- Home

- »

- Consumer F&B

- »

-

Vegan Confectionery Market Size And Share Report, 2030GVR Report cover

![Vegan Confectionery Market Size, Share & Trends Report]()

Vegan Confectionery Market Size, Share & Trends Analysis Report By Product (Chocolate, Sugar, Flour), By Distribution Channel (Offline, and Online), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-854-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

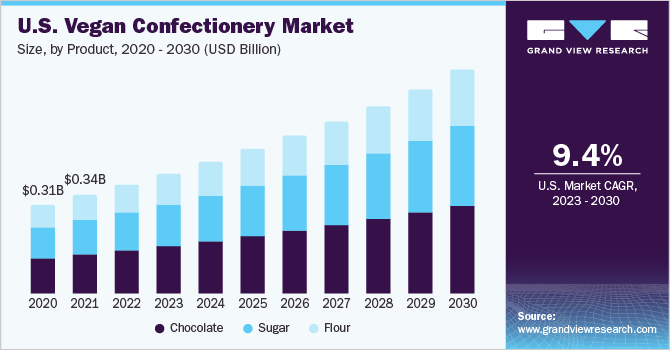

The global vegan confectionery market size was valued at USD 1.23 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.9% from 2023 to 2030. The increasing shift among consumers towards plant-based diets, as a result of lifestyle disorders and health concerns, has been fueling the growth of the worldwide market in recent years. Social media posts on the vegan lifestyle and its benefits also encourage consumers to adopt plant-based diets, thereby contributing to market growth.

Increasing concerns about animal cruelty, personal health & wellness, and the environment have been popularizing plant-based lifestyles among consumers worldwide. As a result, the plant-based food industry has been expanding over the years and offering a wide range of products. Both small and large food firms are entering the industry to tap the potential offered by the rising demand. According to a study conducted by The Vegan Society, the oldest vegan organization in the world in 2022, 38.5% of U.K. citizens chose to reduce their consumption of animal products primarily for health reasons. The research, which involved 2,000 U.K. citizens, also revealed that 23% of respondents had decreased their consumption of animal products since the onset of the Covid-19 pandemic.

Furthermore, the increased number of new product launches in the vegan confectionery industry has accelerated market growth. An article dated May 2023 in the Confectionery News , a prominent online news source for the confectionery market, reported that launches of vegan chocolate confectionery products in Europe experienced a significant 83% growth from 2017 to 2022.The large retail chains, including Walmart, are interested in offering more plant-based food items. In addition, an increased number of lactose-intolerant people has raised the demand for dairy-free confections across the globe. These factors are expected to accelerate the growth of the market in the upcoming years.

There is significant scope for the growth of the global vegan confectionery market, as the concept of veganism is gaining prominence in developed countries such as the U.K., the U.S., Australia, New Zealand, Germany, Italy, France, and Canada. In addition, various Middle Eastern countries such as Israel and Saudi Arabia have been witnessing a growth in the vegan population, which offers several growth opportunities for manufacturers and new entrants.

Many countries in Europe have been witnessing growth in the vegan confectionery market due to increasing health awareness and a rising vegan population seeking ethical and sustainable alternatives. Furthermore, Germany, Italy, and France being the most visited countries in Europe, are creating opportunities for vegan candy manufacturers to supply on-the-go vegan candies in form of packaged and ready-to-eat food. With the largest confectionery product consuming population, the region is taking initiatives to improve the quality and standard of food products by the means of vegan ingredients.

Product Insights

The chocolate product accounted for the market share of 40.4% of the total revenue in 2022. Demand for plant-based chocolate confectionery has grown significantly due to its low-fat and low cholesterol properties. The adoption of the product is increasing remarkably among millennials and centennials. Therefore, manufacturers in the industry have been introducing new products targeting these population groups. For instance, in April 2023, the vegan brand VEGO has introduced its latest product, the Vego Crisp, a new vegan chocolate bar. This bar features VEGO's iconic hazelnut-based dairy-free chocolate, complemented by the addition of roasted rice crisps.

Similarly, in March 2023, The Hershey Company has recently introduced dairy-free alternatives for two of its most iconic brands. They have launched Reese's plant-based peanut butter cups, marking the first time vegan chocolates have been made available in stores across the U.S. since March. Following this success, Hershey's plant-based extra creamy with almonds and sea salt was also released in stores in April 2023.

Sugar vegan confectionery is anticipated to witness the fastest growth over the forecast period due to the rising adoption of plant-based candies. Over the past few years, several new vegan candy products have been launched. For instance, in May 2023, Oomph! Sweets , a line of low-sugar candies made with functional benefits, introduced a new format of its fan-favorite Chews for the first time at Natural Products Expo West, U.S.

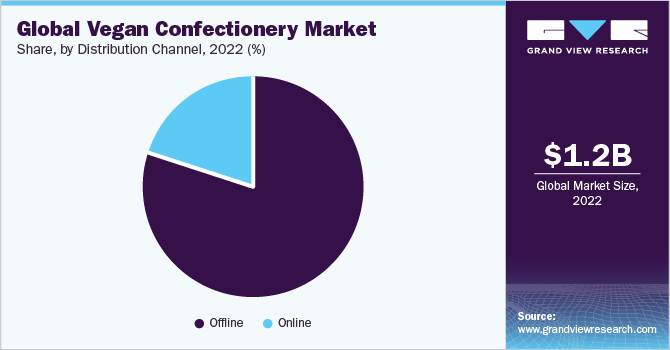

Distribution Channel Insights

The offline distribution channel accounted for the largest market share of 80.3% in 2022 in the vegan confectionery market. The plant-based food industry has been promoting its products by entering into partnerships with grocers and retail chains. For instance, PLANT-BASED FOODS ASSOCIATION partnered with Lucky Stores and started a campaign called “Fall in Love with Plant-Based”. The association has been distributing educational booklets, discounts, and tasting demonstrations for the consumers at selected stores.

Moreover, as of 2022, more than 95% of grocery stores in the U.S. sell plant-based products, including vegan confectionery. Market participants are also expanding their offline distribution channels to enhance the consumer reach. For instance, in October 2021, Cadbury has announced the launch of its very first vegan chocolate bar. To promote this new product and raise awareness about vegan chocolate, they have also opened a pop-up store in London.

The online distribution channel is projected to witness faster growth during the forecast period. The increasing number of online retailers with competitive pricing is boosting the growth of this segment. In addition, the growth can be attributed to the increasing dependency of generation X, millennials, and generation Z on the internet and e-commerce.

Regional Insights

North America dominated the market for vegan confectionery in 2022 with a share of 37.0% in the global revenue. According to a report published by the Good Food Institute in 2022 , 6 out of 10 U.S. households purchased plant-based foods during that year. Plant-based foods accounted for 1.4% of total retail food and beverage sales in 2022. The report also revealed a 7% growth in the plant-based food market, also includes vegan confectionery, from 2021 to 2022, and an impressive 44% growth over the last three years.

Furthermore, the report highlighted an 80% repeat rate for plant-based products in the U.S. This significant increase in the demand and consumption of plant-based items is expected to have a positive impact on the vegan confectionery market, driving growth in the North American vegan confectionery market in the coming years.

Major players in the industry are opening new stores in order to cater to the growing population of vegan enthusiasts in the region. For instance, in May 2023, Aldi announced that it would open 120 new stores across the U.S. by the end of 2023. At the time, the company already had 2280 stores across the U.S. Such trends are anticipated to boost the sales of vegan confectionery, through offline channels, in the region.

The growth of the vegan confectionery market in Europe is being driven by factors such as a notable increase in health consciousness among consumers, leading to a growing demand for healthier and plant-based food options. Additionally, the accessibility and availability of vegan confectionery products have significantly improved due to increasing consumer awareness and demand. According to ProVeg International, a plant-based NGO, a study on vegan trends revealed that the European vegan market grew by 49% from 2017 to 2020.

Furthermore, Asia Pacific region poses a wide scope for the growth of the market in the upcoming years. Growing demand for dairy-free, gluten-free, and plant-based products will drive the market in the region. Increasing health consciousness in the countries of the region, including China, Japan, India, and Indonesia, is expected to fuel the demand for vegan confectionery in the upcoming years.

Key Companies & Market Share Insights

The market can be characterized as a niche market with the presence of both small and large players. Companies have been expanding their product portfolio with innovative products. For instance, in July 2023, Galaxy has introduced a brand-new, fully vegan salted caramel chocolate bar. This dairy-free bar is made using hazelnut paste and features a delectable salted caramel filling. The bar has been made available at the Asda and Ocado supermarket chains in the U.K.

-

In June 2023, Kinnerton Confectionery has introduced NOMO, a new Vegan & Free From chocolate range, both in-store and online at Holland & Barrett, a multinational chain in the U.K. The company's launch includes 5 new products: 2 block bars (Creamy Choc & Dark Chocolate) and 3 countlines (Creamy Choc, Fruit & Crunch, and Caramel & Sea Salt). The NOMO range is not only Vegan but also free from Dairy, Egg, Nuts and Gluten.

-

In September 2022, Nestlé has launched KitKat V, a vegan version of the popular candy, in 15 European countries. In this new version, the milk used in the original KitKat has been replaced with a rice-based alternative. Furthermore, the KitKat V is certified vegan and made from sustainably sourced cocoa.

Some of the key players operating in the global vegan confectionery market include:

-

Taza Chocolate

-

Alter Eco

-

Endangered Species Chocolate, LLC,

-

EQUAL EXCHANGE COOP

-

Chocoladefabriken Lindt & Sprüngli AG

-

Mondelēz International

-

Dylan's Candy Bar

-

Endorfin

-

Goodio

-

Freedom Confectionery

-

Creative Natural Products, Inc.

Vegan Confectionery Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.36 billion

Revenue forecast in 2030

USD 2.62 billion

Growth rate

CAGR of 9.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Saudi Arabia

Key companies profiled

Taza Chocolate; Alter Eco; Endangered Species Chocolate, LLC; EQUAL EXCHANGE COOP; Chocoladefabriken Lindt & Sprüngli AG; MondelÄ“z International; Dylan's Candy Bar; Endorfin; Goodio; Freedom Confectionery; Creative Natural Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vegan Confectionery Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global vegan confectionery market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million; 2017 - 2030)

-

Chocolate

-

Sugar

-

Flour

-

-

Distribution Channel Outlook (Revenue, USD Million; 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global vegan confectionery market size was estimated at USD 1.23 billion in 2022 and is expected to reach USD 1.36 billion in 2023

b. The global vegan confectionery market is expected to grow at a compound annual growth rate of 9.9% from 2023 to 2030 to reach USD 2.62 billion by 2030.

b. North America dominated the vegan confectionery market with a share of 37.2% in 2022. This is attributable to the rising popularity of a plant-based diet among consumers in the U.S.

b. Some key players operating in the vegan confectionery market include Taza Chocolate; Alter Eco; Endangered Species Chocolate, LLC; EQUAL EXCHANGE COOP; Chocoladefabriken Lindt & Sprüngli AG; Mondelēz International; Dylan's Candy Bar; Endorfin; Goodio; Freedom Confectionery; Creative Natural Products, Inc.

b. Key factors that are driving the vegan confectionery market growth include an increasing shift among consumers toward plant-based diets, as a result of lifestyle disorders and health concerns.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."