- Home

- »

- Renewable Chemicals

- »

-

U.S. Esters Market Size & Share, Industry Growth Report, 2019-2025GVR Report cover

![U.S. Esters Market Size, Share & Trends Report]()

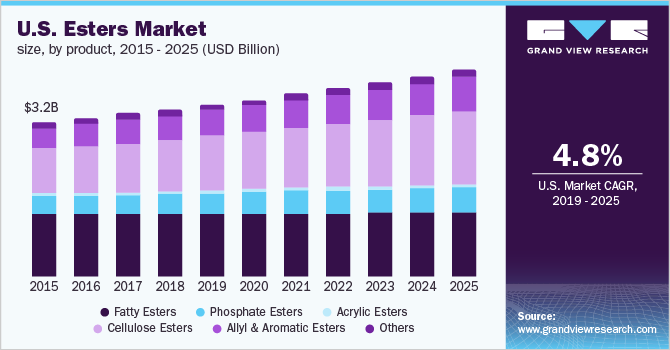

U.S. Esters Market (2019 - 2025) Size, Share & Trends Analysis Report By Product (Fatty Esters, Phosphate Esters, Acrylic Esters, Cellulose Esters, Allyl and Aromatic Esters), By Application, And Segment Forecasts

- Report ID: GVR-1-68038-048-4

- Number of Report Pages: 124

- Format: PDF

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The U.S. esters market size to be valued at USD 4.99 billion by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 4.8% during the forecast period. Shifting consumer trends towards health and beauty has led to the adoption of an active lifestyle and carefully, which further formulates the diet that includes fatty acid esters (FAE). FAE promotes weight loss by burning calories and accelerating the body to metabolize food and energy faster.

Increase in the demand for emulsifiers and stabilizers in personal care and detergent sectors is anticipated to drive product demand over the forecast period. Additionally, hydraulic stability and lubricity of phosphate and fatty acid derivatives are further expected to drive the growth of the industry over the forecast period.

Acrylic esters were the leading segment and accounted for the highest market volume in 2018 and is expected to grow at a CAGR of 4.5% over the forecast period. Non-toxic nature of acrylic esters is responsible for growing adoption in various industries and is used as building blocks for industrial polymers. These esters are extensively used in construction industry.

Fatty esters are largely used as food additives in ice creams, baked goods, and other processed products to moisturize, stabilize, and thicken the food. They are used to provide smooth texture and improve stability of several cosmetics and personal care products. In addition, they are also used in combination with prescription drugs for treating food absorption disorders due to gastrectomy.

Increasing adoption of high calorie, junk diet, and lower exercise rates have boosted obesity levels among the residents in the country. Numerous economic costs are associated with obesity such as medical and productivity. Additionally, direct medical costs such as diagnosis and prescription are associated with obesity-related diseases.

U.S. Esters Market Trends

Increasing adoption of derivatives of esters such as polyesters, growing usage in industrial fabrics, textiles, desktops, household goods, packaging, electrical insulation, and easy availability of a wide range of esters, as well as the growth of the manufacturing sector are among the factors that tend to boost the growth of the esters market over the forecast period.

Over the projected period, increased use of ester in beauty products such as shower gels, shampoos, conditioners, and cosmetics such as lip products and blush is estimated to propel the growth of the market. Furthermore, the food and beverage industry's significant need for esters is estimated to boost the market growth.

Rising production costs of esters, as well as complex processes and variable raw material prices, are expected to hamper the market's growth over the forecast period. Moreover, esters that are used in food products are synthesized, which leads to harmful side effects causing allergic reactions, asthma, and others. These factors are anticipated to limit the market growth.

The market for esters is expected to rise due to growing consumer awareness about the benefits provided by natural esters. Furthermore, rising consumer demand for natural ingredients is expected to drive theproduct demand. Increased consumption and manufacturing of esters are expected to enhance numerous prospects, resulting in the rise of the market during the forecast period.

Product Insights

Fatty esters are used in several applications such as personal care, lubricants, paper and food products. The demand for fatty esters is surging in the industrial applications owing to the environmental responsiveness, which is expected to augment the U.S. esters market growth in the estimated time span.

Along with this, consumers these days are more inclined towards natural and specialty esters in personal care products that will further drive the market’s growth. Increasing consumption of fatty esters in biodiesels coupled with the growing demand for biodiesels due to the presence of supporting regulations is likely to propel the demand for FAE industry rapidly in the forthcoming years.

Additionally, there is an acceleration in the demand for fatty esters, which is derived from vegetable-based sources because of the biomass content. R&D activities in the field of esters have resulted in the development of fatty esters that are used for their thickening and solvency properties.

Recovering economy and increasing demand for bio-lubricants from a highly developed automotive industry is projected to balance the regional demand. Fatty acid esters are also increasingly being used to manufacture sustainable and dermatologically safe detergents and surfactants for household cleaning products.

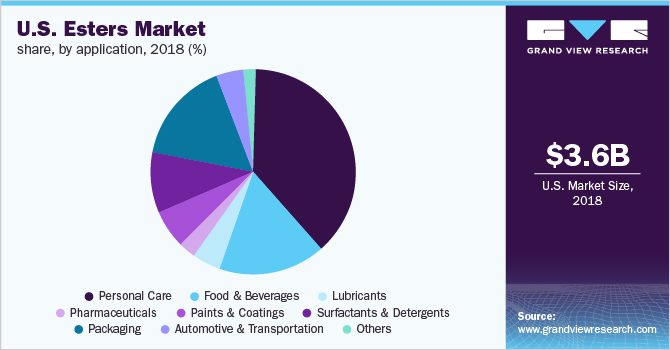

Applications Insights

Esters have marked a significant presence in cosmetics and food industry. However, the ingredient’s biodegradability and environment-friendly characteristic are expected to drive esters demand in other industries too. Stringent environmental regulations are anticipated to urge manufacturers in fuel-dependent industries to switch to eco-friendly alternatives.

Major countries in North America and Europe such as the U.S., Germany, the UK, and France have witnessed a shifting trend towards eco-friendly substitutes in paints, lubricants, chemicals, and packaging industries.

A diverse range of esters has enhanced its application scope in many industrial applications. Fatty esters that are used majorly in the personal care sector have gained market penetration in other applications such as thickening agent and pigment dispersing agents. This is expected to drive innovation in end-use industries, such as paints and coatings, that require stabilizers and dispersants in their pigment solutions.

Cellulose ester derivatives find usage in pharmaceutical industries. Cellulose ester derivatives have enhanced mechanical characteristics and film forming ability that enhance its requirement in osmotic drug delivery systems.

Key Companies & Market Share Insights

Top multinational corporations dominate the U.S. esters market and have incorporated various operations along the value chain, from raw material processing to ester production, until the distribution of finished products.

Ester manufacturers such as Procter & Gamble (P&G), Evonik Industries, Sasol, PCC Chemax, Archer Daniels Midland, Honeywell, and Dow Chemical are actively indulged in product & technology innovations, R&D investments, and industrial collaborations to expand their product portfolio in the global market. There is also a considerable presence of independent alcohol and oleochemical manufacturers such as VVF, Parchem, Matrix Universal, Cayman Chemicals, Pacific Oleo, and Eastman Chemical Company. These independent manufacturers provide raw material to ester manufacturers through a wide distribution network.

Recent Developments

-

In June 2022, Evonik, a leader in specialty chemicals, announced a partnership with the U.S. government with an investment of USD 220 million to build a production facility for pharmaceutical lipids. This investment aims to expand the company’s position in the market and strengthen its healthcare business.

-

In June 2022, LOTTE chemicals, a global chemical company, and Sasol Limited, a chemical and integrated energy company announced their collaboration to produce key components used in electric vehicles. This collaboration will help to provide the solution to the rising demand for batteries.

-

In August 2021, LANXESS, a specialty chemical company, announced the acquisition of Emerald Kalama Chemicals. This acquisition aims to increase the product portfolio and strengthen the position of the company.

U.S. Esters Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 3.80 billion

Revenue forecast in 2025

USD 5.0 billion

Growth Rate

CAGR of 4.8% from 2019 to 2025

Base year for estimation

2018

Historical data

2014 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Country scope

U.S.

Key companies profiled

Eastman Chemical Company, Solvay S.A., PCC Chemax Inc., Archer Daniel Midland Company, BASF SE, DuPont Industrial Biosciences, Sasol Limited, Stepan Company, Croda International, Evonik Industries AG, Arkema, Lanxess

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Esters Market SegmentationThis report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the U.S. esters market on the basis of product and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2025)

-

Fatty Esters

-

Phosphate Esters

-

Acrylic Esters

-

Cellulose Esters

-

Allyl & Aromatic Esters

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2014 - 2025)

-

Personal care

-

Food & beverages

-

Lubricants

-

Pharmaceuticals

-

Paints & coatings

-

Surfactants & detergents

-

Packaging

-

Automotive & transportation

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. esters market size was estimated at USD 3.8 billion in 2019 and is expected to reach USD 3.9 billion in 2020

b. The U.S. esters market is expected to grow at a compound annual growth rate of 4.8% from 2019 to 2025 to reach USD 5.0 billion by 2025.

b. Acrylic esters dominated the U.S. esters market with a share of 28.9% in 2019. This is attributable to high thermal stability, oil resistance and non toxic nature of the product

b. Some key players operating in the U.S. esters market include Eastman Chemical Company, Solvay S.A., PCC Chemax Inc., Archer Daniel Midland Company, BASF SE, DuPont Industrial Biosciences, Sasol Limited, Stepan Company, Croda International, Evonik Industries AG, Arkema, Lanxess

b. Key factors that are driving the market growth include increasing construction spending in the country coupled with growth in demand for fatty acid ester for weight loss and beauty enhancement

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.