Gas Turbine Market Future Outlook: Panacea To Tackle Climate Change

The demand for gas turbines is likely to be attributed growth in heavy equipment industry and increasing energy demand in the emerging markets. Dramatic shift in lifestyles and population growth owing to rapid economic development are likely to propel the demand for gas turbines. Gas turbines play a vital role in reducing greenhouse gas emissions worldwide. With evolving environmental regulations coupled with climate change regulation, the potential for gas turbines in various applications is slated to grow.

Gas turbines are primarily used for power generation. Operating a simple cycle turbine power plant for supplying electricity to industry is very much costlier than purchasing it from outside. Thus, mostly combined cycle power plants are employed which have better efficiency. CHP plant is an example of combined cycle power plant, which can be used for electricity production as well as obtaining mechanical drive.

After the financial crisis in 2008-2009, the industrial gas turbine market has bounced back strongly. The majority of demand for gas turbines is likely to come from on-site power generation facilities. The rising demand for these turbines is majorly driven by favorable policies in emerging markets, for example, Combined Heat and Power (CHP) support scheme implemented in Germany.

"Demand & Supply Landscape "

A major percentage of the demand is likely to come from Asia, especially from China and India. During the forecast period, energy consumption in Asian markets is likely to grow at around 3.7% per year. Asia is anticipated to double its energy consumption in the coming years and is expected to account for over 60% of energy demand as compared to other developing regions.

In the coming years, renewable-based power generation is likely to reach around 30% in China, 25% in India, 50% in Europe, and 25% in North America. Demand for coal in electricity generation is likely to drop by around 30% by 2040.

The industry is expected to witness rising adoption of combined heat and power systems owing to factors such as-

• Increased cost due to supply and transmission constraints

• Grid reliability and power outages

• Climate change concerns

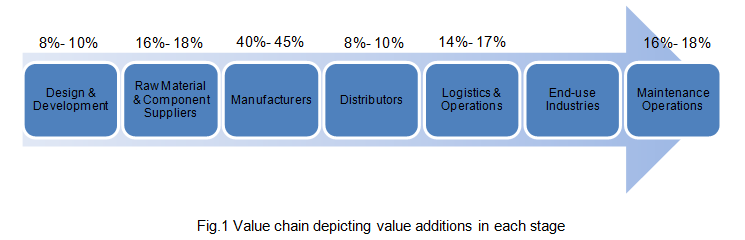

Industry cost structure and Value Chain

Gas turbines industry being consolidated, the focus of the main competitors is on R&D practices to improve the operational efficiency of the units and gain competitive advantage. Market players are striving to increase profits through maintenance and service activities for the existing units.

Gas turbines industry is capital and labor intensive. Raw material and component procurement form the largest cost component, second largest being workforce cost component. The industry requires technically sound and skilled labor and workforce, which increases the overall costing of turbines and other services.

The raw materials are sourced from numerous suppliers. The pricing and availability of these raw materials are highly volatile, owing to the domestic and international economic conditions. The end-users include oil & gas sector, processing firms, large-scale industries, and government-controlled enterprises that procure facilities ranging from component development to offering turnkey projects. Turnkey packages offer the most efficient way of managing the risks, as a majority of the clients do not have an in-house end-to-end design capability. Apart from turnkey projects, these agencies also rope in the major market players and collaborate with them to establish new projects.

"Competitive Landscape"

The industry is consolidated with no new entrants in the past few years. Globalization is the key to market competition, wherein international trade forms an important aspect of sustainable growth. Most of the players have established joint ventures with several customers and suppliers in various countries around the world that help to increase market share, decrease costs, and gain access to new markets. Some example of mergers and acquisition includes:-

• On February 26, 2016, Ansaldo Energia finalized the acquisition of key Alstom technology assets from General Electric. This initiative helps Ansaldo Energia to expand its geographic presence and broaden its product portfolio.

• On November 2, 2015, GE completed the acquisition of Alstom power and grid business. This initiative helps GE to expand its technological base as well as its product offerings in various markets.

• On July 29, 2014, MHPS merged with Babcock-Hitachi to bring enhanced speed to business management.

• On May 6, 2014, Siemens acquired Rolls-Royce gas turbine and energy business. This initiative helps Siemens to close the technology gap for its gas turbine business portfolio.

Gas turbines, being a mature market, growth prospects for new products are lesser. Thus, the manufacturers have concentrated on offering maintenance services to the existing end-users, which has become an important source of profit for the market players.

In-depth report on global gas turbine market by Grand View Research:

In-depth report on global gas turbine market by Grand View Research:

https://www.grandviewresearch.com/industry-analysis/gas-turbine-market