- Home

- »

- Homecare & Decor

- »

-

Thermos Drinkware Market Size And Share Report, 2030GVR Report cover

![Thermos Drinkware Market Size, Share & Trends Report]()

Thermos Drinkware Market Size, Share & Trends Analysis Report By Type (Mugs & Tumblers, Water Bottle, Beverage Bottle), By Application, By Size, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-146-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Thermos Drinkware Market Size & Trends

The global thermos drinkware market size was estimated at USD 3.09 billion in 2024 and is expected to grow at a CAGR of 6.7% from 2025 to 2030. As consumers place greater emphasis on environmental sustainability, thermos bottles have emerged as a favored alternative to single-use plastic and paper cups, significantly contributing to efforts aimed at reducing waste. This shift aligns with broader sustainability initiatives encouraging responsible consumption and eco-friendly practices. Furthermore, the market has adapted to diverse consumer preferences by offering an extensive array of stylish and customizable thermos bottle designs. These options not only cater to the functional needs of users but also appeal to individuals who prioritize aesthetics and personalization in their everyday products. By combining environmental responsibility with appealing design elements, thermos bottles effectively meet the demands of a conscientious consumer base.

The increasing global awareness of plastic pollution is driving consumers to move away from bottled water, thereby facilitating growth in the market for stainless steel water bottles. This trend is further augmented by a growing commitment among consumers to adopt healthier lifestyles, emphasizing hydration, which is anticipated to positively impact product sales during the forecast period. Additionally, stainless steel water bottles contribute to the reduction of greenhouse gas emissions by decreasing the demand for plastic production. According to 2023 U.S. Census data, approximately 60% of American adults have opted for reusable bottles, reflecting a broader shift toward eco-conscious consumer behavior.

Financially, reusable water bottles present a favorable long-term investment. Although they may entail a higher upfront cost, they result in significant savings over time as the cumulative expenses of purchasing bottled water mount. A 2023 blog post by TheRoundup highlights that Americans consume around 50 billion plastic water bottles annually, averaging approximately 13 bottles per person each month. By transitioning to reusable options, individuals could potentially eliminate an average of 156 plastic bottles from their consumption per year, further driving the increasing global demand for thermos drinkware.

The growing popularity of outdoor activities, such as picnics in city parks, visits to local green spaces, and exploration of public trails, creates a promising outlook for thermos bottles. A survey conducted by Maru Voice Canada in 2021 indicated that 52% of Canadians expressed a heightened interest in participating in outdoor leisure activities more frequently, underscoring the market potential for portable drinkware.

Governments around the world are implementing initiatives to phase out single-use plastic water bottles in favor of promoting reusable alternatives made from glass, metal, and other environmentally friendly materials. For instance, Australia, Canada, the United States, and certain states in India have enacted bans on single-use plastic water bottles, thereby creating new growth opportunities for manufacturers of stainless steel water bottles. This regulatory shift not only supports environmental sustainability but also encourages a significant transition toward more responsible consumer choices in beverage containers.

Type Insights

Thermos water bottles accounted for a market share of 56.3% in 2024. Water bottles have evolved into popular lifestyle accessories among outdoor enthusiasts, significantly enhancing their market appeal. A 2022 survey conducted by Winnebago Industries, Inc., a prominent outdoor lifestyle products manufacturer, revealed that 82% of Americans engaged in outdoor activities, including camping, hiking, boating, or visiting state and national parks, at locations away from home. This represents a notable increase from 60% in 2020 to 79% in 2021, underscoring the growing affinity for outdoor recreation and, consequently, the rising demand for durable, reusable water bottles designed for such activities.

The demand for thermos mugs and tumblers is projected to grow at a CAGR of 7.4% from 2025 to 2030. These drinkware products are widely recognized for their exceptional temperature retention capabilities, effectively keeping beverages hot or cold for extended periods-a feature highly valued in office environments. Additionally, their compact, spill-resistant design enhances portability, making them well-suited for both daily commutes and outdoor activities.

Size Insights

Thermos drinkware sized 500 to 1000 ml accounted for a market share of 55.9% in 2024. This segment is particularly popular among students and outdoor enthusiasts who seek the convenience of carrying a water bottle throughout the day. Its compact size is designed for ease of use, fitting comfortably into most bags without occupying excessive space, thereby enhancing its appeal for on-the-go hydration. Additionally, these bottles are available in a wide array of colors, patterns, and designs, offering consumers an appealing blend of aesthetics and functionality. This variety not only enhances the visual appeal but also underscores the practicality and utility of the product, driving its adoption among a diverse consumer base.

The demand for drinkware with capacities below 500ml is projected to grow at a CAGR of 7.5% from 2025 to 2030. Products in this size category are particularly valued for their refillable nature, supporting individuals in monitoring and achieving their daily hydration targets. The compact size promotes frequent refills, serving as a continual visual cue to stay hydrated, which aligns with the preferences of health-conscious consumers prioritizing regular water intake and overall wellness. This size range is especially practical for those who appreciate a lightweight, portable option that facilitates easy tracking of hydration throughout the day, driving its anticipated popularity and adoption.

Application Insights

The demand for thermos drinkware for everyday usage led the market and accounted for a market share of 50.6% in 2023. The versatility of this segment lies in its ability to accommodate a wide variety of beverages, including coffee, tea, water, smoothies, and even soups. This adaptability meets the needs of consumers with diverse dietary preferences, making these products suitable for multiple daily applications. Their functionality appeals particularly to users in office environments and other professional settings, where convenience and flexibility in beverage choice are highly valued. This broad utility supports their widespread adoption, as they provide an all-in-one solution for those seeking to enjoy various beverages throughout the day without the need for multiple containers.

The demand for thermos drinkware for outdoor applications is anticipated to grow with a CAGR of 7.3% from 2025 to 2030. The increased focus on health and well-being motivates people to engage in outdoor activities, providing physical exercise, stress relief, and mental rejuvenation. As per the Outdoor Industry Association report, Outdoor recreation participation in the U.S. increased by 4.1%, reaching an unprecedented 175.8 million individuals, or 57.3% of Americans aged six and older. Notably, 2023 marked the first time that over half of American women engaged in outdoor activities, with female participation rising to 51.9% from 50% in 2022. This heightened engagement in outdoor activities is expected to drive demand for thermos drinkware products, as consumers increasingly seek convenient, durable solutions to keep beverages at ideal temperatures during their excursions. The trend underscores a growing market for high-quality, portable drinkware tailored to the needs of a diverse and active consumer base.

Distribution Channel Insights

The sales of thermos drinkware through supermarkets and hypermarkets accounted for a market share of 39.2% in 2024. This strong performance can be attributed to the widespread accessibility and convenience these retail channels offer, allowing consumers to browse and purchase products during routine shopping trips. Supermarkets and hypermarkets often showcase a diverse selection of thermos drinkware, appealing to a broad consumer base with varied preferences in style, capacity, and functionality. Furthermore, these venues frequently implement promotional strategies and discounts, enhancing product visibility and encouraging impulse purchases, thereby driving substantial sales within this segment.

The sales through online channels are expected to grow at a CAGR of 7.4% from 2025 to 2030. The convenience and ease of online shopping allow consumers to explore a vast array of options, from different brands to unique styles and capacities, which may not be readily available in physical stores. Additionally, e-commerce platforms provide detailed product descriptions, customer reviews, and price comparisons, facilitating more informed purchasing decisions. With the increasing reliance on digital platforms for everyday shopping, coupled with targeted promotions and the ease of home delivery, online channels are well-positioned to capture a growing share of the thermos drinkware market.

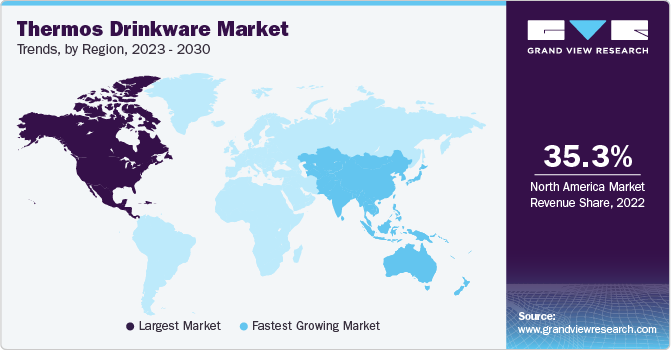

Regional Insights

The North America thermos drinkware market held a share of 34.5% of the global revenue in 2024. Demand for thermos drinkware in North America is experiencing robust growth as consumers become increasingly environmentally conscious and seek alternatives to single-use plastics. In the U.S., for instance, multiple cities and states have enacted legislation aimed at reducing plastic waste, such as California’s ban on single-use plastic water bottles in state parks. Such policies, coupled with widespread campaigns by organizations advocating for reduced plastic consumption, are driving consumers to opt for sustainable, reusable drinkware options. The convenience of thermos bottles for keeping beverages at optimal temperatures further aligns with the fast-paced lifestyle in North America, where on-the-go hydration solutions are highly valued.

U.S. Thermos Drinkware Market Trends

The U.S. thermos drinkware market is expected to grow at a CAGR of 5.5% from 2025 to 2030. In the U.S., the demand for thermos drinkware is propelled by growing consumer awareness around sustainability and health. The National Park Service, for example, actively promotes reusable water bottles in national parks, which has amplified awareness of reusable drinkware options among outdoor enthusiasts. This trend aligns with a broader lifestyle shift towards health and wellness, as individuals increasingly seek products that support both personal well-being and environmental responsibility. Moreover, the U.S. government’s initiatives to reduce plastic pollution, including federal proposals for regulating single-use plastics, create a favorable market environment for thermos drinkware, positioning it as a preferred sustainable choice for consumers.

Asia Pacific Thermos Drinkware Market Trends

Asia Pacific thermos drinkware market accounted for a revenue share of around 20.8% in the year 2024. The Asia Pacific region is witnessing increased demand for thermos drinkware, primarily due to rising awareness of environmental concerns and government initiatives focused on reducing plastic waste. Countries like Japan and South Korea are implementing strict recycling regulations and encouraging the adoption of reusable products. In China, major cities are instituting bans on single-use plastics, creating a favorable environment for sustainable alternatives like thermos bottles. Furthermore, the region’s diverse climate-from tropical to cold-heightens the demand for drinkware capable of maintaining beverage temperature, making thermos products particularly attractive to consumers across varying lifestyles and regional climates.

Europe Thermos Drinkware Market Trends

The European market is projected to grow at a CAGR of 6.9% from 2025 to 2030. In Europe, stringent environmental policies and a high level of consumer eco-awareness are driving significant growth in thermos drinkware demand. The European Union’s comprehensive “Single-Use Plastics Directive” bans various single-use plastic items and mandates member states to encourage reusable alternatives. This regulatory landscape, coupled with a strong culture of environmental stewardship, has fostered a surge in demand for sustainable products like thermos bottles. Additionally, European consumers value durability and quality in their purchases, which enhances the appeal of thermos drinkware as a long-lasting, environmentally friendly solution for both daily use and outdoor activities.

Key Thermos Drinkware Company Insights

The competitive landscape of the thermos drinkware market is characterized by intense competition among both established players and emerging brands, driven by innovation, brand differentiation, and sustainability-focused product development. Leading companies are prioritizing advanced thermal insulation technologies, sleek and ergonomic designs, and high-quality, durable materials to meet evolving consumer preferences for long-lasting and versatile drinkware solutions. Major players are also expanding their product portfolios with customizations in size, design, and functionality to cater to diverse consumer demographics, including urban commuters, outdoor enthusiasts, and eco-conscious users.

In response to the rising demand for sustainable options, several key brands are enhancing their market positioning by integrating eco-friendly materials, such as BPA-free and recycled components, and adopting environmentally conscious manufacturing practices. Strategic partnerships, direct-to-consumer sales channels, and robust e-commerce strategies have become crucial competitive tools, enabling companies to reach broader audiences effectively.

Additionally, ongoing investment in marketing and branding initiatives-such as influencer partnerships and digital advertising-enables these players to strengthen brand loyalty and capture significant market share. Overall, the market’s competitive dynamics underscore a strong focus on innovation, sustainability, and consumer-centric approaches to maintain a competitive edge.

Key Thermos Drinkware Companies:

The following are the leading companies in the thermos drinkware market. These companies collectively hold the largest market share and dictate industry trends.

- Sigg Switzerland AG

- Thermos L.L.C.

- TIGER CORPORATION

- Camelbak

- Zojirushi America Corporation.

- Stanley PMI

- Klean Kanteen

- Hydro Flask.

- KINTO Co., Ltd.

- Contigo Brands.

View a comprehensive list of companies in the Thermos Drinkware Market

Recent Developments

-

In February 2023, Thermos L.L.C. unveiled its innovative Icon™ Series, marking a significant expansion in its product lineup. This new series includes a variety of hot beverage and food storage solutions while introducing an enhanced focus on cold beverage and hydration products. The offerings are designed with consumer convenience in mind, incorporating advanced features such as a Griptec Non-Slip Base for improved handling and a True-Coat finish that ensures durability and aesthetic appeal across all items. This strategic development underscores Thermos L.L.C.'s commitment to meeting the evolving needs of consumers seeking practical and reliable drinkware solutions.

-

In September 2024, Hydro Flask, a renowned leader in high-performance insulated stainless steel bottles and soft goods innovations under Helen of Troy Limited, launched its latest brand campaign titled "We Make It. You Own It." This campaign celebrated Hydro Flask's dedication to enhancing consumer experience and high-quality design while showcasing the innovative ways in which its customers utilized the products. Centered on the theme of empowering users to fully embrace their lifestyles and individual experiences, the campaign effectively combined striking visuals with a refreshed messaging platform.

Thermos Drinkware Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.25 billion

Revenue forecast in 2030

USD 4.49 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, size, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Africa; UAE

Key companies profiled

Sigg Switzerland AG; Thermos L.L.C.; TIGER CORPORATION; Camelbak; Zojirushi America Corporation.; Stanley PMI; Klean Kanteen; Hydro Flask.; KINTO Co., Ltd.; and Contigo Brands.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermos Drinkware Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global thermos drinkware market based on type, size, application, and distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mugs and Tumblers

-

Water Bottle

-

Beverage Bottle

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Outdoor Enthusiasts

-

Everyday Use

-

Specialized

-

-

Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 500 ml

-

500 ml - 1000 ml

-

1000 ml and above

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global thermos drinkware market was estimated at USD 3.09 billion in 2024 and is expected to reach USD 3.25 billion in 2025.

b. The global market for thermos drinkware is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030, reaching USD 4.49 billion by 2030.

b. North America dominated the market with a share of around 34.53% in 2024. This can be attributed to the increasing popularity of colorful offerings from prominent market players, as well as the increased participation in outdoor activities.

b. Some of the key players operating in the thermos drinkware market include Sigg Switzerland AG, Thermos L.L.C., TIGER CORPORATION, Camelbak, Zojirushi America Corporation., Stanley PMI, Klean Kanteen, Hydro Flask., KINTO Co., Ltd., Contigo Brands.

b. Key factors that are driving the thermos drinkware market growth include the awareness among the people for overall well-being by focusing on hydration and elimination of the use of plastic bottles in daily life.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."