- Home

- »

- Next Generation Technologies

- »

-

Project Portfolio Management Market Size Report, 2030GVR Report cover

![Project Portfolio Management Market Size, Share & Trends Report]()

Project Portfolio Management Market Size, Share & Trends Analysis Report By Solution, By Platform (Software, Service), By Deployment, By Enterprise Size, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-911-1

- Number of Pages: 138

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Technology

Project Portfolio Management Market Trends

The global project portfolio management market was valued at USD 4.80 billion in 2022 and is expected to grow at a CAGR of 13.0% from 2023 to 2030. The growing adoption of cloud-based services for the remote monitoring of assignments is an essential factor that is expected to contribute significantly to market expansion. A surge in activities such as automation and digitalization across industries, including healthcare, government, BFSI, telecom, and engineering and construction, has stimulated the need for monitoring and analytical solutions to increase productivity and business efficiency. It is significantly encouraging the implementation of project portfolio management (PPM) solutions.

The growing complexities in projects and the need for timely and efficient management are expected to drive market growth over the forecast period. Furthermore, the need to gain a 360-degree view of project operations and resource management is driving the demand for PPM solutions. The software helps in collaborative scheduling, planning, and faster and more efficient decision-making. Additionally, a surge in the trend of bringing your device coupled with the growing focus of organizations on attaining faster Return on Investment (ROI) are the key factors driving the market growth.

The project portfolio management software assists businesses in improving productivity, increasing the pace of innovation, and adapting to the rapidly shifting economic scenario and competitive dynamics. Additionally, the PPM software offers capabilities such as time tracking, data analytics, and cost management. Increasing penetration of connected devices in emerging economies such as Brazil, China, and India is expected to keep the industry’s growth prospects upbeat. Increasing investments in research and development activities have encouraged the development of innovative solutions, such as mobile application-based project portfolio management solutions, enabling access to an extensive consumer base. All these factors are propelling the growth of the PPM market.

Project portfolio management is a useful solution as it improves the organization’s adaptability toward change and makes it easy to introduce new projects. Additionally, review and monitoring techniques are introduced to track projects for anomalies and delays and invoke necessary steps to streamline them and subsequently achieve higher returns. Furthermore, with the help of PPM solutions, the companies can emphasize more on achieving targets by focusing on strategies instead of the project operations itself. Additionally, it provides techniques such as scoring techniques, heuristic models, and visual or mapping techniques for the assessment of different projects.

Growing competition worldwide is pushing companies to lessen project costs, which in turn is boosting the use of project portfolio management. However, security and privacy issues, especially in the case of cloud deployment, are the major challenges faced by companies while executing PPM solutions. Furthermore, complexity and cost issues involved with project portfolio management solutions are also among the major hurdles to its widespread adoption. These factors are anticipated to impact the adoption of PPM solutions adversely.

Rising digitization and the growing popularity of automation have propelled the demand for analytical & monitoring solutions in multi-regional businesses, supporting the market growth. The Project Portfolio Management (PPM) market is poised to grow considerably in the forecast period due to the rising need for project management software & services to manage and reduce project complexities effectively. Furthermore, rising public & private investments in R&D activities have boosted innovative solutions development, including mobile application-based project portfolio management solutions, allowing firms to reach an extensive consumer base.

The increasing usage of PPM solutions in data management services and the growing trend of Bring Your Device (BYOD) among multiple business sectors are some vital factors driving project portfolio management growth. PPM solutions assist firms in budget alignment, reduce project delivery downtime, and enable efficient resource utilization. Due to these benefits, PPM solutions are adopted in various sectors such as BFSI, engineering & construction, IT & telecom, and government. Integration of AI technologies in PPM software for multiple tasks automation enables the project managers to focus on other essential duties and achieve the project's strategic goals. Various companies are digitizing their operations with increasing internet penetration for the expansion of their business network as well as client base, enhancing industry statistics.

The rising integration of cloud-based solutions due to its various benefits, such as improved productivity & collaboration, easy accessibility, and low maintenance, is creating a positive market outlook across the globe. Moreover, different business firms highly emphasize elevating project cost efficiency without compromising functionality, creating robust market opportunities for cloud-based solutions. Various market players are investing in their R&D to develop cloud-based project portfolio management solutions. For instance, in May 2022, DigitalOcean Holdings, Inc. launched serverless cloud-based project management solutions, enabling scalable, cost-effective, and fast-computing solutions for startups and small businesses.

Changing business needs and significant industry rivalry force companies to modify their business operations to meet evolving market demands. For this, companies from various sectors prefer project portfolio management services to increase the productivity of their business operations and acquire a higher market share. Industry participants are adopting diverse business strategies to enhance their service offerings in the market and attract potential business clients. For instance, in December 2021, Planisware Inc., a project portfolio management provider, partnered with EOS Software to incorporate the EOS Integrated Technology Portfolio Management (ITPM) solution in Planisware Inc.'s business operations.

Security risks associated with cloud-based platforms are key market factors restricting market growth. Increasing unauthorized access activities for data breaching & data stealing results in significant data & financial losses to the organizations. These activities have challenged enterprises in managing privacy & digital security, such as risk management, compliance issues, and rigid technical infrastructure. Market players are enhancing their in-house software development process and implementing various security protocols to improve the security of their project portfolio management software & services. Industry participants are launching security updates frequently for their existing customers to improve their project portfolio management software & services capabilities to defend against evolving digital threats.

Solution Insights

The information technology segment accounted for the largest revenue share of 54.1% in 2022. It is attributed to the increasing demand for more sophisticated and user-friendly PPM software that can help businesses manage their IT projects more effectively. IT projects are often complex and require the coordination of multiple teams and resources. It can make it difficult to track the progress of projects and ensure that they are completed on time and within budget. PPM software can help IT project managers track the progress of their projects, identify and manage risks, and allocate resources more effectively.

The new product development segment is expected to grow at the fastest CAGR of 14.4% during the forecast period. NPD is a complex process that involves a wide range of activities, and PPM software can help NPD project managers track the progress of their projects, identify and manage risks, and allocate resources more effectively.

Platform Insights

The software segment accounted for the largest revenue share of 68.3% in 2022, owing to the increasing demand for more sophisticated and user-friendly PPM software that can help businesses manage their projects more effectively. Additionally, small and medium-sized businesses are increasingly adopting PPM software to improve their project management processes and efficiency. The rise of agile project management and the need for better decision-making are also contributing to the growth of the software segment.

The services segment is expected to grow at the fastest CAGR of 14.1% during the forecast period. The services segment comprises integration and deployment, support and consulting, and training and education services. The surging demand can be attributed to the innovative services offered by the market players, such as process assessment, process improvement, and reporting and analysis. Developments in project portfolio management services such as on-the-job communication facilities, assignment governing policies, and program facilitation services help organizations in comparing macro-environmental factors that lead to increased productivity and ROI.

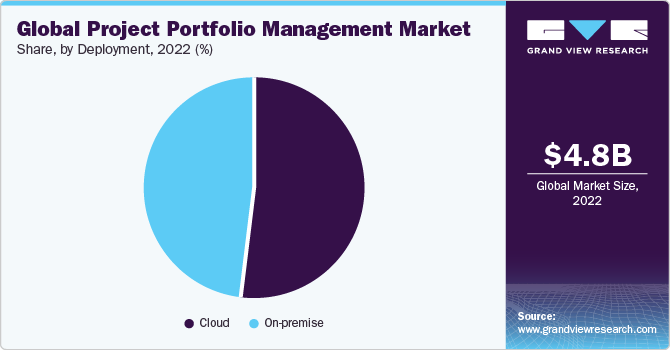

Deployment Insights

The cloud segment accounted for the largest revenue share of 52.5% in 2022 and is expected to grow at the fastest CAGR of 15.2% during the forecast period. Cloud-based solutions offer cost efficiency and flexibility, due to which the user preference for the adoption of these solutions is higher. Cloud systems offer a greater level of scalability, reduced cost of implementation, and continual development. The deployment of cloud-based solutions stimulates the ease of service delivery due to its virtual presence that makes organizations access data across connected devices at any point in time. Moreover, cloud-based PPM solutions facilitate higher control over operations across multiple business channels. These benefits are expected to drive the adoption of cloud PPM solutions across verticals.

The on-premise segment is expected to grow at a significant CAGR of 10.0% during the forecast period. It has been a classical approach that has existed since the beginning of the computer age. The on-premise solution offers total control over the software as all sensitive data is stored internally, and there is no risk of exposing it to a third party. On-premise deployment further enables more options for customizations. However, companies are increasingly shifting toward the usage of cloud-based solutions as on-premise solutions have higher operational costs. The other factor is the high maintenance requirements, as it becomes the organization's responsibility to upgrade and scale the solution when required.

Enterprise Size Insights

The large enterprise segment accounted for the largest revenue share of 62% in 2022. It can be attributed to the availability of high capital and affordability, allowing large organizations to adopt PPM solutions. Large enterprises are investing heavily in participating in today’s competitive industry and are continually undertaking several projects to add innovative product lines or replace and improve existing processes/products. Thus, in a bid to gain a competitive edge, a large enterprise segment is expected to drive the adoption of project portfolio management solutions over the forecast period.

The small and medium enterprise segment is expected to grow at the fastest CAGR of 14.0% during the forecast period. The growth in foreign investments toward SMEs is expected to drive the growth of the segment. The growing SMEs in emerging economies and increasing penetration of information technology services are further contributing to the segment growth. These solutions offer effective monitoring and control of business functions and help in business optimization and decision-making for SMEs.

Application Insights

The BFSI segment accounted for the largest revenue share of 24.0% in 2022. Project portfolio management solutions facilitate the BFSI industry in managing customer transaction data due to its complex multi-regional operation. Technological proliferation in the BFSI industry, such as mobile banking and e-banking, has encouraged the implementation of project portfolio management solutions. Furthermore, the usage of other services by banks, such as debit, credit, and centralized fund managing systems, has led to the usage of these solutions for database monitoring. These solutions facilitate monitoring transactional & customer information and subsequently help in providing high transparency.

IT & Telecom segment is expected to grow at the fastest CAGR of 14.7% during the forecast period. The growth in the IT and telecom segment is attributed to the increasing complexity of IT and telecom projects, the need for real-time data and insights, the growing popularity of cloud computing, and the increasing demand for digital transformation. PPM software can help IT and telecom companies manage their projects more effectively in all of these areas.

The healthcare segment is expected to witness significant growth over the forecast period. The healthcare industry faces many issues, such as the unreliable quality of data owing to various complicated projects. Hence, vendors are offering PPM solutions to this sector to reduce costs and improve patient care and quality, reducing equipment installation time, decreasing readmission rates, accelerating automation of electronic medical records (EMR), and minimizing waiting time to optimize revenue cycles. Owing to these factors, the healthcare segment is witnessing a surge in the adoption of PPM solutions for meeting market demand, delivering uninterrupted patient care, and sustaining costs.

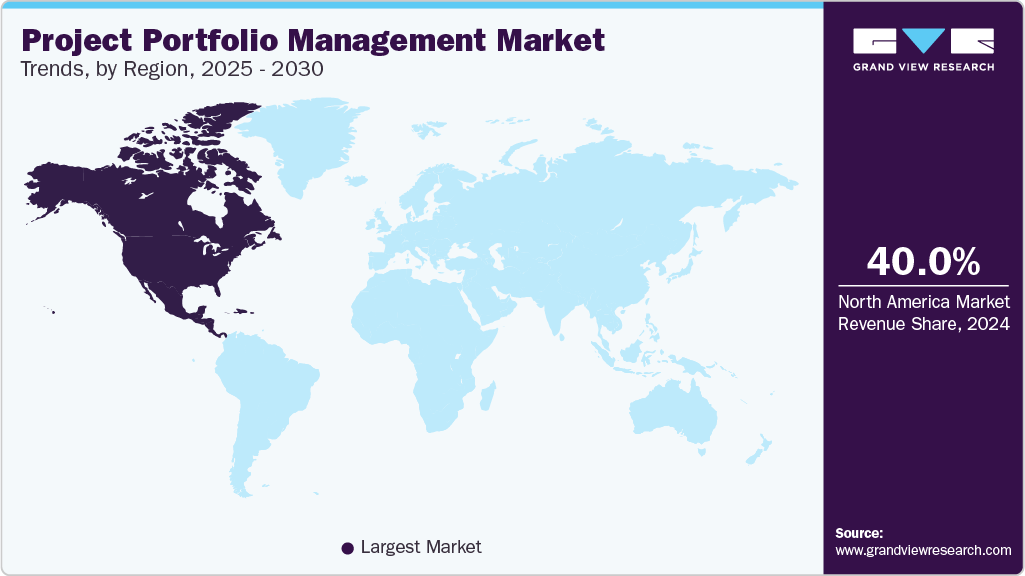

Regional Insights

North America dominated the project portfolio management market, with the largest revenue share of 42.0% in 2022. The region is expected to continue its dominance over the projected timeline owing to the considerable infrastructure advancements and propagation of startup companies. Different industrial companies operating in the region are implementing business intelligence & analytics solutions, and analytics-based strategies are playing a vital role in driving the market growth. Moreover, companies with digital infrastructure are using PPM solutions to initiate collaborative decision-making to enhance their project success rate in the region.

In the U.S., various end-use sectors such as healthcare, manufacturing, BFSI, and construction are adopting project portfolio magnet services to manage overall business operations and eliminate extra costs efficiently. It has created a favorable environment for market expansion in the U.S. Industry players operating in the region are adopting business strategies such as mergers & acquisitions to enhance their service offerings and client base. For instance, in December 2021, Tempo Software acquired ALM Works for an undisclosed amount to assist its clients in making better decisions for their projects in Massachusetts.

Considerable technological advancements, shifting companies' focus on digitizing their operations, and emerging startups are creating a positive market outlook in France. Cloud-based services are becoming popular in the region owing to their cost-effective, scalable, and flexible architecture. Market players are establishing a strategic partnership to introduce cloud-based project management solutions to increase their net sales. For instance, in May 2021, Capgemini collaborated with Orange to form a new company, Bleu, for cloud services in France. This company will provide holistic project portfolio management and cloud services to companies with strong adherence to French state sovereignty requirements in France.

Asia Pacific is expected to grow at the fastest CAGR of 16.4%. The growth is attributed to the increase in the adoption of PPM software, the growing number of large-scale projects, the demand for compliance, the popularity of cloud computing, and the increasing number of government initiatives.

Key Companies & Market Share Insights

The market is characterized by the presence of several big players that hold a significant market share. Several players are emphasizing either acquiring or collaborating with small players to share business intelligence and expertise. For instance,in May 2023, Planview, a platform for connected work from delivery to portfolio planning, collaborated with NTT DATA. As a part of the collaboration, the Planview Tasktop Viz and Planview Tasktop Hub are part of NTT DATA’s global ecosystem of technology solutions and offer organizations improved efficiency and time-to-market predictability.

Key Project Portfolio Management Companies:

- Broadcom

- Celoxis Technologies Pvt. Ltd.

- Changepoint Corporation

- HP Development Company, L.P.

- ServiceNow

- Planview, Inc.

- Planisware

- Microsoft

- Oracle

- Workfront, Inc.

Recent Developments

-

In March 2023, UiPath, an enterprise automation software company, partnered with Planview to integrate Planview Tasktop Hub with UiPath Business Automation Platform. The aim of this partnership was to improve the automation of time-consuming and repetitive tasks and also to accelerate the delivery of products and reduce manual errors.

-

In May 2022, Kimble Applications merged with Mavenlink, a work management vendor, to form a new project management software organization, Kantata. The new brand's portfolio includes products for managing finances, resources, team collaboration, projects, business intelligence (BI), and integrations.

-

In December 2020, Adobe acquired Workfront, a work management platform for USD 1.5 billion. Owing to the acquisition, the clients of Adobe can select from Business, Team, Pro, and Enterprise Plan features for a dozen areas of work management.

Project Portfolio Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.22 billion

Revenue forecast in 2030

USD 12.25 billion

Growth Rate

CAGR of 13.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, platform, deployment, enterprise size, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Broadcom; Celoxis Technologies Pvt. Ltd.; Changepoint Corporation; HP Development Company, L.P.; ServiceNow; Planview, Inc.; Planisware; Microsoft; Oracle; Workfront, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Project Portfolio Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global project portfolio management market based on solution, platform, deployment, enterprise size, application, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Information technology

-

New product development

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

Integration and Deployment

-

Support and Consulting

-

Training and Education

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & medium Enterprises

-

Large enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Government

-

Engineering & construction

-

Healthcare

-

IT & telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the project portfolio management market include Broadcom; Celoxis Technologies Pvt. Ltd.; Changepoint Corporation; HP Development Company, L.P.; ServiceNow; Planview, Inc.; Planisware; Microsoft; Oracle; and Workfront, Inc.

b. The global project portfolio management market size was estimated at USD 4.80 billion in 2022 and is expected to reach USD 5.22 billion in 2023.

b. The global project portfolio management market is expected to grow at a compound annual growth rate of 13.0% from 2023 to 2030 to reach USD 12.25 billion by 2030.

b. North America dominated the project portfolio management market, with the largest revenue share of 42.0% in 2022. The region is expected to continue its dominance over the projected timeline owing to the considerable infrastructure advancements and propagation of startup companies, which are the key factors expected to strengthen the market growth.

b. The growing complexities in projects and the need for timely and efficient management are expected to drive market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."