- Home

- »

- Next Generation Technologies

- »

-

Cyber Security Market Size & Share, Industry Report, 2033GVR Report cover

![Cyber Security Market Size, Share & Trends Report]()

Cyber Security Market (2026 - 2033) Size, Share & Trends Analysis Report By Offering (Hardware, Software, Services), By Security Type, By Solution Type, By Deployment, By Organization Size, By End Use, By Approach, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-115-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cyber Security Market Summary

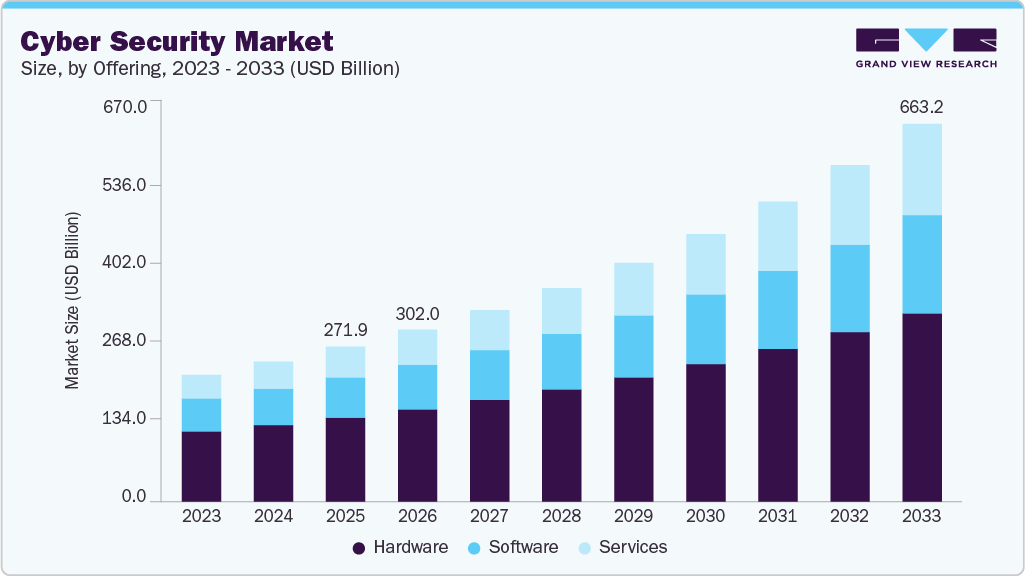

The global cyber security market size was estimated at USD 271.88 billion in 2025 and is projected to reach USD 663.24 billion by 2033, growing at a CAGR of 11.9% from 2026 to 2033. A growing number of cyber-attacks owing to the proliferation of e-commerce platforms, emergence of smart devices, and deployment of cloud are some key factors propelling market growth.

Key Market Trends & Insights

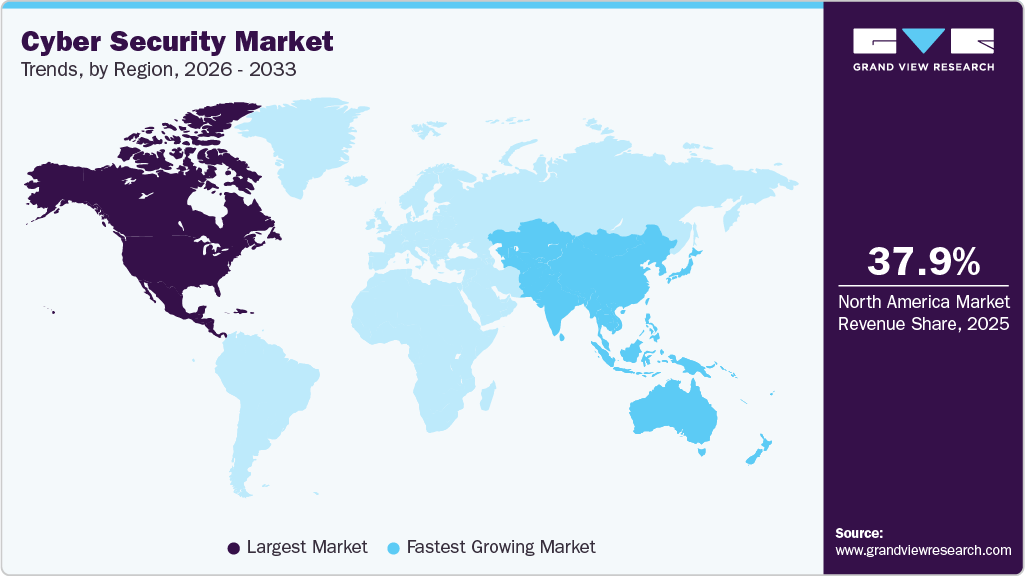

- North America held a 37.9% revenue share of the global cyber security market in 2025.

- In the U.S., the market is driven by increasing cyber threats, regulatory compliance requirements, and rapid digital transformation across enterprises and government organizations.

- By offering, the hardware segment held the largest revenue share of 54.2% in 2025.

- By solution type, the Identity and Access Management (IAM) segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 271.88 Billion

- 2033 Projected Market Size: USD 663.24 Billion

- CAGR (2026-2033): 11.9%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Organizations across verticals such as BFSI, IT & telecom, healthcare, manufacturing, and government are increasingly adopting advanced cybersecurity solutions over traditional perimeter-based security approaches to address the growing sophistication of cyber threats. This shift is driven by demand for integrated, multi-layered security frameworks that combine threat intelligence, endpoint protection, network security, and identity & access management (IAM) with real-time monitoring and automated response capabilities. Cloud-first and hybrid enterprises are prioritizing security platforms that offer seamless integration with SaaS, IaaS, and containerized environments, enabling continuous visibility and protection across distributed workloads.

The cybersecurity market is witnessing rapid adoption of zero-trust architectures, AI/ML-powered threat detection, and extended detection and response (XDR) solutions, as organizations aim to proactively detect, prevent, and respond to increasingly complex cyberattacks. Vendors are differentiating through features such as behavioral analytics, automated incident response, cloud-native security orchestration, and compliance management that align with standards like ISO/IEC 27001, NIST Cybersecurity Framework, GDPR, and sector-specific regulations such as HIPAA for healthcare and PCI DSS for financial services.

Moreover, rising concerns around supply chain security, remote work vulnerabilities, and the proliferation of IoT and OT devices are driving investments in managed security services, secure access service edge (SASE), and identity-centric security solutions. Enterprises are also exploring privacy-enhancing technologies, including homomorphic encryption and confidential computing, to safeguard sensitive data while enabling secure analytics.

Consequently, the cybersecurity market is evolving from standalone point solutions to integrated, intelligence-driven ecosystems that provide end-to-end threat visibility, automated remediation, and compliance assurance. Market leaders are investing in AI-driven threat hunting, automated vulnerability management, and cloud-native security platforms that integrate with major public cloud providers’ native security services. As organizations seek to balance agility, compliance, and risk mitigation in a digitally transformed world, cybersecurity is no longer a reactive function but a strategic, foundational pillar for enterprise resilience and trust across modern digital ecosystems.

Offering Insights

The hardware segment accounted for the largest revenue share of 54.2% in the global cyber security market in 2025, driven by robust, tamper-resistant, and high-performance security solutions that safeguard mission-critical data and infrastructure. This growth is driven by rising enterprise demand for hardware-enforced security modules, secure cryptographic processors, and dedicated security appliances that provide end-to-end protection against sophisticated cyber threats, including ransomware, insider attacks, and supply chain vulnerabilities.

As organizations increasingly operate in hybrid and multi-cloud environments, hardware-based solutions such as Hardware Security Modules (HSMs), Trusted Platform Modules (TPMs), and encrypted storage devices are being prioritized to enforce secure key management, data-at-rest encryption, and hardware-level access controls. For instance, in September 2025, Everfox launched HSV-T hardware-enforced data security platform for tactical and high-risk environments highlight the segment’s capability to deliver physically and digitally hardened security solutions. Such platforms integrate secure cryptographic processing, role-based access, and tamper-evident designs, enabling enterprises and defense organizations to maintain operational continuity while complying with stringent regulatory and security mandates. Consequently, the hardware segment continues to dominate as organizations seek resilient, policy-driven, and compliance-aligned security infrastructures that underpin broader cybersecurity frameworks across critical enterprise and government ecosystems.

The services segment is expected to register the fastest CAGR in the global cyber security market during the forecast period, driven by increasing demand for managed security services, consulting, and implementation support that help organizations rapidly respond to evolving cyber threats. Enterprises are increasingly outsourcing security operations to specialized providers to gain access to advanced threat intelligence, 24/7 monitoring, incident response, and vulnerability management without the need for extensive in-house teams. Moreover, the growing complexity of IT infrastructures and regulatory requirements across industries is prompting businesses to rely on expert-led security services that offer tailored solutions, proactive threat hunting, and integration with AI/ML-driven detection platforms. For instance, managed detection and response (MDR) services are increasingly leveraged to monitor endpoints, networks, and cloud workloads in real time, providing rapid containment and remediation of security incidents. Subsequently, the services segment is witnessing robust growth as organizations prioritize agility, expertise, and scalable cybersecurity capabilities to safeguard critical data, ensure regulatory compliance, and strengthen overall resilience against sophisticated cyberattacks.

Security Type Insights

The infrastructure protection segment accounted for the largest market share of 23.9% in the cyber security market in 2025, driven by the escalating emphasis on safeguarding critical systems and national infrastructure against advanced cyber threats and operational disruptions. As digital transformation accelerates across various sectors, the interdependence between IT and operational technology (OT) has expanded the threat surface, prompting enterprises and government agencies to invest heavily in infrastructure protection controls and threat detection systems that can withstand both cyber and physical attacks.

This robust market demand is further reinforced by evolving cybersecurity performance standards and policy guidance that prioritize risk‑based security practices for critical infrastructure operators. For instance, in December 2025, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) released Cross‑Sector Cybersecurity Performance Goals which provide measurable, foundational actions for critical infrastructure entities to reduce risk across account and device security, data protection, governance, vulnerability management, and incident response, reinforcing the need for comprehensive protection strategies that extend beyond traditional perimeter defenses.

The artificial intelligence model/machine learning model security segment of the cyber security market is experiencing strong growth, with a substantial CAGR, fueled by increasing adoption of AI-driven threat detection, automated remediation, and intelligence-driven security operations. Organizations are leveraging AI/ML models to proactively identify sophisticated cyber threats, including social engineering attacks, phishing campaigns, and advanced persistent threats, which traditional defenses often fail to detect. Enhanced AI capabilities allow for real-time analysis of large-scale data, risk scoring, and detection of anomalies across cloud and on-premises environments, strengthening enterprise defense mechanisms. For instance, in July 2025, Fortra launched AI-driven features in its Cloud Email Protection service, highlighting the market’s momentum. These include AI body content analysis, campaign detection, suspicious URL detection, and overall risk scoring that integrate with automated threat response workflows, enabling security teams to conduct faster, more effective threat hunting. As enterprises increasingly embed AI/ML security models into their cybersecurity frameworks, demand for scalable, intelligent, and adaptive solutions is driving robust segment growth, positioning AI/ML model security as a critical pillar in modern cyber defense strategies.

Solution Type Insights

The Identity and Access Management (IAM) segment accounted for the largest market share of 29.3% in the cyber security market in 2025, driven by rising enterprise demand for centralized identity controls, secure access policies, and regulatory compliance across increasingly hybrid and cloud-native environments. Organizations are prioritizing IAM solutions to manage user identities, enforce role-based access, reduce insider risks, and ensure seamless authentication through multi-factor and single sign-on mechanisms, thereby safeguarding critical enterprise applications and data. For instance, in October 2023, ManageEngine launched its cloud-native Identity360 platform to address workforce IAM challenges.

The platform offers a centralized Universal Directory, identity orchestration, role-based access management, and secure lifecycle management for enterprise identities across integrated applications. In addition, enhancements to its on-premises ADManager Plus solution, including access certification and identity risk assessment capabilities, help organizations enforce compliance, mitigate privilege abuse, and maintain secure, scalable, and efficient identity governance. These innovations underscore the segment’s continued dominance as enterprises seek IAM solutions that combine security, compliance, and seamless user experience.

The risk and compliance management segment of the cyber security market is projected to witness the fastest CAGR during the forecast period, driven by increasing demand for solutions that help organizations proactively identify, assess, and mitigate security and operational risks while ensuring regulatory compliance. Enterprises are prioritizing risk-based approaches that integrate vulnerability management, policy enforcement, and automated reporting to address complex threats across IT and OT environments. The rising complexity of regulatory frameworks across industries such as energy, manufacturing, and critical infrastructure is further fueling adoption of advanced risk and compliance management platforms. For instance, in February 2025, Industrial Defender launched its Platform 8.0, which features an enhanced risk dashboard, advanced threat intelligence integration, and dynamic risk scoring to help industrial operators manage security and compliance risks more effectively. The platform’s updated policy library supports standards such as NERC CIP, AESCSF, TSA Security Directives, and NIS2, enabling organizations to prioritize remediation based on operational impact rather than solely on technical severity. These innovations exemplify how the segment is evolving to provide comprehensive, intelligence-driven, and automated risk and compliance management capabilities, driving its robust growth in the global cybersecurity market.

Deployment Insights

The cloud segment accounted for the largest share of 67.7% in the global cyber security market in 2025, driven by the growing adoption of cloud-native security solutions that provide centralized visibility, scalable threat detection, and rapid incident response across hybrid and multi-cloud environments. Enterprises are increasingly prioritizing cloud deployments to secure workloads, applications, and data while reducing operational complexity, ensuring compliance, and maintaining business continuity in a rapidly evolving threat landscape. For instance, in December 2025, Securonix launched an integration between its Unified Defense SIEM and AWS Security Hub, enabling customers to leverage agentic AI for advanced analytics, threat correlation, and automated response directly within AWS. This integration allows organizations to strengthen their cloud security posture, accelerate incident response workflows, and gain a unified view of threats across multiple cloud platforms. Innovations like these highlight the segment’s dominance, as organizations increasingly adopt cloud-based cybersecurity deployments for agility, scalability, and enhanced operational efficiency.

The on-premises segment is expected to grow at the significant CAGR during the forecast period, driven by rising demand for localized, highly secure cybersecurity deployments that provide full control over data, applications, and infrastructure. Enterprises operating in regulated industries, including finance, healthcare, and government, are prioritizing on-premises solutions to ensure compliance with strict data residency and privacy mandates while mitigating risks associated with cloud vulnerabilities. These deployments allow organizations to implement customized security policies, tightly control access, and integrate with existing IT infrastructure for seamless protection. For instance, in October 2025, OpenText Cybersecurity introduced new capabilities designed to create a trusted foundation for AI within enterprise environments.

These innovations focus on secure, on-premises AI workloads with enhanced data protection, encryption, and policy-based access controls, ensuring that sensitive data remains fully under organizational control while enabling AI-driven threat detection and automation. Such advancements highlight the segment’s growing relevance as organizations seek a balance between leveraging advanced security technologies and maintaining complete oversight over critical data assets, driving robust growth in the on-premises cybersecurity market.

Organization Size Insights

The large enterprises segment accounted for the largest market share of 73.0% in the global cyber security market in 2025, driven by the growing need for comprehensive, scalable, and advanced security solutions to protect vast IT infrastructures, sensitive data, and mission-critical applications. Large organizations face increasingly sophisticated cyber threats, stringent regulatory requirements, and complex multi-cloud and hybrid environments, prompting substantial investments in AI-driven security, identity and access management, threat detection, and risk management platforms to safeguard operations and maintain compliance. For instance, in December 2025, Thales launched its AI Security Fabric, delivering runtime security capabilities designed to protect Agentic AI and LLM-powered applications, enterprise data, and identities. The platform addresses emerging AI-specific threats such as prompt injection, data leakage, and model manipulation, while enabling enterprises to deploy secure AI solutions across cloud and on-premises environments. Innovations like these illustrate how large enterprises are driving the adoption of advanced cybersecurity technologies, reinforcing their dominant market share as they prioritize comprehensive, end-to-end security frameworks.

The SMEs segment is projected to register the fastest CAGR over the forecast period, driven by increasing adoption of affordable, scalable, and user-friendly cybersecurity solutions tailored for small and medium-sized enterprises. With the rapid digitalization of business operations, SMEs face growing exposure to cyber threats but often lack in-house expertise and resources to implement comprehensive security measures. This has led to rising demand for cloud-based security platforms, AI-driven threat detection, and managed security services that provide robust protection while being cost-effective and easy to deploy. For instance, in December 2025, the Commonwealth Bank of Australia (CommBank) launched a national initiative in collaboration with OpenAI to enhance AI, cybersecurity, and digital capabilities for 1 million small businesses. The program offers practical masterclasses and AI learning resources to help SMEs implement secure digital practices, leverage AI for productivity, and safeguard sensitive business and customer data. Initiatives like this highlight how targeted support, education, and accessible cybersecurity solutions are empowering SMEs to adopt advanced security measures, driving strong growth in the segment.

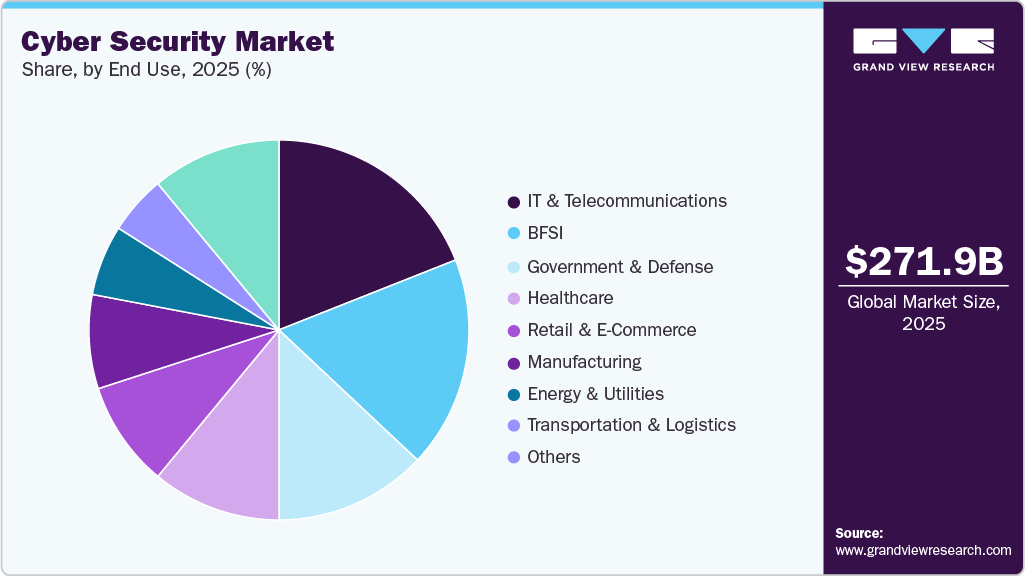

End Use Insights

The IT and telecommunications segment accounted for the largest market share of 18.5% in the global cyber security market in 2025, driven by the increasing reliance of telecom operators and IT service providers on secure digital infrastructure to protect vast volumes of sensitive data, critical applications, and customer information. With the expansion of 5G networks, cloud services, and digital transformation initiatives, organizations in this segment are prioritizing cybersecurity solutions that offer advanced threat detection, network security, identity management, and compliance assurance across complex IT and telecom ecosystems. For instance, in August 2025, Telecom Fiji officially launched NetSafe, a next-generation network-based cybersecurity service powered by Allot. The platform provides always-on protection against malware, ransomware, phishing, and malicious websites while offering content filtering and seamless security directly at the network level. This initiative enables businesses and households to operate with confidence, providing robust and reliable protection without the need for additional software or complex installations. Innovations like NetSafe highlight the segment’s dominant market share as IT and telecom organizations increasingly adopt integrated, scalable, and network-embedded cybersecurity solutions.

The healthcare segment is expected to register the fastest growth during the forecast period in the global cybersecurity market, fueled by the increasing digitization of patient records, telehealth services, and connected medical devices. Healthcare organizations are under growing pressure to protect sensitive patient data, ensure regulatory compliance with standards such as HIPAA, and defend against ransomware, phishing, and other sophisticated cyberattacks targeting critical medical infrastructure. The expanding use of cloud-based electronic health records (EHRs) and AI-driven healthcare applications is further driving demand for comprehensive, adaptive, and real-time cybersecurity solutions. For instance, in April 2024, Oracle introduced advanced cybersecurity capabilities specifically designed to protect healthcare customers against cyberattacks. These solutions include integrated threat detection, automated monitoring, and rapid response workflows tailored for healthcare IT environments, ensuring the confidentiality, integrity, and availability of sensitive health data. Initiatives like this highlight that targeted security solutions are enabling healthcare providers to safeguard critical infrastructure and patient information, driving robust growth in the segment as organizations prioritize cybersecurity as a key enabler of digital healthcare transformation.

Approach Insights

The traditional cyber defense/reactive cyber security segment accounted for the largest market share of 56.2% in the global cyber security market in 2025, driven by widespread enterprise reliance on established threat detection, antivirus, firewall, and intrusion prevention systems to respond to known cyber threats. Organizations continue to prioritize these solutions for their proven effectiveness in mitigating attacks, maintaining operational continuity, and meeting regulatory compliance requirements. Enterprises across industries, especially those with legacy systems and critical infrastructure, rely on reactive measures to protect against malware, phishing, ransomware, and other common attack vectors. The dominance of this segment is also supported by the extensive availability of vendor offerings and integration capabilities with existing IT and network infrastructures. Many enterprises deploy comprehensive reactive cybersecurity platforms that combine endpoint protection, network monitoring, and centralized incident response to detect, contain, and remediate threats efficiently. As organizations balance traditional defense mechanisms with emerging proactive approaches, reactive cybersecurity continues to play a central role in safeguarding enterprise assets, contributing to its leading market share.

Active cyber defense/proactive cyber security segment is projected to register the fastest CAGR over the forecast period, driven by the growing need for organizations to anticipate, prevent, and neutralize cyber threats before they cause damage. Enterprises are increasingly adopting proactive measures such as threat hunting, deception technologies, automated response workflows, and continuous monitoring to identify vulnerabilities and suspicious activities in real time.

The rise of advanced persistent threats (APTs), ransomware attacks, and sophisticated phishing campaigns has prompted organizations to shift from purely reactive approaches to integrated, intelligence-driven security strategies that reduce dwell time and minimize potential losses. Proactive cybersecurity is further accelerated by the integration of AI and machine learning technologies, which enable predictive analytics, anomaly detection, and adaptive defenses tailored to evolving attack patterns. Organizations are also leveraging proactive risk assessment frameworks, penetration testing, and simulation-based exercises to strengthen their security posture and enhance resilience. As enterprises seek to reduce exposure to emerging cyber risks and maintain operational continuity, active defense solutions are becoming essential, driving robust growth and making this segment the fastest-growing approach in the global cybersecurity market.

Regional Insights

North America accounted for the largest market share of 37.9% in 2025 in the global Cyber Security market, driven by rising investments in advanced threat detection, AI- and ML-powered security analytics, and cloud-native security solutions across enterprises and government organizations. The region is characterized by early adoption of zero-trust architectures, identity and access management (IAM) platforms, and proactive threat-hunting services, as businesses respond to increasingly sophisticated cyberattacks, ransomware incidents, and regulatory compliance requirements. Key industry trends include the growing deployment of managed security services, integration of extended detection and response (XDR) platforms, expansion of AI-driven automation for incident response, and heightened focus on protecting critical infrastructure and sensitive data in sectors such as BFSI, healthcare, and IT & telecom. In addition, the rise of remote work, multi-cloud environments, and digital transformation initiatives is accelerating demand for scalable, centralized, and policy-driven cybersecurity frameworks, positioning North America as a leading and highly innovative market globally.

U.S. Cyber Security Market Trends

The U.S. cyber security market is experiencing strong growth, driven by increasing cyber threats, regulatory compliance requirements, and rapid digital transformation across enterprises and government organizations. Key trends include widespread adoption of zero-trust architectures, AI- and ML-powered threat detection, cloud-native security platforms, and identity and access management (IAM) solutions. The market is also witnessing rising demand for managed security services, extended detection and response (XDR), and proactive threat-hunting capabilities, particularly in critical sectors such as BFSI, healthcare, IT & telecom, and defense. In addition, initiatives to secure remote workforces, multi-cloud deployments, and critical infrastructure are accelerating investments in comprehensive, scalable, and intelligence-driven cybersecurity solutions, positioning the U.S. as one of the most advanced and strategically significant markets globally.

Europe Cyber Security Market Trends

The cyber security market in Europe is anticipated to register significant growth from 2026 to 2033, driven by stringent regulatory frameworks such as GDPR, NIS2, and evolving data privacy mandates that compel enterprises to strengthen their security posture. Organizations across BFSI, healthcare, manufacturing, and public sectors are increasingly adopting zero-trust architectures, AI/ML-powered threat detection, cloud-native security solutions, and identity and access management (IAM) platforms. Key industry trends include the growing deployment of managed security services, extended detection and response (XDR) solutions, and proactive threat intelligence to mitigate sophisticated cyberattacks and ransomware incidents. In addition, the surge in cloud adoption, digital transformation initiatives, and cross-border data exchange is accelerating demand for integrated, scalable, and policy-driven cybersecurity frameworks, positioning Europe as a rapidly evolving and highly regulated market.

The UK cybersecurity market is experiencing strong growth, driven by increasing cyber threats, regulatory compliance requirements, and digital transformation initiatives across enterprises and government agencies. Organizations are increasingly adopting zero-trust security models, AI- and ML-powered threat detection, identity and access management (IAM) solutions, and cloud-native security platforms to protect critical infrastructure, sensitive data, and business applications. Key trends include the rising adoption of managed security services, extended detection and response (XDR) solutions, and proactive threat intelligence to mitigate ransomware, phishing, and advanced persistent threats. In addition, government initiatives to enhance national cyber resilience, coupled with the rapid adoption of cloud computing and hybrid IT environments, are driving demand for integrated, scalable, and intelligence-driven cybersecurity solutions in the UK market.

The cyber security market in Germany is witnessing robust growth, driven by rising cyber threats, stringent data protection regulations such as the GDPR, and increasing digitalization across enterprises and government sectors. Organizations are investing heavily in zero-trust architectures, AI/ML-powered threat detection, cloud-native security solutions, and identity and access management (IAM) platforms to safeguard sensitive data, critical infrastructure, and business applications. Key trends include the adoption of managed security services, extended detection and response (XDR), and proactive threat intelligence to combat ransomware, phishing, and advanced persistent threats. In addition, initiatives to strengthen national cyber resilience, the expansion of Industry 4.0, and widespread adoption of cloud and hybrid IT environments are fueling demand for integrated, scalable, and intelligence-driven cybersecurity solutions in the German market.

Asia Pacific Cyber Security Market Trends

Asia Pacific is expected to register the fastest CAGR from 2026 to 2033, driven by rapid digital transformation, cloud adoption, and increasing internet penetration across enterprises and government organizations. The region is witnessing rising investments in AI- and ML-powered threat detection, zero-trust architectures, identity and access management (IAM) solutions, and cloud-native security platforms to counter sophisticated cyber threats and ransomware attacks. Key growth drivers include the expansion of IT & telecom, BFSI, and healthcare sectors, increasing regulatory focus on data privacy, and growing awareness of cybersecurity risks among SMEs and large enterprises alike. In addition, initiatives to secure critical infrastructure, remote workforces, and multi-cloud environments are accelerating demand for integrated, scalable, and intelligence-driven cybersecurity solutions across the Asia Pacific region.

The cyber security market in Japan is poised for robust growth from 2026 to 2033, driven by increasing digitalization across industries, rising cyber threats, and stringent regulatory requirements for data protection and critical infrastructure. Organizations in sectors such as BFSI, healthcare, manufacturing, and IT & telecom are adopting AI- and ML-powered threat detection, zero-trust architectures, identity and access management (IAM) solutions, and cloud-native security platforms to safeguard sensitive data and ensure operational continuity. Key trends include the growing deployment of managed security services, extended detection and response (XDR) solutions, and proactive threat intelligence to mitigate ransomware, phishing, and advanced persistent threats. In addition, government initiatives to enhance national cybersecurity resilience, coupled with rapid adoption of cloud and hybrid IT environments, are fueling demand for integrated, scalable, and intelligence-driven cybersecurity solutions in Japan.

The China cybersecurity market is witnessing rapid growth, driven by increasing digital transformation, adoption of cloud services, and rising cyber threats across enterprises and government organizations. Organizations are prioritizing AI- and ML-powered threat detection, zero-trust security architectures, identity and access management (IAM), and cloud-native security solutions to protect sensitive data, critical infrastructure, and business applications. Key trends include the deployment of managed security services, extended detection and response (XDR) platforms, and proactive threat intelligence to combat ransomware, phishing, and advanced persistent threats. In addition, strict regulatory frameworks, government initiatives to strengthen national cybersecurity, and the expansion of sectors such as IT & telecom, BFSI, and healthcare are fueling demand for integrated, scalable, and intelligence-driven cybersecurity solutions in China.

India’s cybersecurity market is experiencing rapid growth, driven by increasing digitalization, cloud adoption, and the rising prevalence of cyber threats across enterprises, government agencies, and SMEs. Organizations are increasingly adopting AI- and ML-powered threat detection, zero-trust architectures, identity and access management (IAM), and cloud-native security solutions to protect sensitive data, critical infrastructure, and digital services. Key trends include the expansion of managed security services, extended detection and response (XDR), and proactive threat intelligence to address ransomware, phishing, and advanced persistent threats. Furthermore, government initiatives such as the National Cyber Security Strategy, increased regulatory compliance mandates, and the growth of sectors like BFSI, IT & telecom, and healthcare are fueling demand for integrated, scalable, and intelligence-driven cybersecurity solutions across India.

Key Cyber Security Company Insights

Key players operating in the cyber security industry are Accenture, Check Point Software Technologies, Cisco Systems, Cloudflare and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives:

-

In August 2025, CrowdStrike introduced a new era of operational threat intelligence with its Falcon Adversary Intelligence platform, delivering real-time, personalized insights tailored to each customer’s environment. The platform integrates adversary intelligence into analyst workflows, enabling faster detection, investigation, and response by prioritizing threats based on exposures, assets, and active detections. This approach helps security teams act decisively against sophisticated attacks, reducing manual effort and enhancing overall threat-hunting efficiency.

-

In July 2025, Accenture and Microsoft are expanding their collaboration to develop generative AI-powered cybersecurity solutions aimed at helping organizations modernize security operations, automate data protection, and enhance identity and access management. Their joint initiatives, including a project with Nationwide, focus on AI-driven threat detection, SOC modernization, and streamlined security migrations to improve operational efficiency and business resilience.

-

In March 2025, Cloudflare expanded its threat intelligence offerings with a new real-time events platform that provides comprehensive visibility into emerging cyber threats. The platform enables organizations to detect, analyze, and respond to threats faster, enhancing overall security posture across networks, cloud services, and applications.

Key Cyber Security Companies:

The following are the leading companies in the cyber security market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Check Point Software Technologies

- Cisco Systems

- Cloudflare

- CrowdStrike

- Fortinet

- Gen Digital

- IBM

- Microsoft

- Netskope

- Okta

- Palo Alto Networks

- Qualys

- SentinelOne

- Zscaler

Cyber Security Market Report Scope

Report Attribute

Details

Market size in 2026

USD 302.00 billion

Revenue forecast in 2033

USD 663.24 billion

Growth rate

CAGR of 11.9% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Offering, security type, solution type, deployment, organization size, end use, approach, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Accenture; Check Point Software Technologies; Cisco Systems; Cloudflare; CrowdStrike; Fortinet; Gen Digital; IBM; Microsoft; Netskope; Okta; Palo Alto Networks; Qualys; SentinelOne; Zscaler

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cyber Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the cyber security market report based on offering, security type, solution type, deployment, organization size, end use, approach, and region:

-

Offering Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

Professional Services

-

Consulting

-

Governance, Risk, and Compliance (GRC)

-

Incident Response and Readiness

-

Implementation and Integration

-

Training & Education

-

Others

-

-

Managed Services

-

Managed Detection and Response

-

Managed Protection and Controls

-

Managed Security Functions

-

Others

-

-

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Endpoint Security

-

Cloud Security

-

Network Security

-

Application Security

-

Infrastructure Protection

-

Data Security

-

Artificial Intelligence Model/Machine Learning Model Security

-

Hardware Security

-

Others

-

-

Solution Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Unified Threat Management (UTM)

-

Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

-

Data Loss Prevention (DLP)

-

Identity and Access Management (IAM)

-

Security Information and Event Management (SIEM) & Security Orchestration, Automation & Response (SOAR)

-

DDoS

-

Risk and compliance management

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

IT and Telecommunications

-

Retail and E-Commerce

-

BFSI

-

Healthcare

-

Government and Defense

-

Manufacturing

-

Energy and Utilities

-

Automotive

-

Marine

-

Transportation and Logistics

-

Others

-

-

Approach Outlook (Revenue, USD Billion, 2021 - 2033)

-

Traditional Cyber Defense/Reactive Cyber Security

-

Active Cyber Defense/Proactive Cyber Security

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The professional service segment dominated the global cyber security market in 2025 due to the strong preference of organizations for deploying suitable cyber security solutions based on organizational structure is driving the adoption of cyber security services across several industries and sectors. Small and Medium-sized Enterprises (SMEs) have limited budgets due to which these organizations prefer consulting before implementing any solutions, supporting segment growth in the market.

b. The global cyber security market size was estimated at USD 271.88 billion in 2025 and is expected to reach USD 302.00 billion in 2026.

b. The global cyber security market is expected to grow at a compound annual growth rate of 11.9% from 2026 to 2033 to reach USD 663.24 billion by 2033.

b. The cloud segment dominated the cyber security market in 2025 driven by the growing adoption of cloud-native security solutions that provide centralized visibility, scalable threat detection, and rapid incident response across hybrid and multi-cloud environments.

b. The infrastructure protection segment dominated the global cyber security market in 2025 with a revenue share of 23.9%. Infrastructure protection helps in ensuring stability, security, and resilience of critical organization systems that support the functioning of an organization. Infrastructure protection systems help in securing physical and virtual assets including transportation networks, communication systems, and in-house operational assets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.