- Home

- »

- Plastics, Polymers & Resins

- »

-

Strapping Materials Market Size, Share, Trends Report, 2030GVR Report cover

![Strapping Materials Market Size, Share & Trends Report]()

Strapping Materials Market Size, Share & Trends Analysis Report By Application, By Product (Steel, Polypropylene [PP], Polyester [PET]), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-266-2

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Strapping Materials Market Size & Trends

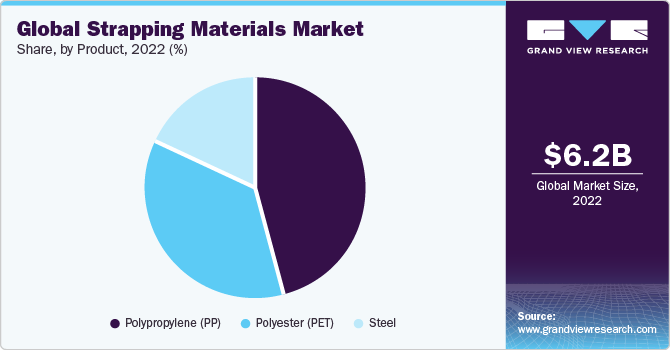

The global strapping materials market size was valued at USD 6.2 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. Plastic materials (ingredients) can be recycled, making it a sustainable packaging substitute. This is expected to be a key factor driving market growth over the forecast period. Plastic ingredients are derived from petroleum-based feedstock like polyester and polypropylene, while metal ingredients are manufactured using steel. Plastic straps exhibit various advantageous properties such as high elongation and tension resistance Steel straps, on the other hand, show high tensile strength, which renders them useful in the packaging of metal and building and construction materials.

There has been a rise in demand for consumer electronics, household appliances, pharmaceutical products, medical devices, and textile goods, which is projected to result in an increase in demand for strapping material as a suitable packaging material. Growth in mail orders and the logistics business, along with the expansion of the e-commerce industry, is projected to further boost the demand for strapping materials.

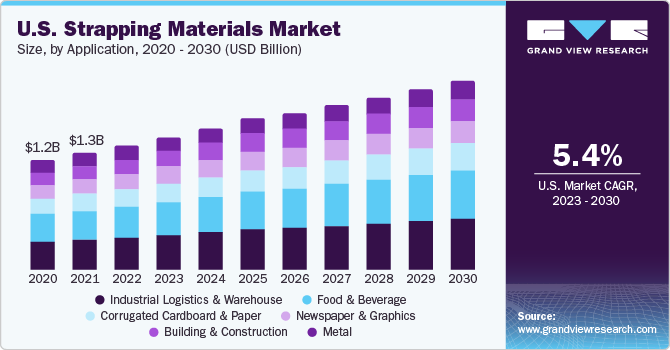

Application Insights

The industrial logistics and warehouse segment accounted for the largest revenue share of 27.2% in 2022. There is enormous growth potential for industrial logistics and warehousing in developed economies such as the U.K. and Germany. Germany is one of the significant logistics hubs in Europe due to its central location, which provides logistics services to about 500 million European residents.

As per a 2023 report on the Logistics Performance Index of 139 countries by the World Bank, Germany ranked 4th and was among the top performers with a score of 4.1. According to the Federal Logistics Associations Statistics Office, Germany is likely to gain significant growth in this sector over the forecast period, with the rise in air cargo and waterway transport. Driven by Germany’s strong performance, the demand for strapping materials in the logistics and warehouse application segment is sure to rise.

In emerging economies, the newspaper and graphics segment has been growing due to an increase in the production and circulation of various magazines and print advertisements. This can be attributed to a rise in the number of pages in a newspaper on specific occasions and rapid urbanization. Newspapers and magazines are often used in the packaging industry and this can subsequently increase the uptake of strapping materials in the newspaper and graphics application segment.

The food & beverage segment is expected to grow at the fastest CAGR of 5.7% during the forecast period. The growth of the segment is attributed to the increasing global demand for packaged food and beverages, which in turn have driven the demand for secure and reliable strapping solutions during transportation and storage. Additionally, the stringent regulations on food safety and hygiene drive the adoption of high-quality strapping materials.

Product Insights

The polypropylene (PP) segment accounted for the largest revenue share of 46.6% in 2022 and is estimated to register the fastest CAGR of 5.3% over the forecast period. Polypropylene offers exceptional strength and durability, making it ideal for securing heavy loads during transportation and storage. Additionally, it is cost-effective compared to other materials, attracting companies looking for affordable yet reliable strapping solutions. Moreover, polypropylene is lightweight, reducing shipping costs and enhancing overall efficiency.

The polyester segment held a significant market share in 2022. As polyester straps help maintain uniform tension on load during the transportation of goods, they are increasingly being used in rigid loads. Shrinking type load, on the other hand, requires the use of polypropylene as it exhibits greater elongation recovery. This implies that it elongates or shrinks from its original size and shape as per requirement.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 36.1% in 2022 and is expected to grow at the fastest CAGR of 5.6% during the forecast period. This growth can be attributed to the increased application of strapping materials in industries such as food and beverages, industrial logistics and warehouses, and newspapers and graphics.

North America held a significant market share in 2022. The rapid growth of the packaged food and industrial logistics and warehouse industries, coupled with growing building and construction activities, is propelling the demand for strapping materials in North America.

North America is characterized by large consumer markets in the U.S., Canada, and Mexico. The U.S. is among the major global trade partners, while Canada is likely to generate more trade opportunities from the U.S. in the coming years. This is likely to generate significant demand for the application of strapping materials in industrial logistics and warehousing.

Key Companies & Market Share Insights

The global strapping materials market is competitive in nature and key players have a global presence and have diversified their business portfolio. Players such as Strapack, Inc. and Signode Packaging Systems have integrated vertically into the value chain. Some of the players are incorporating forward integration as a growth strategy, which may pose a challenge for new players aspiring to enter the market.

Key Strapping Materials Companies:

- Cyklop

- UNIPACK

- Mosca GmbH

- Panorama Packaging Pvt. Ltd.

- Plastofine Industries.

- GREENBRIDGE

- Signode Industrial Group LLC

- Signor Polymers Pvt. Ltd.

- StraPack, Corp.

- Titan Umreifungstechnik GmbH & Co. KG

- 3M

Recent Developments

-

In March 2023, EAM-Mosca Corp. (a subsidiary of Mosca GmbH) announced its sales and marketing partnership with Spain-based Reisopack S.L. According to the agreement, EAM-Mosca will only provide Reisopack’s strapping systems and OEM parts to clients in the US, Mexico, Canada, and Brazil.

-

In July 2020, 3M Fall Protection announced that its self-developed suspension trauma safety straps would be included with all the harnesses under its 3M DBI-SALA product line as a part of the company’s commitment to providing high-quality safety equipment to protect workers.

-

In March 2019, Polychem Corporation (GREENBRIDGE) was acquired by The Sterling Group. The acquisition was anticipated to aid Polychem Corporation in market expansion and growth.

-

In March 2019, Plastofine Industries announced the launch of the Poly-strap branded Pet strapping. Furthermore, the product was approved by the American Association of Rail Roads (AAR).

Strapping Materials Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.61 billion

Revenue forecast in 2030

USD 9.14 billion

Growth rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Taiwan; South Korea; Australia; Argentina; Brazil; South Africa; Saudi Arabia

Key companies profiled

Cyklop; UNIPACK; Mosca GmbH; Panorama Packaging Pvt. Ltd.; Plastofine Industries.;GREENBRIDGE; Signode Industrial Group LLC; Signor Polymers Pvt. Ltd.; StraPack, Corp.; Titan Umreifungstechnik GmbH & Co. KG; 3M

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Strapping Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global strapping materials market report based on application, product, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Industrial Logistics & Warehouse

-

Corrugated Cardboard & Paper

-

Newspaper & Graphics

-

Building & Construction

-

Metal

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Polypropylene (PP)

-

Polyester (PET)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Taiwan

-

South Korea

-

Australia

-

-

Central and South America

-

Argentina

-

Brazil

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global strapping materials market size was estimated at USD 6.2 billion in 2022 and is expected to reach USD 6.61 billion in 2023.

b. The global strapping materials market is expected to grow at a compounded annual growth rate of 4.9% from 2023 to 2030 to reach USD 9.14 billion in 2030.

b. The Asia Pacific dominated the strapping materials market with a share of 36% in 2022. This can be attributed to the increased application of strapping materials in industries such as food and beverages, industrial logistics and warehouse, and newspaper and graphics.

b. Some key players operating in the strapping materials market include 3M, Cyklop International, Dynaric, Inc., and Mosca GmbH,

b. Key factors driving the strapping materials market growth include the rise in demand for consumer electronics, household appliances, pharmaceutical products, medical devices, and textile goods.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."