- Home

- »

- Personal Care & Cosmetics

- »

-

Aroma Chemicals Market Size, Share, Industry Report, 2033GVR Report cover

![Aroma Chemicals Market Size, Share & Trends Report]()

Aroma Chemicals Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Natural, Synthetic, Natural-identical), By Chemicals (Benzenoids, Musk Chemicals, Terpenes & Terpenoids), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-111-1

- Number of Report Pages: 210

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aroma Chemicals Market Summary

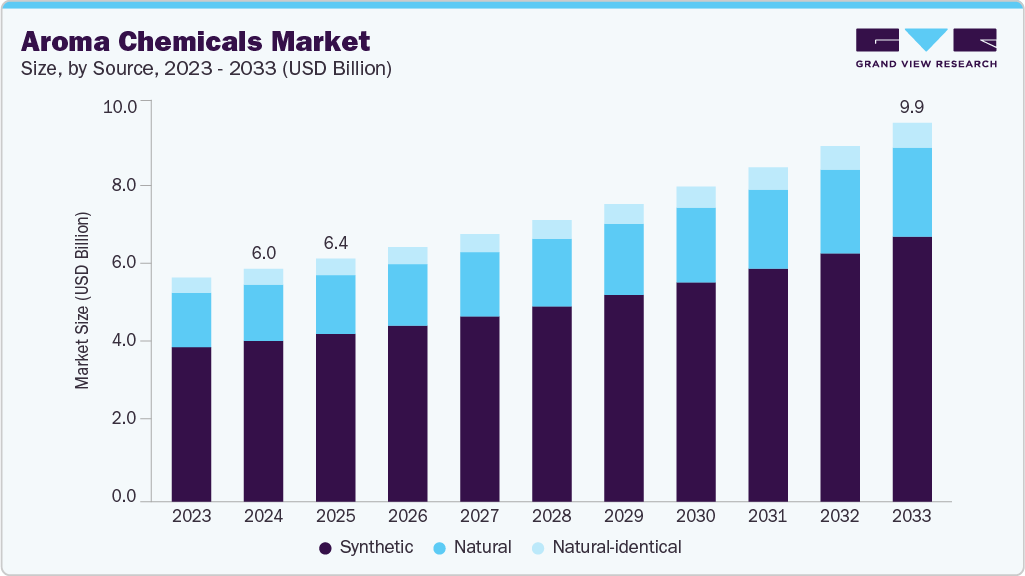

The global aroma chemicals market size was estimated at USD 6,098.2 million in 2024 and is projected to reach USD 9,920.1 million by 2033, growing at a CAGR of 5.7% from 2025 to 2033. The growth is primarily driven by the rising demand for natural and sustainable ingredients across the food & beverage, personal care, and home care industries.

Key Market Trends & Insights

- Asia Pacific dominated the aroma chemicals market with the largest revenue share of 32.7% in 2024.

- The market in China is expected to grow at the significant CAGR of 7.7% from 2025 to 2033.

- By source, the synthetic segment is expected to grow at a significant CAGR of 5.9% from 2025 to 2033 in terms of revenue.

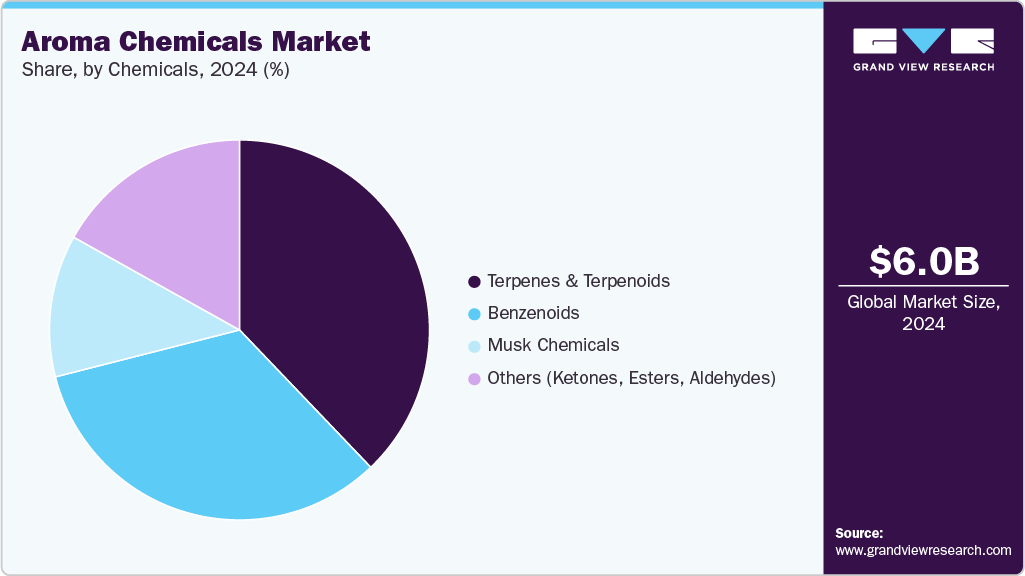

- By chemicals, the terpenes & terpenoids segment held the largest revenue share of 37.9% in 2024 in terms of value.

- By application, the fragrance segment held the largest revenue share of 68.3% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 6,098.2 million

- 2033 Projected Market Size: USD 9,920.1 million

- CAGR (2025-2033): 5.7%

- Asia Pacific: Largest market in 2024

Increasing consumer preference for clean-label and wellness-oriented products, coupled with the expansion of the global fragrance and flavor sectors, is fueling the adoption of both synthetic and bio-based aroma compounds. The global aroma chemicals industry presents significant growth opportunities driven by the accelerating shift toward natural, sustainable, and bio-based ingredients. Advancements in biotechnology, particularly fermentation-based aroma production, are enabling manufacturers to develop high-purity, nature-identical compounds at scale. The growing popularity of functional fragrances in wellness products, aromatherapy, and premium personal care is creating demand for novel and complex aroma profiles.

Despite strong growth potential, the aroma chemicals market faces several challenges, including stringent regulatory frameworks imposed by agencies such as IFRA, REACH, and the FDA, which limit the use of certain synthetic compounds due to health and environmental concerns. Additionally, volatility in the availability and pricing of natural raw materials, driven by climatic conditions and supply chain disruptions, can hinder consistent production.

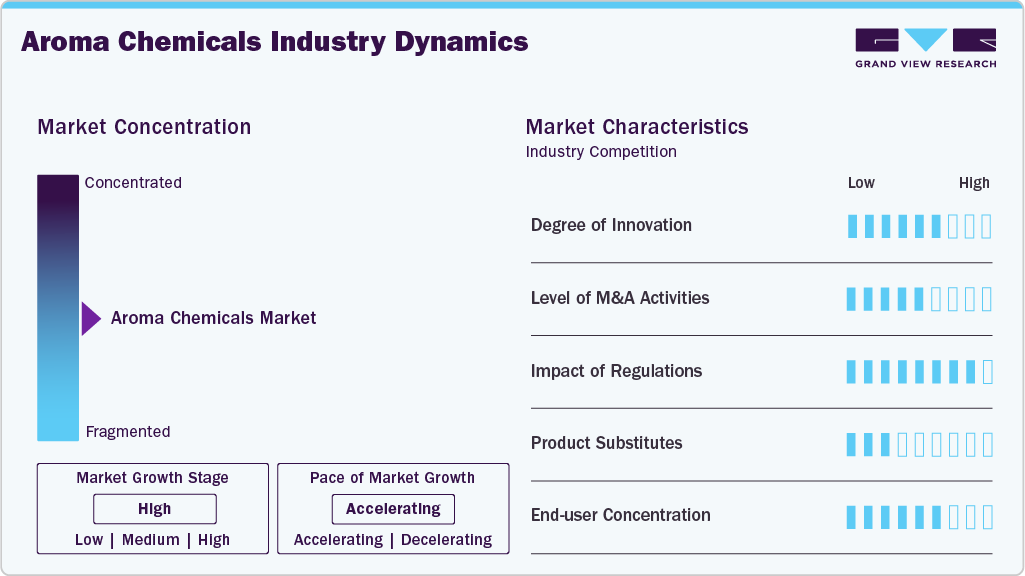

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Privi Organics India Limited, BASF SE, and Kao Corporation, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the market are adopting a combination of strategies to strengthen their market position, including strategic mergers and acquisitions to expand their product portfolios and global footprint. Companies are heavily investing in R&D to develop sustainable, bio-based, and nature-identical aroma compounds that align with evolving consumer preferences and regulatory standards. There is a strong focus on backward integration and securing raw material supply chains to ensure quality and cost stability.

Source Insights

The synthetic segment dominated the market in 2024, accounting for the largest revenue share of 69.9%, primarily due to its cost-effectiveness, scalability, and consistency in quality. Synthetic aroma chemicals are widely used across mass-market applications such as soaps, detergents, air fresheners, and personal care products, where performance and price competitiveness are critical. These compounds offer greater formulation flexibility, longer shelf life, and high olfactory impact, making them a preferred choice for industrial-scale production. Moreover, advancements in synthetic chemistry have enabled the development of complex molecules that replicate natural aromas, further enhancing their adoption in both flavor and fragrance industries.

The natural and natural-identical segments are witnessing steady growth driven by rising consumer demand for clean-label, sustainable, and wellness-oriented products. The natural segment, derived from essential oils, resins, and botanical extracts, is gaining momentum in premium fragrances and organic personal care products, although it remains limited by high costs, supply volatility, and regulatory challenges. The natural-identical segment, synthesized compounds that are chemically identical to natural substances, offers a balance between authenticity and affordability, making it increasingly attractive to formulators aiming for “natural-inspired” positioning without the constraints of natural sourcing. As sustainability and transparency become key differentiators, both these segments are expected to gain further traction over the forecast period.

Application Insights

The fragrance application segment held the largest revenue share of 68.3% in 2024, owing to the extensive use of aroma compounds across a wide range of personal care, home care, and fine fragrance products. Aroma chemicals are integral to enhancing the sensory appeal and brand identity of products such as perfumes, deodorants, lotions, shampoos, soaps, detergents, and air fresheners. The increasing consumer demand for premium, long-lasting, and customized fragrances, particularly in emerging markets and through e-commerce channels, has significantly boosted consumption. Furthermore, the rise of wellness-focused and aromatherapy-based products has contributed to the growing use of both natural and synthetic aroma ingredients in the fragrance sector.

The flavors application segment is also witnessing robust growth, particularly driven by the expansion of the global food and beverage industry and rising consumer preferences for enhanced taste experiences. Within this segment, confectionery, beverages, and bakery products are key contributors, with high usage of esters, aldehydes, and terpenes to deliver fruity, citrusy, and sweet notes. The increasing demand for convenience and ready-to-eat food products further drives the use of aroma chemicals in convenience food, while dairy products utilize flavor compounds to replicate natural butter, cheese, and yogurt profiles. Although smaller in market share compared to fragrance, the flavor segment is steadily gaining momentum, especially with growing interest in clean-label, natural-identical, and functional flavor ingredients.

Chemicals Insights

In 2024, the terpenes & terpenoids segment held the largest revenue share of 37.9%, driven by their widespread use in both flavor and fragrance applications, especially within natural and plant-based product formulations. These compounds, derived from essential oils of citrus fruits, lavender, eucalyptus, and other botanicals, are highly valued for their versatility, natural origin, and aromatic complexity. As consumer demand continues to shift toward natural, wellness-oriented, and clean-label products, terpenes and terpenoids have gained significant traction across fine fragrances, cosmetics, and food and beverage sectors. Additionally, the growing popularity of aromatherapy and functional fragrances has further amplified demand for these bio-based compounds.

The benzenoids segment accounts for a substantial share of the market due to their strong aromatic properties and wide usage in personal care, household products, and fine fragrances. These compounds, such as vanillin and cinnamic acid, are known for their stability and cost-efficiency, making them essential in synthetic fragrance formulations. Musk chemicals, although facing increasing regulatory scrutiny, remain a key component in long-lasting fragrance applications such as deodorants, detergents, and cosmetics, particularly with the growing use of safer alternatives like macrocyclic and polycyclic musks. The others category, comprising ketones, esters, and aldehydes, plays a critical supporting role in creating balanced and layered aroma profiles, especially in specialty and niche formulations. While smaller in revenue share, these compounds are indispensable for enhancing fragrance complexity and flavor authenticity.

Regional Insights

Asia Pacific aroma chemicals market led the global industry in 2024 with a 32.7% revenue share, driven by the rapid growth of personal care, cosmetics, and food & beverage industries across emerging economies. The region benefits from low-cost manufacturing, abundant raw material availability, and rising consumer spending on scented and flavored products. The increasing adoption of Western lifestyle trends and natural formulations has also spurred demand for both synthetic and natural aroma chemicals. Additionally, the expansion of local production facilities by global fragrance houses has further strengthened regional market growth.

China stands as a key contributor within Asia Pacific, supported by its well-established chemical manufacturing base and strong demand for aroma ingredients in personal care, household products, and processed foods. The country’s growing middle class, urbanization, and rising preference for premium and natural products have accelerated the uptake of high-value aroma chemicals. Moreover, China is investing heavily in green chemistry and biotechnological aroma production to reduce environmental impact and comply with evolving international standards.

North America Aroma Chemicals Market Trends

The aroma chemicals market in North America held a 21.4% share in 2024, underpinned by mature end-use sectors such as fine fragrances, cosmetics, and packaged foods. The region continues to witness high demand for innovative, sustainable, and clean-label aroma chemicals, with strong support from regulatory bodies encouraging green formulation practices. The presence of key global flavor and fragrance manufacturers, coupled with significant investments in R&D and natural ingredient sourcing, has kept North America at the forefront of aroma technology innovation.

US Aroma Chemicals Market Trends

The aroma chemicals market in the U.S. is fueled by a robust consumer base for personal care, wellness, and convenience food products. Increasing awareness of health and sustainability has accelerated the shift toward natural and nature-identical aroma compounds. The country also leads in innovation and patent activity, particularly in biotechnology-enabled aroma synthesis, and is home to several major aroma chemical producers and flavor & fragrance conglomerates.

Europe Aroma Chemicals Market Trends

The aroma chemicals market in Europe accounted for 20.8% of the global revenue share in 2024, with a strong heritage in perfumery and flavor innovation. The region maintains stringent regulatory oversight, promoting safer and eco-friendly aroma chemicals. Demand is particularly high in premium cosmetics, fine fragrances, and natural food flavorings, with markets like France, Germany, and the UK leading consumption. Sustainability, traceability, and regulatory compliance are central to product development strategies among European manufacturers.

Germany aroma chemicals market is driven by its advanced chemical industry, focus on sustainability, and strong demand across the personal care, household, and food processing sectors. The country is also a hub for fragrance innovation and is witnessing increasing interest in bio-based and clean-label aroma chemicals. German manufacturers are actively investing in green R&D and digital formulation technologies to cater to both domestic and export demand.

Latin America Aroma Chemicals Market Trends

The aroma chemicals market in Latin America is driven by a growing middle-class population and rising consumption of personal care, home care, and flavored food products. Brazil and Mexico are leading the demand, supported by strong beauty and fragrance cultures. The region offers growth potential for natural aroma ingredients due to its rich biodiversity, although challenges related to economic volatility and regulatory alignment persist.

Middle East & Africa Aroma Chemicals Market Trends

The aroma chemicals market in the Middle East & Africa is experiencing moderate but steady growth, fueled by increasing urbanization, rising disposable incomes, and a strong cultural affinity for fragrances, particularly in the Gulf region. Demand for aroma chemicals is growing across fine fragrances, halal cosmetics, and luxury personal care products. While infrastructure and supply chain constraints remain, investments in local manufacturing and retail expansion are gradually unlocking the region’s market potential.

Key Aroma Chemicals Companies Insights

Key players operating in the aroma chemicals market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Aroma Chemicals Companies:

The following are the leading companies in the aroma chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Privi Organics India Limited

- BASF SE

- Kao Corporation

- Takasgo International Corporation

- Givaudan

- Bell Flowers & Fragrances

- Symrise

- S H Kelkar and Company.

Global Aroma Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6,363.9 million

Revenue forecast in 2033

USD 9,920.1 million

Growth rate

CAGR of 5.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, chemicals, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canda; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

Privi Organics India Limited; BASF SE; Kao Corporation; Takasgo International Corporation; Givaudan; Bell Flowers & Fragrances; Symrise; S H Kelkar and Company

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aroma Chemicals Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global aroma chemicals market report based on source, chemicals, application, and region.

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Natural

-

Synthetic

-

Natural-identical

-

-

Chemicals Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Benzenoids

-

Musk chemicals

-

Terpenes & Terpenoids

-

Others (Ketones, Esters, Aldehydes)

-

- Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Flavors

-

Confectionery

-

Convenience Food

-

Bakery Food

-

Dairy Products

-

Beverages

-

Others

-

-

Fragrance

-

Fine Fragrance

-

Cosmetics and Toiletries

-

Soaps and Detergents

-

Others

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global aroma chemicals market size was estimated at USD 6,098.2 million in 2024 and is expected to reach USD 6,363.9 million in 2025.

b. The global aroma chemicals market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033 to reach USD 9,920.1 million by 2033.

b. The synthetic segment held the largest revenue share in 2024 due to its cost-effectiveness, high stability, and widespread usage across mass-market applications such as soaps, detergents, and packaged foods. Its consistent quality, scalability, and ease of formulation make it a preferred choice for large-scale manufacturing.

b. Some of the key players operating in the aroma chemicals market include Privi Organics India Limited, BASF SE, Kao Corporation, Takasgo International Corporation, Givaudan, Bell Flowers & Fragrances, Symrise. and S H Kelkar and Company.

b. The market is driven by rising demand for scented and flavored consumer products across personal care, home care, and food & beverage industries. Growing preference for clean-label and sustainable ingredients, coupled with advancements in bio-based aroma synthesis, further supports market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.