- Home

- »

- Advanced Interior Materials

- »

-

North America Building Thermal Insulation Market Report 2030GVR Report cover

![North America Building Thermal Insulation Market Size, Share & Trends Report]()

North America Building Thermal Insulation Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Glass Wool, Mineral Wool, EPS), By Application, By End-use, By Region, And By Segment Forecasts

- Report ID: GVR-1-68038-232-7

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

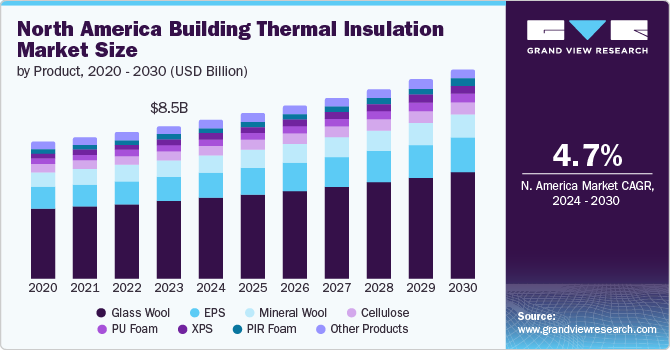

The North America building thermal insulation market size was estimated at USD 8.52 billion in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. This growth is attributed to the development of the residential sector along with the implementation of strict building codes such as the International Energy Conservation Code (IECC) in North America.

The industrial sector in North America is likely to witness a significant expansion owing to the rising GDP of the region. In addition, the manufacturing industry is also expected to benefit from the new policy reforms. This is expected to boost industrial construction in the region, thereby driving the demand for building thermal insulation over the coming years.

The value chain for the North America building thermal insulation market includes raw material manufacturers & suppliers, product manufacturers, assemblers or fabricators, installers, and end users. The presence of a large number of manufacturers and service providers coupled with easy availability of raw materials and easy installation process have resulted in high competition amongst players in North America. The price structure for building thermal insulation varies with respect to products, processes, and raw materials used across North America.

Raw materials used for thermal insulation include fibers, silicon, limestone, polymer resins, composite materials, and others. Composite materials are widely used owing to their abundant availability and ability to mold easily into components used for building thermal insulation. Fluctuating raw material prices result in price variations of the thermal insulating materials, thus affecting the profit margins of companies across the value chain in North America.

Numerous local and international players are present in North America that provide raw materials for thermal insulating components. Increasing demand for energy-efficient buildings, owing to the stringent government regulations and rising awareness regarding environmental degradation, is anticipated to fuel the demand for thermal insulation for residential, non-residential, commercial, and industrial buildings in North America. Favorable government policies coupled with increasing awareness among consumers are expected to remain the key driving factor for the growth of the building thermal insulation market in North America.

Building thermal insulation systems are expected to gain wide acceptance in North America owing to its several benefits such as lightweight materials, improved external appearance, and acoustic performance of the buildings. In the U.S., as per the Federal Energy Policy Act 2005, a tax credit of up to USD 2,000 is provided for builders of new energy-efficient homes that are constructed as per the standards of the Federal Manufactured Homes Construction and Safety Standards.

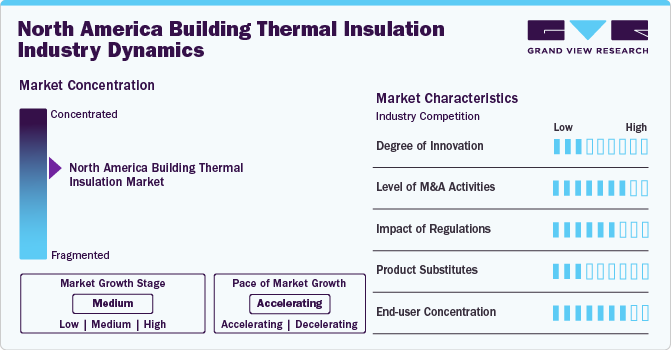

Industry Dynamics

Market growth stage is medium, and its pace is accelerating. Prominent players in the market are aiming to achieve optimum growth by introducing enhanced insulation products by implementing the latest technologies and product innovation. These factors are leading to a moderate degree of innovation.

The market is characterized by a high level of merger & acquisition activities. For instance, in August 2022, Owens Corning acquired Natural Polymers, LLC, which is a Cortland, Illinois-based manufacturer of spray polyurethane foam insulation for building and construction applications.

The market is governed by several bodies around the world that pass regulations regarding the production/use of composite strengthening systems such as American Society for Testing and Materials (ASTM), and Construction Products Regulation 2011 (CPR) have formulated rules, regulations, and standards for insulation materials used in residential & commercial construction.

Plastic foam and wool-derived insulation materials are the most preferred choice owing to their superior insulation performance, vast availability, and comparatively low cost. However, materials such as wood fiber are used for numerous applications despite their high costs. Hence, the product substitution is expected to remain moderate.

Product Insights

Based on product, the glass wool accounted for the largest revenue share of 51.1% in the North America market in 2023. Glass wool is manufactured through heating silica sand at 1200ºC to 1250ºC and converting it into fibers. It can be manufactured in the form of pipes, boards, and blankets of different sizes, with different technical properties specific to its applications.

Glass wool also offers energy-efficient thermal and acoustic insulation and fire safety. It helps to reduce energy consumption and temperature fluctuations. Glass wool provides extremely high-temperature tolerances, as the product itself is flame-resistant. In addition, it is cost-effective, versatile, and easily customizable, thereby accounting for a notable demand for building thermal insulation in North America.

The EPS segment is forecasted to be the fastest growing, with a CAGR of 5.4% from 2024 to 2030. EPS exhibits excellent dielectric strength, and resistance to chemicals, heat, and moisture; making it a preferred material for insulation of electric component in building applications. Foamed plastics are expected to witness significant demand for building insulation applications, owing to the energy efficiency regulations imposed by governments in North America.

The product's various advantages, including thermal insulation, cost effectiveness, and resistance to dust and moisture accumulation, are expected to boost its demand in North America. Its tough and resilient surface offers a higher degree of puncture resistance. The major applications include the insulation of pipes to prevent heat gain, condensation, or frost formation on water and air conditioning lines.

End-use Insights

In terms of end use, the residential segment held the largest revenue share in 2023. The segment is also estimated to grow at the fastest CAGR of 4.8% over the coming years. This growth is attributed to the rise in the number of single-family houses in developing economies and the rising disposable incomes of consumers, which are among the various factors that are projected to drive residential construction activities.

Hence, the growth of the residential construction sector in North America, along with growing building energy consumption norms, are projected to positively influence the demand for insulation in above mentioned applications. The commercial construction segment is inclusive of buildings for office spaces, universities, hypermarkets, supermarkets, departmental stores, shopping malls, hospitals & clinics, restaurants & hotels, resorts, and others.

The rapidly emerging trend of sustainable buildings is one of the major factors driving the growth of the building thermal insulation market in North America. In addition, rising office spaces in North America especially located in subtropical region are expected to witness notable demand for the insulation systems for maintaining the energy benchmarking as well as regulating the temperature levels.

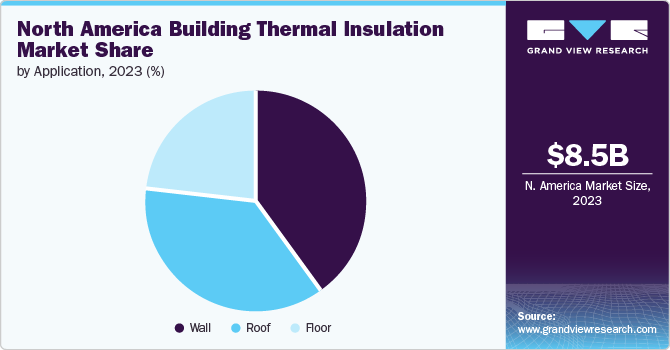

Application Insights

Based on application, the wall segment accounted for the largest revenue share in 2023 and is anticipated to be the fastest-growing segment over the forecast period, with a CAGR of 4.9%. Mineral and XPS are some of the most popular materials used for external thermal wall coatings owing to their low cost, high durability, and convenient installation. Thermal insulation of walls is also one of the essential elements to make the building more energy efficient. Thermal insulated walls, along with insulated roofs, create a protective envelope, which eliminates heat transfer from the external environment through conduction and radiation.

Investments in public infrastructure are on the rise in North America. Institutional buildings such as schools, hospitals, malls, and hotels are adopting high-class architecture and maintaining high energy-efficiency standards. Thus, these trends are projected to positively influence the demand for wall thermal insulation products in North America over the forecast period, since it plays a key role in maintaining the building energy consumption benchmarks across the globe.

Insulated roof panels offer heat retention and prevention benefits, thereby enabling cozy space in the houses and workspaces. The temperature regulated by the insulated roofs leads to improvement in the energy efficiency of the building through a reduction in the usage of air conditioning systems and heaters. Moreover, they act as a protection barrier against harsh climatic conditions. Thus, the aforementioned benefits are projected to drive the demand for insulation materials in roofing applications in North America.

To meet thermal insulation standards in North America, the ground floor needs to be built with multi-layered construction including flooring, under layers, appropriated insulating layer, and base. The insulation materials used for flooring applications require high compressive strength along with superior thermal barrier properties. Thus, XPS is one of the most popular materials used for insulation in flooring applications in North America. The rising significance of maintaining building thermal standards is also expected to drive the demand for insulation materials in North America since it plays a key role in the same.

Regional Insights

Building thermal insulation systems are expected to gain rapid acceptance during the forecast period owing to their lightweight, as well as their contribution to improvement in the external appearance and acoustic performance of buildings. Moreover, increasing demand for energy-efficient buildings owing to the presence of stringent government regulations and a rise in awareness regarding environmental degradation is anticipated to fuel the use of thermal insulation in residential and non-residential buildings.

U.S. Building Thermal Insulation Market Trends

The building thermal insulation market in the U.S. accounted for the largest revenue share of 80.0% in 2023 due to increased demand for energy-efficient construction solutions. In addition, increase in incidents of natural calamities, including hurricanes and wildfire, hitting different parts of the U.S. is anticipated to have a positive effect on construction sector in the country, thereby driving the demand for building thermal insulation over the forecast period.

Canada building thermal insulation market is expected to witness substantial growth owing to the rising construction industry in the country, primarily due to increasing population, urbanization, and high rate of migration. The country is also expected to witness strong growth in demand for multi-family housing units, augmenting the consumption of building thermal insulation over the forecast period.

The building thermal insulation market in Mexico is expected to witness substantial growth on account of the rising construction industry, mainly due to increasing population, urbanization, and increased rate of migration. The gradual recovery in the economic conditions of Mexico, coupled with rising domestic consumption of building thermal insulation in residential buildings, is expected to fuel the market growth.

Key North America Building Thermal Insulation Company Insights

Some of the key players operating in the market include Kingspan Group, GAF Materials Corporation, Saint Gobain S.A., Dow, and Owens Corning:

-

Dow operates in several sectors including agriculture, feed & animal care, beauty & personal care, building, construction & infrastructure, chemical manufacturing & industrial and consumer goods & appliances. The company has over 103 manufacturing sites in about 31 countries around the world.

-

Saint-Gobain S.A. is engaged in designing, manufacturing, and distributing high-performance materials and building materials. In addition, the company provides solutions for energy efficiency, growth challenges, and protection of the environment.

Some of the emerging market participants are Anco Products, Inc., American Rockwool Manufacturing, LLC., Byucksan, and Cellofoam North America, Inc.

-

Anco Products, Inc. is involved in the production and supply of insulation to various industries in Canada, the U.S., and the UK. It is also engaged in manufacturing and marketing air-duct systems and fiberglass insulation products.

-

Byucksan is involved in the production of different building products, including ceiling systems, insulation systems, exterior systems, interior systems, and floor systems.

Key North America Building Thermal Insulation Companies:

The following are the leading companies in the North America building thermal insulation market. These companies collectively hold the largest market share and dictate industry trends.

- Anco Products, Inc.

- Atlas Roofing Corporation

- Cellofoam North America Inc.

- Certain Teed Corporation

- GAF Material Corporation

- Huntsman International LLC

- Johns Manville Corporation

- Knauf Insulation

- Owens Corning

- ROCKWOOL Insulation A/S

- Dow Inc.

- DuPont

- Kingspan Group

Recent Developments

-

In July 2023, Kingspan Insulated Panels North America announced its QuadCore Technology is now standard on all its panels used in cold storage applications. This is the next generation of self-blended hybrid insulation core. The class-leading R-value of R-9.0 per inch for cold storage applications means QuadCore is one of the most thermally efficient insulation cores available on the market. Kingspan’s QuadCore Technology delivers R-values 11% better than high-quality PIR and up to 60% better than PUR.

-

In December 2023, Saint-Gobain S.A. announced the sale of 75% of its stake in its polyisocyanurate insulation (PIR) activity in the United Kingdom under the Celotex brand to SOPREMA, which manufactures and sells PIR insulation across Europe.

North America Building Thermal Insulation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.88 billion

Revenue forecast in 2030

USD 11.72 billion

Growth Rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America

Country scope

U.S., Canada, Mexico

Key companies profiled

Anco Products, Inc., Atlas Roofing Corporation, Cellofoam North America Inc., Certain Teed Corporation, GAF Material Corporation, Huntsman International LLC, Johns Manville Corporation, Knauf Insulation, Owens Corning, ROCKWOOL Insulation A/S, Dow Inc., DuPont and Kingspan Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Building Thermal Insulation Market Report Segmentation

This report forecasts revenue & volume growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the North America building thermal insulation market based on product, application, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Glass Wool

-

Mineral Wool

-

EPS

-

XPS

-

Cellulose

-

PIR Foam

-

PU Foam

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Roof

-

Wall

-

Floor

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America building thermal insulation market size was estimated at USD 8.52 billion in 2023 and is expected to reach USD 8.88 billion in 2024.

b. The North America building thermal insulation market is expected to grow at a compound annual growth rate a CAGR of 4.7 % from 2024 to 2030 to reach USD 11.72 billion by 2030.

b. On the basis of products, the glass wool accounted for the largest revenue share of 51.1% in 2023 as it offers energy efficient thermal and acoustic insulation, as well as fire safety. It helps to reduce energy consumption and fluctuations in temperature.

b. Some key players operating in the North America building thermal insulation market include Anco Products, Inc., Atlas Roofing Corporation, Cellofoam North America Inc., Certain Teed Corporation, GAF Material Corporation, Huntsman International LLC, Johns Manville Corporation, Knauf Insulation, Owens Corning, ROCKWOOL Insulation A/S, Dow Inc., DuPont and Kingspan Group

b. The increasing demand for energy-efficient buildings, owing to the stringent government regulations and rising awareness regarding environmental degradation, is anticipated to fuel the demand for building thermal insulation in North America.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.