- Home

- »

- Biotechnology

- »

-

Proteomics Market Size And Share, Industry Report, 2030GVR Report cover

![Proteomics Market Size, Share & Trends Report]()

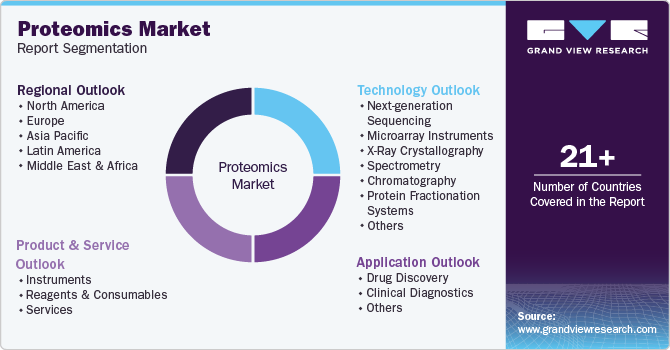

Proteomics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product & Service (Services, Reagents & Consumables, Instruments), By Technology (Spectrometry, Microarray), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-100-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Proteomics Market Summary

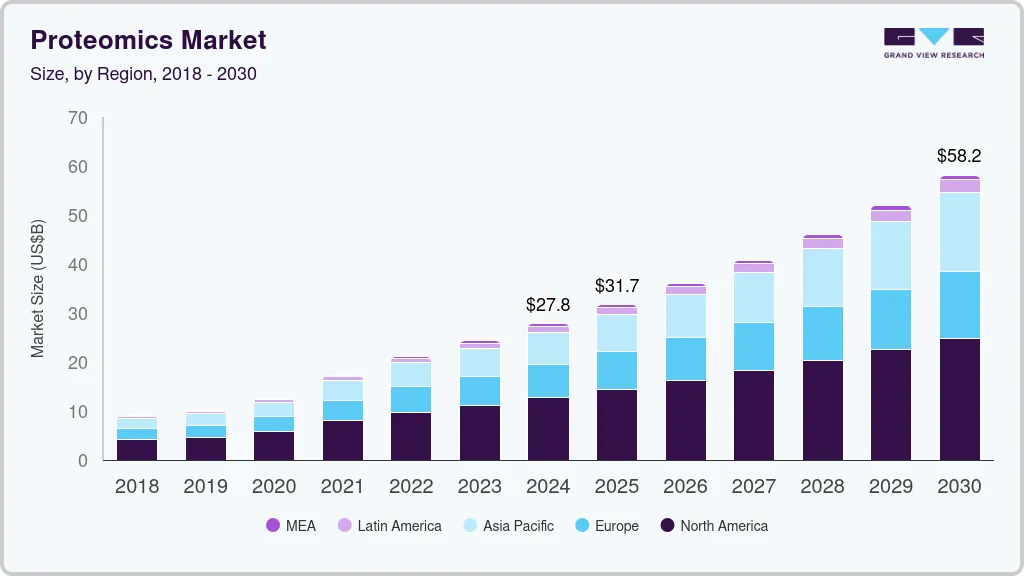

The Global Proteomics Market size was estimated at USD 27.8 billion in 2024 and is projected to reach USD 58.16 billion by 2030, growing at a CAGR of 12.9% from 2025 to 2030. The rising prevalence of chronic & infectious diseases, the increasing demand for rapid & advanced diagnostic solutions in target disease treatment, and the growing demand for personalized medicine are some of the factors contributing to market growth.

Key Market Trends & Insights

- North America Proteomics market dominated the global market and accounted for 45.75% revenue share in 2024.

- The proteomics market in the U.S. is expected to grow over the forecast period.

- By technology, the spectrometry segment captured the largest revenue share of 31.88% in 2024.

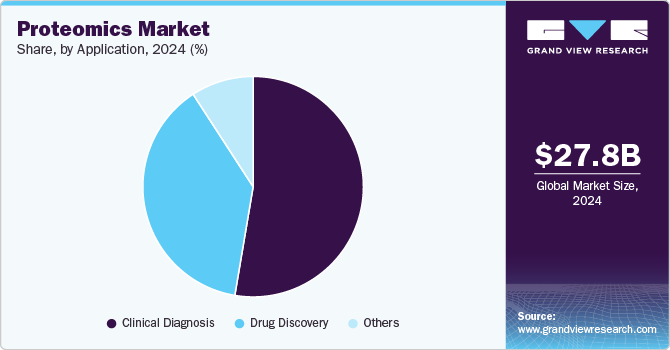

- By application, the drug discovery segment dominated the proteomics market with the largest revenue share of 52.73% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 27.8 Billion

- 2030 Projected Market Size: USD 58.16 Billion

- CAGR (2025-2030): 12.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, technological advancements in protein analysis further propel the market.

The rising prevalence of chronic and infectious diseases drives proteomics industry growth. WHO predicts that there will be over 35 million new cancer cases by 2050, a 77% surge from the approximately 20 million cases estimated in 2022. Moreover, the prevalence of disease increases the demand for pathogenesis research and advanced diagnostics and therapeutics. For instance, according to research published in Nature Communications in July 2024, scientists used a proteomics-based approach to identify effectors secreted by Rickettsia spp, thereby understanding the host-pathogen interface.

In addition, in a recent study published in the journal Nature Medicine in August 2024, scientists developed a proteomic aging clock using plasma proteins. This clock helps measure age and predict the risk of age-related diseases, multimorbidity, and mortality across diverse populations. Moreover, emerging technology such as top-down proteomics helps understand the role of proteoforms in disease mechanisms and precision medicine, aiding in bridging the gap between genotypes and phenotypes.

The integration of advanced high-throughput technologies, such as next-generation mass spectrometers and multi-omics approaches, has contributed to enhanced sensitivity, accuracy, and pace of protein analysis. These technologies enable researchers to conduct high-throughput analyses, enabling more comprehensive studies of protein interactions and functions. In addition, developments in sample analysis methods and software tools for data analysis have streamlined workflows, further delivering high throughput results and making it easier to interpret vast amounts of data generated from proteomic experiments. For instance, according to an article published in the journal Nature Protocols in August 2024, researchers from Northeastern University, Boston, U.S., have developed a nano-proteomic sample preparation (nPOP) method for single-cell proteomics by mass spectrometry. This method is likely to increase throughput by the parallel preparation of numerous single cells in nanoliter-volume droplets deposited on glass slides.

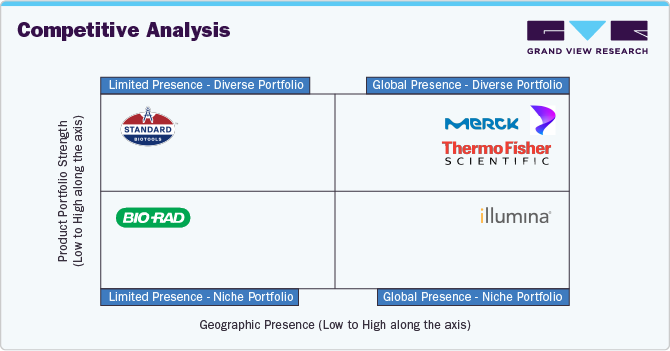

Furthermore, the proteomics industry is witnessing significant growth, driven by advancements in proteomics technology trends such as mass spectrometry, bioinformatics tools, and high-throughput techniques. According to recent proteomics market research, the industry is expanding rapidly as researchers increasingly adopt these technologies for drug discovery, biomarker identification, and personalized medicine. Leading players like Thermo Fisher Scientific Inc., Bio-Rad Laboratories Inc., Illumina, Inc., Merck KGaA, and Danaher are investing heavily in innovative solutions to cater to this rising demand. The expanding proteomics industry size reflects increased funding for life sciences research, collaborations between academic institutions and biotech firms, and the growing need for precision diagnostics.

Rising Prevalence of Chronic And Infectious Diseases

Chronic diseases, such as cardiovascular conditions, diabetes, and cancer, account for a substantial portion of global morbidity and mortality. According to the Institute for Health Metrics and Evaluation in June 2023, over 500 million individuals worldwide are currently living with diabetes, affecting individuals of all ages and genders across every nation. According to the most recent and comprehensive estimations, the current global prevalence stands at 6.1%, positioning diabetes among the top 10 leading causes of death and disability. At the super-region level, North Africa and the Middle East exhibit the highest prevalence rate at 9.3%, which is projected to escalate to 16.8% by 2050. The rate is expected to rise to 11.3% in Latin America and the Caribbean. Furthermore, projections indicate a 90% increase in cardiovascular disease prevalence between 2025 and 2050, underscoring the growing health challenge. These statistics highlight the urgent need for innovative approaches, such as proteomics, to better understand and manage chronic conditions.

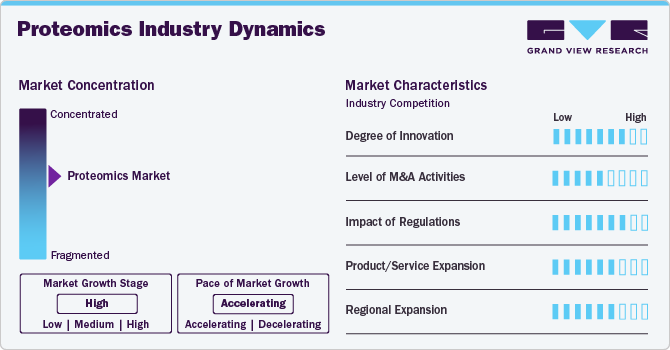

Market Concentration & Characteristics

The proteomics industry is experiencing a significant degree of innovation driven by technological advancements in mass spectrometry and next-generation sequencing technology. Moreover, the integration of artificial intelligence and the development of high-throughput technologies that allow for rapid sample processing and analysis, improving reproducibility and efficiency, further driving market growth.

The industry is witnessing a significant amount of merger and acquisition activity among major players. This is driven by various factors, such as the expansion of product offerings and the need to consolidate in a fast-growing market. For instance, in January 2024, Standard BioTools merged with SomaLogic, thereby strengthening the innovation in multi-omics technology.

Regulatory bodies such as the U.S. FDA, the EMA, etc., establish guidelines that govern the development and commercialization of proteomics technologies and products. These regulations ensure that proteomics solutions meet safety, efficacy, and quality standards before they can be used in clinical settings or marketed to consumers. These agencies are increasingly emphasizing standardization in proteomics workflows to ensure reproducibility and comparability across studies.

Key players are adopting the strategy of increasing production capacity and expanding their market reach to improve the availability of their products and services in diverse geographic areas. Additionally, companies are launching new platforms to strengthen their product and service portfolios.

The industry is witnessing moderate regional expansion, driven by an increasing customer base for proteomics products & services. For instance, in January 2024, Biognosys expanded its presence in the U.S. by opening a new contract research facility focused on proteomics services. This expansion reflects the increasing demand for specialized proteomic services that support drug development processes.

Product & Service Insights

The reagents & consumables segment accounted for the largest revenue share of 72.53% in 2024. Kits designed for mass spectrometry enable researchers to identify proteins within complex biological samples accurately. They facilitate the quantification of protein levels, which is essential for understanding cellular functions and disease mechanisms. Reagents for proteomic assays help identify novel biomarkers critical for early disease diagnosis, particularly in conditions like cancer, Alzheimer’s, and cardiovascular diseases. This leads to the development of targeted therapies.

The services segment is projected to grow at the fastest CAGR from 2025 to 2030 due to the increasing demand for specialized expertise and advanced technologies in protein analysis. As proteomics research becomes more complex, many organizations outsource tasks like mass spectrometry, protein identification, and data analysis to specialized service providers such as Charles River Laboratories, Cell Signaling Technology, Creative Proteomics, and others. These providers offer cutting-edge technology, comprehensive data interpretation, and cost-effective solutions, enabling researchers to focus on core activities. Furthermore, the rising adoption of personalized medicine and biomarker discovery drives the need for high-quality proteomic services, further accelerating the growth of this segment.

Technology Insights

The spectrometry segment captured the largest revenue share of 31.88% in 2024. It is also expected to expand further at the highest during the forecast period. Spectrometry technology is used for identification and characterization of proteins, detection of post-translational modifications, and analysis of protein-protein interactions in proteomics studies. Advancements in mass spectrometry technology, such as increased resolution, speed, and automation, have significantly enhanced its efficiency, making it a preferred tool for proteomics research. Furthermore, the integration of spectrometry techniques with bioinformatics for data analysis has expanded its applications in drug discovery, biomarker identification, and personalized medicine. These factors are anticipated to drive the segment over the forecast period.

The next-generation sequencing (NGS) segment is projected to grow at a significant pace from 2025 to 2030. The declining costs of sequencing technologies have made NGS more accessible to a wider range of research and clinical applications. This cost reduction, coupled with technological advancements that have increased speed and accuracy, is driving broader adoption in various fields, including oncology, genetic disease research, and personalized medicine. Companies involved in the market are tapping into this increasing demand by undertaking various strategic initiatives. For instance, in February 2024, Pixelgen Technologies signed a non-exclusive agreement with Japan's BioStream Co. Ltd to distribute its innovative next generation sequencing spatial proteomics tools for single cells. Such initiatives are likely to boost the growth of the proteomics industry.

Application Insights

The drug discovery segment dominated the proteomics market with the largest revenue share of 52.73% in 2024. This large share can be attributed to the development of structure-based drug design, a greater emphasis on creating personalized drugs, and increased investments in these areas. Additionally, proteomics technologies provide an early indication of a drug's potential in the discovery process, leading to significant cost savings for pharmaceutical companies and ultimately benefiting patients and healthcare systems, thus contributing to the segment's growth.

The clinical diagnostics segment is expected to experience the highest growth rate during the forecast period. This is attributed to the high adoption of protein analysis among clinical researchers to identify biomarkers for early disease detection and identifying individual risk factors. This is expected to create new opportunities for prevention and early intervention of the disease. With the help of proteomics-based diagnosis, it is possible to uncover potential biomarkers and protein expression patterns that can be used to classify and predict tumors, and determine their prognosis, which further contributes to the segment’s growth.

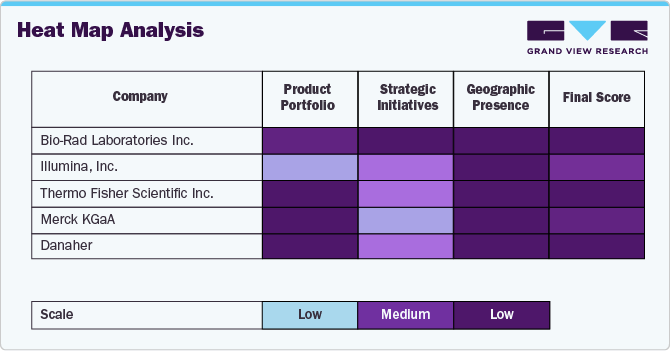

The proteomics industry features intense competition among key players such as Bio-Rad Laboratories Inc., Illumina, Inc., Thermo Fisher Scientific Inc., Merck KGaA, and Danaher, each leveraging distinct strengths. Thermo Fisher Scientific dominates with its extensive portfolio of mass spectrometry instruments, reagents, and data analysis solutions, catering to both large-scale and precision proteomics research. Bio-Rad Laboratories specializes in robust protein separation and identification tools, including electrophoresis and blotting systems. Illumina integrates its sequencing expertise into proteomic workflows, enhancing protein-DNA interaction studies. Merck KGaA focuses on high-performance reagents, sample preparation kits, and customized solutions for proteomic research. Danaher, through subsidiaries like SCIEX and Leica Biosystems, offers advanced protein analysis platforms, ensuring comprehensive end-to-end workflow solutions. Each player strategically emphasizes innovation, product expansion, and collaborations to strengthen its market presence.

Regional Insights

North America Proteomics market dominated the global market and accounted for 45.75% revenue share in 2024, owing to the advancements in technology and growing demand for advanced disease diagnostics. Furthermore, the region benefits from substantial research and development investments in precision medicine, government funding for biotechnology and healthcare research, and highly advanced healthcare infrastructure.

U.S. Proteomics Market Trends

The proteomics market in the U.S. is expected to grow over the forecast period due to the robust research and development landscape in biotechnology and life sciences, harnessing innovation & technological advancements in mass spectrometry and its application in medicine and biotechnology research, and the presence of key players in the country.

Europe Proteomics Market Trends

The European proteomics market is expected to grow at a significant CAGR from 2025 to 2030, owing to the established biotechnology research and development sector, growing focus on spatial biology research, and the presence of key players. Furthermore, significant investments and funding from public and private sources enable the expansion of proteomics research and the commercialization of proteomics products.

The proteomics market in the UK is expected to grow over the forecast period, driven by technological advancements in mass spectrometry and its increasing applications in various fields, such as oncology, neurology, immunology, pathology, and personalized medicine.

Germany proteomics market is witnessing substantial growth in the multi-omics field. It is characterized by active participation from renowned academic institutions, biotechnology and pharmaceutical companies, and government funding for research projects. For instance, in February-March 2024, the European Molecular Biology Laboratory (EMBL) in Germany hosted a series of events and courses with a primary focus on integrating and analyzing multiomics data.

The proteomics market in France is predicted to witness significant growth due to the increasing adoption of advanced protein analysis technologies and the expanding applications in various fields, including cancer research, drug discovery, and translational research. In addition, government initiatives and investments in proteomics research further support the proteomics industry growth in France.

Asia Pacific Proteomics Market Trends

Asia Pacific proteomics market is anticipated to witness the fastest CAGR of 16.06% from 2025 to 2030 in the proteomics market due to the rising prevalence of chronic diseases, rising preference for outsourcing proteomics-based projects, public and private funding for research and development for proteomics studies, favorable government regulations, and a strong presence of biotechnology and biopharmaceutical companies in the region.

The Japan proteomics market is anticipated to grow at a significant CAGR over the forecast period. Robust investments in drug discovery & development, increasing preference for personalized medicine, technological advancements, and supportive government policies are some of the factors contributing to proteomics industry growth.

The proteomics market in China is expected to grow over the forecast period owing to the increasing investments in healthcare innovation and research. The country’s focus on advancing biotechnology and therapeutics, coupled with the rising awareness of precision and medicine, is driving the expansion of the proteomics market in China. Moreover, with the increasing prevalence of chronic diseases, there is a growing demand for effective diagnostic tools, further fueling proteomics industry growth.

The proteomics market in India is anticipated to grow rapidly over the forecast period due to the increasing use of proteomics-based research and the presence of biopharmaceutical companies involved in drug discovery and development. Moreover, the rise of government investment in research activities further boosts market growth.

Middle East & Africa Proteomics Market Trends

The proteomics market in the Middle East and Africa is expected to exhibit growth in the near future due to a rise in the demand for improved diagnostics that aid in the prevention & treatment of diseases, along with increasing government funding in biotechnology research.

The proteomics market in Saudi Arabia is expected to grow over the forecast period due to substantial investment in biotechnology, increased research activities, and government initiatives supporting scientific advancements.

The Kuwait proteomics market is anticipated to witness growth over the forecast period. Kuwaiti institutions are engaging with global researchers and biotech companies to advance biotechnology research. These partnerships enhance the exchange of knowledge and access to advanced technologies, which can boost the market in the country.

Key Proteomics Company Insights

Key players operating in the proteomics market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Proteomics Companies:

The following are the leading companies in the proteomics market. These companies collectively hold the largest market share and dictate industry trends.

- Illumina, Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

- Bruker Corporation

- F. Hoffmann-La Roche Ltd.

- Waters Corporation

- Merck KGaA

- Danaher

- Standard BioTools Inc.

Recent Developments

-

In July 2024, Thermo Fisher Scientific Inc. acquired Olink Holding AB for USD 3.1 billion. This acquisition helped Thermo Fisher to expand its next-generation proteomics product portfolio.

-

In May 2024, Bruker Corporation inaugurated its new production facility in Bremen, Germany. This inauguration is likely to enhance innovation, sustainability, and collaboration in mass spectrometry.

-

In August 2023, Danaher Corporation acquired a life science firm Abcam, thereby leveraging its product portfolio, including tools and reagents for proteomics.

-

In March 2021, SomaLogic, an innovator of the artificial intelligence (AI)-driven proteomics platform, collaborated with CM Life Sciences II to expand the technology platform.

Proteomics Market Report Scope

Report Attribute

Details

Revenue forecast in 2025

USD 31.68 billion

Revenue forecast in 2030

USD 58.16 billion

Growth rate

CAGR of 12.9% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, application, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; and Kuwait

Key companies profiled

Illumina, Inc.; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; Bruker Corporation; F. Hoffmann-La Roche Ltd.; Waters Corporation; Merck KGaA; Danaher; Standard BioTools Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Proteomics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global proteomics market report based on product & service, application, technology, and region.

-

Product & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents & Consumables

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery

-

Clinical Diagnostics

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Next-generation Sequencing

-

Microarray Instruments

-

X-Ray Crystallography

-

Spectrometry

-

Chromatography

-

Protein Fractionation Systems

-

Electrophoresis

-

Surface Plasma Resonance (SPR) Systems

-

Other Technologies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global proteomics market size was estimated at USD 27.78 billion in 2024 and is expected to reach USD 31.68 billion in 2025.

b. The global proteomics market is expected to grow at a compound annual growth rate of 12.92% from 2025 to 2030 to reach USD 58.16 billion by 2030.

b. The reagents and consumables segment dominated the proteomics market in 2024. The large share is attributed to factors such as widespread research in academic institutes coupled with a high frequency of usage of reagents, kits, chemicals, and strips for the analysis of various biological samples.

b. Some key players operating in the proteomics market include Illumina, Inc.; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; Bruker Corporation; F. Hoffmann-La Roche Ltd.; Waters Corporation; Merck KGaA; Danaher; Standard BioTools Inc.

b. Key factors that are driving the proteomics market growth include the rising prevalence of chronic & infectious diseases, the increasing demand for rapid & advanced diagnostic solutions in target disease treatment, and the growing demand for personalized medicine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.