- Home

- »

- Medical Devices

- »

-

Surgical Robots Market Size & Share, Industry Report, 2033GVR Report cover

![Surgical Robots Market Size, Share & Trends Report]()

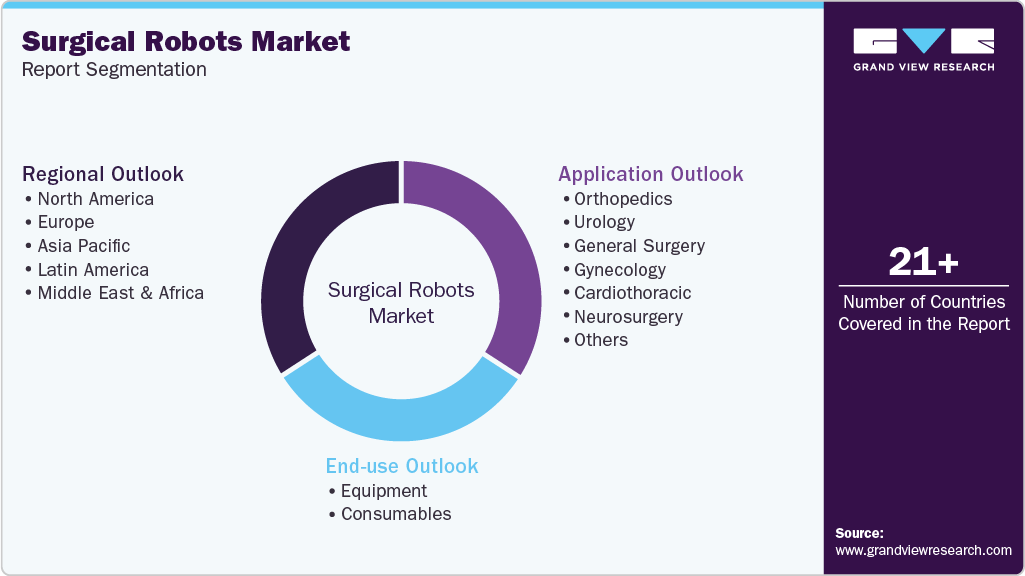

Surgical Robots Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Urology, Orthopedics, Neurology, Gynecology), By End Use (Inpatient, Outpatient), By Region, And Segment Forecasts

- Report ID: 978-1-68038-811-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Surgical Robots Market Summary

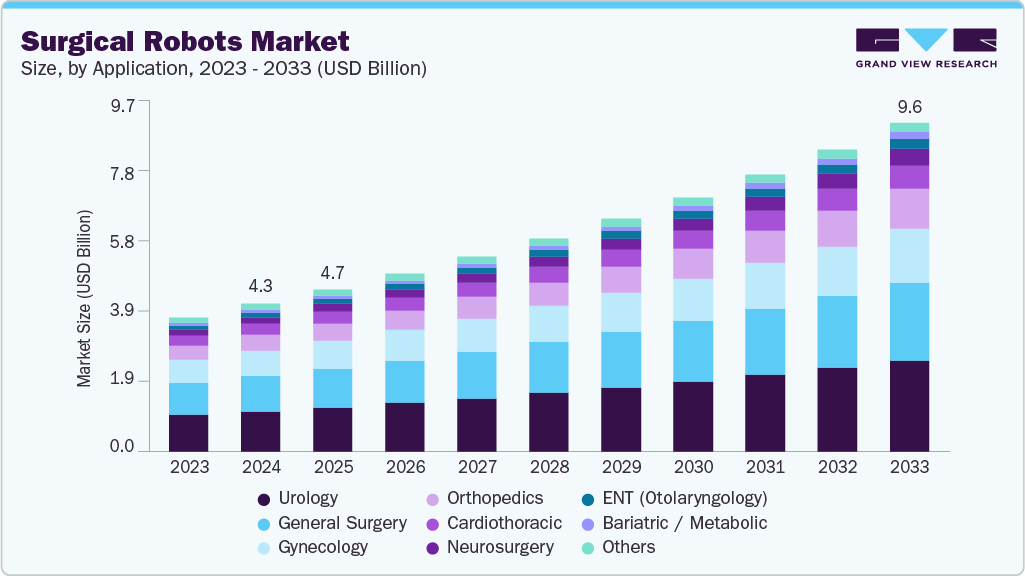

The global surgical robots market size was estimated at USD 4.31 billion in 2024 and projected to reach USD 9.60 billion by 2033, growing at a CAGR of 9.3% from 2025 to 2033. The global shortage of physicians and surgeons, with growing adoption of automated surgical instruments, significantly contributes to market expansion.

Key Market Trends & Insights

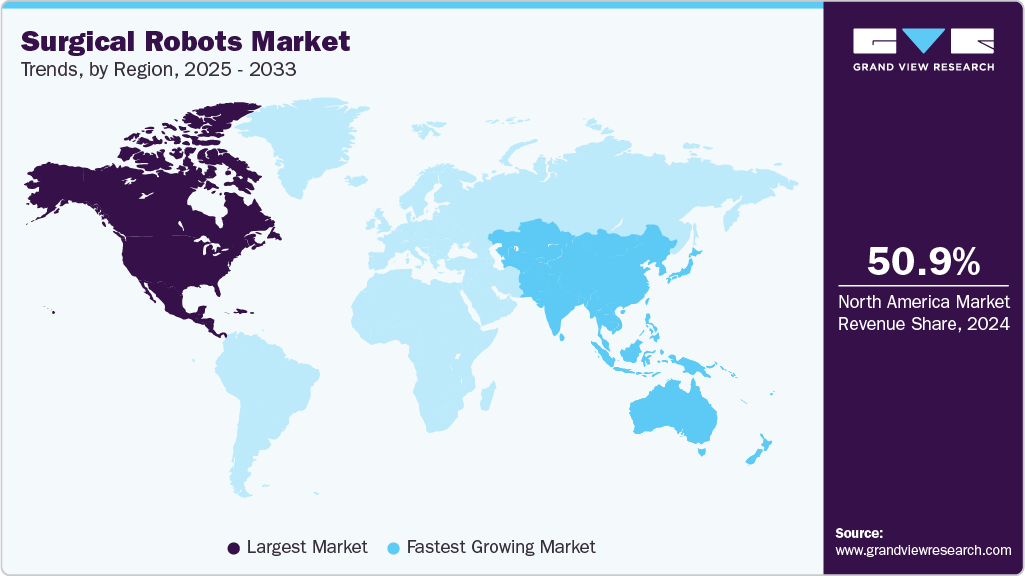

- North America dominated the surgical robots market with the largest revenue share of 50.90% in 2024.

- By application, the urology segment led the market with the largest revenue share of 27.44% in 2024.

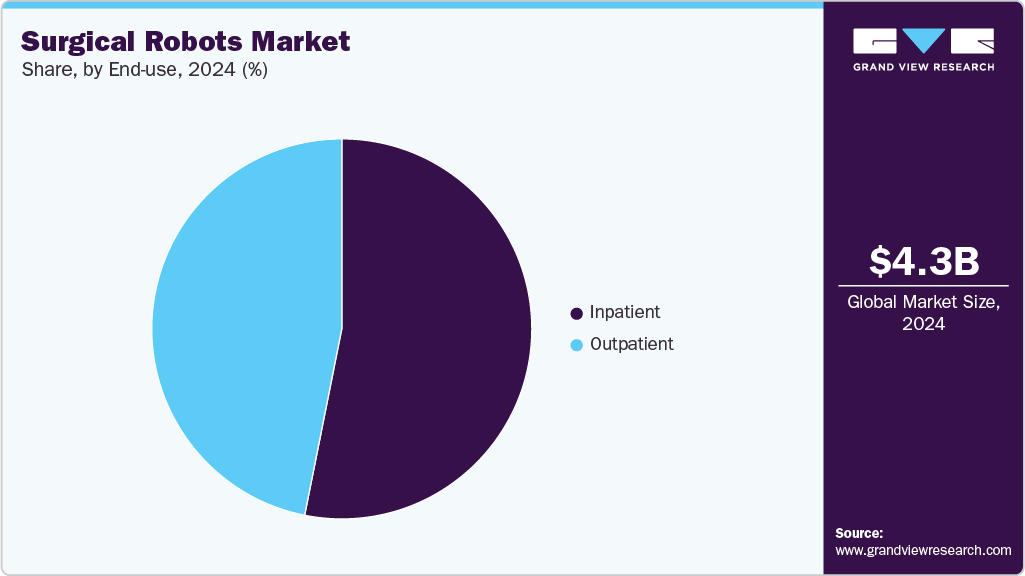

- By end use, the inpatient segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.31 Billion

- 2033 Projected Market Size: USD 9.60 Billion

- CAGR (2025-2033): 9.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Technological advancements, increased investments from regional and international stakeholders, and the rising prevalence of chronic diseases, particularly in knee and hip replacement surgeries, are key drivers of this market growth. In March 2025, according to the American College of Rheumatology, over 790,000 knee and 544,000 hip replacements are performed annually in the U.S., reflecting a steady increase as the population ages.The rising prevalence of joint-related health issues and an aging population is driving demand for orthopedic procedures. Growing patient expectations for quicker recovery and improved mobility further strengthen the need for advanced and effective treatment solutions. In November 2024, as per the American Academy of Orthopedic Surgeons (AAOS) study, over 3.7 million total hip and knee replacement surgeries took place at 1,447 facilities across all 50 states and the District of Columbia during the period from 2012 to 2023.

Advantages associated with these medical procedures include less pain & blood loss, shorter recovery period, lower risk of infections at the site, and smaller or less noticeable scars, aiding market growth. For instance, according to a study published by the Hip and Knee Society comparing the 90-day care costs between patients who received a Mako total knee replacement and patients who underwent conventional knee surgery, the cost of care for patients receiving treatment using Mako was USD 2,400 less than that for those patients who received conventional knee replacement. The study revealed that a reduction of 33% in 90-day readmissions was observed in patients receiving treatment using Mako.

The increasing prevalence of bone degenerative diseases, such as arthritis and osteoporosis, is driving a surge in hip and knee replacement surgeries, significantly impacting market growth. Osteoporosis impacts around 10 million individuals in the U.S., and approximately 75 million people across the U.S., Europe, and Japan collectively. Projections suggest that by 2040, 1 in 4 U.S. adults (78.4 million) will have doctor-diagnosed arthritis, and 1 in 9 adults (34.6 million) will experience arthritis-attributable activity limitations. As the demand for joint replacement procedures rises, advancements in robotic-assisted surgery are transforming the orthopedic landscape by improving precision, reducing recovery times, and enhancing patient outcomes.

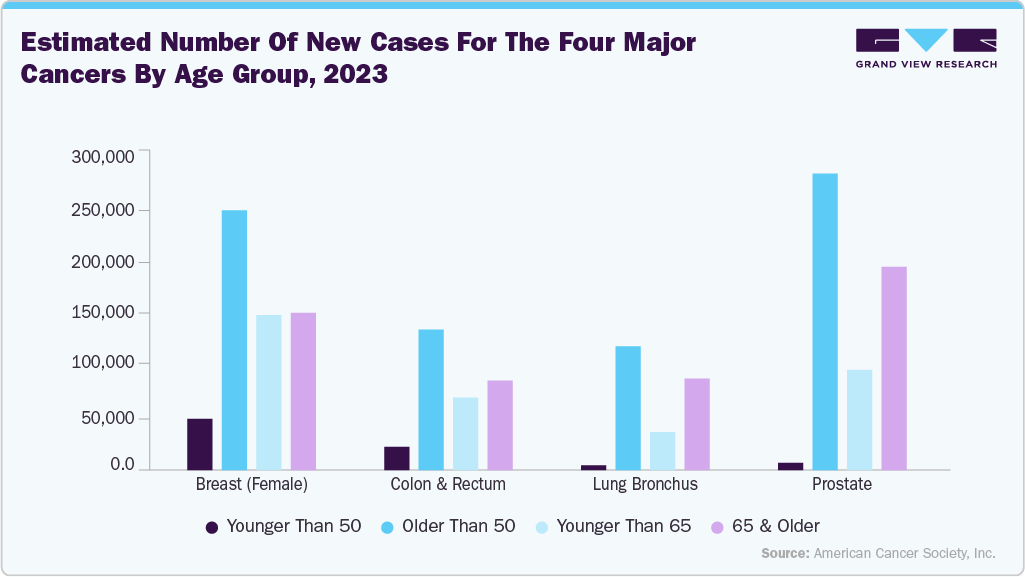

The increasing demand for advanced medical technologies is reshaping the healthcare landscape. In particular, the operational sector is adopting innovative solutions to enhance patient outcomes and streamline procedures.With ongoing advancements, healthcare providers are better equipped to address complex medical challenges and improve overall efficiency. For instance, a report from the World Health Organization in February 2024 highlighted that there were over 20 million new cancer cases worldwide, with 53.5 million individuals surviving at least five years of post-diagnosis.

The growing investments from regional and international stakeholders in the development of advanced medical products are contributing positively to the market’s expansion. Enhancements in visualization and navigation, particularly through surgical navigation systems, are essential for the technological advancement of robotic surgical procedures. High-definition 3D cameras and augmented reality overlays provide surgeons with an immersive perspective of the operative area, improving their spatial awareness and decision-making skills. For instance, in February 2024, CMR Surgical launched its latest innovation, the vLimeLite. This integrated fluorescence imaging system is designed to enhance procedures by providing surgeons with improved visualization capabilities using Indocyanine Green (ICG). ICG is a fluorescent dye that is commonly used in medical imaging to visualize blood flow and tissue perfusion.

In May 2023, the American College of Surgeons reported that over 12 million surgeries had been performed using da Vinci systems globally. There is a 22% increase in clinical procedures utilizing these systems from 2022 to 2023, signifying a growing trend towards adopting advanced technologies. This surge in demand reflects the effectiveness of robotic systems and a shift in practices towards minimally invasive techniques that improve patient outcomes and reduce recovery times.

Systems constitute the most complex part of products and include various hardware components & software solutions. This system enables the surgeon(s) to control the robotic arms and perform surgeries remotely. Some of the components of the system are the surgeon console, patient cart, vision cart, and robotic arms.

Product Pipeline Analysis, By Stage

Company Name

Product Name

Product Stage

Use

Johnson & Johnson

Verb-Auris Robot

The system is expected to receive 510 (k) certification and initiate clinical trials in second half of 2022

Robot-assisted system for general surgery procedures

Johnson & Johnson

Ottava

During 2021, the company plans to work on validation of the robotic system and initiate the clinical trials in 2022.

Robot-assisted system for general surgery procedures

SS Innovations

Mantra' Surgical Robotic System

The company completed clinical validation of the robot and also received registration from Drug Controller of General of India (DCGI). The company is planning to initiate global trials in US and Europe.

Robot-assisted system for general surgery procedures

Regulatory Scenario for Surgical Robots Market

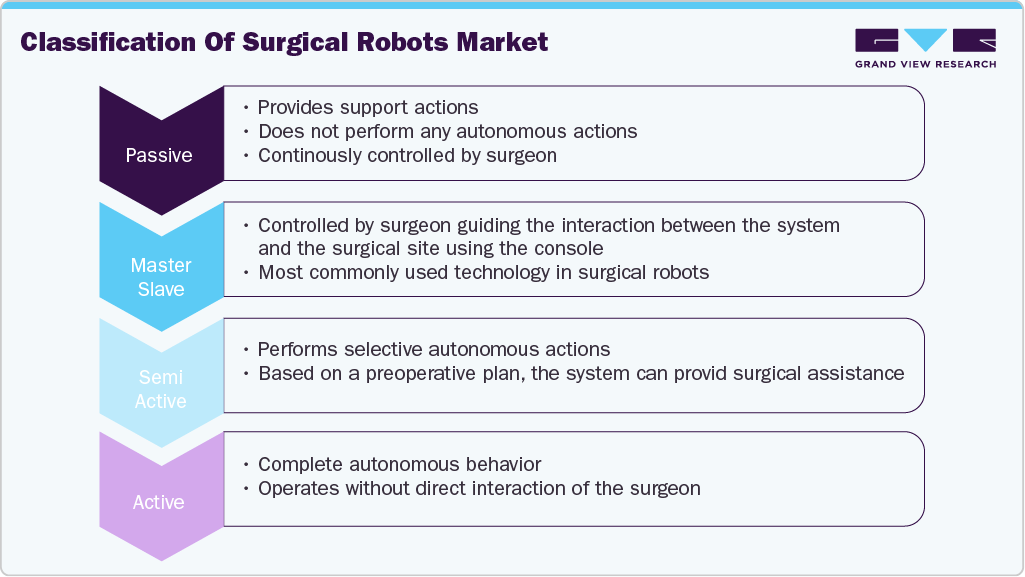

Surgical robots are often referred to as robotic-assisted surgery devices. These devices are presently approved in the U.S. by the FDA and by the EU & CEA in Europe. Certification by these authorities is required for the commercialization and marketing of these devices in 27 EU nations. They are classified into either Class II or Class III as per the FDA based on the risks possessed to the patient.

Class II Surgical Robot Type

Class III Surgical Robot Type

Passive Surgical Robot System

Active/ AI Surgical Robot System

Master Slave Surgical Robot System

A complete comprehensive analysis will be provided in the report

Semi Active Surgical Robot System

According to the EU Medical Device Regulation (MDR 2017/745), these systems are classified as Class IIb medical devices in Europe. For any medical device, the process of securing the U.S. FDA 510(k) premarket approval & Europe CE Mark is a major barrier to commercializing the product. It requires a considerable investment of time and resources.

Sr. No

Country

Regulations, Directives, and Authorities

North America

1

U.S.

Food and Drug Administration (FDA)

Maturity and Outlook Across Various Surgical Robots Market

Comparative Market Analysis: Single-Port vs Multiport Robotic Surgery Platforms

Aspect

Multiport (Established Platform)

Single-Port (Emerging Platform)

Adoption & Maturity

Long-standing and widely adopted across multiple medical specialties; supported by extensive clinical evidence and well-established training pathways.

Recently introduced with limited adoption; currently building clinical validation and surgeon familiarity.

Surgical Capabilities

Provides strong instrumentation, wide range of motion, and versatility, making it suitable for complex and high-force procedures.

Enables surgery through a single entry point; offers improved cosmesis, less invasiveness, and efficiency in tight anatomical spaces.

Clinical Applications

Preferred for large tumors, prostate cancer, and complex reconstructions where strength and flexibility are essential.

Useful for patients with prior abdominal surgeries or “hostile abdomen” cases; favorable for minimally invasive urology and select subspecialties.

Limitations & Challenges

Requires multiple incisions and a larger clinical footprint compared to newer platforms.

Higher system cost, steep learning curve, limited instrument strength, and lack of standardized training protocols.

Market Outlook

Expected to remain the dominant platform, with steady demand and incremental innovation.

Positioned for niche-led growth; adoption likely to expand in urology, ENT, and pediatric surgery as clinical evidence and training improve.

New Surgical Robotics Platforms Emerging from Asia

System

Country of Origin

Initial Authorization

Global Market Presence

Key Highlights

Zamenix (specialized)

South Korea

Clinical use (2023 trials)

Domestic (under evaluation)

Focused on retrograde intrarenal surgery; integrates respiratory motion compensation for stone removal.

Mantra

India

2022

Indonesia, UAE, Nepal, Guatemala, Ecuador

Modular (3-5 arms), ergonomic command center; >150 urological procedures completed.

Toumai

China

2022

European Union

CE Mark; set world record (2024) for 12,000 km intercontinental telesurgery.

Hinotori

Japan

2020

Singapore, Malaysia

Developed by Kawasaki & Sysmex; 8-axis arms; docking-free design; tested for telesurgery using 5G.

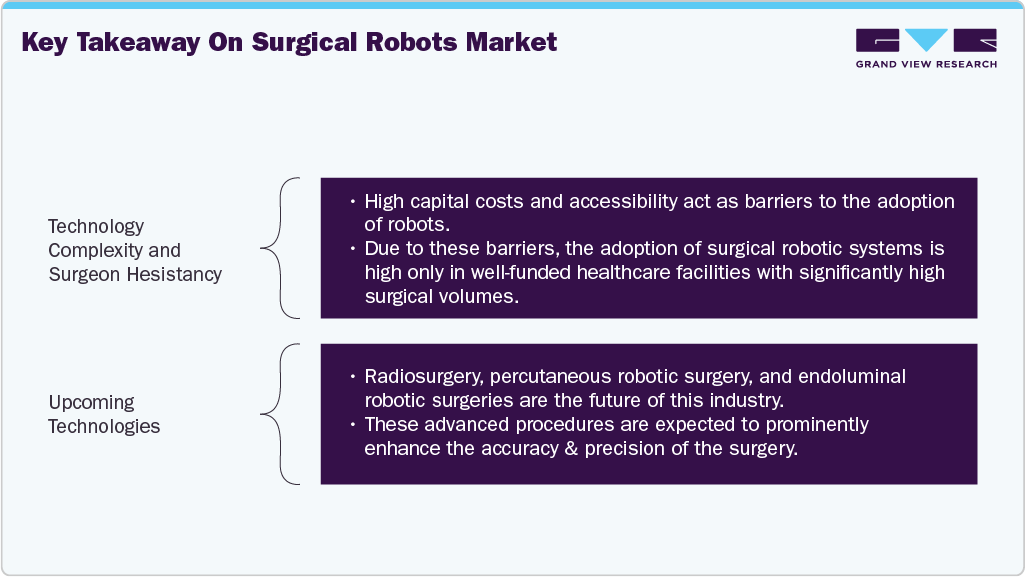

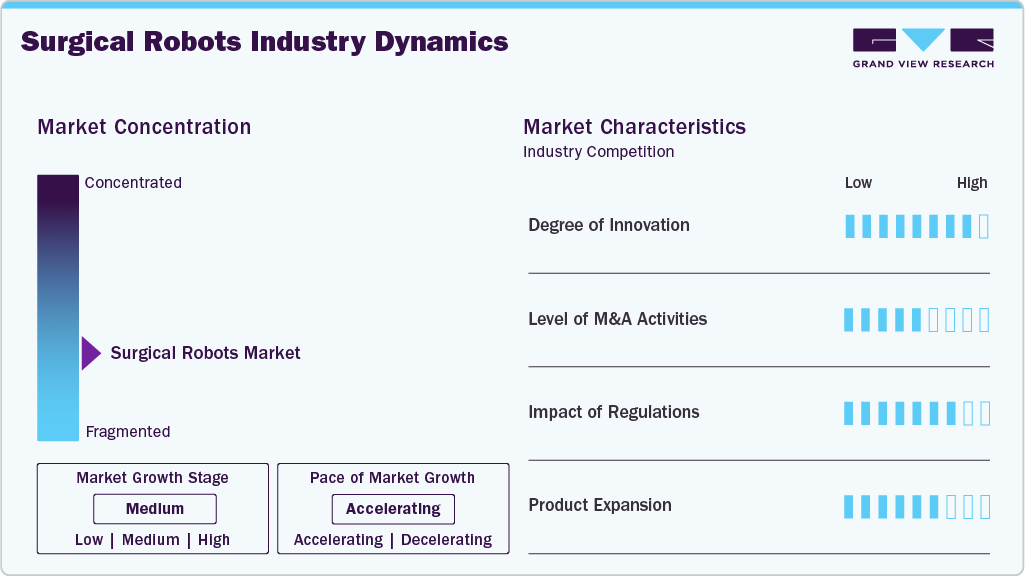

Market Concentration & Characteristics

The surgical robots industry is characterized by a high degree of innovation. The latest technological advancements in medical robotic systems have include improved articulation, tremor filtration, and visualization, enabling surgeons to conduct intricate procedures with unparalleled accuracy and minimal tissue damage. For instance, in February 2023, CK Birla Hospital in India made a significant advancement in orthopedic surgery by introducing fully active robotic technology for minimally invasive knee replacement procedures. This operative robot system accurately assesses deformities, 3D pre-planning, and precise results for better patient outcomes.

The surgical robots industry is characterized by moderate merger and acquisition activity, owing to several factors, including the desire to expand the business to cater to the growing demand for robotics surgery to maintain a competitive edge. For instance, in August 2024, Asensus Surgical announced the completion of its acquisition of Karl Storz, a manufacturer of endoscopic equipment. This strategic move is aimed at enhancing Asensus Surgical’s capabilities in the field of minimally invasive surgery by integrating Karl Storz’s extensive product portfolio and expertise in visualization technologies.

Asensus Surgical President and CEO said,“By joining forces with a leading company in endoscopy that became a system provider for integrated MedTech, we are well-positioned to accelerate the development and delivery of our innovative robotic and digital surgical solutions. This union will benefit patients and surgeons worldwide by advancing precise, safer, and more predictable surgical outcomes."

Surgical robots are presently approved in the U.S. by FDA and by EU & CEA in Europe. Certification by these authorities is required for commercialization and marketing of these devices in 27 EU nations. Surgical robots are classified as Class-II devices as per the U.S. FDA risk-based classification and Class IIa (low risk) or Class IIb (high risk) in Europe. For any medical device, the process of securing the U.S. FDA 510(k) premarket approval & Europe CE Mark is a major barrier to commercializing the product and requires a considerable investment of time and resources.

Several market players are expanding their business by launching new products and getting approvals from regulatory authorities to strengthen their market position and expand their product portfolio. For instance, In November 2024, Johnson & Johnson MedTech announced that the U.S. Food & Drug Administration (FDA) granted approval for the OTTAVA robotic system under an investigational device exemption (IDE). This approval allows the company to begin clinical trials with this advanced clinical technology.

Application Insights

The urology segment led the market with the largest revenue share of 27.44% in 2024. The growth of the market is largely due to the increasing number of complex surgical cases and a shift towards minimally invasive techniques. Surgeons are increasingly turning to robotic platforms as these technologies provide better precision, improved visualization, and greater control during procedures. For patients, this means quicker recovery times and fewer complications, which is contributing to the rapid expansion of this area in healthcare. In April 2025, Intuitive announced the FDA clearance of its SureForm 45 stapler for use in single-port robotic surgery, specifically for urology procedures. This stapler features SmartFire technology, enhancing surgical precision by monitoring tissue compression in real time.

The orthopedic segment is anticipated to grow at the fastest CAGR over the forecast period, owingto the growing number of joint replacement surgeries, developing need for precise alignment in knee and hip operations, and the increasing use of robotic systems that enhance surgical accuracy and patient results. In July 2025, Zimmer Biomet announced its acquisition of Monogram Technologies totaling around USD 177 million, aimed at enhancing its robotics portfolio. This strategic move will integrate Monogram's semi- and fully autonomous robotic technologies into Zimmer Biomet’s ROSA platform. The acquisition is expected to strengthen Zimmer Biomet's position in the orthopedic robotics market and contribute to revenue growth starting in 2027.

End Use Insights

The inpatient segment led the market with the largest revenue share of 53.13% in 2024, as healthcare facilities are increasingly adopting robotic technology to enhance medical procedures. These advanced robots offer precision, minimally invasive techniques, and improved patient outcomes. In January 2025, Prashanth Hospitals inaugurated the Institute of Robotic Surgery, introducing a medical robotic system designed for minimally invasive surgeries. With its features designed to enhance precision and patient safety, along with its applicability across various specialties, this innovation is expected to transform how surgeries are performed.

The outpatient segment is anticipated to grow at the fastest CAGR over the forecast period. These facilities offer patients minimally invasive and highly precise surgeries, emphasized into quicker recovery times and reduced healthcare costs. The growing trend towards outpatient robotic surgeries strengthens the industry's commitment to providing accessible, efficient, and patient-centric medical solutions outside traditional hospital settings. In August 2023, Wilmington Health introduced robotic surgery at their Ambulatory Surgery Center, offering minimally invasive procedures across multiple specialties. The center uses the Da Vinci Xi Multi-Port Robotic Platform, enhancing precision, control, and patient outcomes.

Regional Insights

North America dominated the global surgical robots market with the largest revenue share of 50.90% in 2024. The advancements in surgeries and healthcare facilities for various disorders are increasing the need for these systems for surgeries and treatment in North America. Diligent R&D pertaining to ergonomically designed workstations to improve learning curves and growing clinical adoption of new minimally invasive surgery techniques is expected to boost market demand. In March 2024, Intuitive Surgical obtained FDA 510(k) clearance for its new multiport robotic system, da Vinci 5. The system advances the capabilities of the da Vinci Xi, previously used in over 7 million operations worldwide, setting a new standard for minimally invasive procedures.

U.S. Surgical Robots Market Trends

The surgical robots market in the U.S. accounted for the largest market revenue share in North America in 2024. The growing adoption of minimally invasive procedures in the country due to the need for shorter recovery period is anticipated to drive market growth. The presence of a well-developed healthcare infrastructure in the country, ongoing advancements in robots, and presence of key market players contributes towards market expansion. In April 2025, Medtronic submitted its Hugo robotic-assisted surgery system to the U.S. FDA after meeting primary safety and effectiveness endpoints in an IDE study, with the system showing a 98.5% clinical success rate.

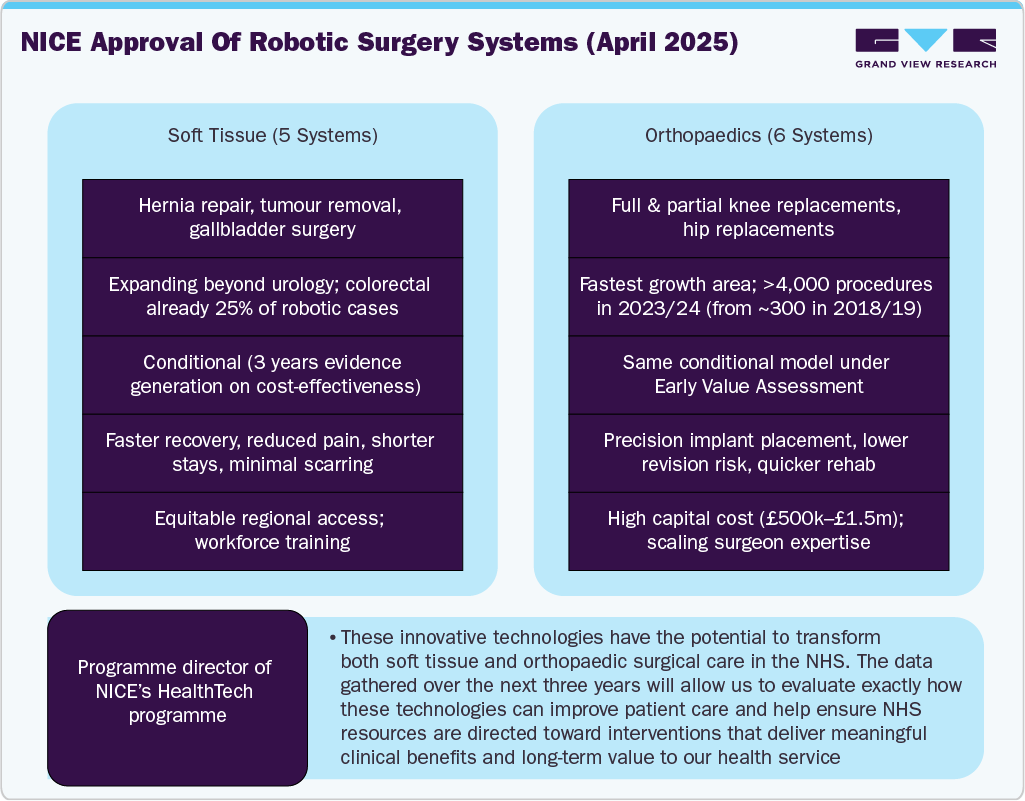

Europe Surgical Robots Market Trends

The surgical robots market in Europe is expected to grow at a significant CAGR over the forecast period. Factors such as presence of a well-developed healthcare infrastructure and favorable reimbursement policies that reduce out-of-pocket expenditure of patients boosts demand. Ongoing research on robots in the region is expected to also contribute towards the market growth over the forecast period. In July 2025, Intuitive Surgical’s da Vinci 5 Surgical System received CE mark approval for adult and pediatric use in Europe, covering minimally invasive procedures across urologic, gynecologic, and general laparoscopic surgeries.

The Germany surgical robots market is expected to grow at a significant CAGR during the forecast period. The presence of high-quality healthcare infrastructure and favorable reimbursement policies are key factors expected to drive this market. Various factors driving the market in Germany include increasing government initiatives for launching local robots and continuous improvements in robots & medical technology in the country.In October 2023, Johnson & Johnson MedTech launched the VELYS Robotic-Assisted Solution in the European market, initially utilized for successful Total Knee surgeries in Germany.

Asia Pacific Surgical Robots Market Trends

The surgical robots market in Asia Pacificis expected to register at the fastest CAGR over the forecast period. Increasing government initiatives undertaken to encourage healthcare providers and other healthcare organizations to adopt technologically advanced medical devices & systems is a key factor indicated to drive this market. In terms of adoption of technology in the APAC region, Japan, Singapore, Australia, and South Korea have been adopting technology on a large scale in the healthcare sector whereas Thailand, China, India, and Malaysia are the emerging markets. In May 2025, MicroPort MedBot received market approval from China’s National Medical Products Administration for its Toumai Tele-Robotic Surgical System.

The China surgical robots market is anticipated to register at a considerable CAGR during the forecast period. Increasing partnerships and launch of products in the Chinese market are expected to drive market growth. Growing modernization of domestic production facilities is leading to the increase in the manufacturing of medical robots in China. China’s use of robotic systems combined with satellite communication represents a significant step forward in remote surgery capabilities, potentially transforming how medical care is delivered across great distances. For instance, in January 2025, Chinese surgeons have successfully conducted remote surgeries using advanced robotic systems and satellite technology. This innovative approach allows surgeons to operate on patients located thousands of kilometers away, demonstrating a significant advancement in medical technology.

Latin America Surgical Robots Market Trends

The surgical robots market in Latin America is expected to witness at a significant CAGR over the forecast period. The growing prevalence of chronic diseases, easy availability of newer technologies & robots, and increasing prevalence of osteoporosis are among key factors driving market growth in this region. For instance, according to the International Osteoporosis Foundation, in Latin America, the economic burden of hip fractures would cost USD 13 billion by 2050.

The Brazil surgical robots market is anticipated to register at a significant CAGR during the forecast period. As per estimates of World Bank, Brazil spends nearly 9.5% of its GDP in healthcare sector and is one of the fastest growing industries in Latin America, owing to its leading healthcare expenditure. In January 2025, MicroPort MedBot’s SkyWalker orthopedic operative robot successfully performed its inaugural total knee arthroplasty in South America at Vera Cruz Hospital in Brazil. The operation showcased accurate bone registration and osteotomy that aligned with the preoperative plans, minimizing trauma and complications.

Middle East & Africa Surgical Robots Market Trends

The surgical robots market in the Middle East and Africa is anticipated to witness at a significant CAGR over the forecast period. High cancer incidence and lack of skilled professionals in this region are boosting the need for robotic-assisted surgeries. In January 2025, King Faisal Specialist Hospital and Research Centre (KFSH&RC) successfully performed a groundbreaking medical procedure. This event marks an important advancement in healthcare services provided by the institution, which is known for its commitment to excellence in patient care and medical research.

The South Africa surgical robots market is anticipated to register at a substantial CAGR during the forecast period. There is a significant shift in the medical technology (medtech) landscape in Africa, particularly focusing on the introduction of the Da Vinci Surgical Robot and its pay-per-use equipment model. The installation of a Da Vinci robot at Busamed Gateway Private Hospital in Kwazulu Natal in August 2024, represents a significant advancement in the accessibility of advanced medical technology in Africa. It allows healthcare facilities to utilize state-of-the-art robotic surgery without incurring the substantial capital costs typically associated with such technologies.

Key Surgical Robotics Company Insights

Key participants in the surgical robots industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and expanding their business footprints.

Key Surgical Robots Companies:

The following are the leading companies in the surgical robots market. These companies collectively hold the largest market share and dictate industry trends.

- Intuitive Surgical

- Medrobots Corporation

- Medtronic

- Renishaw plc

- Smith and Nephew

- Stryker Corporation

- THINK Surgical, Inc.

- Transenterix (Asensus Surgical, Inc.)

- Zimmer Biomet

- MOON Surgical

Surgical Robots Market, Established and Emerging Players Analysis

Established Companies

Emerging Companies

Intuitive Surgical

CMR Surgical

Overview

Intuitive Surgical, Inc. is a global robotic-assisted, minimally invasive surgery leader. Established in 1995, the company's flagship product, the da Vinci Surgical System, was the first to receive FDA approval for general laparoscopic surgery. The surgical system comprises a patient-side cart with robotic arms, a high-performance vision system, a surgeon's console, and proprietary EndoWrist instruments. Intuitive Surgical's technology has revolutionized surgery across multiple disciplines, including urology, gynecology, thoracic surgery, and general surgery.

A complete comprehensive analysis will be provided in the report

Growth Strategies

Focuses on continuous innovation, expanding the capabilities of the da Vinci system, increasing the number of procedures it can perform, and expanding into new geographic markets. It also invests heavily in training programs for surgeons.

A complete comprehensive analysis will be provided in the report

Product Pipeline

da Vinci 5 Robot

A complete comprehensive analysis will be provided in the report

Products

- Da Vinci Xi

- Da Vinci X

- Da Vinci SP

- Ion

A complete comprehensive analysis will be provided in the report

Business Line

A complete comprehensive analysis will be provided in the report

A complete comprehensive analysis will be provided in the report

Recent Developments

-

In July 2025, Care Hospitals in Hyderabad introduced the AI-driven Stryker Mako Robotic System to aid in robotic-assisted joint replacement surgeries. The system combines 3D CT-based surgical planning with real-time guidance, aiming to improve surgical accuracy while minimizing tissue damage.

-

In June 2025, SS Innovations performed the first robotic cardiac surgery in the Americas using its SSi Mantra 3 system at Interhospital, Ecuador, with successful patient outcomes. The company is expanding globally, aiming for FDA clearance in 2026, and has 80 systems installed across 75 hospitals in India and other countries.

-

In April 2025, Johnson & Johnson MedTech announced the successful completion of the first clinical cases using the OTTAVA Robotic Surgical System for gastric bypass surgery at Memorial Hermann-Texas Medical Center.

-

In June 2024, Indian medical device company Meril launched its MISSO surgical robot for knee replacement surgeries, claiming a 98% success rate. This indigenously developed system is designed to be cost-effective, reducing investment by 66% compared to imported systems. It makes robotic surgery more accessible, especially in smaller hospitals. The technology has received approval from CDSCO and is awaiting CE and USFDA approvals.

-

In June 2024, Smith+Nephew introduced a new service called CORIOGRAPH, which is designed to enhance the capabilities of their CORI Surgical System. This service focuses on personalized pre-operative planning and modeling for both patients and surgeons. The aim is to improve surgical outcomes by providing tailored insights that can help with decision-making prior to surgery.

Surgical Robots Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.73 billion

Revenue forecast in 2033

USD 9.60 billion

Growth rate

CAGR of 9.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Smith & Nephew; Medrobots; TransEnterix Surgical, Inc.; Intuitive Surgical; Renishaw plc; Medtronic; Stryker Corporation; Zimmer Biomet; THINK Surgical, Inc; MOON Surgical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Robots Market Segmentation

This report forecasts revenue growth and provides at the global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global surgical robots market report based on application, end use, and region:

-

Application Outlook (Procedure Volume (Surgeries Performed, 000); Unit Volume (Systems Installed, 000); Revenue, USD Million, 2021 - 2033)

-

Orthopedics

-

Hip

-

Knee

-

Spine

-

Others

-

-

Urology

-

General Surgery

-

Gynecology

-

Cardiothoracic

-

Neurosurgery

-

ENT (Otolaryngology)

-

Bariatric / Metabolic

-

Others

-

-

End Use Outlook (Procedure Volume (Surgeries Performed, 000); Unit Volume (Systems Installed, 000); Revenue, USD Million, 2021 - 2033)

-

Inpatient

-

Outpatient

-

-

Regional Outlook (Procedure Volume (Surgeries Performed, 000); Unit Volume (Systems Installed, 000); Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global surgical robots market size was estimated at USD 4.31 billion in 2024 and is expected to reach USD 4.73 billion in 2025.

b. The global surgical robots market is expected to grow at a compound annual growth rate of 9.26% from 2025 to 2033 to reach USD 9.60 billion by 2033.

b. North America dominated the surgical robots market with a share of 50.90% in 2024. This is attributed to the increasing number of hospitals opting for robot-assisted surgeries, the U.S. government's high healthcare spending, and growing regional robotic investments.

b. Some key players operating in the surgical robots market include Smith & Nephew; TransEnterix Surgical, Inc.; Intuitive Surgical; Renishaw plc; Medtronic; Stryker Corporation; Zimmer Biomet; THINK Surgical, Inc.; MOON Surgical, and others.

b. Key factors driving the surgical robots market growth include the global shortage of physicians and surgeons and the growing adoption of automated surgical instruments, which are significantly contributing to market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.