- Home

- »

- Advanced Interior Materials

- »

-

U.S. Fencing Market Size And Share, Industry Report, 2033GVR Report cover

![U.S. Fencing Market Size, Share & Trends Report]()

U.S. Fencing Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Metal, Wood, Plastic & Composites, Concrete), By Application (Residential, Agricultural, Industrial), By Region (Northeast U.S., Midwest U.S., South U.S., West U.S.), And Segment Forecasts

- Report ID: GVR-1-68038-245-7

- Number of Report Pages: 65

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Fencing Market Summary

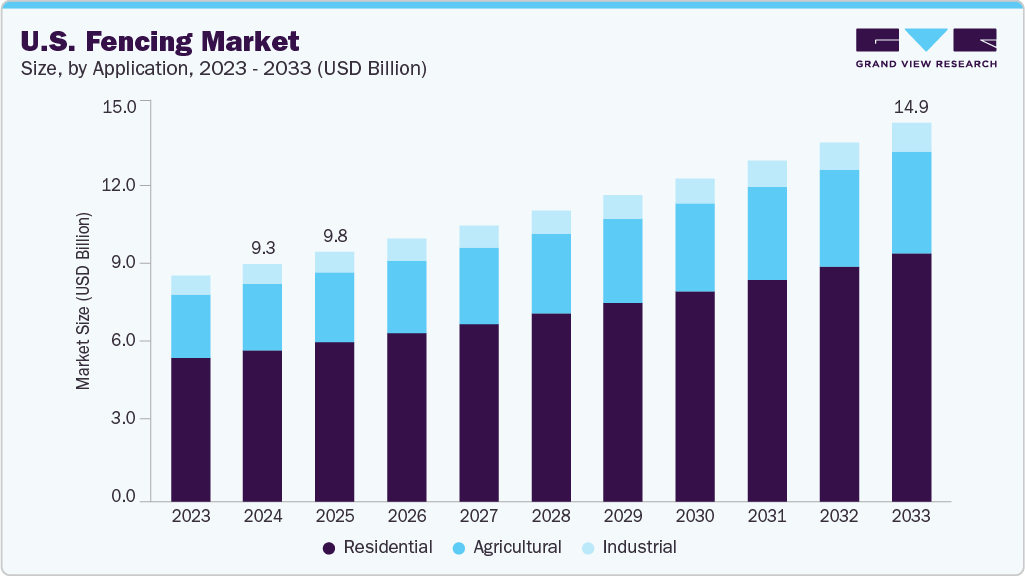

The U.S. fencing market size was estimated at USD 9.33 billion in 2024 and is expected to reach USD 14.86 billion by 2033, registering a CAGR of 5.3% from 2025 to 2033. The demand for fencing in the U.S. is increasing due to a surge in residential and commercial construction activities, along with the growing focus on property aesthetics and boundary security.

Key Market Trends & Insights

- South U.S. dominated the fencing market with the largest revenue share of 40.7% in 2024.

- By material, the concrete fencing segment is expected to grow at the fastest CAGR of 7.2% over the forecast period.

- By application, the residential segment is expected to grow at the fastest CAGR of 5.7% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 9.33 Billion

- 2033 Projected Market Size: USD 14.86 Billion

- CAGR (2025-2033): 5.3%

Rising urbanization, coupled with increased disposable incomes, has led homeowners to invest in durable and stylish fencing materials. Additionally, the expansion of public infrastructure and recreational spaces has fueled fencing installations. The increasing adoption of fences for privacy and safety purposes is also contributing to market growth.Key market drivers include heightened security concerns, property demarcation needs, and the proliferation of smart fencing systems. Rising crime rates and intrusion incidents have made both commercial and residential users adopt advanced fencing solutions such as electric and sensor-based fences. Technological innovations in materials like composite and vinyl offer low maintenance and high durability, attracting consumers. The strong real estate market, coupled with government spending on highways and parks, is stimulating demand.

The market is witnessing innovations such as smart fences equipped with sensors, cameras, and IoT connectivity for intrusion detection. Eco-friendly materials like bamboo, recycled plastic, and composite fences are gaining traction due to sustainability trends. Vinyl and aluminum fences are increasingly preferred for their longevity and low maintenance. Aesthetic and modular fencing systems designed for easy installation and modern designs are trending in residential spaces. The rise of electric and solar-powered fencing in agriculture and security applications reflects growing technology integration. Companies are also investing in automated gate systems to enhance safety and convenience.

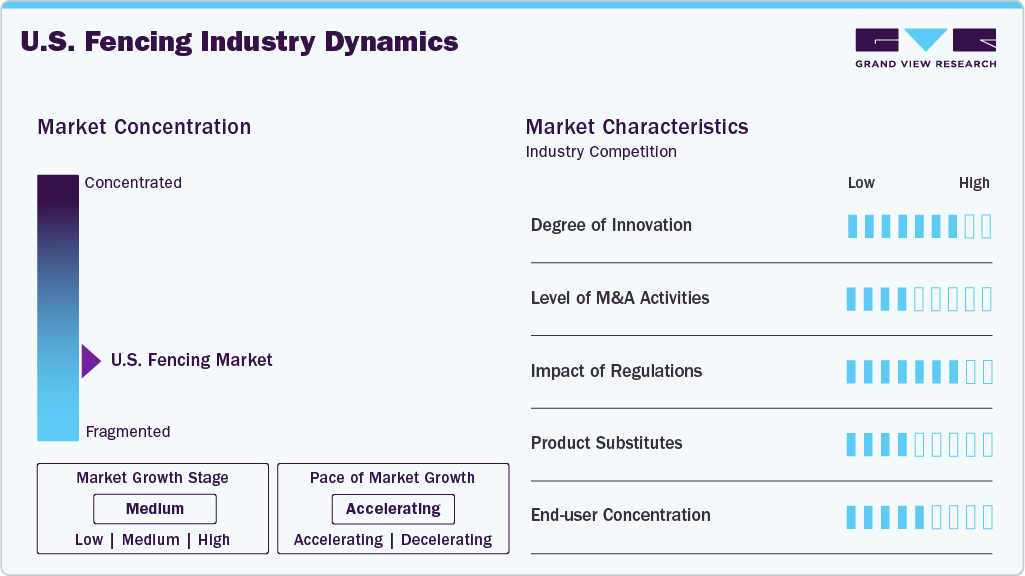

Market Concentration & Characteristics

The industry is moderately fragmented, with several regional and international players competing on design, material quality, and installation services. Major companies, such as Associated Materials LLC, Bekaert, CertainTeed, and Gregory Industries, dominate the market with strong distribution networks. However, small and medium-sized local contractors hold a significant share due to custom design offerings and cost competitiveness. The market’s moderate entry barriers and regional demand variations contribute to competitive diversity.

The threat of substitutes remains moderate, as fencing serves both aesthetic and functional roles. Alternatives like walls or hedges provide boundary demarcation but lack flexibility and ease of installation. Synthetic substitutes and digital surveillance systems may reduce physical fencing demand in some security applications, but overall replacement risk is limited. Material substitution (e.g., from wood to vinyl or metal) is common, though functional needs maintain steady fencing demand.

Application Insights

The residential segment held the highest revenue share of 63.7% in 2024, driven by rising investments in home improvement, privacy, and property enhancement projects. Homeowners increasingly prefer aesthetic and durable fencing materials such as vinyl, aluminum, and composite to improve curb appeal and ensure security. Suburban expansion and new housing developments across states like Texas, Florida, and California continue to fuel demand. The popularity of DIY fencing kits and easy-to-install modular designs has further boosted market penetration. Additionally, trends in outdoor living spaces, including landscaped gardens and patios, are enhancing the need for decorative fencing solutions in residential applications.

The agricultural segment is expected to grow at a significant CAGR of 4.9% over the forecast period, as farmers and ranchers invest in modern fencing systems for livestock containment and crop protection. The expansion of large farms and ranches, coupled with the rising need for durable, cost-effective solutions, has led to increased adoption of barbed wire, woven wire, and electric fencing. Government subsidies for rural infrastructure development and land management programs have also supported market expansion. Manufacturers are introducing high-tensile and corrosion-resistant fencing materials suited to diverse terrains.

Material Insights

The metal fencing segment held the highest revenue market share of 55.8% in 2024, due to its strength, longevity, and minimal maintenance requirements. Steel and aluminum fences are widely used in both residential and commercial sectors for their security and aesthetic versatility. Metal fences are preferred in industrial and government facilities for their ability to withstand extreme conditions and provide robust perimeter protection. The rising popularity of ornamental wrought iron and powder-coated aluminum fencing reflects the blend of security and design appeal. Technological advancements in anti-corrosion coatings and modular fabrication have further strengthened the dominance of metal fencing across the country.

The concrete fencing segment is expected to grow at a significant CAGR of 7.2% over the forecast period, due to its durability, noise-reduction properties, and ability to withstand harsh weather conditions. Increasing use in highways, industrial complexes, and gated communities is driving demand for precast and decorative concrete fencing. The material’s low maintenance and fire-resistant properties make it ideal for long-term applications. Urban expansion projects and government infrastructure initiatives are boosting installations of concrete barriers and perimeter walls. Moreover, advancements in lightweight concrete composites and customizable designs have enhanced its appeal in both commercial and residential fencing projects.

Regional Insights

South U.S. Fencing Market Trends

The South U.S. held the highest revenue share in 2024, driven by rapid construction, population growth, and large property areas across states such as Texas, Florida, and Georgia. Warm weather conditions and diverse architectural styles have spurred demand for vinyl, aluminum, and ornamental fencing. The region also experiences strong demand from agricultural and ranching activities requiring durable and cost-effective fencing solutions. Border security initiatives in southern states have led to the installation of steel and electric perimeter fences. Residential and commercial construction booms in cities like Houston and Atlanta have amplified market opportunities. Affordable land and labor availability make the South an attractive hub for fencing manufacturers and installers.

Northeast U.S. Fencing Market Trends

The fencing market in the Northeast U.S. is driven by residential renovation activities and strict property demarcation regulations in densely populated states like New York, Massachusetts, and New Jersey. Due to limited land availability, privacy fencing and decorative metal fences are in high demand. Homeowners are increasingly opting for vinyl and composite materials that can withstand harsh winters and require minimal maintenance. Urban landscaping projects and the emphasis on enhancing curb appeal have also fueled demand. Commercial spaces and educational institutions are investing in security fencing solutions. High labor costs have pushed demand for prefabricated and DIY fencing kits. Sustainable and weather-resistant materials are gaining traction in this region.

Midwest U.S. Fencing Market Trends

The Midwest U.S. fencing market benefits from large agricultural land holdings and industrial expansion across states such as Illinois, Ohio, and Michigan. The region has a strong demand for chain-link, electric, and barbed wire fences used for farm and livestock management. Residential areas are witnessing growth in wooden and aluminum fencing installations due to affordable land and suburban housing developments. Manufacturing plants and logistics hubs are adopting steel and security-grade fences for perimeter safety. The availability of raw materials and regional manufacturers also supports price competitiveness. Harsh winters and wind conditions have led to the preference for durable, corrosion-resistant materials. Sustainable and locally sourced wood fencing remains popular among homeowners.

West U.S. Fencing Market Trends

The fencing market in the West U.S. is characterized by diverse demand from both urban and rural sectors, particularly in California, Arizona, and Washington. Rising residential developments, wildfire mitigation fencing, and sustainability-driven choices dominate the region’s growth. Homeowners prefer composite and recycled-material fences that suit eco-conscious lifestyles. Commercial sectors invest in modern steel and glass fencing for aesthetic appeal in business parks and retail spaces. Agricultural and vineyard fencing in California’s Central Valley also contributes significantly. The prevalence of DIY culture and tech adoption supports smart fencing installations integrated with home automation systems. Environmental regulations further promote sustainable fencing products.

Key U.S. Fencing Companies Insights

Key players operating in the U.S. fencing market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some of the key players operating in the market include Allied Tube & Conduit, Bekaert.

-

Allied Tube & Conduit, a division of Atkore Inc., is a leading U.S.-based manufacturer of steel and aluminum fencing systems, electrical conduit, and structural products. The company is known for its high-quality galvanized steel fences and innovative perimeter protection solutions.

-

Bekaert is a global leader in steel wire transformation and coating technologies, offering advanced fencing solutions for agricultural, industrial, and residential applications. In the U.S., the company is recognized for its high-tensile wire and barbed fencing products designed for livestock management and perimeter safety.

Associated Materials LLC and Jerith Manufacturing are some of the emerging market participants in the fencing market.

-

Associated Materials LLC is a major player in the North American building materials industry, offering vinyl, metal, and composite fencing solutions under brands like Alside. The company’s fencing products are popular in the residential segment for their aesthetics, durability, and low maintenance.

-

Jerith Manufacturing is one of the oldest and most trusted aluminum fence manufacturers in the U.S., known for producing decorative and security fencing solutions. Based in Philadelphia, the company specializes in residential and commercial-grade ornamental fences. Its products combine strength, style, and longevity, appealing to customers seeking both aesthetic appeal and perimeter protection.

Key U.S. Fencing Companies:

- Allied Tube & Conduit

- Ameristar Fence Products Incorporated

- Associated Materials LLC

- Bekaert

- CertainTeed

- Gregory Industries

- Jerith Manufacturing

- Long Fence Company Inc.

- Ply Gem Residential Solutions

- Poly Vinyl Creations

Recent Developments

- In February 2025, ASSA ABLOY acquired Wallace & Wallace and Wallace Perimeter Security, a Canadian manufacturer, distributor, and installer of perimeter fencing, door, and gate solutions for commercial and residential markets.

U.S. Fencing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.81 billion

Revenue forecast in 2033

USD 14.86 billion

Growth rate

CAGR of 5.3% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Country scope

Northeast U.S., Midwest U.S., South U.S., West U.S.

Key companies profiled

Allied Tube & Conduit; Ameristar Fence Products Incorporated; Associated Materials LLC; Bekaert; CertainTeed; Gregory Industries; Jerith Manufacturing; Long Fence Company Inc.; Ply Gem Residential Solutions; Poly Vinyl Creations

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Fencing Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. fencing market report on the basis of application, material, and region:

-

Material Outlook (Revenue, USD Billion, 2021 - 2033)

-

Metal

-

Wood

-

Plastic & Composites

-

Concrete

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Agricultural

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

U.S.

-

Northeast U.S.

-

Midwest U.S.

-

South U.S.

-

West U.S.

-

-

Frequently Asked Questions About This Report

b. The U.S. fencing market size was estimated at USD 9.33 billion in 2024 and is expected to reach USD 9.81 billion in 2025.

b. The U.S. fencing market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2033 to reach USD 14.86 billion by 2033.

b. The metal fencing segment held the highest revenue market share of 55.8% in 2024, due to its strength, longevity, and minimal maintenance requirements.

b. Some of the key players operating in the fencing market include Allied Tube & Conduit, Ameristar Fence Products Incorporated, Associated Materials LLC, Bekaert, CertainTeed, Gregory Industries, Jerith Manufacturing, Long Fence Company Inc., Ply Gem Residential Solutions, and Poly Vinyl Creations.

b. Key factors driving the U.S. fencing market include rising residential construction, increasing security concerns, infrastructure expansion, and growing demand for durable, low-maintenance fencing materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.