- Home

- »

- Plastics, Polymers & Resins

- »

-

Aerospace Plastics Market Size, Share, Growth Report, 2030GVR Report cover

![Aerospace Plastics Market Size, Share & Trends Report]()

Aerospace Plastics Market Size, Share & Trends Analysis Report By Plastic Type (PEEK, PPSU, PC, PEI, PMMA, PA, PPS, PAI, PPE, PU), By Process, By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-189-4

- Number of Pages: 210

- Format: Electronic (PDF)

- Historical Range: 2019 - 2023

- Industry: Bulk Chemicals

Aerospace Plastics Market Size & Trends

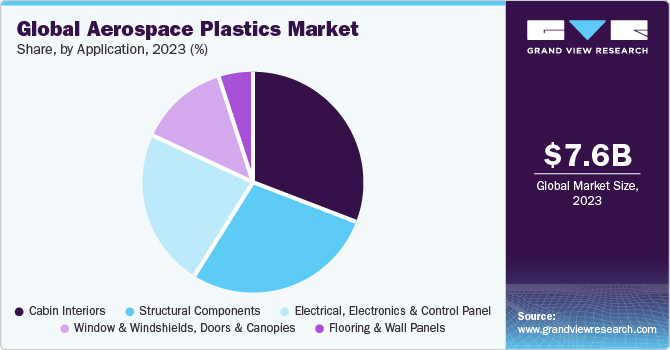

The global aerospace plastics market size was estimated at USD 7.61 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.3% from 2024 to 2030. The increasing demand for plastics in several aerospace applications including cabin interiors, structural components, electrical electronics & control panels, windows, windshields, and canopies is expected to drive the demand for aerospace plastics materials over the next coming years.Plastics being lightweight and highly durable, they are used as an alternative to aluminum and steel components, increasing their share in the overall structure of an airplane.

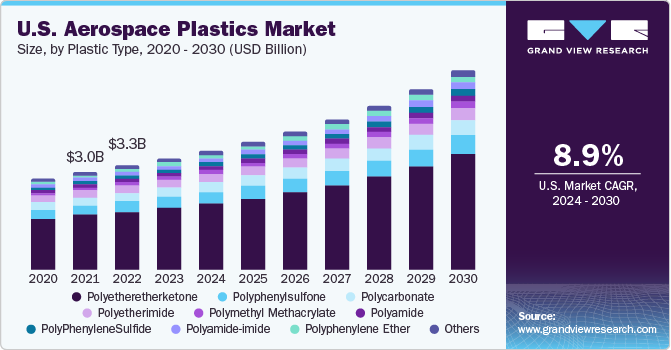

The U.S. market growth is expected to be driven by the rising plastics demand in the aircraft sector. According to the International Trade Administration, U.S. Department of Commerce, the U.S. is considered as the leading country in the global aerospace market. The country hosts a number of aircraft manufacturers such as Boeing, Lockheed Martin Corporation, Gulfstream Aerospace Corporation, and Airbus Helicopters, Inc. among others, which has contributed to the growth of the U.S. aerospace market in the country.

The ongoing developments in aerospace plastics technology along with the rising spending in U.S. aerospace industry is expected to boost the demand for several aerospace plastic types in the industry. According to the Aerospace Industries Association, the U.S. exports from the aerospace and defense sector increased by 11.2% in 2022 and 2023, resulting in the USD 391 billion share of economic value. Also as of September 2023, more than USD 100.0 million has been awarded so far by the U.S. Department of Transportation’s Federal Aviation Administration (FAA) for noise and emission reduction. The award is part of a series of steps to drive innovation across the federal government, aircraft manufacturers, airlines, and fuel producers, thereby positioning American aviation to grow towards net zero emissions by 2050. Such initiatives have driven the demand for substitute materials such as plastics, thus significantly impacting the aerospace plastics market in the U.S.

Aerospace plastics market prices are highly influenced by factors such as shipping & labor costs, currency fluctuations, elasticity of demand & supply, and trade-related tariffs. Since 2023, various geopolitical conflicts in Eastern Europe, Western Asia and Horn of Africa have strained routes of shipping, thereby increasing freight costs, which in turn have added to soaring aerospace plastic grade prices.

Market Concentration & Characteristics

Market growth is driven by rising R&D in the aerospace sector, especially for commercial & freighter aircraft. This leads end-users to spend increasingly on aircraft windows, conductive plastics, technical components, other several interior components, such as valve seats and seals, wire wrap insulation, tray tables and arm rests.

With growing demand patterns, aerospace plastic components companies such as Aero-Plastics, Ensinger GmbH, and Paco Plastics, Inc. are increasing their production capacities. Moreover, the industry is largely characterized by dominance of regional players, leading within their respective regional markets.

Governments of different countries across the world are investing in the aerospace industry. For instance, in June 2023, The UK Government has announced investment of £218 million to support the development of innovative green aviation technology and increase the country market share in the global aerospace industry. Ten innovative new initiatives headed by eminent corporations like Rolls-Royce and Airbus will benefit from the funding infusion. Together with more than 40 partners in the UK, they will contribute to the development of greener, more carbon-efficient, and efficient aircraft parts, including engines, landing gear, wings, and sensors. This is expected to create demand for plastics consumption in the aerospace industry.

In addition, aerospace plastic manufacturers are largely supported by their local governments in the form of subsidies, specialized policies for clearances, and other economic incentives. For example, in January 2023, Toray Industries announced USD 780 million (100 billion yen) investment in rising production capacity for carbon fiber materials used in hydrogen fuel tanks and airplanes by 2025. The strategy includes increasing production of materials used in wind turbine blades, which are primarily produced in Hungary and Mexico.

Plastic Type Insights

The Polyetheretherketone (PEEK) segment held the largest share of 61.51% in 2023. This is attributed to its inherent flame retardancy, excellent stress cracking resistance, outstanding mechanical strength, excellent resistance to rain erosion, and low smoke & toxic gas emissions. Aircraft parts manufactured from PEEK are chemically resistant to hydraulic fluid, water, salt, steam, and jet fuel. Furthermore, the incredible strength and stiffness offered by the most common aerospace plastic make it a suitable alternative to metals such as steel and aluminum.

Polyphenylsulfone (PPSU) Aerospace Plastics Market type is anticipated to grow at a significant CAGR of 8.2% from 2024 to 2030, in terms of Aerospace Plastics Market value. Polyphenyl sulfone (PPSU) is also being used in aircraft components due to its high-temperature resistance (180 °C), good electrical insulation, high impact strength, good chemical compatibility, and favorable dielectric characteristics. Its versatility and compliance with FAA regulations have allowed it to be used in decorative & structural interior components of aircraft. For instance, the Radel brand PPSU from Solvay is used as an alternative to aluminum in the manufacturing of aircraft catering trolleys in the cabin interior. Also, Radel PPSU foam offers better resistance to Skydrol aircraft hydraulic fluid and cleaning agents compared to PEI foam, driving its consumption in the cabin interiors.

Process Insights

Injection molding emerged as the leading process segment and accounted for more than 36.0% in terms of revenue for the global aerospace plastics market in 2023. The injection molding process is significantly used in the production of aerospace parts as it offers repeatable precision with high-volume production. Aerospace parts created through injection molding include housings, lenses, chassis components, panels, bezels, turbine blades, and turbine housings.

The plastic thermoforming process is used in aerospace parts manufacturing on account of benefits such as low tooling costs, high detailing with low costs, ability to produce complex geometry, reduced product development time, and economical large parts manufacturing compared to other aerospace plastic processes.

Application Insights

The cabin interiors application dominated the market and accounted for the largest revenue share of over 31% in 2023. Cabin interiors include seats & seating components, galleys, cabin divider, overhead storage compartment, over-molded aircraft cabin bracket, and other cabin interior components. Earlier aircraft seats consisted of metal composite materials which comply with strict FAA flammability regulations, such as smoke density, vertical burn tests, and heat release tests for aircraft interiors. Moreover, the properties exhibited by the plastic aerospace applications such as lightweight, flame retardancy, cushioning, and other beneficial properties complying with FAA flammability regulations and cost effectiveness have resulted in the inclusion of plastic & plastic composites in seats & seating components. Safran, a global aircraft cabin interior manufacturer uses PEEK polymer and carbon-fibre-LMPAEK composite developed by Victrex plc to manufacture overmoulded aircraft cabin bracket.

The structural components application segment also observed a significant growth in 2023. Structural components consist of aircraft propulsion system components, wingtips, engine parts, rotor, landing gear, fuselage, and other hardware components. Aircraft frame contains the maximum amount of carbon fiber reinforced plastic and composites reducing the weight by 20%. The extended use of composites and plastics in the high-tension loaded environment of the fuselage reduces the maintenance primarily due to fatigue.

End-use Insights

Commercial & freighter aircraft industry dominated the market and held a revenue share of over 72.0% in 2023. The high market share is due to the emergence of several service providers in the air transport industry. The military aircraft segment has also been lucrative, its utilization attributed to growing security and defense concerns. Inclination towards niche air transportation options has led to the exploration of rotary aircraft and gliders for special travel purposes.

Moreover, freight and large passenger aircraft are one of the major end-use industry for plastics in the aerospace industry. The utilization of polymers in aircraft aids in reducing operating cost by reducing the weight and lowers the occurrence of maintenance issues. This has encouraged aircraft manufacturers to potentially increase plastic content in commercial as well as freighter aircraft.

Regional Insights

North America dominated the market and held a revenue share of over 57.0% in 2023 The region is expected to witness a growing demand for fuel-efficient aircraft in the next eight years on account of the rising fuel prices. High replacement rate mainly for regional aircraft is driving the growth in the matured North American aerospace plastics market. The urge to modify/replace the existing inefficient aircraft with a fuel-efficient airplane is expected to augment aerospace plastics market growth in the region. Traditionally, the U.S. aerospace plastics market was driven by high demand in aerospace applications, increasing usage in the production of exterior and interior aircraft components.

In terms of revenue, Western Europe is likely to grow at a CAGR of over 9.5% from 2024 to 2030, on account of the availability of skilled engineers and the glut of investments seen in research and development. The presence of aircraft manufacturing companies in France including European consortiums along with French participants (ATR, EADS, etc.), has bolstered the Western European aerospace polymers market.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In October 2023, Demgy Group acquired E.I.S. Aircraft GmbH, a German company that manufactures thermoplastic and composite components for aerospace. Demgy Group will be able to consolidate its activities in Germany and support its regional leadership through the acquisition, boosting the processing of high value-added plastics, composites, and high-performance polymers for the aeronautics industry.

-

In July 2023, JayKay Enterprises acquired a 76.41% ownership stake in Allen Reinforced Plastics Private Limited (Allen) for USD 10.9 million (~INR 90 crore).JayKay Enterprises will benefit from the acquisition of Allen Reinforced Plastics by expanding its foothold in the defense and aerospace sectors.

Key Aerospace Plastics Companies:

- Victrex plc

- Ensinger

- SABIC

- Solvay

- BASF SE

- Evonik Industries AG

- Toray Advanced Composites

- Saint Gobain Aerospace

- DuPont

- Celanese Corporation

- Sumitomo Chemical Co., Ltd.

- Covestro AG

- the Mitsubishi Chemical Group of companies

- PPG Industries, Inc.

- Röchling

Aerospace Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.61 billion

Revenue forecast in 2030

USD 13.89 billion

Growth rate

CAGR of 9.3% from 2024 to 2030

Historical data

2019 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Plastic type, process, application, end-use, region

Regional scope

North America, Western Europe, Eastern Europe, China, Asia, Southeast Asia, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, France, UK, Italy, Spain, China, India, Japan, Indonesia, Thailand, Brazil, Argentina, Saudi Arabia, United Arab Emirates, and South Africa

Key companies profiled

Victrex plc; Ensinger; SABIC; Solvay; BASF SE; Evonik Industries AG; Toray Advanced Composites; Saint Gobain Aerospace; DuPont; Celanese Corporation; Sumitomo Chemical Co., Ltd.; Covestro AG; the Mitsubishi Chemical Group of companies; PPG Industries, Inc.; and Röchling;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace Plastics Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Aerospace Plastics Market report based on plastic type, process, application, end-use, and region:

-

Plastic Type Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Polyetheretherketone (PEEK)

-

Polyphenylsulfone (PPSU)

-

Polycarbonate (PC)

-

Polyetherimide (PEI)

-

Polymethyl Methacrylate (PMMA)

-

Polyamide (PA)

-

PolyPhenyleneSulfide (PPS)

-

Polyamide-imide (PAI)

-

Polyphenylene ether (PPE)

-

Polyurethane (PU)

-

Others

-

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Injection Molding

-

Thermoforming

-

CNC Machining

-

Extrusion

-

3D Printing

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Cabin Interiors

-

Structural Components

-

Electrical, Electronics, And Control Panel

-

Window & Windshields, Doors, And Canopies

-

Flooring & Wall Panels

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2019 - 2030)

-

Commercial & Freighter Aircraft

-

General Aviation

-

Military Aircraft

-

Mechanical Engineering & Heavy Industries

-

Rotary Aircraft

-

- Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Western Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

-

Eastern Europe

-

China

-

Asia

-

Japan

-

India

-

-

Southeast Asia

-

Indonesia

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aerospace plastics market size was estimated at USD 7.14 billion in 2022 and is expected to reach USD 7.61 billion in 2023.

b. The global aerospace plastics market is expected to witness a compound annual growth rate of 9.0% from 2023 to 2030 to reach USD 13.89 billion by 2030.

b. Polyetheretherketone (PEEK) in the product segment accounted for the largest share of more than 61.4% in 2022 in terms of revenue. This is attributed to the inherent flame retardancy, excellent stress cracking resistance, outstanding mechanical strength, excellent resistance to rain erosion, and low smoke & toxic gas emissions properties of PEEK.

b. SABIC, BASF SE, Solvay, Victrex plc, Evonik Industries AG, Röchling, DuPont, Toray Advanced Composites, and Sumitomo Chemical Company are some of the key players operating in the aerospace plastics market.

b. Key factors that are driving the market growth include due to their durability, high strength, light weight, and high corrosion and chemical resistance and their increasing use for assembling heads-up-displays, night vision systems, firearms, and other military and aerospace applications.

Table of Contents

Chapter 1 Aerospace Plastics Market: Methodology and Scope

1.1 Research Methodology

1.2 Research scope and assumptions

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GVR’s Internal Database

1.3.3 Secondary Sources

1.3.4 Third-Party Perspective

1.3.5 Primary Research

1.4 Information Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation and Data Visualization

1.6 Data Validation and Publishing

1.7 List of Abbreviations

Chapter 2 Aerospace Plastics Market: Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot

2.3 Competitive Landscape Snapshot

Chapter 3 Aerospace Plastics Market: Variables, Trends, and Scope

3.1 Market Lineage Outlook

3.1.1 Global Plastics Market Outlook

3.2 Penetration & growth prospect mapping

3.3 Industry Value Chain Analysis

3.3.1 Raw Material Trends

3.3.1.1 Ethylene

3.3.1.2 Propylene

3.3.1.3 Bisphenol A

3.4 Technology Overview

3.4.1.1 Injection Molding

3.4.1.2 3D Printing

3.5 Regulatory Frameworks

3.5.1 Federal Aviation Regulation

3.5.2 Airbus Standard

3.5.3 Boeing Safety Standard

3.5.4 American Society for Testing and Materials (ASTM)

3.5.5 European Union AViation Safety AGency (EASA)

3.6 Market Dynamics

3.6.1 Market Driver Analysis

3.6.1.1 Growing use of plastics and plastic composites as substitutes for conventional materials used in aircraft manufacturing

3.6.1.2 Flourishing Global Aviation Sector

3.6.1.3 Increasing instances of retiring old aircraft, growing global demand for narrow-body aircraft, and launching of modernized aircraft

3.6.1.4 Surging adoption of plastics in aircraft designs

3.6.2 Market Restraint Analysis

3.6.2.1 Fluctuations in Crude Oil Prices and supply disruptions owing to prevailing geopolitical tensions

3.6.3 Market Opportunity Analysis

3.6.3.1 Development of Biobased plastics for use in aerospace applications

3.6.4 Market Challenge Analysis

3.6.4.1 High costs of plastic resins and plastic composites and their increased fabrication costs

3.7 Business Environment Analysis: Aerospace Plastics Market

3.7.1 Porter’s Five Force Analysis

3.7.2 PESTEL Analysis

3.8 COVID-19 Impact on Aerospace Plastics Market

3.9 Eastern Europe Geopolitical Conflict Implication Overview

3.10 Process Automation Overview; Challenges & Opportunities Ahead

3.10.1 Automation in Injection Molding

3.10.2 Automation in thermoforming

3.10.3 Challenges related to plastic processing automation

3.10.4 Opportunities related to plastic processing automation

Chapter 4 Aerospace Plastics Market: Plastic Type Estimates & Analysis

4.1 Aerospace Plastics Market: Plastic Type Movement Analysis, 2021 & 2030

4.2 Polyether Ether Ketone (PEEK)

4.2.1 Aerospace Plastics Market Estimates and Forecasts, By Polyether ether ketone, 2019 - 2030 (Tons) (USD Million)

4.3 Polyphenylsulfone (PPSU)

4.3.1 Aerospace Plastics Market Estimates and Forecasts, By polyphenylsulfone, 2019 - 2030 (Tons) (USD Million)

4.4 Polycarbonate (PC)

4.4.1 Aerospace Plastics Market Estimates and Forecasts, By polycarbonate, 2019 - 2030 (Tons) (USD Million)

4.5 Polyetherimide (PEI)

4.5.1 Aerospace Plastics Market Estimates and Forecasts, By polyetherimide, 2019 - 2030 (Tons) (USD Million)

4.6 Polymethyl methacrylate (PMMA)

4.6.1 Aerospace Plastics Market Estimates and Forecasts, By polymethyl methacrylate, 2019 - 2030 (Tons) (USD Million)

4.7 Polyamide (PA)

4.7.1 Aerospace Plastics Market Estimates and Forecasts, By polyamide, 2019 - 2030 (Tons) (USD Million)

4.8 PolyPhenyleneSulfide (PPS)

4.8.1 Aerospace Plastics Market Estimates and Forecasts, By polyphenylenesulfide, 2019 - 2030 (Tons) (USD Million)

4.9 Polyamide-imide (PAI)

4.9.1 Aerospace Plastics Market Estimates and Forecasts, By Polyamide-imide, 2019 - 2030 (Tons) (USD Million)

4.10 Polyphenylene Ether (PPE)

4.10.1 Aerospace Plastics Market Estimates and Forecasts, By polyphenylene ether, 2019 - 2030 (Tons) (USD Million)

4.11 Polyurethane (PU)

4.11.1 Aerospace Plastics Market Estimates and Forecasts, By polyurethane, 2019 - 2030 (Tons) (USD Million)

4.12 Others

4.12.1 Aerospace Plastics Market Estimates and Forecasts, By polyphenylene ether, 2019 - 2030 (Tons) (USD Million)

Chapter 5 Aerospace Plastics Market: Process Estimates & Analysis

5.1 Aerospace Plastics Market: Process Movement Analysis, 2021 & 2030

5.2 Injection Molding

5.2.1 Aerospace Plastics Market Estimates and Forecasts, By injection molding, 2019 - 2030 (Tons) (USD Million)

5.3 Thermoforming

5.3.1 Aerospace Plastics Market Estimates and Forecasts, By thermoforming, 2019 - 2030 (Tons) (USD Million)

5.4 CNC Machining

5.4.1 Aerospace Plastics Market Estimates and Forecasts, By CNC Machining, 2019 - 2030 (Tons) (USD Million)

5.5 Extrusion

5.5.1 Aerospace Plastics Market Estimates and Forecasts, By Extrusion, 2019 - 2030 (Tons) (USD Million)

5.6 3D Printing

5.6.1 Aerospace Plastics Market Estimates and Forecasts, By 3D printing, 2019 - 2030 (Tons) (USD Million)

5.7 Others

5.7.1 Aerospace Plastics Market Estimates and Forecasts, By others, 2019 - 2030 (Tons) (USD Million)

Chapter 6 Aerospace Plastics Market: Application Estimates & Trend Analysis

6.1 Aerospace Plastics Market: Application Movement Analysis, 2021 & 2030

6.2 Cabin Interiors

6.2.1 Aerospace Plastics Market Estimates and Forecasts, By Cabin Interiors, 2019 - 2030 (Tons) (USD Million)

6.3 Structural Components

6.3.1 Aerospace Plastics Market Estimates and Forecasts, By Structural components, 2019 - 2030 (Tons) (USD Million)

6.4 Electrical, Electronics, and Control Panel

6.4.1 Aerospace Plastics Market Estimates and Forecasts, By Electrical, Electronics, and Control Panel, 2019 - 2030 (Tons) (USD Million)

6.5 Windows & Windshields, Doors, and Canopies

6.5.1 Aerospace Plastics Market Estimates and Forecasts, By Window & Windshields, Doors, and Canopies, 2019 - 2030 (Tons) (USD Million)

6.6 Flooring & Wall Panels

6.6.1 Aerospace Plastics Market Estimates and Forecasts, By Flooring & Wall Panel, 2019 - 2030 (Tons) (USD Million)

Chapter 7 Aerospace Plastics Market: End-use Estimates & Trend Analysis

7.1 Aerospace Plastics Market: End-use Movement Analysis, 2021 & 2030

7.2.1 Aerospace Plastics Market Estimates and Forecasts, By commercial & freighter aircraft, 2019 - 2030 (Tons) (USD Million)

7.3 General Aviation

7.3.1 Aerospace Plastics Market Estimates and Forecasts, By General aviation, 2019 - 2030 (Tons) (USD Million)

7.4 Military Aircraft

7.4.1 Aerospace Plastics Market Estimates and Forecasts, By Military Aircraft, 2019 - 2030 (Tons) (USD Million)

7.5 Rotary Aircraft

7.5.1 Aerospace Plastics Market Estimates and Forecasts, By Rotary Aircraft, 2019 - 2030 (Tons) (USD Million)

Chapter 8 Aerospace Plastics Market: Region Estimates & Trend Analysis

8.1 Aerospace Plastics market: Region Movement Analysis, 2021 & 2030

8.2 North America

8.2.1 North America Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.2.2 North America Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.2.3 North America Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.2.4 North America Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.2.5 North America Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.2.6 U.S.

8.2.6.1 U.S. Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.2.6.2 U.S. Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.2.6.3 U.S. Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.2.6.4 U.S. Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.2.6.5 U.S. Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.2.7 Canada

8.2.7.1 Canada Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.2.7.2 Canada Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.2.7.3 Canada Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.2.7.4 Canada Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.2.7.5 Canada Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.2.8 Mexico

8.2.8.1 Mexico Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.2.8.2 Mexico Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.2.8.3 Mexico Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.2.8.4 Mexico Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.2.8.5 Mexico Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.3 Western Europe

8.3.1 Western Europe Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.3.2 Western Europe Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.3.3 Western Europe Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.3.4 Western Europe Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.3.5 Western Europe Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.3.6 Germany

8.3.6.1 Germany Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.3.6.2 Germany Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.3.6.3 Germany Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.3.6.4 Germany Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.3.6.5 Germany Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.3.7 France

8.3.7.1 France Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.3.7.2 France Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.3.7.3 France Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.3.7.4 France Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.3.7.5 France Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.3.8 U.K.

8.3.8.1 U.K. Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.3.8.2 U.K. Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.3.8.3 U.K. Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.3.8.4 U.K. Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.3.8.5 U.K. Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.4 Eastern Europe

8.4.1 Eastern Europe Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.4.2 Eastern Europe Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.4.3 Eastern Europe Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.4.4 Eastern Europe Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.4.5 Eastern Europe Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.5 China

8.5.1 China Aerospace Plastics market estimates and forecasts, 2019 - 2030 (tons) (USD Million)

8.5.2 China Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.5.3 China Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.5.4 China Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.5.5 China Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.6 Asia

8.6.1 Asia Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.6.2 Asia Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.6.3 Asia Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.6.4 Asia Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.6.5 Asia Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.6.6 India

8.6.6.1 India Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.6.6.2 India Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.6.6.3 India Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.6.6.4 India Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.6.6.5 India Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.6.7 Japan

8.6.7.1 Japan Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.6.7.2 Japan Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.6.7.3 Japan Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.6.7.4 Japan Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.6.7.5 Japan Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.7 Southeast Asia

8.7.1 Southeast Asia Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.7.2 Southeast Asia Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.7.3 Southeast Asia Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.7.4 Southeast Asia Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.7.5 Southeast Asia Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.7.6 Indonesia

8.7.6.1 Indonesia Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.7.6.2 Indonesia Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.7.6.3 Indonesia Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.7.6.4 Indonesia Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.7.6.5 Indonesia Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.8 Central & South America

8.8.1 Central & South America Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.8.2 Central & South America Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.8.3 Central & South America Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.8.4 Central & South America Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.8.5 Central & South America Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.8.6 Brazil

8.8.6.1 Brazil Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.8.6.2 Brazil Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.8.6.3 Brazil Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.8.6.4 Brazil Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.8.6.5 Brazil Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.9 Middle East & Africa

8.9.1 Middle East & Africa Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.9.2 Middle East & Africa Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.9.3 Middle East & Africa Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.9.4 Middle East & Africa Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.9.5 Middle East & Africa Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.9.6 Saudi Arabia

8.9.6.1 Saudi Arabia Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.9.6.2 Saudi Arabia Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.9.6.3 Saudi Arabia Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.9.6.4 Saudi Arabia Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.9.6.5 Saudi Arabia Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

8.9.7 United Arab Emirates (UAE)

8.9.7.1 United Arab Emirates Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

8.9.7.2 United Arab Emirates Aerospace Plastics market estimates and forecasts, by Plastic Type, 2019 - 2030 (Tons) (USD Million)

8.9.7.3 United Arab Emirates Aerospace Plastics market estimates and forecasts, by Process, 2019 - 2030 (Tons) (USD Million)

8.9.7.4 United Arab Emirates Aerospace Plastics market estimates and forecasts, by Application, 2019 - 2030 (Tons) (USD Million)

8.9.7.5 United Arab Emirates Aerospace Plastics market estimates and forecasts, by End-use, 2019 - 2030 (Tons) (USD Million)

Chapter 9 Competitive Landscape

9.1 Recent Developments & Their Impact Analysis, by Key Market Participants

9.1.1 Key Companies/Competition Categorization

9.2 Vendor Landscape

9.2.1 List of Key Distributors & Channel Partners

9.2.2 List of Key Potential Customers/End-Users

9.3 List of Equipment Suppliers

9.4 Public & Private Companies

9.4.1 Competitive Dashboard Analysis

Chapter 10 Company Profiles

10.1 Victrex plc

10.1.1 Company Overview

10.1.2 Financial Performance

10.1.3 Product benchmarking

10.2 Ensinger

10.2.1 Company Overview

10.2.2 Product benchmarking

10.2.3 Strategic Initiatives

10.3 SABIC

10.3.1 Company Overview

10.3.2 Financial Performance

10.3.3 Product benchmarking

10.3.4 Strategic Initiatives

10.4 Solvay

10.4.1 Company Overview

10.4.1 Financial Performance

10.4.2 Product Benchmarking

10.4.3 Strategic Initiatives

10.5 BASF SE

10.5.1 Company Overview

10.5.2 Financial Performance

10.5.3 Product Benchmarking

10.6 Evonik Industries AG

10.6.1 Company overview

10.6.2 Financial performance

10.6.3 Product benchmarking

10.6.4 Strategic Initiatives

10.7 Toray Advanced Composites

10.7.1 Company overview

10.7.2 Product benchmarking

10.7.3 Strategic initiatives

10.8 Saint-Gobain Aerospace

10.8.1 Company Overview

10.8.2 Product benchmarking

10.9 DuPont de Nemours, Inc.

10.9.1 Company overview

10.9.2 Financial performance

10.9.3 Product Benchmarking

10.10 Celanese Corporation

10.10.1 Company overview

10.10.2 Financial performance

10.10.3 Product benchmarking

10.10.4 Strategic initiatives

10.11 Sumitomo Chemical Co., Ltd.

10.11.1 Company overview

10.11.2 Financial performance

10.11.3 Product benchmarking

10.12 Covestro AG

10.12.1 Company overview

10.12.2 Financial performance

10.12.3 Product benchmarking

10.13 Mitsubishi Chemical Group of Companies

10.13.1 Company Overview

10.13.2 Financial performance

10.13.3 Product benchmarking

10.14 PPG Industries, Inc.

10.14.1 Company Overview

10.14.2 Financial performance

10.14.3 Product benchmarking

10.14.4 strategic initiatives

10.15 Röchling

10.15.1 Company Overview

10.15.2 Product benchmarking

List of Tables

Table 1 List of Abbreviations

Table 2 Aerospace Plastics market estimates and forecasts, by polyether ether ketone, 2019 - 2030 (Tons) (USD Million)

Table 3 Aerospace Plastics market estimates and forecasts, by polyphenylsulfone, 2019 - 2030 (Tons) (USD Million)

Table 4 Aerospace Plastics market estimates and forecasts, by polycarbonate, 2019 - 2030 (Tons) (USD Million)

Table 5 Aerospace Plastics market estimates and forecasts, by polyetherimide, 2019 - 2030 (Tons) (USD Million)

Table 6 Aerospace Plastics market estimates and forecasts, by polymethyl methacrylate, 2019 - 2030 (Tons) (USD Million)

Table 7 Aerospace Plastics market estimates and forecasts, by polyamide, 2019 - 2030 (Tons) (USD Million)

Table 8 Aerospace Plastics market estimates and forecasts, by polyphenylenesulfide, 2019 - 2030 (Tons) (USD Million)

Table 9 Aerospace Plastics market estimates and forecasts, by polyamide-imide, 2019 - 2030 (Tons) (USD Million)

Table 10 Aerospace Plastics market estimates and forecasts, by polyphenylene ether, 2019 - 2030 (Tons) (USD Million)

Table 11 Aerospace Plastics market estimates and forecasts, by polyurethane, 2019 - 2030 (Tons) (USD Million)

Table 12 Aerospace Plastics market estimates and forecasts, by polyphenylene ether, 2019 - 2030 (Tons) (USD Million)

Table 13 Aerospace Plastics market estimates and forecasts, by injection molding, 2019 - 2030 (Tons) (USD Million)

Table 14 Aerospace Plastics market estimates and forecasts, by thermoforming, 2019 - 2030 (Tons) (USD Million)

Table 15 Aerospace Plastics market estimates and forecasts, by CNC machining, 2019 - 2030 (Tons) (USD Million)

Table 16 Aerospace Plastics market estimates and forecasts, by extrusion, 2019 - 2030 (Tons) (USD Million)

Table 17 Aerospace Plastics market estimates and forecasts, by 3D printing, 2019 - 2030 (Tons) (USD Million)

Table 18 Aerospace Plastics market estimates and forecasts, by others, 2019 - 2030 (Tons) (USD Million)

Table 19 Aerospace Plastics market estimates and forecasts, by Cabin Interiors, 2019 - 2030 (Tons) (USD Million)

Table 20 Aerospace Plastics market estimates and forecasts, by structural components, 2019 - 2030 (Tons) (USD Million)

Table 21 Aerospace Plastics market estimates and forecasts, by electrical, electronics, and control panel, 2019 - 2030 (Tons) (USD Million)

Table 22 Aerospace Plastics market estimates and forecasts, by Window & Windshields, Doors, and Canopies, 2019 - 2030 (Tons) (USD Million)

Table 23 Aerospace Plastics market estimates and forecasts, by Flooring & Wall Panels, 2019 - 2030 (Tons) (USD Million)

Table 24 Aerospace Plastics market estimates and forecasts, by commercial & freighter aircraft, 2019 - 2030 (Tons) (USD Million)

Table 25 Aerospace Plastics market estimates and forecasts, by general aviation, 2019 - 2030 (Tons) (USD Million)

Table 26 Aerospace Plastics market estimates and forecasts, by military aircraft, 2019 - 2030 (Tons) (USD Million)

Table 27 Aerospace Plastics market estimates and forecasts, by rotary aircraft, 2019 - 2030 (Tons) (USD Million)

Table 28 North America Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 29 North America Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 30 North America Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 31 North America Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 32 North America Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 33 North America Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 34 North America Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 35 North America Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 36 North America Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 37 U.S. Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 38 U.S. Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 39 U.S. Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 40 U.S. Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 41 U.S. Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 42 U.S. Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 43 U.S. Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 44 U.S. Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 45 U.S. Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 46 Canada Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 47 Canada Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 48 Canada Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 49 Canada Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 50 Canada Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 51 Canada Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 52 Canada Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 53 Canada Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 54 Canada Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 55 Mexico Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 56 Mexico Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 57 Mexico Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 58 Mexico Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 59 Mexico Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 60 Mexico Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 61 Mexico Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 62 Mexico Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 63 Mexico Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 64 Western Europe Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 65 Western Europe Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 66 Western Europe Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 67 Western Europe Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 68 Western Europe Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 69 Western Europe Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 70 Western Europe Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 71 Western Europe Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 72 Western Europe Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 73 Germany Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 74 Germany Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 75 Germany Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 76 Germany Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 77 Germany Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 78 Germany Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 79 Germany Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 80 Germany Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 81 Germany Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 82 France Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 83 France Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 84 France Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 85 France Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 86 France Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 87 France Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 88 France Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 89 France Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 90 France Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 91 U.K. Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 92 U.K. Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 93 U.K. Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 94 U.K. Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 95 U.K. Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 96 U.K. Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 97 U.K. Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 98 U.K. Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 99 U.K. Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 100 Eastern Europe Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 101 Eastern Europe Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 102 Eastern Europe Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 103 Eastern Europe Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 104 Eastern Europe Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 105 Eastern Europe Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 106 Eastern Europe Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 107 Eastern Europe Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 108 Eastern Europe Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 109 China Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 110 China Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 111 China Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 112 China Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 113 China Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 114 China Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 115 China Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 116 China Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 117 China Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 118 Asia Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 119 Asia Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 120 Asia Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 121 Asia Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 122 Asia Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 123 Asia Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 124 Asia Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 125 Asia Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 126 Asia Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 127 India Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 128 India Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 129 India Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 130 India Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 131 India Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 132 India Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 133 India Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 134 India Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 135 India Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 136 Japan Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 137 Japan Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 138 Japan Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 139 Japan Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 140 Japan Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 141 Japan Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 142 Japan Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 143 Japan Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 144 Japan Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 145 Southeast Asia Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 146 Southeast Asia Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 147 Southeast Asia Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 148 Southeast Asia Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 149 Southeast Asia Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 150 Southeast Asia Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 151 Southeast Asia Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 152 Southeast Asia Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 153 Southeast Asia Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 154 Indonesia Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 155 Indonesia Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 156 Indonesia Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 157 Indonesia Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 158 Indonesia Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 159 Indonesia Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 160 Indonesia Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 161 Indonesia Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 162 Indonesia Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 163 Central & South America Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 164 Central & South America Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 165 Central & South America Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 166 Central & South America Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 167 Central & South America Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 168 Central & South America Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 169 Central & South America Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 170 Central & South America Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 171 Central & South America Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 172 Brazil Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 173 Brazil Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 174 Brazil Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 175 Brazil Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 176 Brazil Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 177 Brazil Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 178 Brazil Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 179 Brazil Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 180 Brazil Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 181 Middle East & Africa Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 182 Middle East & Africa Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 183 Middle East & Africa Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 184 Middle East & Africa Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 185 Middle East & Africa Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 186 Middle East & Africa Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 187 Middle East & Africa Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 188 Middle East & Africa Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 189 Middle East & Africa Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 190 Saudi Arabia Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 191 Saudi Arabia Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 192 Saudi Arabia Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 193 Saudi Arabia Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 194 Saudi Arabia Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 195 Saudi Arabia Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 196 Saudi Arabia Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 197 Saudi Arabia Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 198 Saudi Arabia Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

Table 199 United Arab Emirates Aerospace Plastics market estimates and forecasts, 2019 - 2030 (Tons) (USD Million)

Table 200 United Arab Emirates Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (Tons)

Table 201 United Arab Emirates Aerospace Plastics market estimates and forecasts, by plastic type, 2019 - 2030 (USD Million)

Table 202 United Arab Emirates Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (Tons)

Table 203 United Arab Emirates Aerospace Plastics market estimates and forecasts, by process, 2019 - 2030 (USD Million)

Table 204 United Arab Emirates Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (Tons)

Table 205 United Arab Emirates Aerospace Plastics market estimates and forecasts, by application, 2019 - 2030 (USD Million)

Table 206 United Arab Emirates Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (Tons)

Table 207 United Arab Emirates Aerospace Plastics market estimates and forecasts, by end-use, 2019 - 2030 (USD Million)

List of Figures

Fig. 1 Information procurement

Fig. 2 Primary research pattern

Fig. 3 Primary Research Process

Fig. 4 Market research approaches - Bottom-Up Approach

Fig. 5 Market research approaches - Top-Down Approach

Fig. 6 Market research approaches - Combined Approach

Fig. 7 Aerospace Plastics Market - Market Snapshot

Fig. 8 Aerospace Plastics Market - Segment Snapshot (1/4)

Fig. 9 Aerospace Plastics Market - Segment Snapshot (2/4)

Fig. 10 Aerospace Plastics Market - Segment Snapshot (3/4)

Fig. 11 Aerospace Plastics Market - Segment Snapshot (4/4)

Fig. 12 Aerospace Plastics Market - Competitive Landscape Snapshot

Fig. 13 Global Plastics Market, 2017 - 2028 (USD Million)

Fig. 14 Aerospace Plastics Market: Penetration & Growth Prospect Mapping

Fig. 15 Aerospace Plastics Market: Value Chain Analysis

Fig. 16 Aluminum Prices, 2019 - 2021 (USD/Metric Tons)

Fig. 17 Aircraft Deliveries, 2016 - 2021 (Units)

Fig. 18 Brent and WTI Crude Oil Prices, January 2022 - August 2022 (USD/Barrel)

Fig. 19 Aerospace Plastics Market: Porter’s Five Forces Analysis

Fig. 20 Aerospace Plastics Market: PESTEL Analysis

Fig. 21 Aerospace Plastics Market: Plastic Type Movement Analysis, 2021 & 2030

Fig. 22 Aerospace Plastics Market: Process Movement Analysis, 2021 & 2030

Fig. 23 Aerospace Plastics Market: Application Movement Analysis, 2021 & 2030

Fig. 24 Aerospace Plastics Market: End-use Movement Analysis, 2021 & 2030

Fig. 25 Aerospace Plastics Market: Region Movement Analysis, 2021 & 2030

Fig. 26 Aerospace Plastics Market: Competitive Dashboard AnalysisWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Aerospace Plastics Type Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

- Polyetheretherketone (PEEK)

- Polyphenylsulfone (PPSU)

- Polycarbonate (PC)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- PolyPhenyleneSulfide (PPS)

- Polyamide-imide (PAI)

- Polyphenylene ether (PPE)

- Polyurethane (PU)

- Others

- Aerospace Plastics Process Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

- Injection Molding

- Thermoforming

- CNC Machining

- Extrusion

- 3D Printing

- Others

- Aerospace Plastics Application Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

- Cabin Interiors

- Structural Components

- Electrical, Electronics, and Control Panel

- Window & windshields, doors, and canopies

- Flooring & Wall Panels

- Aerospace Plastics End-use Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

- Commercial & freighter aircraft

- General aviation

- Military aircraft

- Rotary aircraft

- Aerospace Plastics Regional Outlook (Volume, Tons; Revenue, USD Million, 2019 - 2030)

- North America

- North America Aerospace Plastics Market, By Plastic Type

- Polyetheretherketone (PEEK)

- Polyphenylsulfone (PPSU)

- Polycarbonate (PC)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- PolyPhenyleneSulfide (PPS)

- Polyamide-imide (PAI)

- Polyphenylene ether (PPE)

- Polyurethane (PU)

- Others

- North America Aerospace Plastics Market, by Process

- Injection Molding

- Thermoforming

- CNC Machining

- Extrusion

- 3D Printing

- Others

- North America Aerospace Plastics Market, by Application

- Cabin Interiors

- Structural Components

- Electrical, Electronics, and Control Panel

- Window & windshields, doors, and canopies

- Flooring & Wall Panels

- North America Aerospace Plastics Market, By End Use

- Commercial & Freighter Aircraft

- General Aviation

- Military Aircraft

- Rotary Aircraft

- U.S.

- U.S. Aerospace Plastics Market, By Plastic Type

- Polyetheretherketone (PEEK)

- Polyphenylsulfone (PPSU)

- Polycarbonate (PC)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- PolyPhenyleneSulfide (PPS)

- Polyamide-imide (PAI)

- Polyphenylene ether (PPE)

- Polyurethane (PU)

- Others

- U.S. Aerospace Plastics Market, by Process

- Injection Molding

- Thermoforming

- CNC Machining

- Extrusion

- 3D Printing

- Others

- U.S. Aerospace Plastics Market, By Application

- Cabin Interiors

- Structural Components

- Electrical, Electronics, and Control Panel

- Window & windshields, doors, and canopies

- Flooring & Wall Panels

- U.S. Aerospace Plastics Market, By End Use

- Commercial & Freighter Aircraft

- General Aviation

- Military Aircraft

- Rotary Aircraft

- U.S. Aerospace Plastics Market, By Plastic Type

- Canada

- Canada Aerospace Plastics Market, By Plastic Type

- Polyetheretherketone (PEEK)

- Polyphenylsulfone (PPSU)

- Polycarbonate (PC)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- PolyPhenyleneSulfide (PPS)

- Polyamide-imide (PAI)

- Polyphenylene ether (PPE)

- Polyurethane (PU)

- Others

- Canada Aerospace Plastics Market, by Process

- Injection Molding

- Thermoforming

- CNC Machining

- Extrusion

- 3D Printing

- Others

- Canada Aerospace Plastics Market, By Application

- Cabin Interiors

- Structural Components

- Electrical, Electronics, and Control Panel

- Window & windshields, doors, and canopies

- Flooring & Wall Panels

- Canada Aerospace Plastics Market, By End Use

- Commercial & Freighter Aircraft

- General Aviation

- Military Aircraft

- Rotary Aircraft

- Canada Aerospace Plastics Market, By Plastic Type

- Mexico

- Mexico Aerospace Plastics Market, By Plastic Type

- Polyetheretherketone (PEEK)

- Polyphenylsulfone (PPSU)

- Polycarbonate (PC)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- PolyPhenyleneSulfide (PPS)

- Polyamide-imide (PAI)

- Polyphenylene ether (PPE)

- Polyurethane (PU)

- Others

- Mexico Aerospace Plastics Market, by Process

- Injection Molding

- Thermoforming

- CNC Machining

- Extrusion

- 3D Printing

- Others

- Mexico Aerospace Plastics Market, By Application

- Cabin Interiors

- Structural Components

- Electrical, Electronics, and Control Panel

- Window & windshields, doors, and canopies

- Flooring & Wall Panels

- Mexico Aerospace Plastics Market, By End Use

- Commercial & Freighter Aircraft

- General Aviation

- Military Aircraft

- Rotary Aircraft

- Mexico Aerospace Plastics Market, By Plastic Type

- North America Aerospace Plastics Market, By Plastic Type

- Western Europe

- Western Europe Aerospace Plastics Market, By Plastic Type

- Polyetheretherketone (PEEK)

- Polyphenylsulfone (PPSU)

- Polycarbonate (PC)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- PolyPhenyleneSulfide (PPS)

- Polyamide-imide (PAI)

- Polyphenylene ether (PPE)

- Polyurethane (PU)

- Others

- Western Europe Aerospace Plastics Market, by Process

- Injection Molding

- Thermoforming

- CNC Machining

- Extrusion

- 3D Printing

- Others

- Western Europe Aerospace Plastics Market, By Application

- Cabin Interiors

- Structural Components

- Electrical, Electronics, and Control Panel

- Window & windshields, doors, and canopies

- Flooring & Wall Panels

- Western Europe Aerospace Plastics Market, By End Use

- Commercial & Freighter Aircraft

- General Aviation

- Military Aircraft

- Rotary Aircraft

- Germany

- Germany Aerospace Plastics Market, By Plastic Type

- Polyetheretherketone (PEEK)

- Polyphenylsulfone (PPSU)

- Polycarbonate (PC)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- PolyPhenyleneSulfide (PPS)

- Polyamide-imide (PAI)

- Polyphenylene ether (PPE)

- Polyurethane (PU)

- Others

- Germany Aerospace Plastics Market, by Process

- Injection Molding

- Thermoforming

- CNC Machining

- Extrusion

- 3D Printing

- Others

- Germany Aerospace Plastics Market, By Application

- Cabin Interiors

- Structural Components

- Electrical, Electronics, and Control Panel

- Window & windshields, doors, and canopies

- Flooring & Wall Panels

- Germany Aerospace Plastics Market, By End Use

- Commercial & Freighter Aircraft

- General Aviation

- Military Aircraft

- Rotary Aircraft

- Germany Aerospace Plastics Market, By Plastic Type

- U.K.

- U.K. Aerospace Plastics Market, By Plastic Type

- Polyetheretherketone (PEEK)

- Polyphenylsulfone (PPSU)

- Polycarbonate (PC)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- PolyPhenyleneSulfide (PPS)

- Polyamide-imide (PAI)

- Polyphenylene ether (PPE)

- Polyurethane (PU)

- Others

- U.K. Aerospace Plastics Market, by Process

- Injection Molding

- Thermoforming

- CNC Machining

- Extrusion

- 3D Printing

- Others

- U.K. Aerospace Plastics Market, By Application

- Cabin Interiors

- Structural Components

- Electrical, Electronics, and Control Panel

- Window & windshields, doors, and canopies

- Flooring & Wall Panels

- U.K. Aerospace Plastics Market, By End Use

- Commercial & Freighter Aircraft

- General Aviation

- Military Aircraft

- Rotary Aircraft

- U.K. Aerospace Plastics Market, By Plastic Type

- France

- France Aerospace Plastics Market, Plastic Type

- Polyetheretherketone (PEEK)

- Polyphenylsulfone (PPSU)

- Polycarbonate (PC)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- PolyPhenyleneSulfide (PPS)

- Polyamide-imide (PAI)

- Polyphenylene ether (PPE)

- Polyurethane (PU)

- Others

- France Aerospace Plastics Market, by Process

- Injection Molding

- Thermoforming

- CNC Machining

- Extrusion

- 3D Printing

- Others

- France Aerospace Plastics Market, By Application

- Cabin Interiors

- Structural Components

- Electrical, Electronics, and Control Panel

- Window & windshields, doors, and canopies

- Flooring & Wall Panels

- France Aerospace Plastics Market, By End Use

- Commercial & Freighter Aircraft

- General Aviation

- Military Aircraft

- Rotary Aircraft

- France Aerospace Plastics Market, Plastic Type

- Eastern Europe

- Eastern Europe Aerospace Plastics Market, By Plastic Type

- Polyetheretherketone (PEEK)

- Polyphenylsulfone (PPSU)

- Polycarbonate (PC)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- PolyPhenyleneSulfide (PPS)

- Polyamide-imide (PAI)

- Polyphenylene ether (PPE)

- Polyurethane (PU)

- Others

- Eastern Europe Aerospace Plastics Market, by Process

- Injection Molding

- Thermoforming

- CNC Machining

- Extrusion

- 3D Printing

- Others

- Eastern Europe Aerospace Plastics Market, By Application

- Cabin Interiors

- Structural Components

- Electrical, Electronics, and Control Panel

- Window & windshields, doors, and canopies

- Flooring & Wall Panels

- Eastern Europe Aerospace Plastics Market, By End Use

- Commercial & Freighter Aircraft

- General Aviation

- Military Aircraft

- Rotary Aircraft

- Eastern Europe Aerospace Plastics Market, By Plastic Type

- China

- China Aerospace Plastics Market, By Plastic Type

- Polyetheretherketone (PEEK)

- Polyphenylsulfone (PPSU)

- Polycarbonate (PC)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- PolyPhenyleneSulfide (PPS)

- Polyamide-imide (PAI)

- Polyphenylene ether (PPE)

- Polyurethane (PU)

- Others

- China Aerospace Plastics Market, by Process

- Injection Molding

- Thermoforming

- CNC Machining

- Extrusion

- 3D Printing

- Others

- China Aerospace Plastics Market, By Application

- Cabin Interiors

- Structural Components

- Electrical, Electronics, and Control Panel

- Window & windshields, doors, and canopies

- Flooring & Wall Panels

- China Aerospace Plastics Market, By End Use

- Commercial & Freighter Aircraft

- General Aviation

- Military Aircraft

- Rotary Aircraft

- China Aerospace Plastics Market, By Plastic Type

- Asia

- Asia Aerospace Plastics Market, By Plastic Type

- Polyetheretherketone (PEEK)

- Polyphenylsulfone (PPSU)

- Polycarbonate (PC)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- PolyPhenyleneSulfide (PPS)

- Polyamide-imide (PAI)

- Polyphenylene ether (PPE)

- Polyurethane (PU)

- Others

- Asia Aerospace Plastics Market, by Process

- Injection Molding

- Thermoforming

- CNC Machining

- Extrusion

- 3D Printing

- Others

- Asia Aerospace Plastics Market, By Application

- Cabin Interiors

- Structural Components

- Electrical, Electronics, and Control Panel

- Window & windshields, doors, and canopies

- Flooring & Wall Panels

- Asia Aerospace Plastics Market, By End Use

- Commercial & Freighter Aircraft

- General Aviation

- Military Aircraft

- Rotary Aircraft

- India

- India Aerospace Plastics Market, By Plastic Type

- Polyetheretherketone (PEEK)

- Polyphenylsulfone (PPSU)

- Polycarbonate (PC)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- PolyPhenyleneSulfide (PPS)

- Polyamide-imide (PAI)

- Polyphenylene ether (PPE)

- Polyurethane (PU)

- Others

- India Aerospace Plastics Market, by Process

- Injection Molding

- Thermoforming

- CNC Machining

- Extrusion

- 3D Printing

- Others

- India Aerospace Plastics Market, By Application

- Cabin Interiors

- Structural Components

- Electrical, Electronics, and Control Panel

- Window & windshields, doors, and canopies

- Flooring & Wall Panels

- India Aerospace Plastics Market, By End Use

- Commercial & Freighter Aircraft

- General Aviation

- Military Aircraft

- Rotary Aircraft

- India Aerospace Plastics Market, By Plastic Type

- Japan

- Japan Aerospace Plastics Market, By Plastic Type

- Polyetheretherketone (PEEK)

- Polyphenylsulfone (PPSU)

- Polycarbonate (PC)

- Polyetherimide (PEI)

- Polymethyl Methacrylate (PMMA)

- Polyamide (PA)

- PolyPhenyleneSulfide (PPS)

- Polyamide-imide (PAI)

- Polyphenylene ether (PPE)

- Polyurethane (PU)

- Others

- Japan Aerospace Plastics Market, by Process