- Home

- »

- Organic Chemicals

- »

-

Sodium Silicate Market Size, Share & Growth Report, 2030GVR Report cover

![Sodium Silicate Market Size, Share & Trends Report]()

Sodium Silicate Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Catalysts, Pulp & Paper, Food & Healthcare, Detergents, Elastomers), By Region (North America, Europe, APAC, CSA), And Segment Forecasts

- Report ID: GVR-4-68039-913-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2025

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sodium Silicate Market Summary

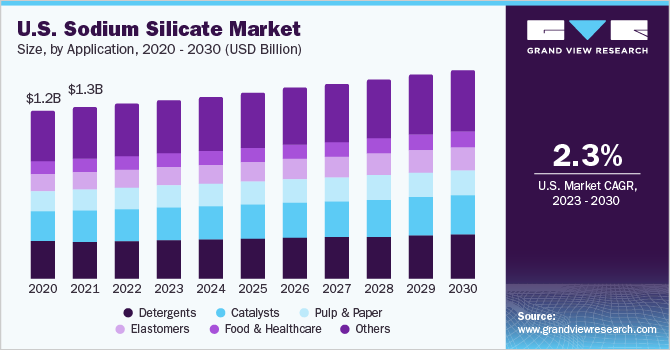

The global sodium silicate market size was valued at USD 11.25 billion in 2022 and is projected to reach USD 15.62 billion by 2030, growing at a CAGR of 4.2% from 2025 to 2030. Increasing demand for other sodium derivatives such as zeolites and precipitated silica as catalysts in bio and chemical processes is expected to drive product demand over the forecast period.

Key Market Trends & Insights

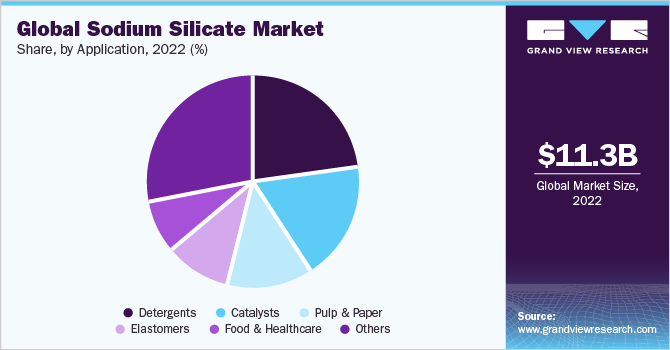

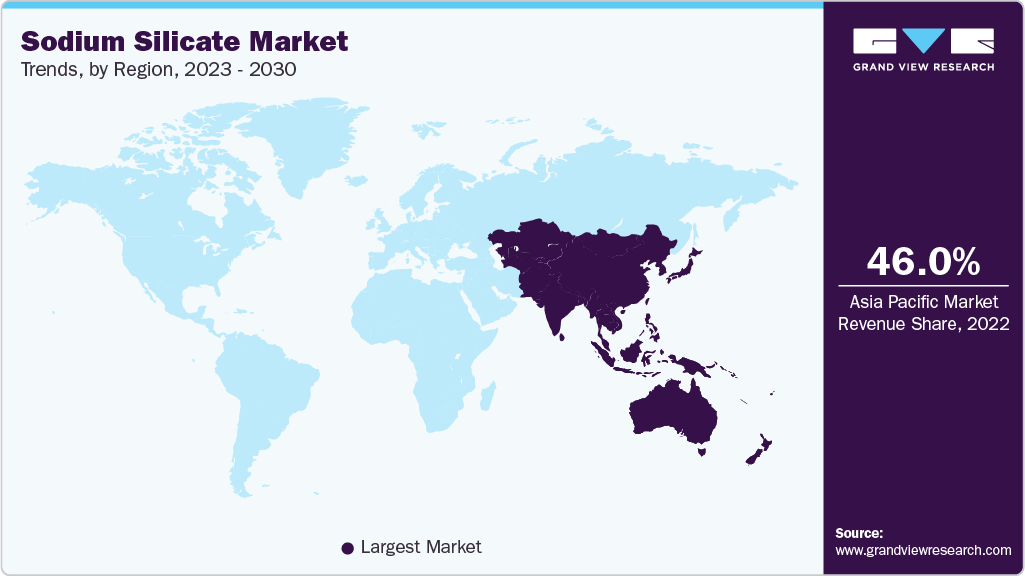

- Asia Pacific is leading the sodium silicate market and accounting for a revenue share of over 46% in 2022.

- Europe is anticipated to account for revenue share of over 17% in 2022.

- Based on application, the detergents in application segment dominated the market with a revenue share of over 22% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 11.25 Billion

- 2030 Projected Market Size: USD 15.62 Billion

- CAGR (2023-2030): 4.2%

- Asia Pacific: Largest market in 2022

Sodium silicate is a key source of reactive silica that has high demand in numerous application industries, including detergent, rubber, food and beverage, and paper and pulp. Increasing demand for other derivatives such as silica gels and silica sols in applications, including paints and coatings, plastics, and ink, is expected to have a positive impact on the market growth over the forecast period.The U.S. is the largest consumer of the sodium silicate in North America with a revenue share of over 81% in 2022. This growth is attributed to the fact that majority of the manufacturers in the region are captive user of sodium silicate and are engaged in further processing the product to produce its downstream chemicals. Detergents and cleaning products was the largest application segment for the product over the past few decades, however, growing demand for liquid detergents has seriously impacted the sodium silicate growth in detergents.

The price trend of the compound is impacted by certain key parameters, including raw material cost and transportation costs (depending on customer location). In 2016, the price of sodium carbonate, an important raw material for manufacturing the compound, declined, which thus caused a drop in the prices of the end-products. However, the prices recovered quickly in 2017 as the prices of the compound also stabilized.

High investments by manufacturing companies in R&D to improve the chemical and physical properties of the product are expected to drive the prices in the future. The rapid growth of end-use industries such as food and beverages, catalysts, and elastomers across the globe is expected to drive the demand over the forecast period..

Application Insights

The detergents in application segment dominated the market with a revenue share of over 22% in 2022. The product has high demand as a detergent builder owing to its superior emulsification, wetting, and deflocculation properties. The application of the compound in detergents reduces the surface tension, which results in improved dirt and soil removal.

The compound reacts with dissolved polyvalent cations to give its precipitates. Zeolite and precipitated silica are the key downstream products obtained with this process. Growing demand for these products as a catalyst in bio and chemical processes is expected to drive the segment over the forecast period. They are an important ingredient for manufacturing hydrogen peroxide bleach liquors. Increasing consumption of the compound in the pulp bleaching industry for deactivating various metals, including manganese, iron, and copper, is expected to bode well for the sodium silicate market over the forecast period.

Precipitated silica is one of the key products obtained using sodium silicate. It finds a wide application scope in the production of silicone rubber compounds. The product reduces the overall cost of silicone elastomers. Also, the product improves fatigue resistance, tensile, and tear strength of elastomers. As a result, it is anticipated to gain significant demand in elastomers over the projected period.

Regional Insights

Asia Pacific is leading the sodium silicate market and accounting for a revenue share of over 46% in 2022. This growth is attributed to the high demand for sodium silicate and its derivatives in number of end-use industries including construction, paints, cardboards and textiles. Low cost coupled with less hazards associated the product is anticipated to propel its demand in mechanical as well as pharmaceutical and food industry in the region.

Growth of the pulp and paper industry in Mexico, coupled with increasing foreign investments, is expected to have a positive impact on the regional market growth. The presence of major pulp and paper manufacturing companies in the region, such as Copamex, International paper, CMPC, Smurfit Kappa, and Grupo Durango, are expected to raise demand for the compound in manufacturing bleaching and binding agents.

Europe is anticipated to account for revenue share of over 17% in 2022. Growing demand for the compound in pulp and paper and healthcare applications is expected to drive the industry over the projected period. The production capacity for glass grade sodium silicate in the region is over 1,400 kilo per annum. However, the manufacturers are indulged in captive consumption and do not offer sodium silicates in the market.

The market in Germany is primarily driven by growing demand for products as a filler in the elastomer sector. Growth of the automotive segment, coupled with the presence of major tire manufacturers, including Continental AG, Fulda, and Troester in the region, is anticipated to have a positive impact on market growth. The construction sector in India was valued at over USD 125 billion and is expected to grow at a significant rate owing to population growth and increasing consumer disposable income. Growth of the construction industry in India, which is primarily driven by the infrastructure sector, is expected to drive demand for cement and other binding materials

Key Companies & Market Share Insights

The majority of the companies are expected to target their products aimed at the production of silica derivatives, including precipitated silica, silica gel, and zeolites. Manufacturers are likely to focus more on the development of a wide variety of products along with mergers and expansions so as to expand its application scope in niche segments, including welding, cement, agriculture, and food.

Market participants are employing strategies including mergers and acquisitions, joint ventures, and production capacity expansion to broaden their product portfolio, and thus gain a larger market share. For instance, BASF SE, inaugurated a new production plant in Caojing, Shanghai, China, which is focused on chemical catalysts. The move was aimed at increasing the production capacity to meet the rising demand for chemical catalysts, as well as to strengthen their regional presence. Some of the prominent players in the global sodium silicate market include:

-

Solvay S.A

-

PQ Corporation

-

Evonik Industries AG

-

CIECH Group

-

BASF SE

-

PPG Industries, Inc

-

W.R. Grace & Company

-

Tokuyama Corporation

-

Sinchem Silica Gel Co, Ltd.

-

Shangyu Huachang Industrial Co., Ltd.

-

hijiazhuang Shuanglian Chemical Industry Co. Ltd

-

Nippon Chemical Industrial Co., Ltd.

-

Huber Engineered Materials

-

IQE Group

-

Occidental Petroleum Corporation

Sodium Silicate Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.43 billion

Revenue forecast in 2030

USD 15.62 billion

Growth Rate

CAGR of 4.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilo tons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; Netherlands; Russia; Switzerland; China; India; Japan; South Korea; Australia; Thailand; Indonesia; Singapore; New Zealand; Philippines; Brazil; Argentina; Chile; UAE; Saudi Arabia; South Africa; Egypt; Iran

Key companies profiled

Solvay S.A; PQ Corporation; Evonik Industries AG; CIECH Group; BASF SE; PPG Industries, Inc.; W.R. Grace & Company; Tokuyama Corporation; Sinchem Silica Gel Co Ltd.; Shangyu Huachang Industrial Co., Ltd.; hijiazhuang Shuanglian Chemical Industry Co. Ltd; Nippon Chemical Industrial Co., Ltd.; Huber Engineered Materials; IQE Group; Occidental Petroleum Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

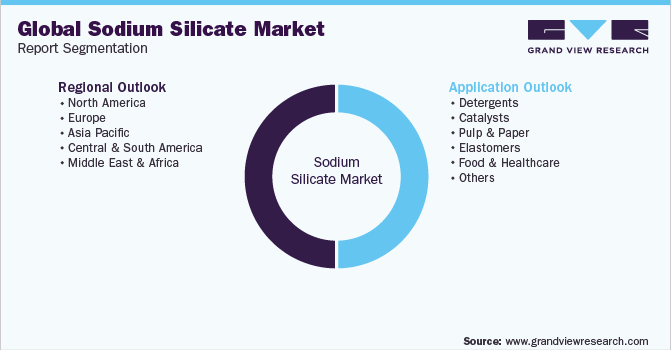

Global Sodium Silicate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global sodium silicate market report on the basis of application and region:

-

Application Outlook (Volume, Kilo tons; Revenue, USD Million, 2018 - 2030)

-

Detergents

-

Catalysts

-

Pulp & paper

-

Elastomers

-

Food & healthcare

-

Others

-

-

Regional Outlook (Volume, Kilo tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Switzerland

-

France

-

Italy

-

Spain

-

Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

Indonesia

-

Singapore

-

New Zealand

-

Philippines

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

Egypt

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global sodium silicate market size was estimated at USD 11.25 billion in 2022 and is expected to reach USD 11.43 billion in 2023.

b. The global sodium silicate market is expected to grow at a compound annual growth rate of 4.2% from 2023 to 2030 to reach USD 15.62 billion by 2030.

b. Asia Pacific dominated the sodium silicate market with a share of over 46% in 2022. This is attributable to population growth, increasing consumer disposable income, and growing demand for binding materials in construction sector.

b. Some key players operating in the sodium silicate market include Solvay S.A., PQ Corporation, Evonik Industries AG, CIECH Group, BASF SE, PPG Industries, Inc., W.R. Grace & Company, Tokuyama Corporation, Sinchem Silica Gel Co, Ltd., Shangyu Huachang Industrial Co., Ltd., Nippon Chemical Industrial Co., Ltd., and Huber Engineered Materials.

b. Key factors that are driving the market growth include increasing demand for sodium derivatives such as zeolites and precipitated silica as catalysts in bio and chemical processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.