- Home

- »

- Medical Devices

- »

-

Super-resolution Microscopes Market Size Report, 2022-2030GVR Report cover

![Super-resolution Microscopes Market Size, Share & Trends Report]()

Super-resolution Microscopes Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (STED Microscopy, STORM), By Application (Life Science, Nanotechnology), By Region, And Segment Forecasts

- Report ID: 978-1-68038-404-8

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Super-resolution Microscopes Market Summary

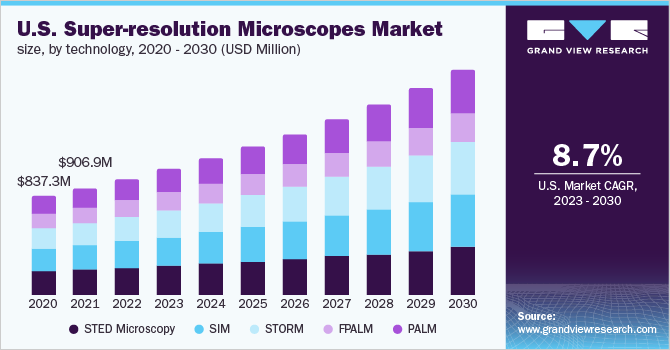

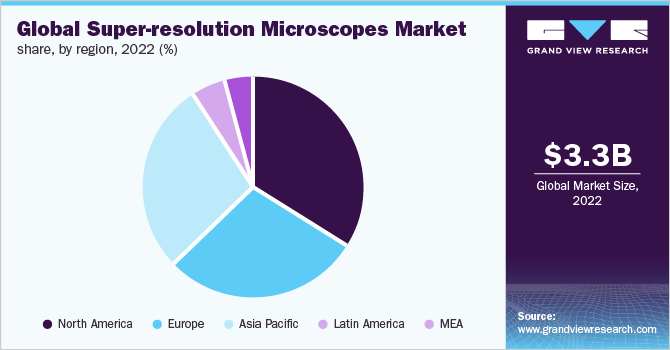

The global super-resolution microscopes market size was estimated at USD 3,317.0 million in 2022 and is projected to reach USD 6,615.1 million by 2030, growing at a CAGR of 9.0% from 2023 to 2030. Increasing applications in the life science industry, technological advancements, and the growing focus on nanotechnology are expected to drive the market during the forecast period.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2022.

- Country-wise, South Africa is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, stimulated emission depletion (STED) microscopy accounted for a revenue of USD 767.0 million in 2022.

- Stochastic Optical Reconstruction Microscopy (STORM) is the most lucrative technology segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 3,317.0 Million

- 2030 Projected Market Size: USD 6,615.1 Million

- CAGR (2023-2030): 9.0%

- North America: Largest market in 2022

Super-resolution microscopes overcome the limitation of confocal as well as fluorescence microscopy as they provide increased X-Y resolution beyond 200 - 250 nm. Super-resolution microscopy is expected to give new insights into ongoing research in medical science and nanotechnology by offering resolutions up to 10-20 nm. These advanced microscopes are used by researchers in medical procedures and diagnoses. For instance, micro-endoscopy is used with the help of multiphoton or other advanced imaging techniques for the long-term application of these tools in novel medical treatment.

Super-resolution microscopes allow the visualization of the cellular sample with a resolution similar to that of an optical fluorescence microscope and diffraction-limited resolution. It is possible to uniquely visualize the desired molecular species in three dimensions, cellular environment, and the live cells.The use of super-resolution microscopy in biological sciences is growing. Currently, nanoimaging and non-diffraction-limited optical methods are altering our understanding of biological phenomena. Advanced super-resolution microscopes allow for molecular analysis. The most recent application of microscopes is a cellular examination at the nanoscale level. STED, the most recent super-resolution microscopy technology, is more compatible with living biological samples, making it valuable in life sciences. SIM has 3D imaging as well as live-cell imaging.

COVID-19 super-resolution microscopes market impact: 8.61% growth from 2020 to 2021

Pandemic Impact

Post COVID Outlook

During the pandemic, a decrease in the manufacturing and supply of all kinds of medical devices, including super-resolution microscopes, has been recorded due to the sudden shut down of activities to prevent the spread of infection.

Post COVID-19, the demand for super-resolution microscopes is expected to rise with the lifting of restrictions on production and supply. The scope of super resolutions microscopes is expected to expand to critical healthcare research on diseases such as cancer in revealing high-order chromatin folding in early carcinogenesis. The growing scope of microscopy in life sciences is driving the market.

Key players invested in supply chain technologies during the later phases of the pandemic. For instance, for improving the supply of stock, Olympus Corporation launched supply chain automation in January 2021, reducing 40% manual power and resulting in a double shipment rate. The application of super-resolution microscopes for COVID-19 studies further propelled the market demand in the later phases of the pandemic.

Post-COVID-19, the latest and advanced microscopes based on new technologies developed during the pandemic are expected to have a high market utility and demand. Increasing government funding for research is also expected to drive the market post-COVID-19. The National Institute for Materials Science, controlled by the Japanese government, is promoting nanotechnology research by supporting the top research organizations in Japan.

The super-resolution microscopes are procured by research labs, national and international institutes, research centers, government-funded labs, and academic labs. The usage of these microscopes is high among the national and international institutes where research on high-risk pathogen is conducted. These microscopes are also purchased by public institutions funded by the government. The demand for super-resolution microscopes is high due to their unique feature of providing ultra-low resolution and other scientific benefits that are not provided by other microscopes.

Technology Insights

The Stimulated Emission Depletion (STED) microscopy segment accounted for the largest revenue share of over 23.12% in 2022 due to its ability to deliver diffraction-unlimited images, with no need for further computational processing. The application of fast-beam scanners has established STED microscopy as one of the quickest super-resolution imaging techniques available as it does not require data processing after the acquisition. STED-FCS (Fluorescence Correlation Spectroscopy) has applications in single-molecule studies on membranes, where it gives data for lipid membrane diffusion. Triplet Relaxation (T-REX) STED microscopy, used to reduce photobleaching, is used for imaging individual neurofilament substructures.

The STORM technology segment is expected to register the highest CAGR of 10.09% during the forecast period. This can be attributed to technological advancements, collaborations between various industry players, and research funded by government organizations.STROM microscopes can be used in conjunction with AX/AR confocal microscopes. Nikon Corporation announced the debut of the AX and AX R confocal microscopes in May 2021. These new microscopes have a newly rebuilt scan head with 8K*8K resolution, ultra-fast resonant scanning, and the biggest 25mm field of view in the world.

FPALM (Fluorescence Photoactivation Localization Microscopy) is used in conjunction with other technologies to improve resolution. PALMIRA (PALM + Independently Running Acquisition) multiplies the data acquisition rate by 100. The application of FPALM in Photoactivatable Green Fluorescent Protein (PA-GFP) has solved numerous biological difficulties that conventional microscopes with poor resolution could not resolve. FPALM's fluorophores labeling allows for motion quantification as well as fixed and live-cell imaging of membranes, cytoskeleton, and cytosolic proteins.

Application Insights

The life science segment held the largest revenue share of over 4o.0% in 2021. This can be attributed to the increasing applications of super-resolution microscopy in the field of research & development and diagnostics. For instance, in the field of neuroscience, the use of fluorescence imaging techniques and specialized probes has provided insights into the cellular structures of neurons. Such data is being used for investigations of neurodegenerative and autoimmune disorders. The growing applicability of super-resolution microscopes in diagnostics is anticipated to fuel the market growth.

The nanotechnology segment is expected to expand at the highest CAGR during the forecast period owing to the increasing application in the visualization of the interaction of nanomaterials with biological entities at high resolution. In addition, the governments of various countries are supporting nanotechnology research and key players are coming up with nanotechnology-based products, which, in turn, is driving the market. For instance, the U.S. government announced 1.7 billion in funding in 2021 for nanotechnology research.

The use of super-resolution microscopy in material science is new, but it is developing quickly. The development of nanomaterials is a hybrid of material science and nanotechnology. Furthermore, super-resolution microscopy is often used to study the spatial distribution of lipid bilayers and other materials. The Institute of Photonic Sciences (ICFO) has a custom-built STORM/PALM for single-molecule detection and localization with super-resolution. The study team is looking for a viable approach to extend the biological application of live-cell imaging by merging a super-resolution microscope with single-molecule-based methods.

Regional Insights

North America held the largest revenue share of over 33.74% in 2022 and will retain its leading position throughout the forecast period. Advanced healthcare facilities, high investment in R&D for understanding the mechanism of various diseases, and extensive drug development activities in the region are projected to fuel the market growth.

Extensive medical research is carried out in the region for studying various disease mechanisms and various pathways that need to be resolved beyond the limit of conventional microscopy. For such cases, super-resolution microscopy plays an important role in the inspection. Leading players in the market like Danaher (parent company for Leica Microsystem) and Applied Precision (GE Healthcare) are headquartered in the U.S., with the manufacturing site present at different locations.

Asia Pacific is expected to register the highest CAGR of 9.75% during the forecast period. This is attributed to the increasing adoption of such microscopy across industries, such as academic life science, biotechnology, pharmaceutical, and nanotechnology. However, the market in Europe is greater as compared to the market in the Asia Pacific, mainly due to the presence of a large number of high-end systems in the region.

Key Companies & Market Share Insights

Collaboration is one of the ongoing trends in this market. For instance, the collaborations of JEOL with Nikon and Carl Zeiss with Seiko in the past years have enhanced the super-resolution microscopes-related product competitiveness, with increased sales, and have also established new markets. Collaborations generally have taken place in the production phase and are expected to increase in the fields, such as development and engineering. Technological knowledge in mechatronics, software, analog electronics, and physics is fundamental to the viability of most companies. Some prominent players in the global super-resolution microscopes market include:

-

ZEISS

-

Applied Precision (GE Healthcare)

-

Nikon Corporation

-

Olympus Corporation

-

Leica Microsystems (Danaher Corporation)

-

Bruker Corporation

-

Hitachi High Technologies

Super-resolution Microscopes Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.6 billion

Revenue forecast in 2030

USD 6.6 billion

Growth Rate

CAGR of 9.04% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany;France; Italy; Spain; Japan; China; Brazil; Mexico; South Africa

Key companies profiled

ZEISS; Nikon Corporation; Olympus Corporation; Leica Microsystems (Danaher Corporation); Hitachi High Technologies; Applied Precision (GE Healthcare); Bruker Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

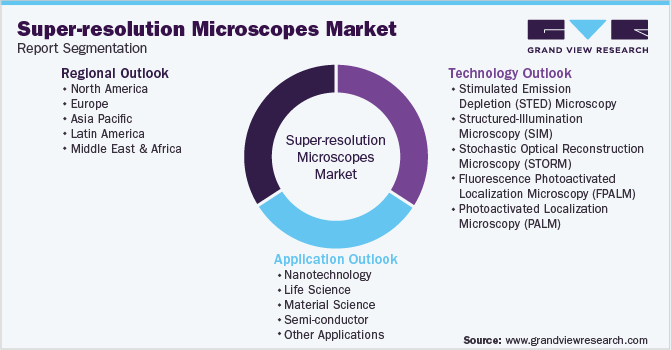

Global Super-resolution Microscopes Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global super-resolution microscopes market report on the basis of technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Stimulated Emission Depletion (STED) Microscopy

-

Structured-Illumination Microscopy (SIM)

-

Stochastic Optical Reconstruction Microscopy (STORM)

-

Fluorescence Photoactivated Localization Microscopy (FPALM)

-

Photoactivated Localization Microscopy (PALM)

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Nanotechnology

-

Life Science

-

Material Science

-

Semi-conductor

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global super-resolution microscopes market size was estimated at USD 3.3 billion in 2022 and is expected to reach USD 3.6 billion in 2023.

b. The global super-resolution microscopes market is expected to grow at a compound annual growth rate of 9.04% from 2023 to 2030 to reach USD 6.6 billion by 2030.

b. North America dominated the super-resolution microscopes market with a share of 33.7% in 2022. This is attributable to advanced healthcare facilities, high investment in research & development for understanding the mechanism of various diseases, extensive drug development activities in the region, as well as the availability of reimbursement facilities for medical treatments.

b. Some key players operating in the super-resolution microscopes market include Carl Zeiss Meditec AG, Nikon Corporation, Olympus Corporation, Leica Microsystems (Danaher Corporation), Hitachi High Technologies, Applied Precision (GE Healthcare), Bruker, Carl Zeiss Meditec AG, and Danaher (with the acquisition of Leica Microsystem and GE healthcare microscopy business).

b. Key factors that are driving the super-resolution microscopes market growth include increasing applications in the life science industry, technological advancements, and a growing focus on nanotechnology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.