- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Solar Control Window Films Market Size, Share Report, 2030GVR Report cover

![Solar Control Window Films Market Size, Share & Trends Report]()

Solar Control Window Films Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-134-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

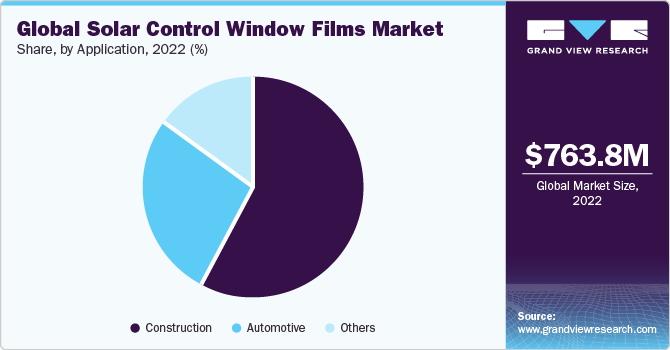

The global solar control window films market size was estimated to be USD 763.81 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2023 to 2030. Solar control window films protect from harmful radiation in a car or room since severe ultraviolet (UV) rays are fatal and can lead to skin cancer. In addition, these films are useful for preventing the fading of furniture in the interiors of a car as well as of houses. The installation of these films is inexpensive and user-friendly and helps improve the aesthetic sense of a building. According to the U.S. Department of Energy, approximately one-third of a building’s cooling costs are attributed to heat gained through windows.

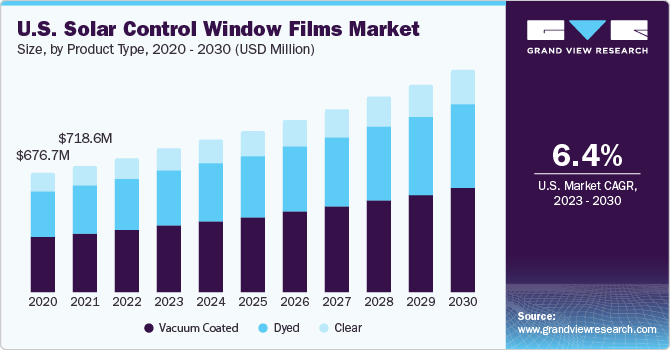

Solar control window films control the amount of heat that penetrates through the windows, thus helping reduce the cost and energy required to cool the building using appliances such as air conditioners, and helping in reducing the carbon footprint. The United States is the dominant market in the North American region. Major companies such as 3M, Johnson Laminating & Coating, Inc., Eastman Chemical Company, and Madico Inc. are based in the country. The U.S. has been experiencing a resurgence in the construction sector, particularly the residential space.

Favorable government policies, coupled with the growing automotive sector, have driven the market growth in this country. Vacuum-coated solar control window films accounted for the largest revenue share in the U.S. in 2022. Extreme weather conditions in this country have forced people to install vacuum-coated solar control window films, which reflect the sun away from the building or vehicle. Dyed films, which are most commonly used in the automotive segment, are expected to witness an increased demand on account of the growing automotive industry in the U.S.

Application Insights

The construction segment accounted for the largest revenue share of over 58.0% in 2022. Based on applications, market has been categorized into residential and non-residential. The growing population and increasing per capita income levels have driven the construction industry globally. Solar control window films have many advantages in the construction sector. Blocking harmful UV rays not only prevents people from contracting skin disorders but also improves employees' productivity in offices.

With rising atmospheric conditions, the application of solar control films on the windows of vehicles has become even more important. They block harmful UV and infrared radiation from entering the car. This not only keeps the car cool but also avoids fading of the interiors, such as the dashboard and seat covers of cars. In addition, these films avoid glare and reflection of lights even at night while driving.

Product Type Insights

The vacuum-coated films segment dominated the market in 2022 with a share of over 47.0%. This is because these films reflect the largest amount of solar radiation, keeping the interiors cooler as compared to other films. Increasing construction activities globally and the growing automotive industry are the main drivers providing the necessary boost to the global market. Vacuum-coated solar control window films are also known as reflective films.

The metal content in these films reflects the sun's incoming heat and also blocks harmful UV rays, which can prove fatal. These films are metalized using various methods, such as sputtering, vapor deposition, and beam deposition. Dyed solar control window films, also known as non-reflective films, are the next leading product for the market. These films are mainly used on automotive windows. The growing automotive industry around the world, particularly in the emerging Asia Pacific, Latin American, and Middle East & Africa is a major driver of the segment growth. These films also find applications in the construction sector, particularly in tropical regions.

Regional Insights

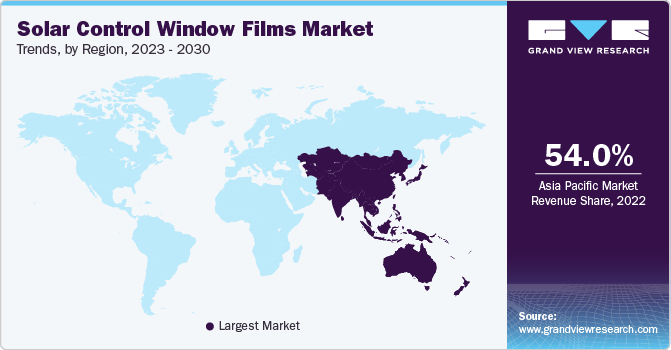

Asia Pacific accounted for a revenue share of over 54.0% in 2022. The developing economies across the region have been upgrading their energy infrastructure to meet the rising demand for power and taking measures to control future energy consumption. Stringent regulatory policies and norms to curb carbon emissions followed by growing consumer inclination toward renewable electricity infrastructure are expected to complement market growth. North America was the second-largest market in 2022.

The construction industry in this region is witnessing an upward surge because of lenient lending policies and the recovery of the residential construction sector. This region is expected to advance at the second-highest CAGR of 6.3% through 2030. The North American market is also driven by the expanding automotive industry and an extensive presence of various major automotive manufacturers, such as Ford Motor Company, Tesla, and General Motors. The construction sector dominated the regional market in 2022.

Installation Insights

Flat roof solar installation dominated the global market in 2022 and accounted for a revenue share of above 42.0%. Flat-roof solar installations tend to be more cost-effective than traditional pitched-roof installations. Flat roofs are typically easier to access, require less complex racking systems, and often involve shorter cable runs. This can lead to lower installation and maintenance costs.

Furthermore, flat roofs provide a large, unobstructed space for solar panel installation. This implies that a significant amount of solar capacity can be installed on a relatively small footprint. For commercial and industrial buildings with limited land space, flat roofs are an ideal location for solar arrays, hence, is expected to boost product demand during the forecast period.

Key Companies & Market Share Insights

Research activities across the market are focused on new materials, which combine several properties and are projected to gain wide acceptance in this industry in the coming years.

Key Solar Control Window Films Companies:

- 3M

- Eastman Performance Films, LLC

- Saint-Gobain Performance Plastics Corporation

- Garware Hi-Tech Films Limited

- Johnson Window Films, Inc.

- Avery Dennison Corporation

- Sican Co., Ltd.

- The Window Film Company

- Lintec Europe (UK) Limited

- Madico, Inc.

- Solar Control Films Inc.

- Solar Screen International SA

- Dexerials Corporation

- Nexfil USA

- E&B Co., Ltd.

- HAVERKAMP GmbH

Solar Control Window Films Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 812.4 million

Revenue forecast in 2030

USD 1,271.9 million

Growth rate

CAGR of 6.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million sq. ft.; revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue and volume forecast, company profiles, competitive landscape, growth factors, and trends

Segments covered

Product type and application

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; The Netherlands; Spain; China; India; Japan; South Korea; Australia; Indonesia; Thailand; Vietnam; Brazil; Argentina; Saudi Arabia; U.A.E.; South Africa

Key companies profiled

3M; Eastman Performance Films, LLC; Saint-Gobain Performance Plastics Corp.; Garware Hi-Tech Films Ltd.; Johnson Window Films, Inc.; Avery Dennison Corp.; Sican Co., Ltd.; The Window Film Company; Lintec Europe (UK) Ltd.; Madico, Inc.; Solar Control Films Inc.; Solar Screen International SA; Dexerials Corp.; Nexfil USA; E&B Co., Ltd.; HAVERKAMP GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

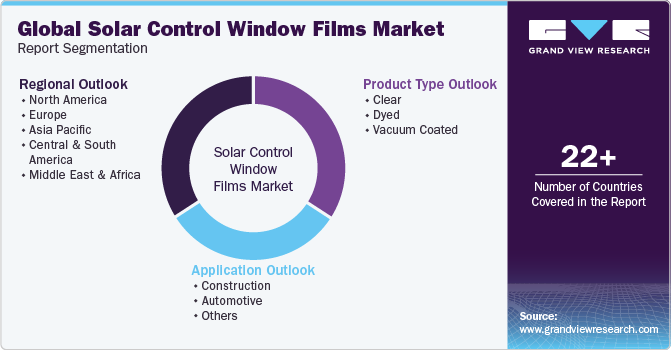

Global Solar Control Window Films Market Report Segmentation

This report forecasts revenue and volume growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2023 to 2030. For the purpose of this study, Grand View Research has segmented the solar control window films market report on the basis of product type, application, and regions:

-

Product Type Outlook (Volume, Million Sq. ft.; Revenue, USD Million, 2018 - 2030)

-

Clear

-

Dyed

-

Vacuum Coated

-

-

Application Outlook (Volume, Million Sq. ft.; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Million Sq. ft.; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

The Netherlands

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global solar control window films market size was estimated at USD 763.81 million in 2022 and is expected to reach USD 812.4 million in 2023.

b. The global solar control window films market is expected to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 1,271.9 million by 2030.

b. Vacuum coated dominated the solar control window film market with a share of more than 47.01% in 2022. This is due to the attribute of films reflecting a large amount of solar radiation and keeping the interiors cooler as compared to other films.

b. Some key players operating in the solar control window films market include 3M Company (U.S.), Eastman Chemical Company (U.S.), Saint-Gobain (France), and Garware Hi-Tech Films Limited (India).

b. Key factors that are driving the solar control window film market growth include the property to protect the interiors of buildings and cars from harmful ultra-violet (UV) rays and infrared radiations (IR).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.