- Home

- »

- Pharmaceuticals

- »

-

Biomarkers Market Size And Share, Industry Report, 2030GVR Report cover

![Biomarkers Market Size, Share & Trends Report]()

Biomarkers Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Efficacy, Validation), By Product, By Application (Drug Discovery & Development, Personalized Medicine), By Disease, By Region, And Segment Forecasts

- Report ID: 978-1-68038-979-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Biomarkers Market Summary

The global biomarkers market size was estimated at USD 81.04 billion in 2023 and is projected to reach USD 194.21 billion by 2030, growing at a CAGR of 13.36% from 2024 to 2030. The rising prevalence of cancer, significance of companion diagnostics, investments in research, and significant innovations owing to ongoing research are anticipated to drive market growth.

Key Market Trends & Insights

- The North America led the market with a revenue share of 43.94% in 2023.

- Asia Pacific is anticipated to attain the fastest CAGR from 2024 to 2030.

- Based on type, the safety segment held the largest revenue share of 37.62% in 2023.

- Based on product, the consumables segment led the market in 2023.

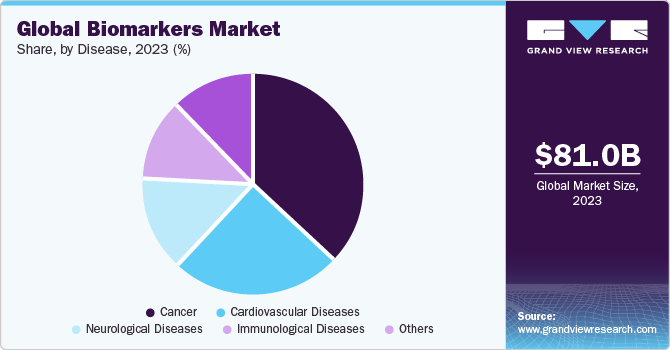

- Based on disease, the cancer segment led the market in 2023 and is expected to retain its dominance from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 81.04 Billion

- 2030 Projected Market Size: USD 194.21 Billion

- CAGR (2024-2030): 13.36%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

For instance, in February 2023, National Institutes of Health announced funding of USD 4 million to Eastern Virginia Medical School (EVMS) for research and development of biomarker for early detection of aggressive prostate cancer.Increase in the prevalence of fatal diseases has been observed over the past few years, which includes cancer, diabetes, cardiovascular disorders, and other chronic diseases. One of the major factors leading to an increase in their prevalence is lifestyle changes. According to the American Cancer Society, in 2022, an estimated 1.9 million new cancer cases are expected to be registered in the U.S., accounting for 609,360 deaths. Breast and lung cancers were observed as the most common ones worldwide. According to the World Health Organization (WHO), in 2022, an estimated 236,740 new cases of lung cancer were expected to be reported in the U.S., accounting for 130,180 deaths.

The use of biomarkers in infectious disease diagnosis is anticipated to become increasingly common in the upcoming years. For instance, as per Frontiers in Microbiology in 2020 , potential MicroRNA-based biomarkers have been identified for the diagnosis of infections such as influenza infections, rhinoviruses, HIV, tuberculosis, malaria, Ebola, and Hendra virus. These are aimed at facilitating early onset of infectious diseases. Biomarkers are also under study for the diagnosis of SARS-CoV-2. They have a high prognostic potential, which is projected to play a crucial role in the diagnosis of asymptomatic cases that hinder the tracking of pandemic cases. Furthermore, the high stability despite freeze and thaw cycles gives them an added advantage.

Innovative treatments that combine biomarkers with new or existing medicines are continuously being launched. For instance, biomarkers can now be used for the treatment of neurological diseases to track brain health by measuring molecules. Recent developments are making treatment of neurological diseases easier, for example, the development of biomarker signatures. This has resulted in noninvasive testing, faster drug development, and early diagnosis. R&D is leading to the discovery of novel biomarkers.

The emergence of digital biomarker which assists pharmaceutical companies with contextual and supplementary information to conclude clinical trial decisions is further propelling growth of the market. IXICO plc, a digital technology-based company that has expertise in neurosciences, is collaborating with biopharmaceutical companies to validate clinically digital biomarkers and use them in regulatory compliant clinical trials. Another new biomarker technology published in PLOS Journal in June 2021 is bowel cancer relapse detection biomarkers with the help of ctDNA. This can be used as a prognostic tool that predicts the recurrence with a 100% accuracy rate, thereby enabling better treatment.

Leading players are focusing on introducing programs that can increase the commercialization of biomarker-based products. For instance, in November 2022, NeoGenomics, under the sponsorship of ImmunoGen, launched a novel biomarker testing program for patients with Epithelial Ovarian Cancer (EOC). This initiative targeted FRα in patients with platinum-resistant EOC and increased patient access to FDA-approved ImmunoGen's ADC, ELAHERE. Similarly, in April 2021, Amgen launched a Biomarker Assist Program for metastatic Non-Small Cell Lung Cancer (NSCLC) patients and increased access to testing.

Market Concentration & Characteristics

Market growth stage is high and the pace is accelerating. The biomarkers market is characterized by a high degree of innovation fueled by rapid technological advancements. R&D is leading to the discovery of novel biomarkers. For instance, as per Nature Journal in 2020 , tetranectin is a potential biomarker for heart failure diagnosis. Similarly, in 2020, sTNFR2 was revealed as a novel biomarker for the diagnosis of acute adult T-cell leukemia/lymphoma. The market is likely to witness lucrative growth over the forecast period due to such discoveries and technological advancements.

The industry is also characterized by a high level of partnership and collaboration activity by the leading players. It is one of the most adopted strategies by the players to enhance early commercialization of their products and improve the availability of products. For instance, in March 2023, Koneksa extended its partnership with SSI Strategy to scale and accelerate the adoption of digital biomarkers.

The biomarker segment is witnessing rapid technological advancements and high demand for personalized medicine. Thus, to ensure patient access to these new technologies, a reimbursement framework needs to be worked upon to meet the changing market scenario. This will potentially encourage manufacturers to invest in new products as reimbursement policies have a direct impact on the development and growth of diagnostic & prognostic tools.

The market players undertake this strategy to strengthen their product portfolios and offer diverse technologically advanced & innovative products to their customers. This is the most prominently adopted strategy by the companies to attract more customers. For instance, in July 2022, the U.S. FDA granted Breakthrough Device Designation to Elecsys Amyloid Plasma Panel for early detection of Alzheimer’s disease. Roche is the first IVD manufacturer to receive Breakthrough Device Designation for a blood-based biomarker test for Alzheimer’s.

Type Insights

The safety segment held the largest revenue share of 37.62% in 2023. Safety biomarkers can be used to customize therapies for patients, due to high risk of adverse reactions. They can predict or detect exposure effects or adverse drug events. Increase in the use of safety biomarkers in drug discovery & development is anticipated to boost market growth.Furthermore, an increase in population at high risk of developing various diseases, such as cancer, cardiovascular conditions, and kidney disorders, is expected to positively influence the market. Growing awareness of routine health checkups and lower drug attrition rates, which have been linked to biomarker-based therapies, are driving segment growth.

The efficacy biomarkers segment is expected to grow at the fastest CAGR from 2024 to 2030. Efficacy biomarkers aid in predicting patient responses to a specific drug. Despite the challenges in research, several findings have been reported on efficacy biomarkers. For instance, ATPase-copper Transporting β Polypeptide (ATP7B) is a biomarker used for detection of ovarian cancer. Furthermore, collaborative efforts between companies and academic institutes are expected to enhance the discovery of biomarkers. For instance, in June 2023, the National Cancer Institute announced the launch of ComboMatch platform trial which helps researchers to test efficacy of treatment combinations.

Product Insights

The consumables segment led the market in 2023. The growing emphasis on personalized and precision medicine has led to a growing need for biomarkers to identify specific disease markers and tailor treatment plans accordingly. This drives the demand for consumables used in biomarker discovery and validation. Moreover, the rising prevalence of chronic diseases such as cardiovascular diseases, cancer, and neurodegenerative disorders have led to an increase in consumption of consumables further driving market growth.

The services segment is anticipated to exhibit a lucrative CAGR over the projected period. Biomarkers are used in clinical trials for patient stratification, monitoring treatment responses, and assessing safety. Biomarker services support the design, implementation, and analysis of clinical trials, ensuring that biomarkers are effectively utilized for decision-making in drug development. Moreover, clinical laboratories and diagnostic service providers offer biomarker-based diagnostic testing services for various diseases. These services help in the accurate and reliable detection of biomarkers, contributing to early disease diagnosis and monitoring.

Application Insights

The drug discovery & development segment dominated the market in 2023. Biomarkers can be beneficial for accelerating drug development for certain diseases by predicting drug efficacy more easily than conventional clinical endpoints. Hence, they can help in identifying candidates that are likely to fail, thereby reducing drug development costs. Therefore, key players operating in this segment are focused on using biomarkers in drug development, which is leading to strategic alliances and thus driving the market.For instance, in June 2022, InterVenn Biosciences collaborated with the Foundation for the National Institutes of Health’s Biomarker Consortium and the Worldwide Innovative Network (WIN) Consortium, which aims to advance clinical trials, improve patient care, enhance precision oncology, and accelerate biomarker discovery.

The diagnostics segment is projected to register the fastest CAGR from 2024 to 2030. The increasing research focused on identification of new diagnostic biomarkers is fueling this growth. For instance, in February 2022, Japanese scientists found two new diagnostic tissue biomarkers, PHGDH and TRIM29, indicated for malignant pleural mesothelioma. These can be used to diagnose mesothelioma quickly and help doctors in differentiating between mesothelioma and other cancers.R&D in the segment confirms the development of novel biomarkers for early-stage detection of diseases such as Alzheimer's.

Disease Insights

The cancer segment led the market in 2023 and is expected to retain its dominance from 2024 to 2030. The growth of this segment is attributed to an increase in demand for rapid & accurate diagnostic tools and rise in global incidence of cancer. According to Global Cancer Observatory, about 19.3 million new cancer cases were recorded in 2020, while around 10 million cancer deaths were reported in the same year. In addition, growth in research activities for discovery and development of novel cancer biomarkers is widening the scope for market growth. In June 2022, researchers from the Tokyo University of Agriculture and Technology developed a novel technique based on DNA computation for the identification of cancer miRNA patterns. By using low concentrations of the target biomarkers, the new technique can be a promising tool for early cancer diagnosis.

The immunological diseases segment is expected to attain the fastest CAGR from 2024 to 2030. This is mainly attributed to the increase in research aided with the rising prevalence of immunological diseases. For instance, in May 2023, according to article published by Boston Children’s Hospital, researchers have identified immune biomarkers that have helped in predicting COVID-19 severity and are mostly likely to help in future pandemics.Furthermore, increasing R&D in the renal biomarkers segment is anticipated to fuel the segment’s growth. For instance, in May 2022, researchers from the University of Houston, with the help of immunoproteomics-based discovery studies, reported potential biomarkers related to lupus nephritis related to clinical parameters, such as renal pathology indices. These biomarkers for lupus nephritis can be used to provide more reliable clinical blood tests for the disease, replacing kidney biopsy, which is a currently used invasive test.

Regional Insights

North America led the market with a revenue share of 43.94% in 2023, due to high disease burden, technological advancements, increased consumer awareness, supportive government initiatives, and improvements in healthcare infrastructure. Local presence of key players is anticipated to increase the penetration of novel biomarkers. Major players operating in the market include Abbott; Merck & Co., Inc.; Johnson & Johnson Services, Inc.; Thermo Fisher Scientific, Inc.; and Bio-Rad Laboratories, Inc.; Many academic institutions, research centers, and universities are collaborating with key market players to develop biomarkers for diagnosing and monitoring numerous diseases. Increasing efforts for the development of digital biomarkers and increasing investments as well as collaboration activities are anticipated to drive growth.

Asia Pacific is anticipated to attain the fastest CAGR from 2024 to 2030. Factors such as high prevalence of cancer, surge in funding for discovery, low cost of clinical trials in developing nations, and rising research initiatives are expected to support regional growth. Several advancements in R&D by biopharmaceutical companies are expected to positively impact the market. For instance, in December 2021, Denovo Biopharma LLC announced the discovery of a novel genetic marker for a gene therapy-based medicine. This would facilitate treatment for patients with recurrent high-grade glioma, an unmet medical need with estimated survival of less than a year.

Key Companies & Market Share Insights

Some of the leading market players include F. Hoffmann-La Roche AG, Abbott, QIAGEN, and PerkinElmer Incorporated. Key players are focusing on geographic expansions and gaining market approvals for innovative products. These players are heavily investing in advanced technology and infrastructure, allowing them to efficiently process & analyze a large volume of samples. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Atlas Genetics Ltd.; Hologic, Inc.;Myriad Genetics, Inc.; and Genomic Health, Inc. are some of the emerging market participants. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Biomarkers Companies:

- F. Hoffmann-La Roche AG

- Epigenomics AG

- Abbott

- Thermo Fisher Scientific Inc

- General Electric

- Eurofins Scientific

- Johnson & Johnson Services, Inc.

- QIAGEN

- Bio-Rad Laboratories, Inc.

- Siemens Healthineers AG

- Merck KGaA

- PerkinElmer Inc.

- Agilent Technologies, Inc.

Recent Developments

-

In October 2023, Labcorp announced the launch of tri-biomarkers blood test for diagnosis of Alzheimer’s disease.

-

In October 2023, Mindray announced the launch of high-sensitivity NT-proBNP and troponin I (hs-cTnI) cardiac biomarkers. The launch is expected to enhance the company’s product portfolio of cardiac biomarkers used in the management and diagnosis of cardiovascular diseases.

-

In August 2023 , Quest Diagnostics entered into partnership with Envision Sciences for the commercial launch of novel prostate cancer biomarker test for identification of severe and aggressive forms of the disease.

-

In February 2023, Cardio Diagnostics Holdings Inc. announced the launch of PrecisionCHD, a epigenetic-genetic blood test for early diagnosis of coronary heart disease.

Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 91.52 billion

Revenue forecast in 2030

USD 194.21 billion

Growth rate

CAGR of 13.36% from 2024 to 2030

Historical data

2023

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, application, disease, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

F. Hoffmann-La Roche AG.; Abbott; Epigenomics AG; General Electric; Johnson & Johnson Services, Inc.; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; Siemens Healthineers AG; QIAGEN; Merck KGaA; PerkinElmer Inc.; Agilent Technologies, Inc.; Eurofins Scientific

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Biomarkers Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the biomarkers market report based on type, product, application, disease, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Safety Biomarkers

-

Efficacy Biomarkers

-

Predictive Biomarkers

-

Surrogate Biomarkers

-

Pharmacodynamic Biomarkers

-

Prognostics Biomarkers

-

Validation Biomarkers

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumable

-

Services

-

Software

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Drug Discovery & Development

-

Personalized Medicine

-

Disease Risk Assessment

-

Others

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Safety Biomarkers

-

Efficacy Biomarkers

-

Predictive Biomarkers

-

Surrogate Biomarkers

-

Pharmacodynamic Biomarkers

-

Prognostics Biomarkers

-

Validation Biomarkers

-

-

Cardiovascular Diseases

-

Safety Biomarkers

-

Efficacy Biomarkers

-

Predictive Biomarkers

-

Surrogate Biomarkers

-

Pharmacodynamic Biomarkers

-

Prognostics Biomarkers

-

Validation Biomarkers

-

-

Neurological Diseases

-

Safety Biomarkers

-

Efficacy Biomarkers

-

Predictive Biomarkers

-

Surrogate Biomarkers

-

Pharmacodynamic Biomarkers

-

Prognostics Biomarkers

-

Validation Biomarkers

-

-

Immunological Diseases

-

Safety Biomarkers

-

Efficacy Biomarkers

-

Predictive Biomarkers

-

Surrogate Biomarkers

-

Pharmacodynamic Biomarkers

-

Prognostics Biomarkers

-

Validation Biomarkers

-

-

Others

-

Safety Biomarkers

-

Efficacy Biomarkers

-

Predictive Biomarkers

-

Surrogate Biomarkers

-

Pharmacodynamic Biomarkers

-

Prognostics Biomarkers

-

Validation Biomarkers

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global biomarkers market size was valued at USD 81.04 billion in 2023 and is expected to reach USD 91.52 billion by 2024.

b. The global biomarkers market is expected to grow at a compound annual growth rate of 13.36% from 2024 to 2030 to reach USD 194.21 billion by 2030.

b. Cancer dominated the disease segment in 2023 with 37.45% of the market share, driven by a heightened demand for accurate and rapid diagnostic tools as well as a sharp growth in prevalence on a global scale.

b. Some key players operating in the biomarkers market include Abbott; Qiagen; F. Hoffmann-La Roche Ltd.; Thermo Fisher Scientific, Inc.; Siemens Healthineers AG; Bio-Rad Laboratories, Inc.; Johnson & Johnson Services, Inc; and Epigenomics AG.

b. The increasing prevalence of chronic diseases, advancements in the techniques used for the development of biomarker-based diagnostics, and the growing geriatric population are factors likely to boost the biomarkers market significantly throughout the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.