- Home

- »

- Next Generation Technologies

- »

-

Workforce Management Market Size & Share Report, 2030GVR Report cover

![Workforce Management Market Size, Share & Trends Report]()

Workforce Management Market (2023 - 2030) Size, Share & Trends Analysis Report By Solution, By Deployment (On-premise And Cloud), By Company Size (Large Enterprises And SMEs), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-929-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Workforce Management Market Summary

The global workforce management market size was valued at USD 8.07 billion in 2022 and is projected to reach USD 19.35 billion by 2030, growing at a CAGR of 11.7% from 2023 to 2030. Factors such as workforce optimization, increasing cloud deployment, and the need to comply with regulatory mandates drive market growth.

Key Market Trends & Insights

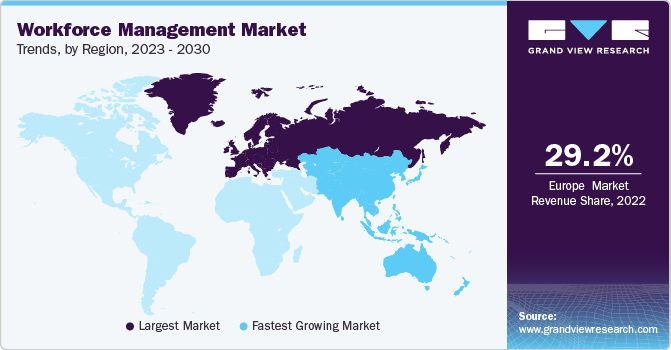

- Europe dominated the market and accounted for the largest revenue share of 29.2% in 2022.

- Asia Pacific is expected to grow at the fastest CAGR of 16.1% during the forecast period.

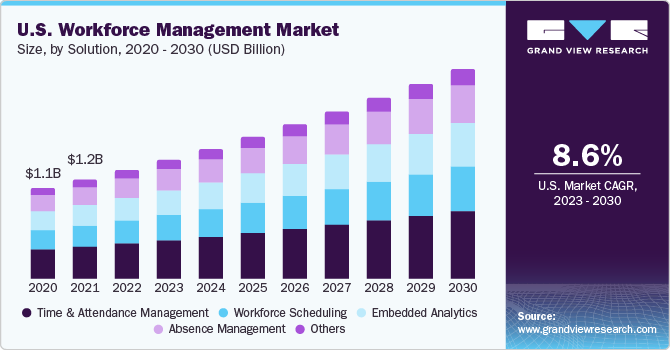

- Based on the solution, the time & attendance management segment accounted for the largest revenue share of 35.9% in 2022.

- Based on deployment, the on-premise segment accounted for the largest revenue share of 50.7% in 2022.

- Based on company size, the large enterprises segment accounted for the largest revenue share of 64.8% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 8.07 Billion

- 2030 Projected Market Size: USD 19.35 Billion

- CAGR (2023-2030): 11.7%

- Europe: Largest market in 2022

- Asia Pacific: Fastest growing market

The growing need for connected and unified enterprises and an integrated workforce management system spread across diverse locations is anticipated to boost demand across various end-user industries. The industry encompasses applications including absence management, time & attendance management, leave management, labor scheduling and budgeting, and workforce analytics. While the industry's demand for complete management suites is high, mobile-ready applications are expected to gain the highest growth spurt in the foreseeable future. In addition, the need to comply with regulatory bodies such as The Family and Medical Leave Act (FMLA) is estimated to drive the demand for compliance-based absence management solutions over the forecast period.

The standardization and streamlining of labor-related operations is one of the key areas that HR departments across various industries focus on. This trend is anticipated to direct the changes in the attributes and specifications of the solutions made available by the vendor. While integration coupled with agility is the most in-demand functionality among end users, its compliance and ease of use will also considerably affect customers' buying decisions.

Workforce analytics is anticipated to become a significant solution segment and will make new avenues available for future developments in upcoming product suites. As vendors differentiate their products amongst seemingly similar portfolios, analytics might offer the cutting edge for companies looking to address the technologically mature markets of North America and Europe. In addition, consideration for regional labor laws, the ability to integrate with other HR applications, and industry-specific attributes are expected to be the prime drivers of demand over the coming years.

The market experienced a significant impact due to the COVID-19 pandemic. The COVID-19 pandemic brought about numerous challenges for businesses worldwide, leading to the disruption of traditional work environments and the adoption of remote work models. As a result, organizations must adapt their workforce management strategies to accommodate these changes. With employees working from home or in hybrid work environments, organizations have sought digital tools and platforms that enable effective collaboration, communication, and task allocation among remote teams. It has fueled the growth of cloud-based workforce management software and virtual communication tools.

Workforce optimization (WFO) represents a wide range of software solutions and integrated business processes, focusing on boosting employees’ efficiency and workforce engagement (WFE). Workforce optimization software sets resources up for success by offering required information and sharing knowledge through a user-friendly dashboard. It enables interaction with respective customers more effectively across a variety of channels. Also, it supports automation in several roles of the employee-employer relationship, thereby improving communication and saving time.

Furthermore, workforce optimization helps increase customer retention by improving customer engagement and related services. It helps to analyze current and previous communication with customers, consequently finding the root cause of customer conduct and allowing the implementation of customer retention strategies. Enterprises can have detailed access to customer retention management tools and tactics using WFO software, which enhances the company’s customer service capabilities. Besides, workforce optimization offers cost-effective solutions by leveraging analytics and insights to simplify productivity and efficiency. Simplifying productivity with WFO software minimizes labor costs and streamlines the uninterrupted information flowing demand requirement for improving productivity.

With the advent of cloud computing, mobile technology, and big data, the methods for business operations optimization have become easier. Whether it’s a CRM system such as Salesforce, marketing automation software, inbound marketing software, or workforce management software, the tools enterprises use significantly enhance the experience of both their customers and employees. For instance, cloud-based workforce management platforms help to optimize time utilization by automating conventional labor-intensive assignments. Also, it empowers instant communication through a dedicated mobile application, which allows customers to be instantly notified of respective activities, such as a granted leave request or any changes to their schedule.

Cloud-based solution deployment for administering workforce management WFM has become increasingly crucial for enterprises under pressure to reduce expenditure, maximize workplace productivity, and improve their bottom line. The popularity of remote working and the prevalence of mobile devices have made workforce management solutions necessary for successfully managing resources across different business sites. The most effective solutions incorporate applications, such as analytics, reporting, employee scheduling, and inquiry resolution metrics catering to the requirements of the flexible modern employee. Cloud-based deployment provides enterprises with this flexibility and agility at scale.

Solution Insights

Based on the solution, the global market is segmented into workforce scheduling, time & attendance management, embedded analytics, and absence management. The time & attendance management segment accounted for the largest revenue share of 35.9% in 2022. Solutions such as time & attendance management systems have been in use across numerous industries for quite some time and are expected to gain steady growth in the future. These solutions are heavily used in organizations with a large labor force, such as manufacturing, healthcare, and retail, and will continue to attract customers in the coming years.

The embedded analytics segment is expected to grow at the fastest CAGR of 13.8% during the forecast period. The rise of cloud computing and software-as-a-service (SaaS) solutions has played a significant role in adopting embedded analytics in workforce management. Cloud-based workforce management platforms offer the flexibility and scalability required to integrate analytics seamlessly. It allows organizations to leverage the power of analytics without the need for extensive infrastructure investments or IT resources.

Deployment Insights

Based on deployment, the global market is segmented into on-premise and cloud. The on-premise segment accounted for the largest revenue share of 50.7% in 2022. The segment is anticipated to dominate in developing countries, where technology is adopted more slowly. As many labor management solution users are laggards in technological adoption, the cloud deployment segment is expected to grow in the latter part of the forecast period.

The cloud segment is expected to grow at the fastest CAGR of 14.3% during the forecast period. Cloud is the preferred deployment option for workforce solutions in the industry primarily because it facilitates flexibility, cost-saving, and ease of operations. Moreover, marketing efforts by leading solution vendors have been instrumental in establishing the cloud as a feasible and streamlined deployment option amongst industries with a traditional outlook.

Company Size Insights

Based on company size, the market is segmented into large enterprises and small and medium enterprises (SMEs). The large enterprises segment accounted for the largest revenue share of 64.8% in 2022. Large enterprises typically operate in multiple locations, employ diverse workforce segments, and manage complex shift scheduling. As a result, they have a greater need for robust and scalable workforce management solutions to streamline their operations, optimize resource utilization, and enhance overall productivity.

The small and medium enterprises (SMEs) segment is estimated to register the fastest CAGR of 14.5% over the forecast period. The need to comply with labor regulations and industry standards drives the SME segment in the market. With workforce management software, SMEs can streamline compliance processes, mitigate legal risks, and maintain accurate records, enhancing their business reputation and credibility.

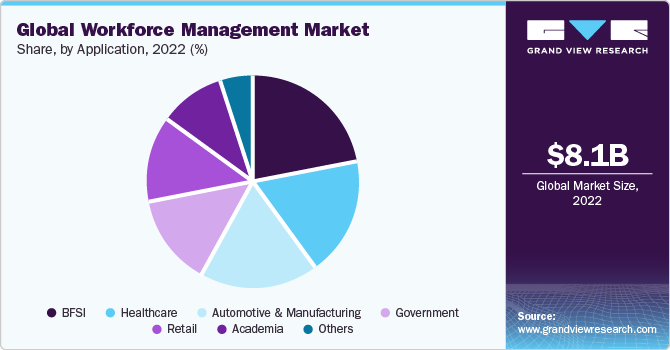

Application Insights

Based on application, the market is segmented into academia, automotive & manufacturing, BFSI, government, healthcare, retail, and others. The BFSI segment held the largest revenue share of 22.0% in 2022. The demand for labor scheduling and labor budgeting solutions has been increasing in the industry and is the major driver behind the increasing revenue share of the BFSI segment. Furthermore, the growing number of millennials in this industry's workforce is propelling the demand for labor tracking and employee satisfaction in the segment.

The healthcare channel segment is expected to grow at the fastest CAGR of 13.9% over the forecast period. The shift towards value-based care models and the emphasis on cost optimization have also propelled the demand for workforce management solutions in the healthcare industry. Furthermore, technological advancements, such as cloud-based workforce management software, mobile applications, and artificial intelligence-driven analytics, have enhanced the capabilities and usability of workforce management solutions in healthcare.

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 29.2% in 2022. Stringent regulations in Europe have necessitated the implementation of robust workforce management systems. Compliance with labor regulations, including working hours, breaks, and vacation policies, is crucial for organizations operating in the region. For instance, European countries have provisions for various leave entitlements, including annual, maternity/paternity, parental, and sick leave. Organizations must comply with these regulations and provide employees with the appropriate leave entitlements, ensuring they receive their entitled time off and benefits.

Asia Pacific is expected to grow at the fastest CAGR of 16.1% during the forecast period. The growth of the workforce management marke t in the Asia Pacific can be attributed to the increasing government initiatives and investments in digitization and a growing number of automation projects that aim to enhance organizations' productivity. Additionally, a large skilled workforce is expected to drive the region's talent management and recruitment software market.

Key Companies & Market Share Insights

Industry players are enhancing their solutions with extra capabilities, including analytics, compliance, and different vendor integration, to add a competitive edge to the products. In addition, these vendors focus on making workforce management solutions a tactical tool rather than a tracking, operations-driven application, which will drive the research & development initiatives in the industry.

The key players are involved in new product developments, agreements, product launches, mergers and acquisitions, and expansion strategies to improve their market penetration. For instance, in May 2023, Veriforce acquired Global Worker Pass. The acquisition is expected to broaden Veriforce's product portfolio and provide clients with a comprehensive solution for managing their global workforce. Also, the acquisition is further helping Veriforce's clients keep ahead of the competition in an increasingly globalized corporate market.

Key Workforce Management Companies:

- UKG Inc.

- SAP SE

- Oracle Corporation

- WorkForce Software, LLC

- NICE

- ActiveOps PLC

- Infor

- Ceridian HCM, Inc

- EG Solutions

- Blue Yonder Group, Inc

- Reflexis Systems, Inc

- Replicon

- SISQUAL Workforce Management, Lda.

Recent Development

-

In June 2023, Strata Decision Technology announced the launch of the Real-Time Workforce Management (RTWM) solution, specifically developed to meet nursing leaders' financial and operational objectives. This new offering builds upon Strata's extensive StrataJazz platform and aims to provide nursing leadership with precise and practical data to enhance communication between leaders and staff. Traditional methods, such as manual or offline modeling, frequently lead to inconsistent data sets and unreliable forecasts, hindering nursing leaders' ability to transition from analysis to implementation.

-

In May 2023, WorkAxle collaborated with TalenTeam to provide advanced workforce management solutions that enhance operational efficiency for organizations in Europe and the Middle East. This collaboration enables WorkAxle to extend its presence in the European market and deliver customized solutions that cater to the specific requirements of businesses in the Middle East.

-

In April 2023, Workday, Inc. partnered with Alight, Inc. to offer HR and payroll professionals a global simplified and integrated payroll solution. Initially launching in six prominent European regions, including Benelux, Germany, Italy, the Nordics, Spain, and Switzerland, this collaboration integrates Alight's workforce technology platform, Alight Worklife, with Workday Human Capital Management on a unified digital platform. The unified platform aims to provide organizations with an efficient and consistent experience for handling the challenges of managing a multinational workforce.

-

In March 2023, UJET, Inc. launched UJET WFM in partnership with Google Cloud. UJET provides innovative analytical solutions for the contact center sector by launching its workforce management suite, accessible within the Google Cloud Contact Centre AI Platform. UJET WFM enhances remote contact center agent efficiency and client experience by providing highly reliable prediction, planning, and real-time compliance monitoring.

-

In January 2023, Accenture partnered with UKG Inc. to assist Ardent Health Services in enhancing visibility and agility in its workforce operations. Ardent Health Services, which operates 30 hospitals and 200 care sites, is implementing changes to improve work-life experiences for frontline employees through flexible scheduling solutions. The collaboration between Accenture and UKG aims to support Ardent in transforming workforce management, enabling better employee experiences, operational optimization, and the creation of new business value.

-

In July 2022, Procore Technologies, Inc. launched Procore Workforce Management, a suite of two key products: Field Productivity and Workforce Planning. By combining these two solutions, contractors can access a highly comprehensive construction workforce management system. It enables them to have clear insights into their workforce, make accurate forecasts, and effectively manage human resources. The goal is to facilitate meeting or surpassing projected schedules and budgets.

Workforce Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.92 billion

Revenue forecast in 2030

USD 19.35 billion

Growth Rate

CAGR of 11.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, company size, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates (UAE); Saudi Arabia; South Africa

Key companies profiled

UKG Inc.; SAP SE; Oracle Corporation; WorkForce Software, LLC; NICE; ActiveOps PLC; Infor; Ceridian HCM, Inc; EG Solutions; Blue Yonder Group, Inc; Reflexis Systems, Inc; Replicon; SISQUAL Workforce Management, Lda.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Workforce Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global workforce management market based on solution, application, deployment, company size, and region:

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Workforce Scheduling

-

Time & Attendance Management

-

Embedded Analytics

-

Absence Management

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Academia

-

Automotive & Manufacturing

-

BFSI

-

Government

-

Healthcare

-

Retail

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premise

-

-

Company Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global workforce management market size was estimated at USD 8.07 billion in 2022 and is expected to reach USD 8.92 billion in 2023.

b. The global workforce management market is expected to grow at a compound annual growth rate of 11.7% from 2023 to 2030 to reach USD 19.35 billion by 2030.

b. The BFSI segment held the largest revenue share of the workforce management market in 2022. The demand for labor scheduling and labor budgeting solutions has been increasing in the industry and is the major driver behind the increasing revenue share of the BFSI segment.

b. Some key players operating in the workforce management market include Kronos Incorporated, SAP SE, Oracle Corporation, Workforce Software Group Inc., Nice Systems, Active Ops Limited, Nice Systems Inc., and Infor, among others.

b. Th key factors driving the growth of the market include workforce optimization, increasing cloud deployment, and the need to comply with regulatory mandates. Moreover, the growing need for connected and unified enterprise, as well as an integrated workforce management system spread across diverse locations, is anticipated to boost demand across various end-user industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.