- Home

- »

- Medical Devices

- »

-

Blood Pressure Monitoring Devices Market Size Report, 2033GVR Report cover

![Blood Pressure Monitoring Devices Market Size, Share & Trends Report]()

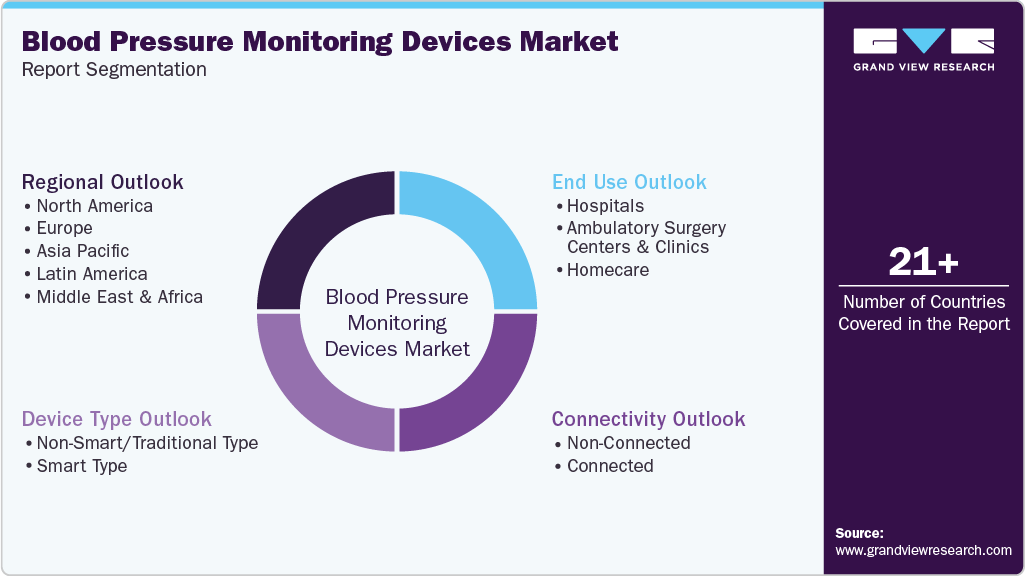

Blood Pressure Monitoring Devices Market (2026 - 2033) Size, Share & Trends Analysis Report By Device Type (Non-Smart/Traditional Type, Smart Type), By End-use (Hospitals, Homecare, Ambulatory Surgery Centers & Clinics), By Region, And Segment Forecasts

- Report ID: 978-1-68038-586-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Blood Pressure Monitoring Devices Market Summary

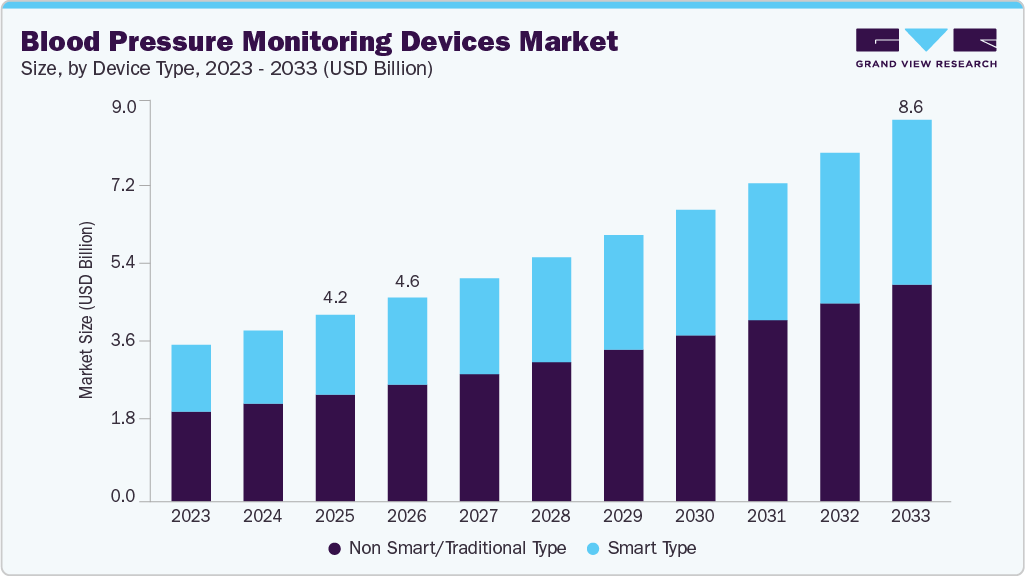

The global blood pressure monitoring devices market size was estimated at USD 4.19 billion in 2025 and is expected to reach USD 8.56 billion by 2033, growing at a CAGR of 9.34% from 2026 to 2033. The market expansion can be attributed to the increasing incidence of hypertension due to changing lifestyles.

Key Market Trends & Insights

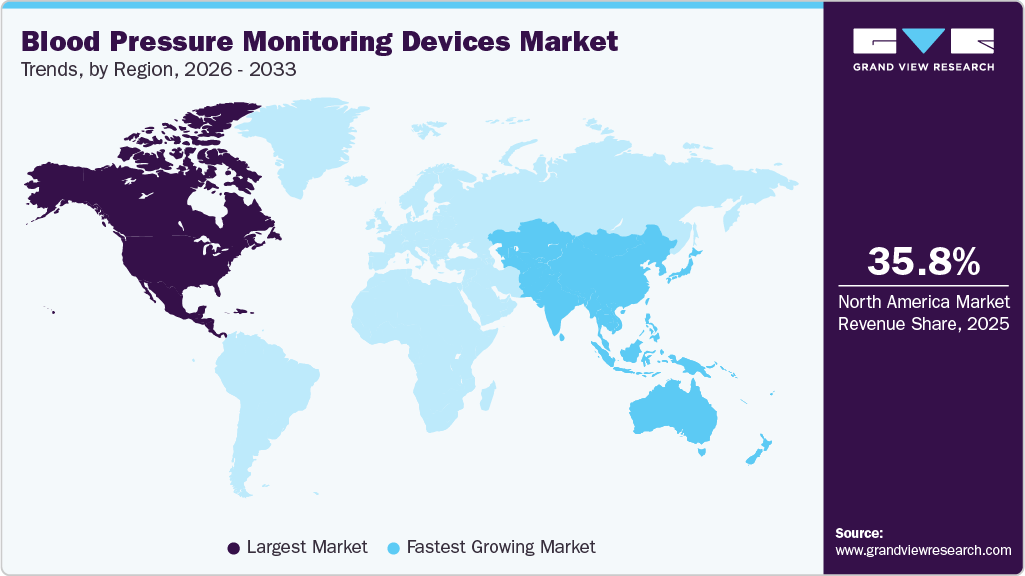

- North America dominated the market, with a revenue share of 35.77% in 2025.

- The U.S. blood pressure monitoring devices industry is expected to witness significant growth from 2026 to 2033, owing to the adoption of integrated solutions.

- By device type, the non-smart/traditional type segment held the largest market share in 2025.

- Based on connectivity type, the non-connected segment accounted for the largest revenue share in 2025.

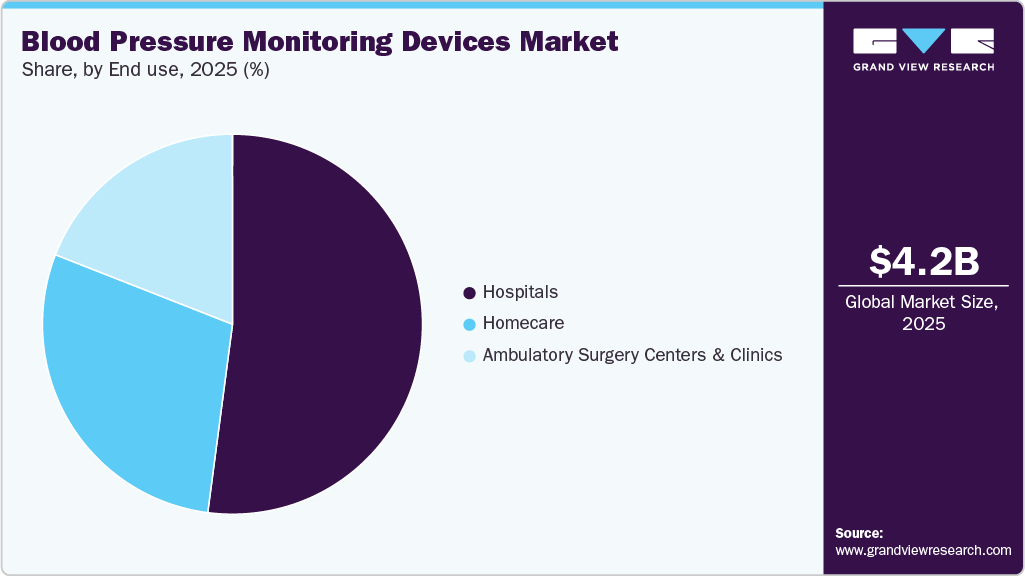

- By end use, the hospitals segment accounted for the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4.19 Billion

- 2033 Projected Market Size: USD 8.56 Billion

- CAGR (2026-2033): 9.34%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Rising Prevalence of Hypertension and Cardiovascular Diseases

The increasing rates of hypertension and cardiovascular diseases are fueling the growth of the blood pressure monitoring devices industry, as more people require reliable and regular blood pressure monitoring. With lifestyle risk factors such as obesity, stress, inactivity, and poor diet on the rise, hypertension diagnoses are becoming more common and often require ongoing management. Since cardiovascular diseases are a leading cause of death, early detection and regular monitoring are essential to prevent serious complications. This expanding patient base is driving demand for home-use, digital, wearable, and clinical blood pressure monitoring devices.

According to a World Health Organization (WHO) study published in September 2025, hypertension remains one of the most significant global health challenges, affecting an estimated 1.4 billion adults aged 30-79 years in 2024. A major concern is that around 600 million adults (44%) are unaware they have hypertension, highlighting critical gaps in screening and early detection. Even among those diagnosed and treated, approximately 630 million people, only about 320 million (23%) have their condition under control, underscoring the urgent need for better disease management and consistent monitoring. As hypertension is a leading cause of premature death worldwide, global health strategies have set ambitious goals, including reducing uncontrolled hypertension by 25% between 2010 and 2025.

Technological Advancements

Cuffless blood pressure monitoring is transforming product innovation by setting new standards for convenience and real-time health insights. Technologies such as Nanowear’s SimpleSense-BP, the first non-invasive, continuous monitoring system with FDA clearance in January 2024, demonstrate how nanotechnology and AI are advancing hypertension care. Tech players, such as Apple, are also moving into medical wearables, aiming for clinical-grade accuracy with innovations like liquid-filled pressure sensors in future Apple Watch models. Academic breakthroughs, such as Caltech’s resonance sonomanometry, which uses sound waves and ultrasound for non-invasive readings, highlight the transition to next-generation sensing. These developments are raising expectations for comfort, ongoing data analysis, integration, and portability, fueling growth in the premium segment of the blood pressure monitoring device market.

AI Integration in Blood Pressure Monitoring Devices: Key Applications and Examples

AI Application

Function

Example

Impact

Continuous Vital Signs Monitoring

AI analyzes heart rate, respiratory rate, posture, and activity trends

Philips Healthdot + smartQare - Healthdot is a wearable biosensor that continuously monitors vitals such as HR and RR and transmits data to clinicians via the smartQare platform.

Enhances patient safety, enables seamless in-hospital to home care transition

ECG Analysis & Arrhythmia Detection

AI interprets ECG waveforms from ambulatory monitors to detect arrhythmias

iRhythm Zio Patch + ZEUS AI - a wearable ECG monitor analyzed by ZEUS AI to detect arrhythmias with high accuracy for outpatient cardiac monitoring.

Improves diagnostic yield, reduces cardiologist reading time

Predictive Glucose Monitoring

AI predicts hypoglycemia events and analyzes glucose trends up to 2 hours ahead

Roche Accu-Chek SmartGuide CGM - a continuous glucose monitor using AI to forecast hypo events and glucose trends, supporting proactive diabetes management.

Enables proactive diabetes management, reduces hypoglycemia risks

Increasing Adoption of Remote Patient Monitoring

The growing use of remote patient monitoring primarily drives the market growth, as healthcare shifts toward continuous, home-based care. RPM enables real-time blood pressure tracking outside of clinics, facilitating the detection of complications early and preventing hospital readmissions. The increasing prevalence of chronic diseases such as hypertension and diabetes makes ongoing monitoring essential. Providers and insurers support RPM for its ability to improve outcomes, boost patient engagement, and cut long-term costs. Advances in Bluetooth BP monitors, health apps, and IoT devices have also made remote monitoring more reliable and accessible, speeding up adoption.

Medicare’s 2025 reimbursement changes make remote patient monitoring (RPM) for hypertension much more attractive, boosting demand for blood pressure monitoring devices. Providers now receive regular payments for onboarding and managing patients, provided they submit at least sixteen readings monthly, ensuring steady revenue for health systems using RPM. NYU Langone’s success, with a 22.2% return on investment and 55% adherence, shows RPM for hypertension can be both effective and profitable. These incentives encourage hospitals and clinics to expand RPM programs, thereby increasing sales of home blood pressure monitors, software, and related technologies, and establishing reimbursement-driven RPM as a key driver of market growth.

Growing Awareness of Home Healthcare Benefits

Growing awareness of the benefits of home healthcare is driving demand for blood pressure monitoring devices, as more people appreciate the convenience, cost savings, and health improvements that home monitoring offers. With heart disease and hypertension on the rise, individuals are monitoring their blood pressure more regularly to catch issues early and stick to treatment. Healthcare providers are also promoting remote monitoring to reduce hospital visits and improve chronic disease management. This trend boosts demand for user-friendly, precise, and connected blood pressure monitors, supporting market growth.

May Measurement Month (MMM) is the world’s largest blood pressure screening campaign, raising awareness and promoting early detection of hypertension. In India, the CCDC leads widespread screenings and education efforts, aiming for nearly one million BP readings in 2024. MMM helps identify undiagnosed cases, encourages healthy habits, and supports stronger public health policies to reduce cardiovascular disease.

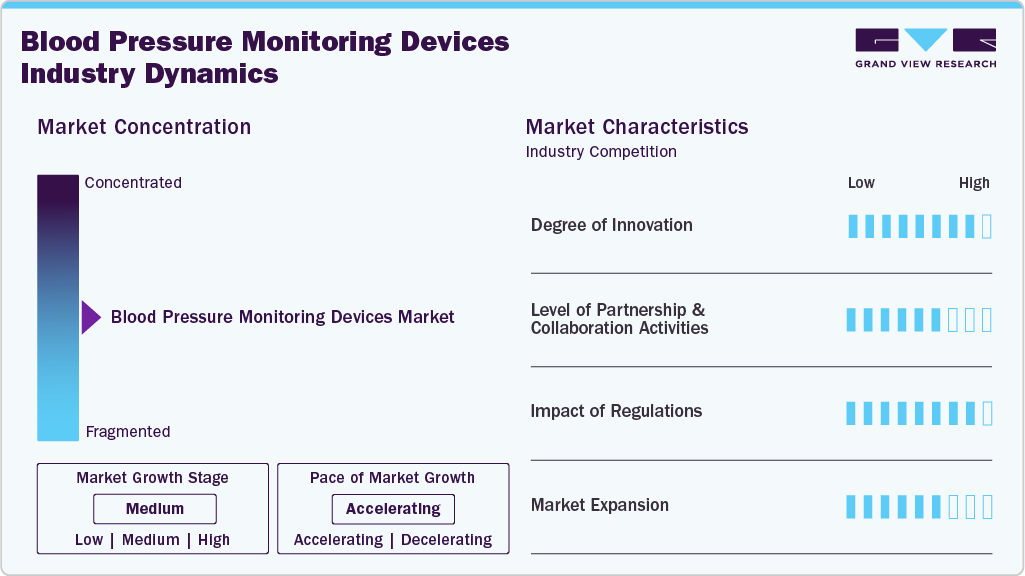

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the blood pressure monitoring devices market are high. However, the regional expansion observes moderate growth.

In November 2024, the FDA granted authorization to De Novo for OMRON Healthcare’s new blood pressure monitors, equipped with AI-powered atrial fibrillation (AFib) detection, marking an important advancement in cardiac monitoring technology. This approval enables OMRON to introduce an innovative class of devices that measure blood pressure and analyze heart rhythm irregularities using artificial intelligence, allowing for the early identification of AFib-a significant risk factor for stroke.

OMRON Healthcare President and CEO Ranndy Kellogg said:

“OMRON Healthcare is making AFib screening a more integral part of our blood pressure monitoring experience as part of our Going for Zero mission to eliminate heart attack and stroke,” “AFib is a serious condition that is under-discussed, under-checked and underdiagnosed. We want to change that.”

The level of partnerships & collaboration activities by key players in the industry is high, with major players joining forces to enhance technological capabilities, broaden product offerings, and streamline global access to advanced monitoring solutions. In January 2025, Sky Labs signed a memorandum of understanding (MOU) with Japan’s Otsuka Pharmaceutical to work together on expanding the global distribution and market presence of its smart ring blood pressure monitoring device. The collaboration follows clinical validation and regulatory approvals in South Korea and is part of Sky Labs’ broader effort to scale its innovative wearable technology worldwide to better support hypertension management and cardiovascular care.

The impact of regulations on the market is high as they ensure the safety and accuracy of blood pressure monitoring devices. Manufacturers in the U.S. must follow the FDA’s 510(k) process, proving device accuracy, clinical validation, and GMP compliance. In Europe, devices must meet EU MDR standards, which include strong clinical evidence and post-market checks for CE marking. International standards such as ISO 81060-1/2 guide product testing. The growing focus on cybersecurity, data privacy (GDPR, HIPAA), labeling, and usability also influences device approval and design.

The industry's level of product expansion is moderate. Omron Healthcare’s launch of Complete, the first blood pressure monitor integrating both blood pressure and EKG measurement capabilities in a single retail device, marks a major advancement in home cardiovascular monitoring. This innovation allows users to simultaneously track two critical heart health indicators, blood pressure and heart rhythm, without needing multiple devices or clinical visits. Designed for convenience and early detection, Complete helps identify conditions such as atrial fibrillation (AFib), hypertension irregularities, and other cardiovascular risks more efficiently.

Device Type Insights

The non-smart/traditional type segment accounted for the largest revenue share of the blood pressure monitoring devices market in 2025. The widespread use of traditional devices such as sphygmomanometers and automated digital blood pressure monitors drove this dominance. These devices are cost-effective, easy to use, and preferred in both clinical and home healthcare settings, especially in regions with limited access to advanced technology.

The smart segment is expected to grow at the fastest CAGR over the forecast period. The increasing demand for digital monitors can be associated directly with the rising awareness level among patients regarding cardiovascular disease, hypertension, BP monitoring devices, and the growing prevalence of hypertension worldwide. In addition, continuous technological advancements such as improvements in wearable technology, apps, & mobiles in the consumer healthcare segment, declining average selling prices for retailers & manufacturers, and rising penetration in the professional market are propelling market growth.

Connectivity Insights

Based on connectivity type, the Non-connected segment accounted for the largest revenue share in 2025. Non-connected Blood Pressure (BP) monitoring devices, such as manual sphygmomanometers and basic digital monitors, are often more cost-effective than their smart counterparts. Their affordability makes them accessible to a broader range of consumers, especially in regions with limited healthcare budgets. The simplicity of these devices eliminates the need for complex technology and connectivity features, resulting in lower production costs and retail prices. This cost advantage drives demand in developed and emerging markets, where budget constraints are a significant factor in purchasing decisions.

The Connected BP monitoring devices is growing at the fastest CAGR over the forecast period, due to the growing emphasis on digital health and remote patient monitoring. One major driver is the increasing demand for real-time health data and the integration of such data into broader health management systems. These devices, which offer features like Bluetooth or Wi-Fi connectivity, enable seamless data transfer to healthcare providers and patient health apps, allowing for continuous monitoring and timely intervention.

End Use Insights

The hospital segment led the blood pressure monitoring devices industry, accounting for the largest revenue share of 52.07% in 2025. The need for cost-effective, fast, and accurate diagnostic tools for better health outcomes drives the adoption of BP monitoring devices. Moreover, hospitals increasingly rely on digital and connected monitoring devices to streamline patient data integration with electronic health records (EHRs), improve diagnostic accuracy, and enhance clinical decision-making. Growing surgical volumes, intensive care admissions, and the need for real-time hemodynamic monitoring also contribute to strong demand.

The home care segment is expected to witness rapid growth over the forecast period. The cost efficiency of this alternative option for BP monitoring and the availability of intelligent wearables that offer mobility are expected to support the growth. Hence, the inclination towards independent living is expected to propel market growth.

Regional Insights

The North America blood pressure monitoring devices market held the most significant revenue share, with 35.77% in 2025, due to its highly regulated & developed healthcare infrastructure. Increasing investments in creating accurate and adequate blood pressure monitors are among the key factors expected to fuel market growth in the coming years. Changing lifestyles and the rising geriatric population, which is prone to chronic diseases and requires BP monitoring devices for diagnosis & treatment of the diseases, are some of the factors contributing to the growth of this market.

U.S. Blood Pressure Monitoring Devices Market Trends

The U.S. blood pressure monitoring devices industryheld a significant share of North America in 2025. Rising CVD cases in the U.S. are expected to further fuel the market growth. According to an article published in January 2024 by the American Heart Association, in the U.S., CVD results in about 2,552 deaths each day. Furthermore, nearly 119 million adults in the country had hypertension in 2019, and high BP was the primary cause of death for around 494,873 U.S. residents in the same year.

The Canada blood pressure monitoring devices market is projected to witness the fastest CAGR over the forecast period, which can be attributed to the rising geriatric population in this region. For instance, according to Statistics Canada, there were more than 861,000 people aged 85 and older in 2021, nearly twice as many as in the 2001 census. Moreover, this number is projected to triple by 2046 and reach 2.5 million, according to a similar source. As the geriatric population is more susceptible to hypertension and related chronic disorders, the demand for blood pressure monitoring devices is expected to grow.

Europe Blood Pressure Monitoring Devices Market Trends

The blood pressure monitoring devices industry in Europe is experiencing significant growth, driven by the rising prevalence of hypertension and cardiovascular diseases. As populations in countries such as Germany, the UK, France, and Italy age, healthcare systems are prioritizing early diagnosis and continuous monitoring of chronic conditions. This trend has accelerated the adoption of traditional and intelligent BP monitors, with consumers seeking at-home solutions for health management.

The Germany blood pressure monitoring devices market held a substantial revenue share in 2025 and is expected to witness significant growth over the forecast period, owing to ongoing technological advancements coupled with improving healthcare infrastructure. Germany is the largest market for medical devices in Europe. It is four times larger than the UK medical devices market, making a substantial contribution to the market in Europe.

The market for blood pressure monitoring devices in the UK is projected to witness lucrative growth over the forecast period. This can be attributed to the growing population and increasing number of people suffering from several chronic disorders. For instance, per the Office for National Statistics, the UK population is estimated to grow by 2.1 million by 2030, representing 69.2 million, an increase of around 3.2%.

Asia Pacific Blood Pressure Monitoring Devices Market Trends

The Asia Pacific blood pressure monitoring devices industry is expected to grow exponentially over the forecast period. Significant factors driving growth include favorable government initiatives that support the adoption of advanced medical devices, the growing geriatric population, and rising healthcare expenditures.

The Japan blood pressure monitoring devices market’s growth is driven by the presence of market leaders, such as Omron Healthcare and Nihon Kohden. For instance, in 2020, Omron’s healthcare business segment experienced increased demand for thermometers & blood pressure monitors in Europe, Japan, and Central & South America due to the high demand for at-home health management during the pandemic.

The blood pressure monitoring devices market in China is anticipated to grow over the forecast period. According to the WHO, nearly 270 million Chinese individuals have hypertension, with around 13.8% of the patients having their condition under control, indicating the need for constant monitoring and high growth potential for BP monitors in the country. In addition, as per the eHealth initiative to help meet high unmet needs, the government deployed eHealth and wearable medical devices with connectivity via Bluetooth or other health management systems, thereby driving the market growth.

Latin America Blood Pressure Monitoring Devices Market Trends

Brazil and Argentina primarily dominate the Latin American blood pressure monitoring devices industry. The Latin America market is expected to experience steady growth during the forecast period, driven by the increasing number of people living with chronic diseases and cardiac disorders.

Middle East & Africa Blood Pressure Monitoring Devices Market Trends

The market of the Middle East and Africa blood pressure monitoring devices is anticipated to witness steady growth over the forecast period. The fundamental driving forces include supportive government initiatives, increasing healthcare expenditure, and growing awareness. Moreover, according to the World Health Observatory report by the WHO, nine Middle Eastern countries have the highest obesity statistics ranking among adults aged 18 and above. Obesity is one of the risk factors for developing hypertension, and the high prevalence of obesity is, thus, anticipated to fuel market growth.

Key Blood Pressure Monitoring Devices Company Insights

The global market for blood pressure monitoring devices is experiencing intense competition due to its price sensitivity. The companies are adopting competitive strategies such as mergers & acquisitions, strategic alliances, collaborative agreements, and partnerships to sustain the competition. The industry's growth is directly linked to the increasing investments by manufacturers in developing cost-effective, innovative, and user-friendly products.

Key Blood Pressure Monitoring Devices Companies:

The following are the leading companies in the blood pressure monitoring devices market. These companies collectively hold the largest market share and dictate industry trends.

- Omron Healthcare

- Welch Allyn, Inc.

- A&D Medical Inc.

- SunTech Medical, Inc.

- American Diagnostics Corporation

- Withings

- Briggs Healthcare

- GE Healthcare

- Kaz Inc.

- Microlife AG

- Rossmax International Ltd.

- GF Health Products Inc.

- Spacelabs Healthcare Inc.

- Philips Healthcare.

- B. Braun SE

Recent Developments

-

In May 2025, Tenovi launched a cellular-connected blood pressure monitor designed to support stroke prevention and broader cardiovascular care by enabling continuous, remote monitoring of blood pressure and irregular heart rhythms, allowing clinicians to detect early warning signs of hypertension and intervene sooner.

Nizan Friedman, Ph.D., CEO and co-founder of Tenovi, said:

“Tenovi fully supports the mission of the AgeTech Collaborative from AARP to improve lives as people age,” “Our platform offers a seamless pathway for companies focused on better health outcomes to scale quickly through our network of over 180 remote patient monitoring partners.”

-

In March 2025, the HUAWEI WATCH D2 officially debuted in India, marking a significant step for wearable health tech by bringing medical-grade blood pressure monitoring to the mainstream smartwatch segment. Launched with features that go beyond typical fitness tracking, Watch D2 uses advanced sensors and an integrated mechanism to measure blood pressure more accurately than conventional optical wearable sensors.

-

In September 2024, Nihon Kohden’s Board of Directors approved the purchase of a 71.4% stake in NeuroAdvanced Corp. (“NAC”), the parent company of Ad-Tech Medical Instrument Corporation (“Ad-Tech”) in the U.S. Following the acquisition, NAC and Ad-Tech were consolidated and designated as principal subsidiaries of Nihon Kohden, as their total capital represented 10% or more of Nihon Kohden’s overall capital.

Blood Pressure Monitoring Devices Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 4.58 billion

Revenue forecast in 2033

USD 8.56 billion

Growth rate

CAGR of 9.34% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device type, connectivity, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Omron Healthcare; Welch Allyn, Inc.; A&D Medical Inc.; SunTech Medical, Inc.; American Diagnostics Corporation; Withings; Briggs Healthcare; GE Healthcare; Kaz Inc.; Microlife AG; Rossmax International Ltd.; GF Health Products Inc.; Spacelabs Healthcare Inc.; Philips Healthcare; B. Braun

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Blood Pressure Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global blood pressure monitoring devices market report based on device type, connectivity, end use, and region:

-

Device Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Non-Smart/Traditional Type

-

Sphygmomanometer/Aneroid BP Monitor

-

Automated/Digital Blood Pressure Monitor

-

Upper Arm-based Traditional BP Monitors

-

Wrist-based Traditional BP Monitors

-

Finger-based Traditional BP Monitors

-

-

Ambulatory Blood Pressure Monitor

-

-

Smart Type

-

Upper Arm-based Smart BP Monitors

-

Wrist-based Smart BP Monitors

-

Finger-based Smart BP Monitors

-

-

-

Connectivity Outlook (Revenue, USD Million, 2021 - 2033)

-

Non-Connected

-

Connected

-

Wi-Fi-based

-

Bluetooth-based

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgery Centers & Clinics

-

Homecare

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global blood pressure monitoring devices market size was estimated at USD 4.19 billion in 2025 and is expected to reach USD 4.58 billion in 2026.

b. The global blood pressure monitoring devices market is expected to grow at a compound annual growth rate of 9.34% from 2026 to 2033 to reach USD 8.56 billion by 2033.

b. North America dominated the blood pressure monitoring devices market with a share of over 35.77% in 2025. This is attributable to a highly regulated & developed healthcare infrastructure, increasing investments for the development of accurate, effective BP monitors, and increasing new product launches along with technological advancements.

b. Some key players operating in the blood pressure monitoring devices market include Omron Healthcare; Welch Allyn, Inc.; A&D Medical Inc.; SunTech Medical, Inc.; American Diagnostics Corporation; Withings; Briggs Healthcare; GE Healthcare; Kaz Inc.; Microlife AG; Rossmax International Ltd.; GF Health Products Inc.; Spacelabs Healthcare Inc.; Philips Healthcare; B. Braun

b. Key factors that are driving the blood pressure monitoring devices market growth include increasing incidences of hypertension due to changing lifestyles, growing geriatric population base, increasing the risk of lifestyle associated disorders, rising incidences of obesity & sedentary lifestyle, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.