- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Americas Seeds Market Size & Share Analysis Report, 2030GVR Report cover

![Americas Seeds Market Size, Share & Trends Report]()

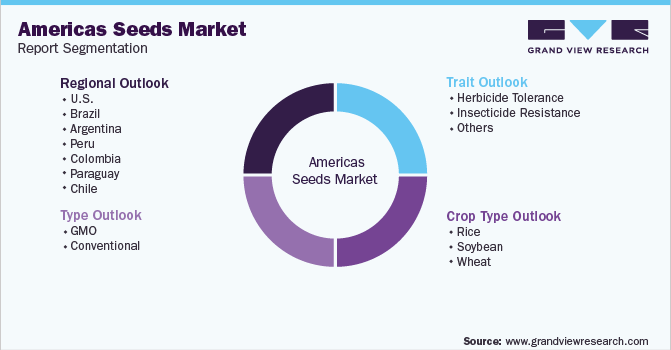

Americas Seeds Market Size, Share & Trends Analysis Report By Type (GMO, Conventional), By Trait (Herbicide Tolerance, Insecticide Resistance), By Crop Type (Rice, Soybean, Wheat), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-029-7

- Number of Report Pages: 93

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

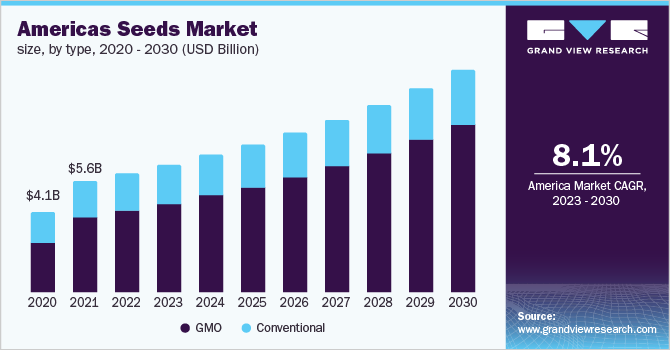

The Americas seeds market size was valued at USD 6.02 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.1% from 2023 to 2030. The growing demand for protein meals and genetically modified crops is a crucial factor driving market growth. Busy & hectic schedules of consumers, especially in urban areas, have resulted in increased incidences of chronic diseases and micronutrient deficiencies. However, changing consumer perceptions and increasing inclination toward a healthy lifestyle are spurring demand for fortified food products. Increasing cases of coronavirus had led governments across the world to impose lockdowns in 2020 to contain the spread of the infection. This created a disturbance in the supply chain of the North America and Central & South America seeds market. Seed processing plants were shut down for a brief period to safeguard the health of workers; however, their operations were resumed shortly as food items fell under the category of essential items.

Supportive bailout plans by the governments helped to ease the difficulties faced by small farmers. For instance, in May 2020, USDA announced direct assistance to farmers through the Coronavirus Food Assistance Program (CFAP). CFAP provided up to USD 16.0 billion to support America’s farmers and ranchers impacted by the coronavirus pandemic.

The market is expected to witness significant growth on account of factors such as the increasing popularity of plant-based meats and drinks, the rising adoption of a vegan diet, and a surge in the number of flexitarian consumers. A vegetarian diet is healthy and lower in calories compared to a meat-based one. Plant-based food helps in weight management as well as is cost-effective. These factors are augmenting the demand for staple crops such as wheat, rice, and soybean.

Soybean is among the best sources of plant-based protein. It is high in protein, as well as soluble and insoluble fiber, making it a key ingredient for protein shakes, sports nutrition, and weight management/replacement meals. Soybean also has a meat-like texture; hence, it is used as a meat alternative to produce soy-based tempeh. The U.S. holds a major market share in the meat substitutes and sports nutrition markets. The country has a large base of manufacturers and consumers and is witnessing high demand for soybean crops.

The demand for commercial seeds is rising rapidly, which is resulting in the mechanization of the production process, the adoption of various agricultural practices, as well as technological improvements. Some of these are the usage of drones and sensors for seed planting & monitoring, robotics aid for seed R&D and other applications, urban farming & hydroponics, and the use of IoT (Internet of Things) in agricultural activities.

Farmers are hiring robotic firms to increase their productivity. For instance, in June 2020, three tractors and planters seeded more than 500 acres of soybeans at a northwest Iowa, U.S. farm without anyone on the tractor. Sabanto, a Chicago-based robotic farming company, helped Bellcock Farms plant seeds using remote-controlled utility tractors, each pulling five-row planters. Several other farmers in Iowa and Illinois have also hired the company to provide robotic planting help.

Type Insights

The GMO segment accounted for a share of 68.2% of the global revenues in 2022. One of the main advantages of GM seeds is that they can help increase crop yield and reduce the need for pesticides and other chemicals. This can lead to cost savings for farmers and can also help reduce the environmental impact of agriculture, driving demand for GMO seeds in the region.

One of the main drivers of the GM seeds market is the increasing demand for food, fueled by a growing global population. GM seeds can increase crop yields, which can help meet the rising demand for food. The market for GM seeds is also being driven by the rising demand for biofuels.

The conventional segment is expected to expand at a CAGR of 4.7% during the period from 2023 to 2030. One of the main advantages of conventional seeds is that they have a long history of safe use. Traditional plant breeding methods have been used for centuries, and there is a well-established track record of the safety of conventionally bred crops. In contrast, genetically-modified (GM) seeds are a relatively new technology and there is an ongoing debate about their safety.

Trait Insights

The herbicide tolerance segment accounted for a revenue share of nearly 53.0% in 2022. The market for herbicide-tolerant seeds is significant, with many farmers relying on these seeds to manage weeds and improve crop yield. In particular, the adoption of genetically engineered herbicide-tolerant crops has increased significantly in recent decades, with some of the most widely grown crops, including corn, soybeans, and cotton that are now available in herbicide-tolerant varieties.

One of the main advantages of herbicide-tolerant seeds is that they allow farmers to use herbicides more effectively and efficiently, reducing the amount of labor and resources needed to control weeds.

According to the U.S. Department of Agriculture (USDA), the percentage of domestic soybean acres planted with herbicide-tolerant (HT) seeds has steadily risen over the years. In 1997, only 17.0% of the domestic soybean acres were planted with HT seeds, but by 2001, this figure had increased to 68.0%. By 2014, 94.0% of domestic soybean acres were planted with HT seeds, and this percentage remained relatively stable, at 95.0%, in 2021 and 2022.

The insecticide resistance segment is expected to expand at a CAGR of 8.1% during the forecast period. There are several ways in which insecticide resistance can be incorporated into crop seeds, including genetic engineering techniques, traditional plant breeding methods, and the use of coatings or treatments that protect seeds from pests. In the U.S., insect-resistant crops containing genes from the soil bacterium Bacillus thuringiensis have been available for cotton and corn crops since 1996. These crops produce insecticidal proteins that help protect against pests.

Crop Type Insights

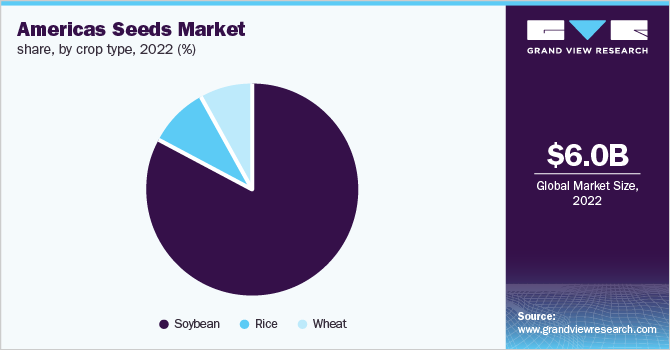

The soybean segment accounted for a share of more than 83.0% of the global revenues in 2022. Soybean is a valuable crop that is widely cultivated in many parts of the world, including North and South America. The U.S., Brazil, and Argentina are the major soybean-producing countries in the region.

According to a paper published in the European Geosciences Union and Copernicus Publications, the majority of the global soybean supply, around 80.0%, is produced by three major soybean-producing regions, namely Southeast South America (SESA), Central Brazil (CB), and the U.S. As reported by the U.S. Department of Agriculture (USDA), 55.0% of all soybeans produced globally come from Latin America, particularly from countries such as Brazil, Argentina, and Paraguay.

The wheat segment is estimated to expand at a CAGR of 5.6% during the forecast period. Wheat is one of the most important staple crops in the world, providing food for more than one-third of the global population. According to the World Economic Forum, the U.S. is the fourth-largest wheat-producing country with a total yield of 1.2 billion tons from 2000 to 2020 comprising 8.4% of the global wheat production. Furthermore, as per the data from the Observatory of Economic Complexity (OEC), Canada and the U.S. were the second and third-largest exporters of wheat in 2020 with an export worth USD 7.13 billion and USD 7.04 billion, respectively.

Regional Insights

The U.S., Brazil, and Argentina are some of the key seed markets in the Americas region. The market in the U.S. is mainly driven by the presence of key players and innovative product strategies undertaken by them. Companies are venturing into partnerships and collaborations for seed research. The growing focus on launching transgenic seeds is driving the growth of the genetically modified seeds market in North and South America.

The growing presence of a few emerging players and the active involvement of global key players in the U.S. has been driving the U.S. seeds market. The concentration in the seeds market has led to high competitive rivalry, which has increased the prices of seeds and traits. The U.S. is one of the largest seed markets globally. According to the USDA, in 2021, soybean production totaled a record 4.44 billion bushels, up by 5.0% from 2020; the harvested area was also up by 5.0% from 2020. This is indicative of the rising demand for soybean seeds in the country.

GM soybean seeds are projected to witness a high growth rate in Brazil owing to increasing product launches by the key market players. For instance, Bayer launched transgenic soybean seed varieties with Intacta 2 Xtend technology in 2020. These seeds were employed with traits such as high resistance against insect and weed pressure. There is an increasing preference for insecticide resistance traits in seeds in Brazil.

Key Companies & Market Share Insights

The seeds industry has been experiencing decent growth in recent years. This is attributed to technological advancements in rice breeding, and growing demand for the crops and soybeans, which is directly tied to the demand for plant-based proteins. The increasing soybean cultivation has led to a rise in demand for seeds, especially in countries such as the U.S., Argentina, and Brazil, where soybean cultivation is highly concentrated.

The soya bean seeds market in North America and Central & South America is competitive, with the presence of many major players and innovators competing in the market. The rice and wheat seeds market is moderately fragmented.

New product launches, collaborations, and partnerships are some of the most important strategies adopted by the key players in the seeds market in North and South America. Companies are introducing new products and implementing product innovation to cater to the growing demand for seeds from farmers and growers.

Some of the key developments and strategic initiatives carried out by the leading manufacturers are listed below:

-

Advanta Seeds and Bunge underwent a partnership to acquire a 20.0% stake each in SeedcorpHO. This investment is intended to expand the company’s market reach in Brazil and strengthen its product portfolio to offer integrated solutions to the farmers

-

Rice Tec Inc. introduced the first medium grain hybrid, RT3202, produced for the southern U.S. market

-

Bayer and RAGT Semences underwent a partnership to develop high-potential hybrid wheat seeds to enhance sustainable agricultural practices in Europe

Some of the prominent key players in Americas seed market include:

-

Bayer AG

-

BASF SE

-

Corteva Agriscience

-

Advanta Seeds

-

Syngenta Corporation

-

Rice Tec, Inc.

-

Lima grain

-

Florimond Desprez

-

AgReliant Genetics, LLC

-

SLC Agrícola

Americas Seeds Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.46 billion

Revenue forecast in 2030

USD 11.27 billion

Growth rate

CAGR of 8.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, trait, crop type, region

Regional Scope

U.S.; Brazil; Argentina; Peru; Colombia; Paraguay; Chile

Key companies profiled

Bayer AG; BASF SE; Corteva Agriscience; Advanta Seeds; Syngenta Corporation; RiceTec, Inc.; Lima grain; Florimond Desprez; AgReliant Genetics, LLC; SLC Agrícola

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Americas Seeds Market Segmentation

This report forecasts revenue growth at country level and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the Americas seeds market based on the type, trait, crop type, and region:

-

Type Outlook (Revenue, USD Million; 2017 - 2030)

-

GMO

-

Conventional

-

-

Trait Outlook (Revenue, USD Million; 2017 - 2030)

-

Herbicide Tolerance

-

Insecticide Resistance

-

Others

-

-

Crop Type Outlook (Revenue, USD Million; 2017 - 2030)

-

Rice

-

Soybean

-

Wheat

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

U.S.

-

Brazil

-

Argentina

-

Peru

-

Colombia

-

Paraguay

-

Chile

-

Frequently Asked Questions About This Report

b. The Americas seeds market size was estimated at USD 6.02 billion in 2022 and is expected to reach USD 6.46 billion in 2023.

b. The Americas seeds market is expected to grow at a compound annual growth rate of 8.1% from 2023 to 2030 to reach USD 11.27 billion by 2030.

b. The soybean segment dominated the Americas seeds market with a share of over 83% in 2022. This is attributable to the versatility of the crop and the ability to thrive in different climatic conditions.

b. Some key players operating in the Americas seeds market include Bayer AG, BASF SE, Corteva Agriscience, Advanta Seeds, and Syngenta Corporation.

b. Key factors that are driving the Americas seeds market growth include the growing demand for protein meals and genetically modified crops, along with changing consumer lifestyles and the resultant inclination towards fortified foods.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."