- Home

- »

- Smart Textiles

- »

-

Respiratory Protective Equipment Market Size Report, 2033GVR Report cover

![Respiratory Protective Equipment Market Size, Share & Trends Report]()

Respiratory Protective Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Air Purifying Respirators, Supplied Air Respirators), By End Use (Oil & Gas, Fire Services), By Region, And Segment Forecasts

- Report ID: 978-1-68038-692-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Respiratory Protective Equipment Market Summary

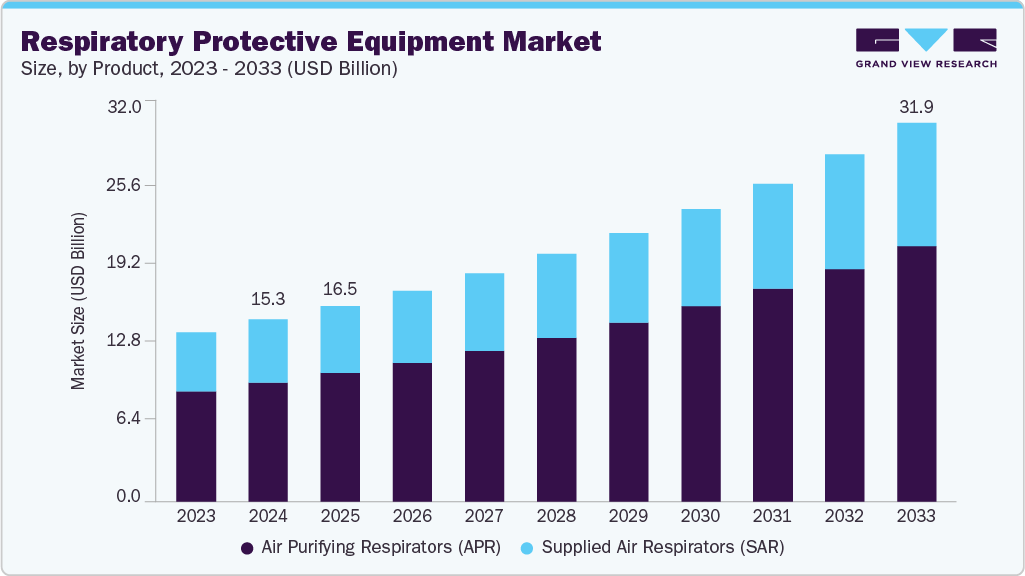

The global respiratory protective equipment market size was estimated at USD 15,341.2 million in 2024 and is projected to reach USD 31,946.5 million by 2033, growing at a CAGR of 8.6% from 2025 to 2033. The growing awareness about worker safety and stringent government regulations is expected to positively impact the growth.

Key Market Trends & Insights

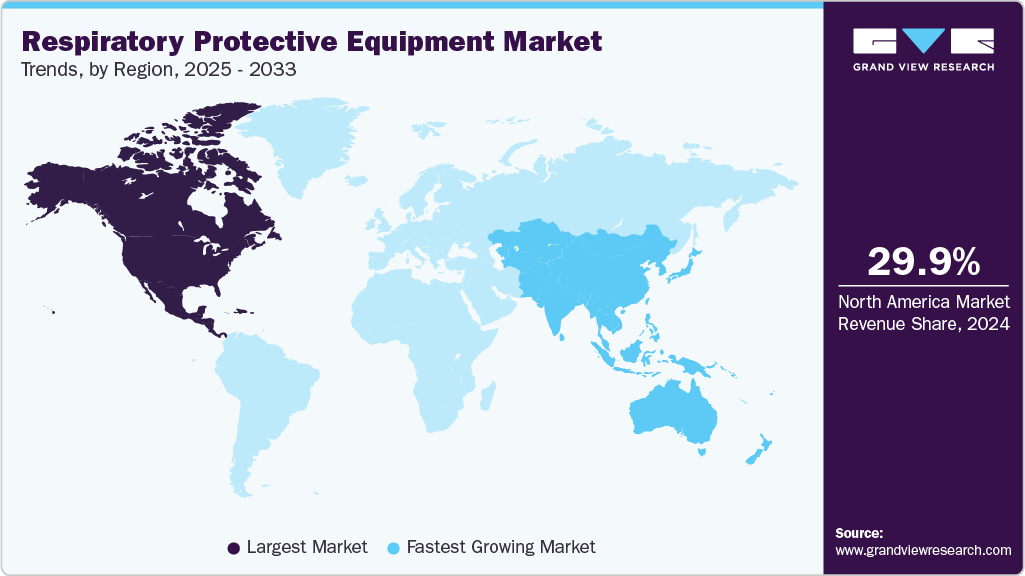

- North America dominated the respiratory protective equipment market with the largest revenue share of 29.9% in 2024.

- The respiratory protective equipment market in India is expected to grow at a substantial CAGR of 12.5% from 2025 to 2033.

- By product, the air purifying respirators segment is expected to grow at a considerable CAGR of 9.0% from 2025 to 2033 in terms of revenue.

- By end use, the industrial segment is expected to grow at a considerable CAGR of 10.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 15,341.2 Million

- 2033 Projected Market Size: USD 31,946.5 Million

- CAGR (2025-2033): 8.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing region

The demand for disposable masks during the COVID-19 pandemic surged significantly, requiring manufacturers to boost their production capacity. The increasing emphasis on employee health and safety is significantly boosting the demand for respiratory protective equipment. Governments and regulatory bodies worldwide are implementing strict workplace safety standards, especially in hazardous industries.

This trend is particularly evident in sectors like construction, mining, and manufacturing. Employers are compelled to invest in high-quality RPE to comply with these regulations. As a result, the market is experiencing strong growth driven by legal and ethical responsibilities.

Market Concentration & Characteristics

The respiratory protective equipment market is moderately concentrated, with a limited number of key players holding significant market share. These companies benefit from strong technological capabilities and established global distribution channels. High entry barriers, such as regulatory compliance and certification requirements, limit new entrants. However, regional manufacturers and niche players contribute to competition in localized markets.

The market exhibits a moderate to high degree of innovation, driven by the need for enhanced safety, comfort, and usability. Advances include smart respirators with sensors, improved filtration technologies, and ergonomic designs. Innovation is also fueled by changing workplace hazards and user demand for lighter, more efficient equipment. Continuous R&D efforts are essential to maintain product performance and regulatory compliance.

The respiratory protective equipment industry sees a steady level of M&A activity, primarily aimed at expanding product portfolios and entering new geographic markets. Larger companies often acquire smaller, specialized firms to gain access to niche technologies or regional distribution. These strategic moves help strengthen market presence and customer reach. M&A also supports innovation and cost efficiency through shared resources.

Regulations have a significant impact on the RPE industry, influencing product design, testing, and certification. Compliance with international standards ensures user safety and legal market entry. Regulatory bodies regularly update guidelines based on new health data and risks, driving continuous improvement. Failure to meet standards can lead to product recalls or restricted sales, making compliance a critical business factor.

Product Insights

Air-purifying respirators (APR) led the global market and accounted for more than 65.4% of the total revenue share in 2024. The significant demand for disposable masks, such as N95 and surgical masks, during the pandemic has been a key factor responsible for the segment’s large share. The segment is expected to maintain its dominance throughout the forecast period. The demand for N95 and surgical masks, particularly among first responders, healthcare workers, and the general public, is anticipated to persist post-pandemic due to the understanding that masks are the primary means of protection. Half-mask APRs are utilized in industries like healthcare, mining, fire services & emergency response, and the military.

The supplied air respirators (SARs) segment is estimated to witness steady growth from 2025 to 2033. These respirators are primarily used in cases of negative pressure and when PAPRs do not offer sufficient protection, particularly in hazardous environments. The expansion of the chemical, pharmaceutical, and oil & gas industries in the Asia Pacific region is expected to be the key factor driving the demand for SARs.

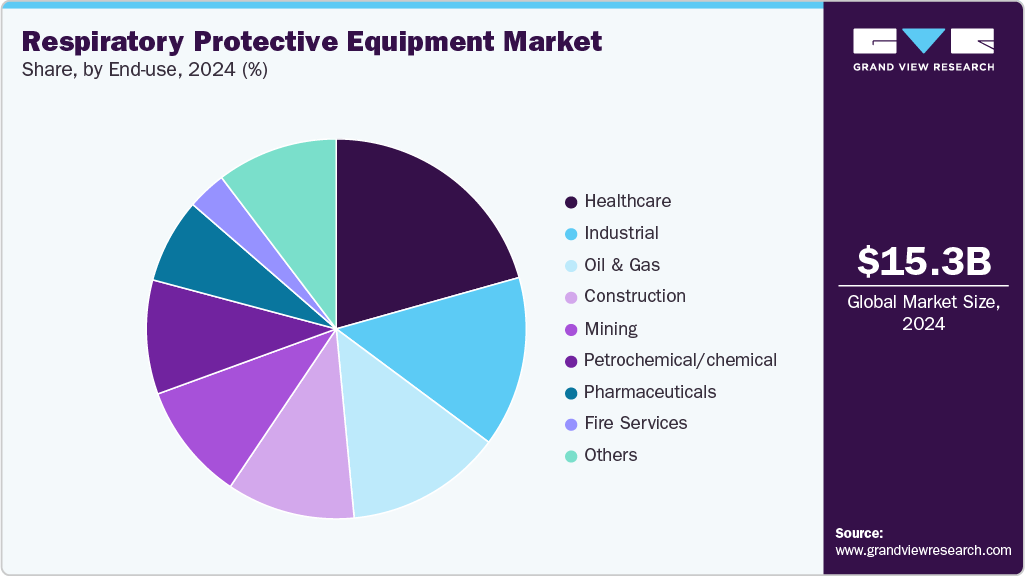

End Use Insights

The healthcare segment led the respiratory protective equipment market, accounting for over 20.6% of global revenue in 2024. The emergence of global infectious diseases, such as COVID-19, Influenza A (H1N1), and the Ebola virus, promotes the use of protective respiratory equipment in the healthcare sector, driving industry growth over the forecast period. Additionally, the increased awareness of worker safety during the pandemic boosted product demand from the industrial end use segment.

In the construction sector, the demand for respiratory protective equipment is likely to witness significant CAGR growth over the forecast period. To revive the economic downturn caused by the pandemic, governments have been providing financial stimuli to promote infrastructure development. Employees in the construction industry are exposed to respiratory hazards, including silica dust, lead dust, and silica vapors, which is why the RPE market in the construction industry is expected to grow at a steady CAGR over the forecast period.

Regional Insights

North America dominated the global respiratory protective equipment market, accounting for 29.9% of global revenue in 2024. The growing adoption of RPE in sectors such as oil and gas drilling, electric power utilities, and industries dealing with combustible dust has significantly driven product penetration in recent years. Additionally, strict safety regulations are anticipated to remain a major driver for market growth in the region over the forecast period.

U.S. Respiratory Protective Equipment Market Trends

The U.S. dominated the North American respiratory protective equipment industry and accounted for 81.0% share in 2024, due to its strong industrial base and strict occupational safety regulations. Government agencies enforce high standards for worker protection, driving widespread use of RPE across sectors like healthcare, manufacturing, and construction. The country also sees continuous innovation in protective technologies, improving comfort and effectiveness. A heightened focus on employee health and safety further strengthens demand.

The Canada respiratory protective equipment market is experiencing notable growth, supported by increased awareness of workplace safety. Expanding industries such as energy, mining, and construction are adopting more stringent safety measures, boosting RPE demand. Government support and regulatory updates are encouraging employers to prioritize respiratory protection. Additionally, a growing focus on environmental and health risks is driving the adoption of advanced protective solutions.

Europe Respiratory Protective Equipment Market Trends

Europe represents a mature and well-regulated market for respiratory protective equipment, driven by strict occupational health and safety laws across the region. Regulatory bodies such as the European Agency for Safety and Health at Work enforce comprehensive standards that mandate the use of RPE in various high-risk industries. The region’s strong industrial base, along with heightened environmental and health awareness, supports consistent demand. Ongoing investment in workplace safety and innovation continues to shape the European RPE landscape.

The Germany respiratory protective equipment market dominates the Europe RPE market due to its large-scale industrial activities and strict compliance with workplace safety standards. Industries such as automotive, chemicals, and heavy manufacturing widely use RPE to ensure worker protection. The country’s focus on engineering excellence also fosters the development and adoption of advanced protective technologies. This industrial and regulatory strength solidifies Germany’s leading position in the market.

The respiratory protective equipment market in the UK is witnessing strong growth, supported by an increasing focus on occupational health and updated safety policies. The healthcare sector, in particular, has seen a surge in demand for protective gear, especially following the pandemic. Additionally, sectors like construction and utilities are driving demand through modernization and regulatory alignment. Innovation and awareness campaigns continue to support market growth across the country.

Asia Pacific Respiratory Protective Equipment Market Trends

The respiratory protective equipment industry in Asia Pacific is estimated to witness the fastest CAGR over the forecast period, driven by industrial expansion and increasing health awareness. Rising concerns over air pollution, occupational hazards, and respiratory diseases are prompting both governments and industries to adopt stricter safety measures. Regulatory frameworks are gradually strengthening across countries, encouraging widespread use of RPE. The region’s diverse economies, from highly industrialized nations to emerging markets, contribute to dynamic demand patterns.

The China respiratory protective equipment market leads Asia Pacific, driven by its extensive industrial base and stringent safety regulations. The country's manufacturing sector, particularly in industries like construction, mining, and chemicals, necessitates widespread use of RPE to safeguard workers. Additionally, China's proactive measures to combat air pollution and respiratory diseases have further propelled the demand for protective equipment.

The respiratory protective equipment market in India is experiencing considerable growth at the fastest CAGR of 12.5% during the forecast period, fueled by increasing industrialization and a heightened focus on worker safety. The construction, manufacturing, and healthcare sectors are adopting RPE to comply with evolving safety standards and to protect workers from respiratory hazards. Moreover, the rising awareness of air pollution and its health impacts has led to greater adoption of protective equipment among the general population.

Middle East & Africa Respiratory Protective Equipment Market Trends

The Middle East & Africa respiratory protective equipment industry is experiencing steady growth, driven by increasing industrial activities, heightened awareness of occupational health, and stricter safety regulations. Key sectors such as oil & gas, construction, and manufacturing are major contributors to this demand, with a growing emphasis on worker safety and compliance with international standards. Additionally, the COVID-19 pandemic has underscored the importance of respiratory protection, leading to sustained adoption across various industries.

The Saudi Arabia respiratory protective equipment market stands as a dominant player in MEA, attributed to its robust industrial base and significant investments in infrastructure development. The country's Vision 2030 initiative has spurred growth in sectors like oil & gas, construction, and manufacturing, all of which require stringent safety measures. Government regulations and a focus on enhancing worker safety standards further bolster the demand for respiratory protective equipment in the Kingdom.

Central & South America Respiratory Protective Equipment Market Trends

The Central & South America respiratory protective equipment industry is growing steadily, fueled by expanding mining, agriculture, and construction activities. Increasing awareness about worker health and safety, along with rising urban pollution levels, is encouraging broader adoption of respiratory protection. The region faces unique challenges, such as exposure to dust in mining and agricultural environments, driving demand for specialized RPE. Moreover, governments are gradually strengthening regulations to improve occupational safety standards across industries.

The Brazil respiratory protective equipment market leads the RPE market in Central & South America, due to its large mining and manufacturing sectors, which demand rigorous safety measures. The country’s ongoing infrastructure projects and industrial expansions contribute to the rising use of RPE. Brazil’s focus on improving workplace safety regulations and increased investment in health awareness campaigns are key growth drivers.

Key Respiratory Protective Equipment Company Insights

Some of the key players operating in the market include 3M, Alpha Pro Tech Limited, and Ansell Ltd.

-

3M is a diversified global technology company known for its innovation across multiple industries, including healthcare, consumer goods, safety, and industrial products. Founded in 1902, 3M has developed thousands of products such as adhesives, abrasives, and personal protective equipment. The company emphasizes research and development to create solutions that improve daily life and workplace safety. 3M is headquartered in Minnesota, USA, and operates worldwide. It is also recognized for its strong commitment to sustainability and corporate responsibility.

-

Ansell Ltd. is a global leader in protective solutions, primarily manufacturing gloves and other personal protective equipment (PPE) for healthcare, industrial, and consumer markets. The company’s products are designed to safeguard workers from hazards such as chemicals, infections, and cuts. Ansell emphasizes innovation and quality to ensure safety in challenging environments. Founded in Australia, Ansell operates worldwide, serving sectors like medical, manufacturing, and food processing. The company is also committed to sustainability and improving workplace safety standards globally.

Key Respiratory Protective Equipment Companies:

The following are the leading companies in the respiratory protective equipment market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Alpha Pro Tech Limited

- Ansell Ltd.

- Honeywell International Inc.

- Avon Rubber plc

- MSA Safety Incorporated

- Intech Safety Pvt. Ltd.

- Delta Plus Group

- Bullard

- ILC Dover LP

- DuPont

- Kimberly-Clark Corporation

- Polison Corporation

- Uvex Safety Group

- Gateway Safety, Inc.

Recent Developments

-

In January 2025, in response to the devastating wildfires in Los Angeles, 3M has partnered with Direct Relief to provide essential respiratory protection. The company has pledged 5 million N95 respirators to support Direct Relief's humanitarian efforts during wildfire seasons. These respirators are strategically pre-stocked in Los Angeles to ensure quick deployment to affected communities. Distribution is facilitated through local health clinics and nonprofit partners, including the YMCA. This initiative aims to safeguard the respiratory health of first responders and residents exposed to wildfire smoke.

-

In March 2025, Dräger launched the NIOSH-certified ProAir, a closed-circuit breathing apparatus (CCBA) offering up to four hours of continuous oxygen. Targeted at federal agencies and emergency responders, this strategic innovation enhances safety and mission readiness in high-risk environments such as confined spaces, HAZMAT, and rescue operations.

Respiratory Protective Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16,510.8 million

Revenue forecast in 2033

USD 31,946.5 million

Growth rate

CAGR of 8.6% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Report updated

June 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Japan; China; India; Australia; Indonesia; Thailand; Malaysia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

3M; Alpha Pro Tech Limited; Ansell Ltd.; Honeywell International Inc.; Avon Rubber plc; MSA Safety Incorporated; Intech Safety Pvt. Ltd.; Delta Plus Group; Bullard; ILC Dover LP; DuPont; Kimberly-Clark Corporation; Polison Corporation; Uvex Safety Group; Gateway Safety, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

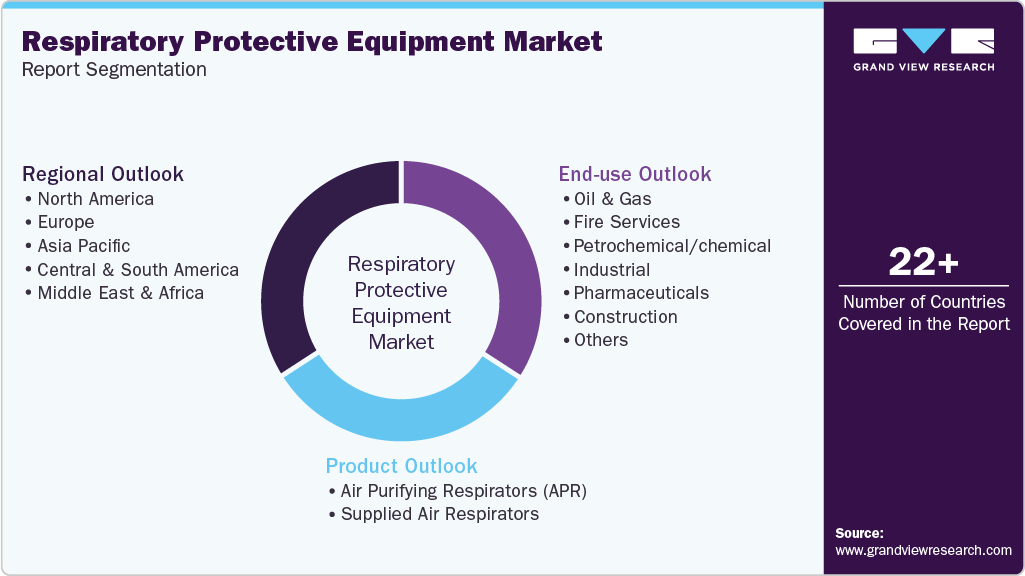

Global Respiratory Protective Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the respiratory protective equipment market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Air Purifying Respirators (APR)

-

Unpowered Air-Purifying Respirators

-

Disposable Filtering Half Mask Respirator

-

N95 Mask

-

Surgical Mask

-

Others

-

-

Half Mask Respirator

-

Full Face Mask Respirator

-

-

Powered Air-Purifying Respirators (PAPR)

-

Half Mask Respirator

-

Full Face Mask Respirator

-

Helmets, Hoods, Visors

-

-

Escape Respirators

-

-

Supplied Air Respirators

-

Self-contained Breathing Apparatus

-

Full Face Masks

-

Airline Respirators

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil & Gas

-

Fire Services

-

Petrochemical/chemical

-

Industrial

-

Pharmaceuticals

-

Construction

-

Healthcare

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Indonesia

-

Thailand

-

Malaysia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. Air-purifying respirators (APR) led the global market and accounted for more than 65.4% of the overall revenue share in 2024. The widespread demand for disposable masks, such as N95 and surgical masks, during the pandemic, has been a critical factor responsible for the segment’s high share.

b. Some of the key players operating in the respiratory protective equipment market include 3M, Alpha Pro Tech Limited, Ansell Ltd., Honeywell International Inc., Avon Rubber p.l.c., MSA Safety Incorporated, Intech Safety Pvt. Ltd., Delta Plus Group, Bullard, ILC Dover LP, DuPont, Kimberly-Clark Corporation, Polison Corporation, Uvex Safety Group, Gateway Safety, Inc.

b. The respiratory protective equipment market is driven by rising industrial safety regulations, growing awareness of workplace health hazards, and increased demand due to airborne diseases like COVID-19. Technological advancements in product design and comfort are also boosting adoption.

b. The global respiratory protective equipment market size was estimated at USD 15,341.2 million in 2024 and is expected to be USD 16,510.8 million in 2025.

b. The global respiratory protective equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2033 to reach USD 31,946.5 million by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.