- Home

- »

- Food Additives & Nutricosmetics

- »

-

Xanthan Gum Market Size And Share, Industry Report, 2030GVR Report cover

![Xanthan Gum Market Size, Share & Trends Report]()

Xanthan Gum Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Oil & Gas, Food & Beverage, Pharmaceutical, Cosmetics), By Region (North America, Europe, APAC, CSA, MEA), And Segment Forecasts

- Report ID: 978-1-68038-379-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Xanthan Gum Market Summary

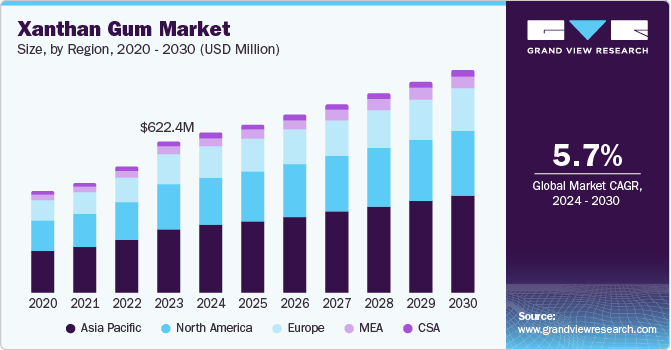

The global xanthan gum market was estimated at USD 622.4 million in 2023 and is projected to reach USD 917.5 million by 2030, growing at a CAGR of 5.7% from 2024 to 2030. Market growth is driven by the expansion of the food industry, increased consumer demand for healthy products, and advancements in production technology.

Key Market Trends & Insights

- Asia Pacific held the largest market share in 2023, accounting for 42.0% of the revenue.

- The Middle East & Africa region is anticipated to grow at 5.8% over the forecast period.

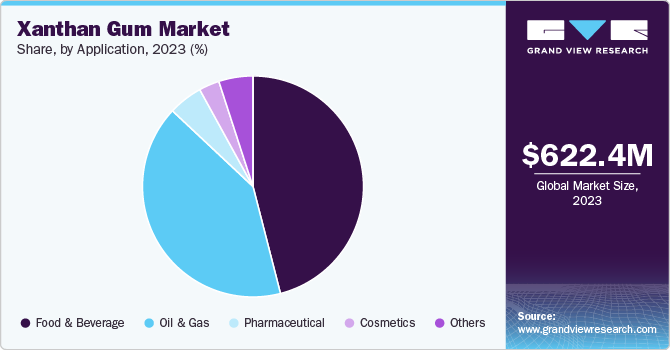

- By application, the food & beverage segment dominated the market with a 45.8% revenue share in 2023.

- The oil & gas segment is expected to exhibit significant growth with a CAGR of 5.9% over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 622.4 Million

- 2030 Projected Market Size: USD 917.5 Million

- CAGR (2024-2030): 5.7%

- Asia Pacific: Largest market in 2023

Globalization of diets, broader industry adoption, and regulatory requirements for environment-friendly practices are also contributing to the market’s upward trajectory.

Xanthan gum serves as an effective substitute for gluten in gluten-free products, enhancing texture and stability, which further propels its use in the food industry. The growing awareness and demand for healthier food options have led to a significant increase in the adoption of xanthan gum as a natural ingredient.

In addition to its widespread applications in the food industry, xanthan gum also finds applications in pharmaceuticals, personal care, and industrial sectors such as oil and gas. Its unique properties, including thickening and stabilizing, make it valuable in diverse applications, including drilling fluids and cosmetic formulations. The continuous improvements in extraction and fermentation technologies have also enhanced the production efficiency of xanthan gum, making it more accessible to manufacturers across various sectors.

Furthermore, regional growth dynamics are also driving the market’s growth. The market is geographically diverse, with North America, Europe, and Asia-Pacific being significant hubs for production and consumption. The increasing demand for organic and non-GMO products has also positively influenced the market, as consumers are increasingly seeking natural food additives such as xanthan gum.

Application Insights

The food & beverage segment dominated the market with a revenue share of 45.8% in 2023. Xanthan gum’s unique rheological properties enable its seamless integration into various food products. Its viscosity-increasing, emulsification-maintaining, and texture-enhancing capabilities make it a valuable additive in mass-market products, including sauces, dressings, dairy products, and gluten-free bakery items. Moreover, it facilitates shelf preservation, texture stability, and storage integrity in processed foods.

Oil & gas is expected to register significant growth with a CAGR of 5.9% over the forecast period. Xanthan gum is a highly sought-after additive for its exceptional compatibility, enabling it to effectively thicken solutions at very low concentrations. In the oil drilling industry, maintaining optimal viscosity levels in drilling fluids is crucial for wellbore stability and efficient cuttings removal. As environmental concerns escalate, xanthan gum’s biological origin and biodegradable properties make it an attractive solution for the industry, reducing its environmental footprint.

Regional Insights

Asia Pacific xanthan gum market dominated the global market with a revenue share of 42.0% in 2023. In the Asia Pacific region, a growing demand for processed, convenience, and gluten-free foods has driven the use of xanthan gum as a thickening agent. Leveraging advanced biotechnology and high-tech production methods, local companies have boosted yields and reduced costs, increasing the availability of xanthan gum within the region.

China Xanthan Gum Market Trends

The xanthan gum market in China held a significant market share in 2023. The country boasts a significant advantage in producing xanthan gum due to its abundant raw material resources, particularly corn, which is a primary feedstock for the production of glucose. As a leading corn producer, China ensures a stable and cost-effective supply of corn, making it an ideal location for xanthan gum manufacturing.

Middle East & Africa Xanthan Gum Market Trends

Middle East & Africa xanthan gum market is expected to register the second-fastest growth of 5.8% over the forecast period. The region is rich in natural resources, particularly in agriculture, with diverse climatic conditions conducive to cultivating various crops. This region offers a favorable environment for growing corn and soybeans, which are essential feedstocks for producing glucose through fermentation, ultimately yielding xanthan gum.

The xanthan gum market in Saudi Arabia is expected to grow in forecast period. The country’s geographic location grants it a strategic advantage, allowing for seamless access to key markets in Europe, Asia, and Africa. This positioning enables the establishment of efficient marketing networks for xanthan gum production and export. Furthermore, the country’s abundant natural resources, including petroleum and natural gas, provide essential feedstocks for synthesizing chemicals used in xanthan gum production.

North America Xanthan Gum Market Trends

North America xanthan gum market held a substantial market share in 2023. Companies in this region have concentrated their research and development efforts on refining extraction methods and formulations, enhancing xanthan gum’s versatility across various applications. Key players have invested in the North American market, leveraging strategic production facility locations to drive growth and capitalize on market opportunities.

The xanthan gum market in the U.S. dominated North America. The U.S. food and beverage industry’s emphasis on health and wellness drives a consistent demand for xanthan gum. The country’s rigorous food safety and quality standards ensure the additive’s safety and quality, fostering confidence among end-users and enhancing the reputation of U.S.-produced xanthan gum in both domestic and international markets.

Europe Xanthan Gum Market Trends

Europe xanthan gum market was identified as a lucrative region in 2023. Europe’s well-established industrial sector enables the efficient manufacturing and distribution of xanthan gum. Germany, France, and the UK, leading chemical producers in the region, facilitate large-scale production. European companies prioritize R&D investments to develop innovative technologies and enhance xanthan gum production, driving growth and competitiveness in the market.

The xanthan gum market in UK is expected to grow rapidly in the coming years. The UK’s growing health-conscious population is a significant driver of market demand. The country’s prominent food technology research institutions focus on innovative food additives, fostering an environment that promotes health improvements and drives the development of new xanthan gum applications, functionalities, and uses in various food products.

Key Xanthan Gum Company Insights

Some key companies in the xanthan gum market include ADM; Foodchem International Corporation; Deosen Biochemical (Ordos) Ltd.; Cargill, Incorporated; and Ingredion; among others. Owing to increasing competition, market participants have been implementing tactics and strategies such as new product launches, enhanced distribution, new product launches, geographical expansion and more.

-

Cargill, Incorporated is a multinational agribusiness company, known for its sustainability and innovation in the food supply chain. The company is a significant manufacturer of xanthan gum, leveraging its expertise to drive growth and efficiency in the production of this key ingredient.

-

Ingredion specializes in the development and delivery of a diverse range of food and beverage ingredients, including hydrocolloids such as xanthan gum. The company’s expertise lies in crafting innovative solutions that enhance the texture, stability, and overall quality of food products, enabling customers to create unique and compelling consumer experiences.

Key Xanthan Gum Companies:

The following are the leading companies in the xanthan gum market. These companies collectively hold the largest market share and dictate industry trends.

- ADM

- Foodchem International Corporation

- Deosen Biochemical (Ordos) Ltd.

- Cargill, Incorporated

- Ingredion

- CP Kelco U.S., Inc.

- Fufeng Group

- HEBEI XINHE BIOCHEMICAL CO., LTD

- MEIHUA HOLDINGS GROUP CO., LTD.

- Qingdao Unionchem Co.,Ltd.

Recent Developments

-

In June 2024, J.M. Huber Corporation announced the latter’s intent towards the sale of CP Kelco to Tate & Lyle, enabling a strategic collaboration to develop a diverse range of plant-based and fermentation-derived ingredients, offering tailored solutions to customers.

Xanthan Gum Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 656.9 million

Revenue forecast in 2030

USD 917.5 million

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, CSA, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Netherlands, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

ADM; Foodchem International Corporation; Deosen Biochemical (Ordos) Ltd.; Cargill, Incorporated; Ingredion; CP Kelco U.S., Inc.; Fufeng Group; HEBEI XINHE BIOCHEMICAL CO., LTD; MEIHUA HOLDINGS GROUP CO., LTD.; Qingdao Unionchem Co.,Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Xanthan Gum Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global xanthan gum market report based on application, and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Food & Beverage

-

Pharmaceutical

-

Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

CSA

-

Brazil

-

Argentina

-

-

MEA

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.