 and is projected to reach USD 714.1 billion by 2030, growing at a CAGR of 5.4% from 2024 to 2030. The growing demand for bakery products across the globe is driven by the trend towards convenient foods and the evolving lifestyles of people.

Key Market Trends & Insights

- The North America bakery product market accounted for a revenue share of 27.4% in 2023.

- The U.S. bakery product market is expected to grow at a significant CAGR over the forecast period.

- By Product, Cakes & pastries dominated the market and accounted for a revenue share of 28.2% in 2023.

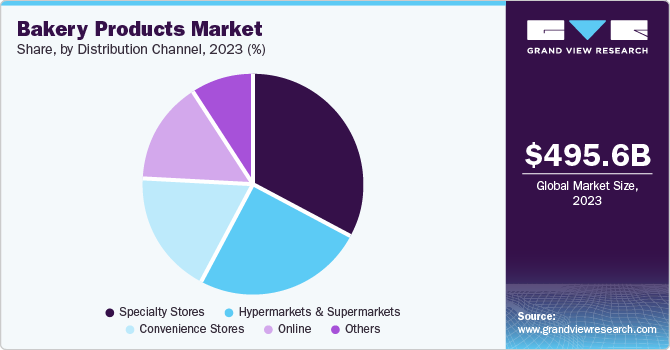

- By Distribution Channel, The specialty stores segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 495.6 Billion

- 2030 Projected Market Size: USD 714.1 Billion

- CAGR (2024-2030): 5.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

A variety of bakery products are available in the market, with constant changes in bakery products catering to different consumer groups, which is expected to drive market growth over the forecast period.The bakery sector provides a wide range of products such as cakes, brownies, cupcakes, croissants, cookies, and other bakery items. This selection accommodates a wide range of preferences and events. For example, biscuits, which are bakery products, are constantly improving and are commonly used as an evening snack in households and cater to the evolving needs and preferences of consumers driving the market growth.

Various bakery products are commonly used in various places. Such as cakes and pastries are a big part of celebrations in various countries. It is a commonly seen bakery product in wedding celebrations, birthday celebrations office parties, and house parties. Similarly, bakery items such as bread have been a fundamental part of people's diets across the globe for many years. Bread and butter is the most common morning breakfast in many households. Moreover, the growing popularity of natural nutrition, healthy lifestyle, and organic food has led to a higher need for whole wheat, low-on-calorie, natural, and additive-free bakery items. The continuous innovations and changes as per consumer demand are the key factors of market growth.

The hectic lifestyle of people and busy schedules demand convenient food choices. Bakery items provide easy and convenient breakfast or snack choices that are ideal for consuming while on the move. Pre-made bakery products, and bakery shops offering quick pick-up options are ideal for meeting this demand. Also, the major growing factor is the affordability and the economical price of the product. The solid distribution channel allows customers to have easy access to bakery products. The rise of online shopping allows easy access to a wider range of bakery products. Moreover, coffee shops and cafes frequently include freshly baked pastries and goods in their menu, enhancing the convenience and enjoyment for customers.

Product Insights

Cakes & pastries dominated the market and accounted for a revenue share of 28.2% in 2023. Cakes and pastries are popular desserts around the globe. It has been a part of cultural and religious customs in history as well. Their delicious tastes, variety of textures, and adaptability make them attractive to a vast range of people. Cakes and pastries are a traditional delicacy of many countries; it is an important part of celebrations and parties worldwide. This trend of celebrating events such as festivals, birthdays, weddings, office parties, and housewarming parties with cakes is highly adopted by several countries anticipating more growth of the sector in the bakery products market.

The cookies segment is expected to grow at a significant CAGR over the forecast period. Cookies provide a convenient and delicious way to meet the desired sweet cravings. There is a diverse range of flavors and textures available in cookies which cater variety of consumers with different tastes and preferences. The increasing emphasis on health and well-being is increasing and the demand for digestive cookies, nutritional cookies, whole grain cookies, gluten-free, and no-sugar cookies has increased over the last few years. It is a ready-made and easy breakfast and snack option, which is a key factor in the growth of the cookies segment.

Distribution Channel Insights

The specialty stores segment dominated the market in 2023. Specialty stores often focus on the niche preferences of consumers. Such stores cater to customers with their specific needs of taste and flavor, size, and shape of various bakery products. Customers with specific dietary needs such as gluten-free products, organic, vegan breads, and pastries mostly prefer specialty stores as they provide customized products as per consumer needs. Specialty bakeries are well known for constant innovations and offering unique products. The consumer looking for a unique blend of traditional and modern combinations of bakery products also find their preferred bakery choices in these stores. Specialty stores are capturing a growing segment of the market by meeting these evolving consumer demands

The online segment is projected to grow at the fastest CAGR of 7.7% over the forecast period. Online purchasing enables customers to make orders from the comfort of their homes and receive freshly baked products delivered to their doorsteps. This appeals the busy individuals who have limited time to shop. Online platform provides variety of bakery products, including both local bakery products and specialty shop products from across the country. It gives consumers a wider scope of selection. The recent upsurge in food delivery systems, applications, and services has made it more feasible for customers to order bakery products online. Additionally, social media marketing is making bakery products more popular and connects directly to online customers driving the segment growth.

Regional Insights

The North America bakery product market accounted for a revenue share of 27.4% in 2023. North America has a huge population and a strong tradition of consuming bakery products in festivals and celebrations. Artisan bakery goods with distinctive flavors and ingredients are highly demanded in the region.

U.S. Bakery Product Market Trends

The U.S. bakery product market is expected to grow at a significant CAGR over the forecast period. The bakery sector witnessed a strong resurgence in demand for bakery products in social gatherings and celebrations after the pandemic. The increased demand for bakery products made with organic ingredients, low sugar, and whole grain items is largely in demand in the country. Vegan products and gluten free products are gaining traction and helping the market to grow.

Europe Bakery Product Market Trends

Europe bakery product market dominated the market with a revenue share of 34.0% in 2023. The European bakery products market is well-established in terms of distribution channels, supply chain, wide product range, and consumer preferences. The innovation and development in the bakery product is influenced by the health consciousness preferences of customers are driving the market growth.

The UK bakery product market is expected to grow rapidly in the coming years due to the market offers promising growth opportunities, fueled by consumer trends, innovation, and evolving shopping behaviors. The UK has a large number of independent bakery houses and bakery products such as cakes and pastries are a major part of their celebrations and customs.

Asia Pacific Bakery Products Market Trends

Asia Pacific bakery products market is anticipated to grow with the fastest CAGR of 6.7% over the forecasted period. The rising influence of western food culture in many Asian countries leads to increase in demand for breads, pastries, and cakes in the region. For the growing urbanization and a busy lifestyle, the ready to eat bakery products are becoming popular. The bakery products market is still an untapped business in many Asian countries and people are seeing potential and developing new businesses, which is driving the growth in the region.

China bakery products market held a substantial market share in 2023. China is currently the second-largest bakery market globally and is predicted to maintain its position in future as well. China's bakery industry is experiencing growth due to the increase in the disposable income of people, the adoption of Western diets, and a greater desire for convenient food choices.

Key Bakery Products Company Insights

Some of the key companies in the bakery products market include Grupo Bimbo S.A.B. de C.V., Britannia Industries, Nestlé S.A., General Mills, Inc., and Campbell Soup Company. Organizations are focusing on increasing their customer base by launching new products in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Britannia Industries is a leading food products company established in India, now catering to more than 80 countries in the world. Their key businesses are in bakery, dairy, and adjacent snacking categories.

-

Campbell Soup Company is an American company, it is one of the largest processed food companies with a wide range of products such as processed soups, other canned foods, baked goods, beverages, and snacks. Their mission is ‘connecting people through food they love’.

Key Bakery Products Companies:

The following are the leading companies in the bakery products market. These companies collectively hold the largest market share and dictate industry trends.

- Grupo Bimbo S.A.B. de C.V.

- Britannia Industries

- Nestlé S.A.

- General Mills, Inc.

- Campbell Soup Company

- Associated British Foods plc

- Kraft Foods Group, Inc.

- ITC Limited

- Finsbury Food Group Limited

Recent Developments

-

In July 2023, Campbell Soup announced a huge investment of USD 160 million in its Richmond, Utah bakery, to expand its production to meet customers' demand.

-

In March 2023, Britannia Industries Limited, announced that it had crossed 100cr revenue in its treat croissant business, in one year of product launch.

Bakery Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 521.2 billion

Revenue forecast in 2030

USD 714.1 billion

Growth Rate

CAGR of 5.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia & New Zealand, Brazil, Saudi Arabia

Key companies profiled

Grupo Bimbo S.A.B. de C.V.; Britannia Industries; Nestlé S.A.; General Mills, Inc.; Campbell Soup Company; Associated British Foods plc; Kraft Foods Group, Inc.; ITC Limited; Finsbury Food Group Limited

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bakery Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bakery products market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bread & Rolls

-

Cakes & Pastries

-

Cookies

-

Tortillas

-

Pretzels

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Bakery Stores

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

- Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Central & South America

-

Brazil

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.