- Home

- »

- Next Generation Technologies

- »

-

Big Data Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Big Data Market Size, Share & Trends Report]()

Big Data Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Technology (Analytics, Database, Visualization, Distribution Tools, Others), By Service, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-528-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Big Data Market Summary

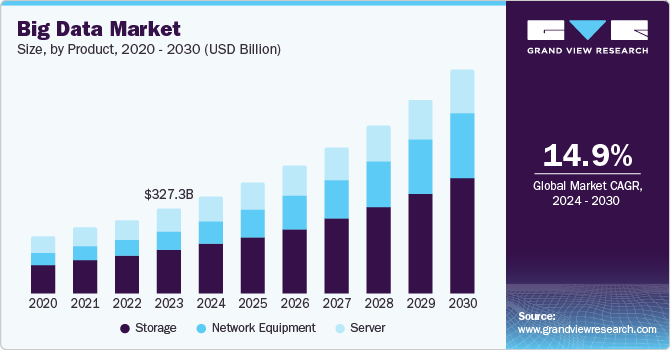

The global big data market size was estimated at USD 327.26 billion in 2023 and is projected to reach USD 862.31 billion by 2030, growing at a CAGR of 14.9% from 2024 to 2030. A key growth-driving factor for this market is the increasing use of diverse and large datasets generated through multiple business operations to attain advantages such as enhanced decision-making processes, improved ongoing engagements with different stakeholders, well-determined strategies, and significantly better customer experiences.

Key Market Trends & Insights

- North America big data market dominated the market with a revenue share of 36.8% in 2023.

- The U.S. big data market dominated the regional industry in 2023.

- Based on products, the storage segment dominated the global industry and accounted for a revenue share of 51.1% in 2023.

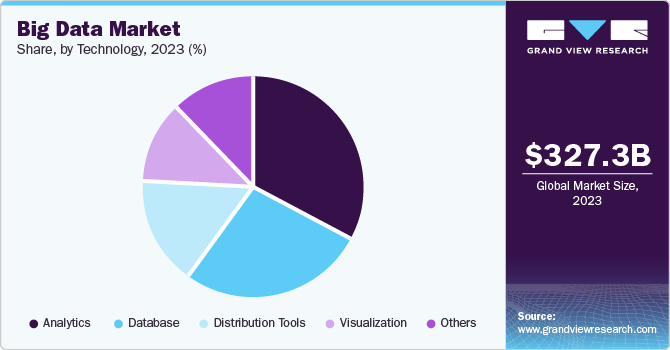

- By technology, the analytics segment accounted for the largest revenue share in 2023.

- By service, the consulting services segment has the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 327.26 Billion

- 2030 Projected Market Size: USD 862.31 Billion

- CAGR (2024-2030): 14.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Big data is exceptionally large collections of unstructured, structured, or semi-structured data sets that grow continuously over time. Traditional data management systems cannot store or process these datasets. The complex velocity, volumes, and variety associated with these datasets make it difficult for conventionally used systems to analyze and produce assistance or insights. The increasing inclination towards collection, storage, and use of data associated with multiple business dynamics, growing demand for advanced analytics solutions, trends such as real-time processing, and global scale of numerous industries connected with vast digital footprints are expected to develop increasing demand for big data market during next few years.

The emergence of technologies such as artificial intelligence and machine learning is expected to result in the integration of advanced technology tools and big data to ensure the processing of extremely complex datasets and the delivery of extraordinary analytical insights. Research & development activities focused on areas such as cloud-native technologies, industry-specific analytical tools, business intelligence solutions, and the availability of user-friendly platforms are also anticipated to result in growth for the big data industry.

Digitization trends and increases in the use of technology-driven devices and tools such as smartphones, wearables, home automation devices, smartwatches, robotics, autonomous vehicles, and others have generated huge volumes of data. Modern businesses in consumer electronics, consumer goods, healthcare, welfare & governance, automotive, security, law & order, critical infrastructure management, utilities, media & entertainment, education, logistics, food, and others heavily rely on data. This has developed a need for innovative data management systems and big data analytics solutions.

A growing number of digital monetary transactions, increasing market penetration of online shopping websites, the emergence of technologies such as blockchain, augmented reality, precision medicine, and others, rising availability and accessibility of highly automated systems, devices, and services, and trends such as personalization and customization prevailing in various industries are expected to fuel growth for big data market during the forecast period.

Product Insights

Based on products, the storage segment dominated the global industry and accounted for a revenue share of 51.1% in 2023. The hard disk drive is a cost-effective big data storage device. However, flash storage applications such as memory cards, USB, smartphones, and tablets are gaining more popularity than hard disk drives due to decreasing cost and fast data access. The essential fact accelerating the storage segment is that it is not restricted to specific capacities, and the storage volume can be increased to terabyte or petabyte sizes.

The network equipment segment is expected to experience the fastest CAGR during the forecast period. Solid-state memory, cloud storage, hybrid cloud storage, and backup appliances are some network-attached storage equipment. This equipment does not need continuous power to preserve data and can be considered an option for non-volatile data storage. Additionally, cloud storage provides virtual data storage and allows access to the data from anywhere. Such innovations are adding value to the market's growth.

Technology Insights

The analytics segment accounted for the largest revenue share in 2023. This is attributed to the expanding usage of data analytics in numerous businesses in multiple industries, such as healthcare, media and entertainment, transportation, banking, transportation, logistics, food delivery, e-commerce and others. Enterprises continuously utilize these analytics to design strategies to minimize errors and succeed in a competitive market. Additionally, unlike traditional methods, big data analytics is anticipated to enter into Cloud Data Centres (CDCs) to utilize their huge computational capabilities and extract data. Therefore, such a huge application of data analytics has paved the way for growing market demand.

The visualization segment is expected to experience the fastest CAGR from 2024 to 2030. One of the best advantages of data visualization is that it makes data easily comprehensible to the general public or particular audiences. For instance, a government health agency can offer a map showing areas that have been vaccinated during outbreaks, with the help of data visualization. Data Visualization provides ease in identifying connections and trends in a data set by displaying the data graphically or in a chart. Visualization provides easily assessable data, increasing the chances of exploration and cooperation and influencing practical decision-making, contributing to the key driving factor for market growth during the forecast period.

Service Insights

The consulting services segment has the largest revenue share in 2023. Data evaluation and audits allow consultants to pinpoint areas for enhancement, uncover potential risks, and suggest the best strategies for data modernization, analytics, and more. Big data enhances the process of data management of an organization's data to facilitate the analysis process. Data analytics firms provide services for testing and personalization by running experiments to enhance strategies, content, and user experiences. Another application of big data is anticipating future events by studying patterns in a dataset, called predictive modeling, which is useful for consultancy services. These various applications are attributed to the market growth of consultancy services.

The training & development segment is expected to experience a significant growth during the forecast period. With advanced analytics such as machine learning algorithms, human resource (HR) professionals can pinpoint areas where employees lack skills, predict upcoming talent requirements, and create personalized training initiatives to fill the skill gaps. Recognizing and rectifying skill gaps is crucial for maximizing employee capabilities, streamlining operational procedures, and fostering business expansion. Using big data, organizations can link the performance of employees and training by ensuring the effectiveness of their training. These big data applications in training & development drive the growth of the big data market.

End-use Insights

The manufacturing segment dominated the big data market in 2023. The manufacturing industry has recently adopted multiple technologies and automation systems. By utilizing data from different sources, manufacturers acquire knowledge about the performance of production procedures, enhance the supply chain, reduce expenses, and improve the quality of products manufactured through processes. Using big data analytics in manufacturing enhances predictive maintenance, downtime prevention, and operational efficiency. For instance, big data can support manufacturers in forecasting necessary maintenance to prevent breakdowns and reduce downtime.

The gaming segment is projected to grow at the fastest CAGR over the forecast period. The applications of big data in predictive analysis, detecting frauds, analysis of player behavior, and innovative video game development are responsible for fueling the big data market. For instance, Niantic, an American software firm, is well known for creating the popular augmented reality mobile game Pokémon Go. Gaming organizations' constant use of big data analytics to understand player behavior, enhance virtual reality experiences, and optimize the game using location data drives the demand for the big data market.

Regional Insights

North America big data market dominated the market with a revenue share of 36.8% in 2023. The increasing use of big data solutions by numerous key companies in multiple industries present in the region has driven growth for this regional industry in recent years. Moreover, the rising investments by organizations in research and development initiatives to boost efficiency and enhance operational procedures drive the growth in the market. The presence of various companies offering services, solutions and technology assistance associated with big data in this region has also contributed to the growth of North America big data market.

U.S. Big Data Market Trends

The U.S. big data market dominated the regional industry in 2023. This market is primarily influenced by the factors such as the exponential growth in dependability on data, generation of huge amounts of data through digital footprint of customers and transactions and increasing need for the sophisticated data management solutions. The growing gaming industry in the region and the constant focus of organizations to enhance the customer experience by utilizing big data analytics are anticipated to drive market growth. Emergence of modern technologies in the country, such as driverless on-demand cabs, drone deliveries, automated monitoring and response, and others have resulted in growing need for advanced data analytics tools

Europe Big Data Market Trends

Europe big data market was identified as a lucrative region in 2023. The regional industry is driven by the rising investments by governments and organizations in digital technologies such as AI, robotics, and others, leading to increasing demand for the technology solutions associated with big data. Companies emphasize the importance of big data services, which aid them in obtaining important insights, improving operations, making decisions based on data, and driving innovation in healthcare, business, research, and finance.

The UK big data market is expected to grow rapidly during the forecast period. The key growth factors for this market include the rising adoption of advanced technologies such as AI, machine learning, and others in multiple businesses, the growing dependence of businesses on data availability, insights derived through data analytics tools, and increasing availability and accessibility of consumer data. The integration between novel technologies such as blockchain, predictive maintenance, and AI is expected to develop greater demand for the big data market in the UK.

Asia Pacific Big Data Market Trends

Asia Pacific big data market is anticipated to witness the fastest CAGR from 2024 to 2030. This market is primarily driven by factors such as the entry of multiple businesses from various industries in the region, a huge number of consumers, unprecedented growth in digital transactions, and increasing availability of extremely large datasets. The presence of various information & technology-related organizations and SMEs in the region, which have been focusing on innovation and delivery of effective big data solutions to its clients. These solutions are associated with distributed processing, storage and management, analytics & visualization, data quality assurance, and more.

The China big data market held a substantial revenue share of the regional industry in 2023. The thriving e-commerce, fintech, and digital payment sectors contribute significantly to data generation and demand for big data solutions. In addition, rapid advancements in cloud computing, AI, and data analytics technologies create new opportunities for big data applications. Various industries, including finance, healthcare, manufacturing, and retail, are increasingly adopting big data analytics to improve efficiency and decision-making. These factors are expected to drive growth for this market during the forecast period.

Key Big Data Company Insights

Some of the key companies in the big data market include Accenture, Cloudera, Inc., OPERA Solutions Inc., Oracle, and others. Manufacturers constantly invest in research and development to develop comprehensive big data solutions to enhance functionalities. Vendors are attempting to lower hardware expenses to gain a competitive edge. Therefore, key companies are prioritizing mergers & acquisitions and venture funding to support technological advancements and intricate ecosystems.

-

Accenture, a global professional services company, focuses on strategy, consulting, technology, and operations services. The company offers big data solutions and software including data engineering, AI-powered solutions for automation, prediction, and decision-making, cloud-based data solutions, and more.

-

IBM, a multinational consulting and technology company, offers solutions and services in data analytics, application services in the cloud, E-commerce, IT infrastructure, and others. The company provides solutions such as IBM Cloud Pak for Data, IBM Watson, IBM Db2, IBM InfoSphere, IBM BigInsights, and more.

Key Big Data Companies:

The following are the leading companies in the big data market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Cloudera, Inc.

- OPERA Solutions Inc.

- EMC

- Hewlett Packard Enterprise Development LP

- IBM

- Mu Sigma.

- Oracle

- Splunk Inc. (Cisco Systems, Inc.)

- Teradata

Recent Developments

-

In March 2024, Cisco, one of the prominent companies in the software and technology industries, completed the acquisition of Splunk, an expert organization in machine data. With this acquisition, Cisco aims to attain enhanced services, improved connectivity, and an expanded product portfolio related to security solutions.

-

In March 2024, Oracle, major market player in technology industry, launched globally distributed autonomous database, Oracle Database 23ai, characterized with the feature such as raft replication, synchronous duplicated tables, parallel cross-shard dml support, fine-grained refresh rate control and more.

Big Data Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 373.87 billion

Revenue forecast in 2030

USD 862.31 billion

Growth Rate

CAGR of 14.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, service, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, China, Japan, India, Brazil

Key companies profiled

Accenture; Cloudera, Inc.; OPERA Solutions Inc.; EMC; Hewlett Packard Enterprise Development LP; IBM; Mu Sigma; Oracle; Splunk Inc. (Cisco Systems, Inc.); Teradata

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Big Data Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the big data market report based on product, technology, service, end use, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Storage

-

Server

-

Network Equipment

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Analytics

-

Database

-

Visualization

-

Distribution Tools

-

Others

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consulting

-

Deployment & Maintenance

-

Training & Development

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Manufacturing

-

Retail

-

Media & Entertainment

-

Gaming

-

Healthcare

-

Telecommunication

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

- Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.