- Home

- »

- Biotechnology

- »

-

Recombinant DNA Technology Market Size Report, 2030GVR Report cover

![Recombinant DNA Technology Market Size, Share & Trends Report]()

Recombinant DNA Technology Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Medical, Non-medical), By Component (Expression System), By Application, By End Use, And Segment Forecasts

- Report ID: GVR-1-68038-872-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Recombinant DNA Technology Market Trends

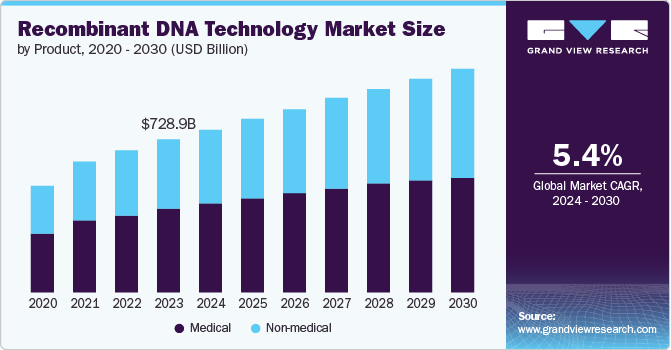

The global recombinant DNA technology market size was valued at USD 728.9 billion in 2023 and is projected to grow at a CAGR of 5.4% from 2024 to 2030. Increasing use of genetic engineering in healthcare, agriculture, and industry biotechnology are the key market drivers enhancing the market growth. Recombinant DNA technology (RDT) is essential for enhancing healthcare by creating new vaccines and drugs. The demand for RDT is increasing due to the growing need for protein therapeutics and monoclonal antibodies.

RDT has revolutionized biological research and has become a vital tool for enhancing traits in living organisms. Drivers supporting the growth of this technology include its extensive applications across various disciplines, such as medicine, agriculture, and industry. One of the primary drivers is the increasing demand for efficient treatments for various ailments, which has led to the development of recombinant DNA-based therapies and vaccines.

The technology’s ability to produce vital proteins necessary for maintaining nutrition and preventing health issues has also contributed to its growing demand. For instance, the production of insulin through RDT has greatly benefited diabetic patients worldwide. Furthermore, the rise in urbanization, global population growth, shrinking arable land, and significant food scarcity have driven the development of genetically modified organisms (GMO) that can act as bio-degraders and producers of clean fuel. This has led to a surge in research on GMOs, which is expected to to propel the market further.

Market growth is also driven by the emergence of new diagnostic kits, monitoring devices, and therapeutic approaches. The increasing adoption of RDT in agriculture has enabled the production of high-yielding crops, disease-resistant varieties, and improved nutritional content. As a result, the demand for recombinant DNA-based products is expected to continue growing, driven by the need for sustainable solutions to meet the increasing global food demands and address environmental concerns.

Product Insights

Medical products dominated the market and accounted for a share of 54.9% in 2023. The technology has revolutionized medicine and has significantly impacted patient treatment. It has improved illness treatment by enabling the replacement of diseased or damaged genes with healthy genes. There has been an increase in the need for different genetically engineered products used for healthcare or clinical reasons. For instance, medicines made from GMOs uses genetically modified bacteria to produce insulin.

The non-medical segment is expected to register the fastest CAGR of 6.5% during the forecast period. Non-medical segment is subdivided into biotech crops and specialty chemicals. The non-medical sector involves use of biotech crop technology to grow different crops. The increasing need for genome editing is expected to boost market expansion in the future. Canada, USA, India, Brazil, and Argentina are among the countries extensively using biotech crops.

Component Insights

Cloning vectors accounted for a revenue share of 59.3% in 2023. Segment growth worldwide is attributable to its critical role in cloning and expressing foreign genetic material. Versatile cloning vectors, such as plasmids, viruses, and artificial chromosomes, facilitate the development of genetically modified organisms, therapeutic proteins, and valuable products by inserting, amplifying, and expressing target genes.

Expression systems are expected to grow significantly with a CAGR of 5.1% during the forecast period. Expression systems used in RDT can be categorized into four types: mammalian, bacterial, yeast, and baculovirus/insect. A majority of the industry acquisitions have been driven by advancements in efficient protein expression and large-scale protein purification techniques. Notably, mammalian expression systems have gained significant market presence, particularly with the development of cell lines such as HEK293 and Chinese Hamster Ovarian, which offer improved expression yields and scalability.

Application Insights

The health & diseases segment dominated the market with a revenue share of 36.4% in 2023, fueled by its potential in developing novel therapeutics and improving existing treatments. rDNA technology enables the production of recombinant proteins, vaccines, and gene therapies that target various diseases more effectively. The ability to modify genetic material has revolutionized the pharmaceutical industry, driving advancements in personalized medicine, targeted drug delivery, and genetic disorder treatment. The demand for safer and more efficient healthcare solutions is expected to continue driving market growth.

The environment segment is expected to grow at the fastest CAGR of 8.5% over the forecast period. rDNA enables microorganisms to perform tasks such as bioremediation, waste treatment, and biofuel production, breaking down pollutants and converting biomass into renewable energy sources. Moreover, genetically modified crops are developed for pest resistance, disease tolerance, and environmental stress, reducing pesticide use and promoting agricultural sustainability.

End Use Insights

Biotechnology and pharmaceutical companies accounted for a largest revenue share of 49.4% in 2023. These companies are using this technology to uphold the quality of their medication production. It is anticipated that the use of this technology in manufacturing different pharmaceuticals is expected to have a substantial impact in the upcoming years. Several companies such as Pfizer, New England Biolabs, GenScript, Biogen have raised their investments in order to provide improved options for consumers and develop more effective medications for medical treatment.

Academic & government research institutes segment is expected to grow at a CAGR of 7.1% over the forecast period. These institutes lay the groundwork by conducting basic research to understand the mechanisms of genes, their functions, and how to manipulate them. This knowledge base is essential for developing new applications of RDT. Research organizations often partner with biotechnology and pharmaceutical firms, sharing valuable knowledge and utilizing state-of-the-art amenities. This accelerates the development process and minimizes risks for companies.

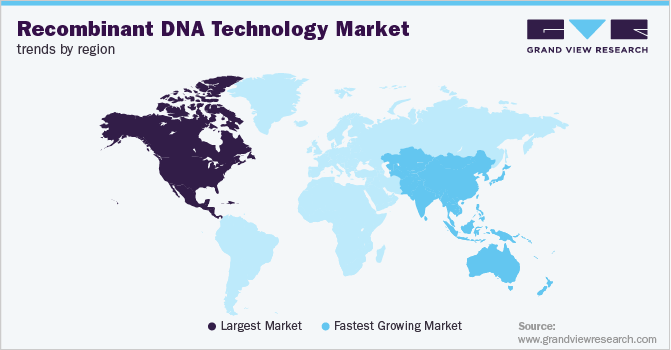

Regional Insights

North America recombinant DNA technology market dominated the global recombinant DNA technology market in 2023 with 36.7% of its total revenue share, owing to the large number of manufacturing units in this region. Government agencies and private stakeholders in North America are driving support for biotechnology research, solidifying the region’s leadership in RDT.

U.S. Recombinant DNA Technology Market Trends

Recombinant DNA technology market in the U.S. dominated the North America recombinant DNA technology market with a revenue share of 71.7% in 2023, aided by the higher percentage of worldwide funds allocated to healthcare-related research and development initiatives. This has resulted in major investments in creating and using new methods such as RDT for developing innovative drug and medical treatments. Moreover, a favorable regulatory setting encourages innovation by speeding up approval processes for recombinant products.

Europe Recombinant DNA Technology Market

Europe Recombinant DNA technology market was identified as a lucrative region in 2023 due to presence of strong regulatory bodies in place to address the ethical and scientific issues associated with technology usage has driven progress at a regional level.

The UK recombinant DNA technology market is expected to grow rapidly in coming years due to growth in demand for new medicines and therapies. RDT is utilized for the creation of various medications such as insulin, growth hormone, and certain vaccinations. With the population getting older and more people suffering from chronic diseases, the need for these products is likely to increase.

Asia Pacific Recombinant DNA Technology Market

Asia Pacific recombinant DNA technology market is anticipated to witness significant growth in the global recombinant DNA technology market due the Asian economies such as China, with their low cost manufacturing hubs, has captured the interest of international organizations seeking to move their operations there.

Japan recombinant DNA technology market is expected to grow rapidly in the coming years. Japan ranks as one of the highest importers per capita of food and feed produced using modern biotechnology techniques. Improvements in Japan’s regulatory framework for GE crops continue to be made. Moreover, Japan does not have any major trade barriers that would restrict the import of GE products from Western countries.

Key Recombinant DNA Technology Company Insights

Some key companies in the market include Pfizer Inc., Sanofi, New England Biolabs, GlaxoSmithKline plc, and GenScript. The key players are prioritizing customer acquisition and retention by implementing strategic initiatives such as mergers, acquisitions, and partnerships with other major companies.

-

Sanofi is healthcare company that develops, manufactures, and distributes vaccines and medicines. The company engages in the research and development, marketing of pharmacological products, and manufacturing, principally in the prescription market and also develops over-the-counter medications.

-

New England Biolabs supplies recombinant and native enzymes for life science research, offering products and services for genome editing, synthetic biology, and next-generation sequencing.

Key Recombinant DNA Technology Companies:

The following are the leading companies in the recombinant DNA technology market. These companies collectively hold the largest market share and dictate industry trends.

- Pfizer Inc.

- Sanofi

- New England Biolabs

- GlaxoSmithKline plc

- GenScript

- Thermo Fisher Scientific Inc.

- Biogen Inc.

- Merck & Co., Inc.

- Amgen Inc.

- Monsanto Company

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Eli Lilly and Company

Recent Developments

-

In May 2024, GenScript Biotech Corporation expanded its in vitro transcription RNA synthesis portfolio by introducing self-amplifying RNA (saRNA) synthesis services. This technology enables robust protein expression from a small amount of RNA, enhancing vaccine, immunotherapy, and gene therapy development.

-

In March 2024, Eli Lilly and Company announced the presentation of three cancer treatments at the American Association for Cancer Research Annual Meeting. The presentations focused on agents targeting Nectin-4, KRAS G12D, and BRM (SMARCA2), with IND applications planned for 2024.

Recombinant DNA Technology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 780.0 billion

Revenue forecast in 2030

USD 1,067.1 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Base year of estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, component, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait

Key companies profiled

Pfizer Inc.; Sanofi; New England Biolabs; GlaxoSmithKline plc; GenScript; Thermo Fisher Scientific Inc.; Biogen Inc.; Merck & Co., Inc.; Amgen Inc.; Monsanto Company; F. Hoffmann-La Roche Ltd; Novartis AG; Eli Lilly and Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recombinant DNA Technology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global recombinant DNA technology market report based on product, component, application, end use, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Medical

-

Therapeutic Agent

-

Human Protein

-

Vaccine

-

-

Non-medical

-

Biotech Crops

-

Specialty Chemicals

-

Other Non-medical Products

-

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Expression System

-

Mammalian

-

Bacteria

-

Yeast

-

Baculovirus / Insect

-

Other Expression Systems

-

-

Cloning Vector

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Agriculture

-

Health & Disease

-

Human

-

Animal

-

-

Environment

-

Other Applications

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biotechnology and Pharmaceutical Companies

-

Academic & Government Research Institutes

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.