- Home

- »

- Medical Devices

- »

-

Bio Detectors And Accessories Market Size Report, 2030GVR Report cover

![Bio Detectors And Accessories Market Size, Share & Trends Report]()

Bio Detectors And Accessories Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Application (Clinical, Food & Environmental, Defence), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-764-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bio Detectors And Accessories Market Trends

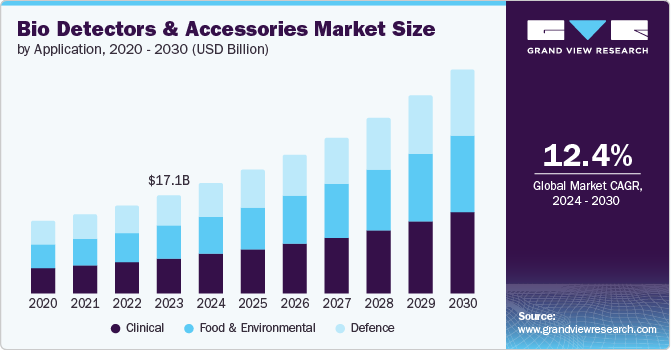

The global bio detectors and accessories market size was valued at USD 17.11 billion in 2023 and is projected to grow at a CAGR of 12.4% from 2024 to 2030. Airborne diseases pose a global health challenge, with approximately 7 million air-pollution-related deaths were estimated by the World Health Organization in 2024. As pollution levels continue to rise, the demand for bio detectors increases, enabling effective detection and monitoring of pathogens and pollutants.

The threat of bio-terrorism remains a critical concern worldwide. Rapid and accurate detection of biological agents is essential for early intervention and prevention. Bio detectors play a crucial role in identifying potential bio-threats, enhancing security and safeguarding public health. In clinical settings, timely detection of infectious diseases is vital for patient management and infection control.

Furthermore, technological advancements in bio detection instruments contribute significantly to market growth. Ongoing research and development have led to innovations such as portable devices, improved sensitivity, and automation. These advancements enhance the efficiency and accuracy of bio detectors, meeting diverse application needs.

Product Insights

The instruments segment dominated the market and accounted for a share of 37.9% in 2023. The market for bio detectors & accessories includes a wide array of devices and instruments used for the identification of biological materials or markers, such as bio-molecules or pathogens. These tools find extensive application in clinical, research, and environmental settings. Accessories may include software, reagents, or consumables necessary for the proper functioning of these detectors. This market offers a diverse range of technologies, including bio-sensors, polymerase chain reaction immune assays, and others, catering to various needs in food safety, agriculture, environmental monitoring and healthcare. Instruments in the detector and accessories sector are essential to identify biological markers or materials. PCR machines, bio-sensors, flow cytometers, mass spectrometers, are commonly used in research institutions, labs and clinics to analyze biological samples and detect specific targets such as infections, genetic material and others.

The reagents and media segment is expected to grow at CAGR of 13.1% in 2024 to 2030. This growth can be attributed to advancement in biodetection technologies which require specialized reagents and media that are essential for accurate detection and analysis of biological substances. Ongoing research efforts in field such as genomics, proteomics and molecular biology drive the need for innovative reagents and media formulations increased demand for point of care testing which allows rapid diagnostics at the patient's location which requires the use of specific reagents and media which are made for portable devices.

Application Insights

The clinical segment accounted for the largest revenue share of 36.1% in 2023. This is attributable to the growing demand for reliable and accurate diagnostic devices in healthcare settings. These detectors play a crucial role in identifying various viruses, biomarkers and illnesses, making them indispensable for doctors in diagnosing and monitoring the health of their patients.

The food & environmental segment is expected to grow at the fastest CAGR of 13.1% during the forecast period. The increasing concerns regarding food safety and environmental pollution are driving the demand for detectors and accessories. As awareness and regulations become more stringent, there is a growing need for advanced instruments to identify diseases, toxins and pollutants in the environment & food.

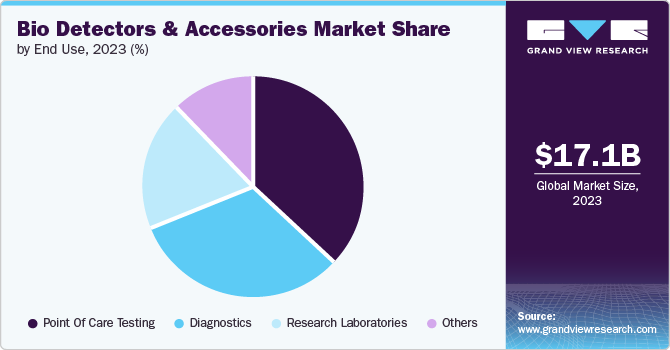

End Use Insights

Point of care testing dominated the market with a revenue share of 37.6% in 2023. With point-of-care testing devices, medical professionals can obtain results rapidly, often within minutes, enabling them to make prompt treatment decisions. Point-of-care testing devices offer a solution to the time-consuming process of sending samples to laboratories and waiting for results. This is particularly beneficial in urgent settings such as emergency rooms or remote areas where immediate findings are crucial. In addition, these devices require fewer resources and transportation compared to standard laboratory testing, potentially reducing the overall cost of testing. Ultimately, point-of-care testing facilitates swift diagnosis and treatment, leading to improved patient outcomes and reduced morbidity rates.

Diagnostics is projected to experience the fastest CAGR during the forecast period. This is primarily due to the increasing demand for rapid and accurate identification of a wide range of diseases, pollutants and infections. As a result of technological advancements, there is a growing requirement for advanced diagnostic devices & accessories to facilitate early diagnosis and detection. In addition, the rise in healthcare awareness, government initiatives for disease control, and the need for point-of-care testing are contributing factors to the growth of this segment.

Regional Insights

North America bio detectors and accessories market dominated the market in 2023. It is attributable to favorable government initiatives to encourage research and development. North America is at the forefront of pioneering bio-detecting accessories and technologies. With a significant number of pharmaceutical firms, research facilities, and academic institutions, the region provides an ideal environment for biotech R&D, leading to the emergence of bio-detection solutions.

U.S. Bio Detectors And Accessories Market Trends

The bio detectors and accessories market in the U.S. dominated the North America market in 2023 due to the increasing cost of healthcare and stringent regulations in safety of health and food which makes sure the quality of food and disease control is propelling the market growth.

Europe Bio Detectors And Accessories Market Trends

Europe bio detectors and accessories market was identified as a lucrative region in 2023 due to government initiatives for disease control and healthcare awareness among the people.

Bio detectors and accessories market in UK is expected to grow rapidly in the coming years due to rise in healthcare awareness and the recent pandemic effect.

Germany bio detectors and accessories market held a substantial market share in 2023 owing to increasing investment in the healthcare segment and technology.

Asia Pacific Bio Detectors And Accessories Market Trends

The Asia Pacific bio detectors and accessories market is anticipated to witness the fastest CAGR in the coming years. This growth is owing to the significantly increasing investments in bio detectors technologies. The need for bio detectors is being driven by growing knowledge and concerns food safety, environmental pollution and disease outbreaks.

Japan bio detectors and accessories market is expected to grow rapidly in the coming years due to the rise in healthcare awareness and government initiatives for disease control.

Bio detectors and accessories market in China held a substantial market share in 2023 owing to recent pandemic effect and the need for point-of-care testing to avoid disease transmission.

Bio Detectors And Accessories Company Insights

Some of the key companies in the bio detectors and accessories market include LightDeck Diagnostics; Thermo Fisher Scientific Inc. Organizations in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Bio-Rad Laboratories, Inc. provides software, instruments, consumables, and reagents, for areas such as gene expression, cell biology, protein purification, drug discovery, food safety, and science education. Their products are based on technologies to separate, identify, purify, amplify and analyze biological materials

-

BERTIN TECHNOLOGIES design and manufacture measurement, observation, and detection systems and instruments for critical or scientific applications.

Recent Developments

- In April 2024, Bio-Rad Laboratories, Inc. introduced ultrasensitive multiplexed digital Polymerase Chain Reaction (PCR) assay, ddPLEX ESR1 Mutation Detection Kit. This new assay enhances the organization’s Droplet Digital PCR offerings for oncology, providing highly sensitive detection assays to support translational research, disease monitoring and therapy selection.

- In March 2023, Heska Corporation announced the successful acquisition of LightDeck Diagnostics. LightDeck is a trailblazer in planar waveguide fluorescence immunoassay diagnostics, boasting robust manufacturing capabilities and research and development expertise.

Bio Detectors And Accessories Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.13 billion

Revenue forecast in 2030

USD 38.64 billion

Growth Rate

CAGR of 12.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, Kuwait, and South Africa

Key companies profiled

Bio-Rad Laboratories, Inc.; PositiveID Corporation; LightDeck Diagnostics; Thermo Fisher Scientific Inc.; Shimadzu Corporation; and BERTIN TECHNOLOGIES.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bio Detectors And Accessories Market Report Segmentation

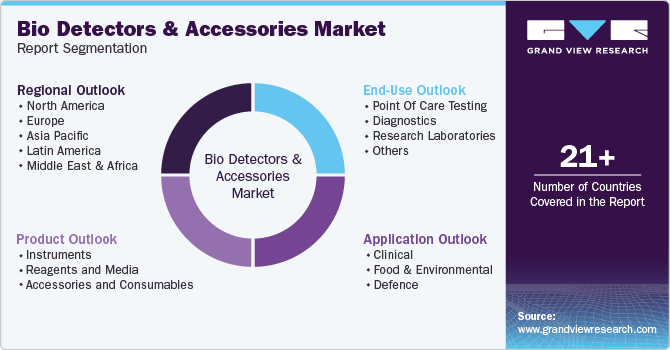

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bio detectors and accessories report based on product, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents and Media

-

Accessories and Consumables

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical

-

Food & Environmental

-

Defence

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Point Of Care Testing

-

Diagnostics

-

Research Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.