- Home

- »

- Sensors & Controls

- »

-

Tunable Diode Laser Analyzer Market, Industry Report, 2030GVR Report cover

![Tunable Diode Laser Analyzer Market Size, Share & Trends Report]()

Tunable Diode Laser Analyzer Market (2025 - 2030) Size, Share & Trends Analysis Report By Measurement Type (In-Situ, Others), By Industrial Application (Oil & Gas, Cement), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-038-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Tunable Diode Laser Analyzer Market Summary

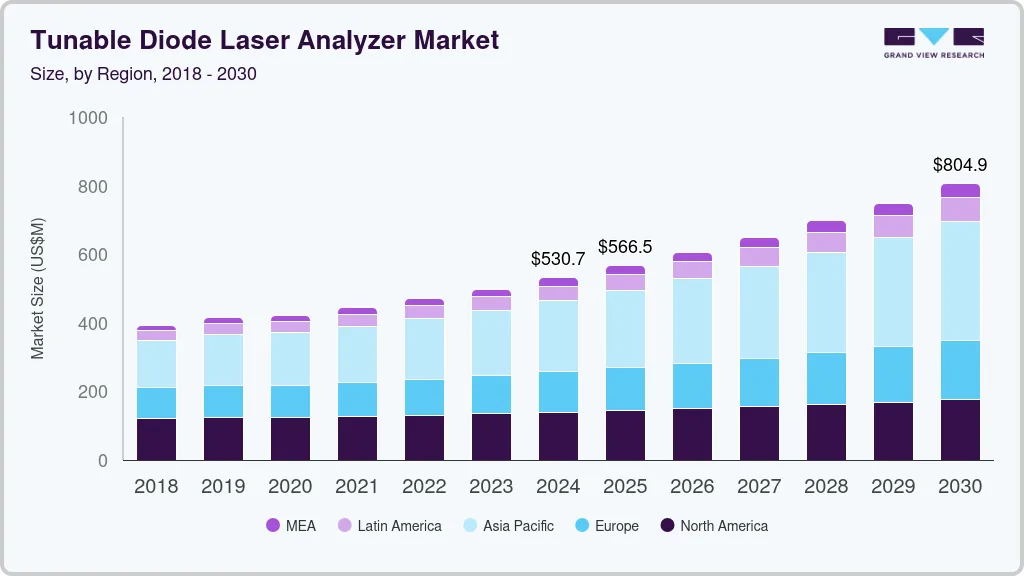

The global tunable diode laser analyzer market size was estimated at USD 530.7 million in 2024 and is projected to reach USD 804.9 million by 2030, growing at a CAGR of 7.3% from 2025 to 2030. This growth is attributed to strict environmental regulations, heightened focus on workplace safety, and rapid industrialization in emerging economies.

Key Market Trends & Insights

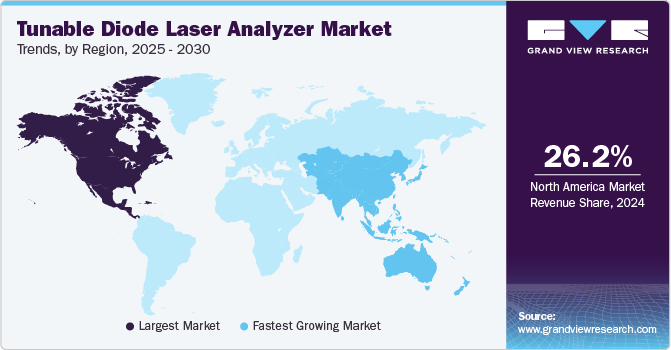

- North America's tunable diode laser analyzer market dominated the global market and accounted for the largest revenue share of 26.2% in 2024.

- The tunable diode laser analyzer market in the U.S. led the North American market and held the largest share in 2024.

- By measurement type, the in-situ segment dominated the global tunable diode laser analyzer industry,with the largest revenue share of 61.1% in 2024.

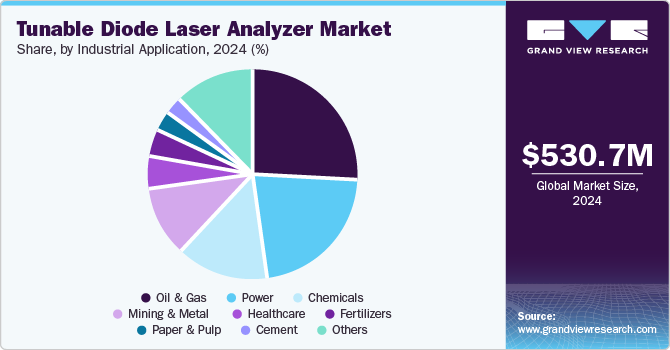

- By industrial application, the oil & gas segment led the market and accounted for the largest revenue share of 25.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 530.7 Million

- 2030 Projected Market Size: USD 804.9 Million

- CAGR (2025-2030): 7.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, as industries continue to prioritize safety and environmental responsibility, the TDLA market is expected to thrive in the coming years. A tunable diode laser analyzer is a device that uses laser absorption spectrometry to measure the concentration of specific gases. It operates by emitting infrared light through a gas sample, where the absorption of light at specific wavelengths indicates the presence and concentration of certain gas molecules. This technique allows for fast, accurate, and interference-free measurements, making it suitable for various industrial applications, including monitoring oxygen, methane, and other gases in challenging environments.The increasing enforcement of environmental regulations across various countries leads to market expansion. Governments are implementing stringent policies to monitor and control emissions, particularly in industries such as oil and gas, petrochemicals, and manufacturing. For instance, in December 2023, the U.S. Environmental Protection Agency (EPA) announced a final rule to reduce methane emissions from oil and natural gas operations significantly. These regulations necessitate the adoption of advanced monitoring technologies such as TDLA, which can provide accurate and real-time data on gas concentrations. As industries strive to comply with these regulations, the demand for TDLA systems is expected to rise.

Moreover, industries are increasingly aware of the health risks associated with hazardous gases and air pollutants. Implementing TDLA systems helps detect these gases effectively, thereby enhancing workplace safety and ensuring compliance with health standards. Moreover, as companies focus on sustainability initiatives, they are investing in technologies that not only meet regulatory requirements but also promote environmentally friendly practices.

Furthermore, the rapid industrialization and urbanization in emerging economies also play a crucial role in the market's expansion. Countries such as China and India are witnessing significant growth in industrial activities, leading to an increased need for effective gas analysis solutions. In addition, the rising number of manufacturing units and energy production facilities in these regions creates a substantial market for TDLA systems.

Measurement Type Insights

The in-situ segment dominated the global tunable diode laser analyzer industry,with the largest revenue share of 61.1% in 2024, primarily driven by the increasing demand for real-time and continuous gas monitoring in various industrial processes. In addition, in-situ TDLA systems allow for direct measurements of gas concentrations without the need for sample extraction, which enhances accuracy and reduces delays. Furthermore, industries such as oil and gas, chemicals, and power generation rely heavily on these systems to optimize processes, ensure compliance with environmental regulations, and maintain safety standards.

The other measurement segments are expected to grow at a significant CAGR of 7.0% over the forecast period, owing to advancements in technology that improve the efficiency and accuracy of extractive measurement methods. Furthermore, as industries seek more versatile solutions for gas analysis, the demand for these alternative measurement techniques is expected to rise. Moreover, innovations in sample conditioning and analysis are expected to enhance their appeal, making them suitable for applications where in-situ measurements may not be feasible.

Industrial Application Insights

The oil & gas segment led the market and accounted for the largest revenue share of 25.4% in 2024. This growth is attributed to the industry's need for precise gas analysis across various operations. The oil and gas sector requires accurate monitoring of gases such as methane and hydrogen sulfide to optimize production processes and ensure safety. In addition, TDLA’s ability to provide real-time data facilitates better decision-making and compliance with rigid environmental regulations. Furthermore, as exploration and production activities expand globally, the oil and gas segment is expected to maintain its leading market share.

TDLAs are extensively used across natural gas and LNG plants for the easy detection and removal of moisture in the gas streams between various processes. The measurement of moisture content is crucial for petrochemical companies to meet the quality specifications and to protect pipelines from corrosion. Moreover, TDLAs are primarily employed in refineries for the detection of corrosive sulfur compounds, which may incur the high cost of operation and maintenance for the process infrastructure.

The cement segment is expected to grow at the fastest CAGR of 9.2% over the forecast period, primarily due to the increasing focus on reducing emissions in cement manufacturing processes. For instance, HeidelbergCement aims to cut CO₂ emissions by 30% by 2030, targeting 400 kg CO₂/t CEM, a 47% reduction from 1990. Half of the revenue should come from sustainable products. They'll scale carbon capture, aiming for a cumulative 10mt CO₂ reduction by 2030. Financial targets include 5% annual revenue growth and over 10% ROIC. This initiative focuses on lowering the clinker content in cement and increasing the utilization of alternative fuels. Moreover, cement plants are under pressure to monitor their emissions closely due to regulatory requirements aimed at minimizing environmental impact.

Regional Insights

North America's tunable diode laser analyzer market dominated the global market and accounted for the largest revenue share of 26.2% in 2024, primarily driven by stringent environmental regulations and a growing demand for precise emissions monitoring. In addition, the oil and gas sector is a significant contributor to this trend, as companies strive to comply with regulations while enhancing production efficiency through real-time gas analysis. Moreover, advancements in TDLA technology improve operational safety and efficiency, further fueling market expansion.

U.S. Tunable Diode Laser Analyzer Market Trends

The tunable diode laser analyzer market in the U.S. led the North American market and held the largest share in 2024, driven by strict environmental regulations and rising demand for precise emissions monitoring across various sectors. Furthermore, the oil and gas industry plays a pivotal role in this expansion, as companies strive to meet compliance standards while enhancing production efficiency through real-time gas analysis. Moreover, technological advancements in TDLA are improving operational safety and efficiency, prompting key manufacturers to invest in innovative solutions to address these evolving needs.

Asia Pacific Tunable Diode Laser Analyzer Market Trends

The Asia Pacific tunable diode laser analyzer market is expected to grow at the fastest CAGR of 9.1% over the forecast period, driven by rapid industrialization and increasing investments in environmental monitoring technologies across various sectors. Developing economies, such as China and India, are expected to foresee proliferation in various industries such as pulp & paper, metal & mining, power generation, and cement, which provides the base for the installation of TDLAs over the traditional analyzing devices.

The growth of the tunable diode laser analyzer market in China is expected to be driven by its status as the world's largest manufacturing hub and a major consumer of fossil fuels. Moreover, government initiatives aimed at improving air quality and reducing greenhouse gas emissions are further driving the adoption of TDLA technology. For instance, in December 2023, China's State Council unveiled an action plan aimed at improving air quality as part of its commitment to high-quality economic development. The plan sets ambitious targets to reduce PM2.5 levels in major cities by 10% by 2025 and to limit heavy air pollution days to 1% or less annually.

Europe Tunable Diode Laser Analyzer Market Trends

Europe's tunable diode laser analyzer market is witnessing significant growth, fueled by the region's commitment to reducing greenhouse gas emissions and improving air quality. In addition, the European Union's stringent regulations on emissions monitoring compel industries such as chemicals, energy, and manufacturing to adopt advanced gas analysis technologies such as TDLA. Furthermore, the growing emphasis on sustainability and process optimization drives demand for real-time monitoring solutions, positioning TDLA as a critical tool for compliance and operational efficiency in European industries.

The tunable diode laser analyzer market in Germany dominated the European market and accounted for the largest revenue share in 2024, owing to the country's robust industrial foundation and its strong commitment to environmental sustainability. Furthermore, the implementation of strict regulations aimed at reducing greenhouse gas emissions compels industries such as chemicals, energy, and manufacturing to adopt advanced gas analysis technologies such as TDLA.

Key Tunable Diode Laser Analyzer Company Insights

Key players in the tunable diode laser analyzer industry include ABB Ltd., Emerson Electric Co., General Electric Corporation, and others. These players adopt strategies such as product development, partnerships, acquisitions, and geographic expansion to strengthen their positions. Furthermore, they also focus on enhancing technological capabilities and building strong relationships to drive growth.

-

Emerson Electric Co. provides innovative solutions across various industries, including industrial automation and process management. In the tunable diode laser analyzer (TDLA) market, Emerson offers a diverse range of TDLA models designed for applications such as oil and gas, chemical processing, and environmental monitoring. Their analyzers are known for their advanced features, enabling precise gas measurements that support regulatory compliance and operational efficiency.

Key Tunable Diode Laser Analyzer Companies:

The following are the leading companies in the tunable diode laser analyzer market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Emerson Electric Co.

- General Electric Corporation

- Mettler-Toledo International Inc

- Norsk Elektro Optikk (NEO) Monitors AS

- Servomex

- Sick AG

- Endress+Hauser

- Siemens AG

- Yokogawa Electric Corporation

Recent Developments

-

In August 2024, ABB announced its acquisition of the Födisch Group, enhancing its continuous emission monitoring systems (CEMS). This acquisition broadens ABB's portfolio, addressing industrial emission measurement needs. Födisch Group's advanced analyzer solutions complement ABB's offerings, promising a comprehensive suite for customers.

-

In November 2023, ABB launched the Sensi+, a compact analyzer designed to detect natural gas contaminants using innovative Off-Axis Integrated Cavity Output Spectroscopy (OA-ICOS) technology.

-

In February 2023, LioniX International, collaborating with project REAP partners, developed an on-chip, ultra-narrow linewidth tunable diode laser analyzer for the near-infrared range.

Tunable Diode Laser Analyzer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 566.4 million

Revenue forecast in 2030

USD 804.9 million

Growth Rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Measurement type, industrial application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, KSA, South Africa

Key companies profiled

ABB Ltd.; Emerson Electric Co.; Servomex Corporation; Mettler-Toledo International Inc; Norsk Elektro Optikk (NEO) Monitors AS; Servomex; Sick AG; Endress+Hauser; Siemens AG; Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tunable Diode Laser Analyzer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tunable diode laser analyzer market report based on measurement type, industrial application, and region.

-

Measurement Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In-situ

-

Others

-

-

Industrial Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Power

-

Oil & Gas

-

Mining & Metal

-

Healthcare

-

Chemicals

-

Fertilizers

-

Paper & Pulp

-

Cement

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.