North America Building Thermal Insulation Market: Influenced By Strong Energy Codes

The demand for energy is on a rise in the developed as well as developing countries and so is the price of energy. Insulating homes help in curbing up to 20% of the regular energy costs as it considerably reduces the cooling and warming prices during summers and winters, respectively. Although the growth in the housing sector has slowed down in the U.S., the re-insulation market is acting as one of the growth drivers for this industry.

A study by the U.S. EPA estimated that proper insulation in a building could save up to 20% of heating and cooling costs. Rigid PU foams and spray PU foams are widely used as insulation materials in buildings to prevent heating and cooling losses, thus improving overall energy efficiency of the building. Increasing energy prices coupled with growing importance for sustainable infrastructure are major factors driving PU demand in insulation applications in construction.

At present, the tax credit for effective home insulation is 10% of the cost of insulation materials and systems, excluding installation costs. The U.S. home insulation market immensely gained from these government initiatives, as labor training as well as monetary aid were provided in abundance. Moreover, favorable building codes in the U.S. and Canada coupled with the establishment of energy certification agencies such as LEED and U.S. Green Building Council are expected to have a positive influence on North American insulation market.

"Industry Value Chain"

North America building thermal insulation market value chain consists of raw material suppliers, insulation material manufacturers, distributors, and end users. Major companies operating in the market include Atlas Roofing Corporation, Bayer, Certain Teed, Cellofoam North America, Inc., Dow Building Solutions, GAF Materials Corp., and Owens Corning Corp.

"Product, Application, End-use and Regional Trends"

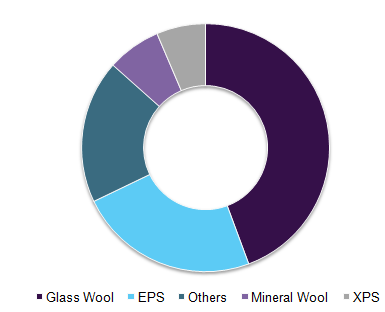

North America glass wool building thermal insulation accounted for 44.3% of market share by volume in 2015. Glass wool reduces temperature fluctuations and energy consumption, and is one of the most economical thermal insulation product available in the market.

North America building thermal insulation market share by product, 2015

Wall insulation holds the highest share but is expected to lose some of the shares to roofing applications over the forecast period. Roof thermal insulation segment is expected to emerge as the fastest growing segment. Roof being the most prominent source of heat as it is directly exposed to sunlight, is required to be properly insulated in order to enhance the overall effect of insulation.

"Future Trends"

In North America, future economic growth is expected to be led largely by domestic demand. With diminished reliance on exports, this region will focus increasingly on trade and investment in their home market. This will be facilitated by relatively easy access to finance and a robust local labor market. Over the longer term, the trend will strengthen because the growing middle-class population and rising income levels will fuel domestic demand further.

In-depth report on North America building thermal insulation market by Grand View Research:

In-depth report on North America building thermal insulation market by Grand View Research:

https://www.grandviewresearch.com/industry-analysis/north-america-building-thermal-insulation-market