- Home

- »

- Medical Devices

- »

-

Atrial Fibrillation Market Size & Share, Industry Report, 2033GVR Report cover

![Atrial Fibrillation Market Size, Share & Trends Report]()

Atrial Fibrillation Market (2026 - 2033) Size, Share & Trends Analysis Report By Treatment (Pharmacological Treatment, Non Pharmacological Treatment), By End-use (Hospitals, Specialty Clinics), By Region, And Segment Forecasts

- Report ID: 978-1-68038-004-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Atrial Fibrillation Market Summary

The global atrial fibrillation market size was estimated at USD 29.52 billion in 2025 and is projected to reach USD 65.33 billion by 2033, growing at a CAGR of 10.52% from 2026 to 2033. The market is driven by a growing disease burden, rapid technological evolution in treatment and diagnostics, and the shift toward remote patient monitoring.

Key Market Trends & Insights

- North America atrial fibrillation industry dominated the global market in 2025 and accounted for the largest revenue share of 41.50%.

- The U.S. atrial fibrillation industry dominated the North American region in 2025.

- By treatment, the pharmacological treatment segment held the largest revenue share of 66.68% in 2025.

- By end use, the hospitals segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 29.52 Billion

- 2033 Projected Market Size: USD 65.33 Billion

- CAGR (2026-2033): 10.52%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Companies capable of integrating these advancements into comprehensive care solutions are likely to lead market growth as clinical practices adapt to more efficient and patient-centric models. Strategic collaborations and acquisitions aimed at expanding access to innovative therapies will further accelerate market competitiveness.The rising prevalence of atrial fibrillation, driven by aging populations and an increase in risk factors such as hypertension, diabetes, and obesity, is a major factor driving market growth. Atrial fibrillation is one of the leading causes of stroke and heart failure, prompting healthcare systems to prioritize early diagnosis and effective management. The growing patient pool is directly increasing demand for pharmacological treatments and advanced interventional procedures. In May 2024, the CDC highlighted atrial fibrillation (AFib) as the most common heart arrhythmia treated in the U.S. The number of Americans affected by AFib is expected to rise to 12.1 million by 2030. AFib plays a role in roughly 158,000 deaths each year and contributes to about 1 in 7 stroke cases.

Technological advancements in catheter ablation, 3D electro-anatomical mapping, and wearable ECG monitors are enhancing the precision and safety of atrial fibrillation treatments. Integration of artificial intelligence in arrhythmia detection and procedural planning is enabling faster, more accurate diagnosis and targeted therapy. These innovations are expanding treatment options to more patients while improving procedural outcomes and reducing recurrence rates. In April 2025, according to the Heart Rhythm Society (HRS), new research unveiled at Heart Rhythm 2025 showcased how artificial intelligence (AI) is enhancing safety and success rates in atrial fibrillation (AFib) treatments. The AI-driven DeePRISM model enables real-time waveform analysis during ablation procedures, improving outcomes for patients with persistent AFib. Experts highlighted AI’s potential to transform electrophysiology by boosting clinical confidence and procedural precision.

The adoption of remote monitoring and telehealth platforms is changing how atrial fibrillation is managed, allowing continuous rhythm monitoring beyond clinical settings. Wearable ECG devices and smartphone-linked applications are providing real-time data to both patients and physicians, supporting proactive management and early intervention. Healthcare providers are leveraging these tools to monitor larger patient populations efficiently, especially for post-procedural follow-up and long-term care. In May 2025, researchers from the Melbourne Brain Centre developed an AI model that can detect silent atrial fibrillation (AF) in stroke patients by analyzing brain MRI scans. The technology showed promising accuracy (AUC 0.81) in differentiating AF-related strokes, offering a non-invasive and efficient detection method. This approach could potentially accelerate diagnosis and personalize stroke care by flagging hidden AF cases needing further cardiac evaluation.

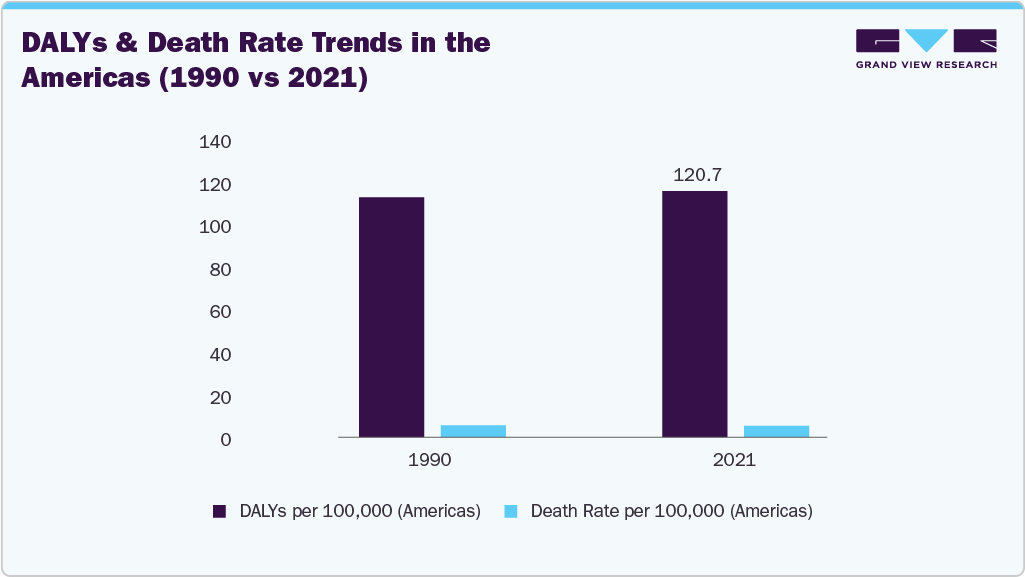

The clustered column chart highlights the incremental rise in atrial fibrillation-related disability-adjusted life years (DALYs) and death rates across the Americas from 1990 to 2021. DALYs increased from 117.14 to 120.68 per 100,000 and death rates rose from 4.18 to 4.84 per 100,000. This reflects a persistent and growing burden on healthcare systems, particularly in regions where access to early detection and advanced treatment remains uneven. Without targeted healthcare policies to bridge these regional disparities, the clinical and economic strain of atrial fibrillation is projected to intensify in the coming decades.

Atrial fibrillation (AF) remains the most common sustained cardiac arrhythmia worldwide, posing a substantial challenge to healthcare systems due to its association with stroke, heart failure, and elevated mortality risks. Despite advancements in treatment options, the global prevalence of AF has more than doubled over the past three decades, driven by aging populations and lifestyle-related risk factors. In July 2025, according to The Lancet Regional Health Americas, regional disparities continue to shape the burden of atrial fibrillation across the continent. The U.S. experienced the highest rise in AF incidence and prevalence, while Canada saw a decline after age adjustments. Middle-income countries account for the majority of AF cases, facing rising incidence rates with limited screening infrastructure. Addressing these systemic gaps is critical to mitigating AF’s escalating clinical and economic impact in the region.

Market Concentration & Characteristics

The global atrial fibrillation industry is characterized by a high degree of innovation, driven by rapid advancements in catheter ablation technologies, AI-based arrhythmia detection algorithms, and integration of real-time mapping systems. Companies are continuously investing in next-generation electrophysiology platforms that enable more precise and efficient procedures. In July 2024, Mayo Clinic introduced a new FDA-approved therapy called pulsed field ablation (PFA) to treat atrial fibrillation. Unlike traditional thermal ablation methods, PFA uses short bursts of high energy to target heart tissue, thereby minimizing damage to surrounding structures while selectively targeting the heart tissue.

The market is witnessing a moderate level of mergers and acquisitions, primarily focused on strategic partnerships between medtech giants and smaller companies specializing in arrhythmia technologies. While the sector has not experienced aggressive consolidation, targeted acquisitions aimed at expanding electrophysiology product portfolios and digital health capabilities are becoming more common. In February 2025, Novartis revealed plans to acquire Anthos Therapeutics in a deal valued at up to USD 3.1 billion, strengthening its cardiovascular pipeline with a focus on atrial fibrillation (AFib). Central to the acquisition is abelacimab, an innovative factor XI inhibitor designed to lower stroke and embolism risks in AFib patients.

The regulatory environment has a moderate impact on the market, with stringent approval processes for ablation devices, wearables, and digital diagnostic tools. Regulatory bodies like the FDA and EMA are encouraging the development of innovative AFib treatment solutions but maintaining rigorous safety and efficacy standards. Compliance with guidelines for device interoperability and data privacy (e.g., HIPAA, GDPR) is increasingly critical, especially for AI-enabled diagnostic platforms.

Market players are actively expanding their service offerings by entering new geographies and enhancing patient care models through integrated arrhythmia management programs. Hospitals and specialized cardiac centers are adopting comprehensive AFib care pathways, combining advanced diagnostics, minimally invasive interventions, and remote monitoring services. Companies are also focusing on launching mobile applications and telehealth platforms for post-procedural monitoring and long-term patient engagement.

Regional expansion activities in the atrial fibrillation industry are robust, as companies target emerging economies with large undiagnosed patient populations and growing demand for advanced cardiac care. Expansion efforts are particularly strong in Asia Pacific, Latin America, and parts of the Middle East, where governments are investing in upgrading healthcare infrastructure. Strategic partnerships with local distributors and collaborations with healthcare providers are key enablers of regional market penetration.

Treatment Insights

By treatment, the pharmacological treatment segment dominated the market with the largest revenue share of 66.68% in 2025 and is anticipated to grow at the fastest CAGR over the forecast period due to the widespread use of antiarrhythmic and anticoagulant drugs as first-line therapy for managing atrial fibrillation symptoms and preventing stroke. Continuous advancements in drug formulations, coupled with increasing patient preference for non-invasive treatment options, are further boosting segment growth. In July 2025, a systematic review published in the European Journal of Clinical Pharmacology assessed the effectiveness and safety of concomitant use of direct oral anticoagulants (DOACs) and antiarrhythmic drugs. The analysis of 17 observational studies involving over 2.6 million patients found no increased stroke risk but indicated a potential elevated bleeding risk with certain antiarrhythmics like diltiazem and verapamil.

The nonpharmacological treatment segment is anticipated to grow at a significant CAGR over the forecast period owing to increasing adoption of catheter ablation procedures, growing demand for minimally invasive interventions, and technological advancements in mapping and navigation systems. The segment is also benefiting from a rising number of clinical guidelines endorsing ablation as a frontline therapy for symptomatic patients. In April 2025, Medtronic announced positive clinical trial results for its investigational Sphere-360 pulsed field ablation catheter in atrial fibrillation treatment. The device achieved 88% arrhythmia-free outcomes at one year with no serious safety events. Medtronic plans to initiate a U.S. pivotal trial for Sphere-360 later in 2025.

End Use Insights

By end use, the hospitals segment dominated the market with a revenue share of 60.59% in 2025 and is anticipated to grow at the fastest CAGR over the forecast period due to the high volume of atrial fibrillation procedures performed in hospital settings and the availability of advanced electrophysiology labs. The increasing number of hospitals equipped with state-of-the-art ablation technologies and specialized arrhythmia management units is further driving segment growth. Favorable reimbursement policies and the presence of multidisciplinary cardiac care teams are enhancing patient preference for hospital-based treatments. In September 2024, Kauvery Hospital Alwarpet introduced Fluoroless Ablation for Atrial Fibrillation, a radiation-free procedure that utilizes intracardiac echocardiography and 3D electro-anatomical mapping. This minimally invasive technique enhances precision and safety in treating AF.

The specialty clinics segment is expected to grow at a significant rate during the forecast period driven by increasing preference for outpatient-based atrial fibrillation treatments and the rising establishment of dedicated electrophysiology centers. These clinics offer faster appointment availability, personalized care pathways, and cost-effective procedural options, which are attracting a growing patient base. In September 2024, Bryan Health's Bryan East Campus in Nebraska performed the state’s first FDA-approved pulsed field ablation (PFA) procedure for atrial fibrillation using the Farawave PFA catheter. This non-thermal, tissue-selective technology reduces procedure time, minimizes complications, and accelerates recovery.

Regional Insights

North America atrial fibrillation industry dominated the global market with a revenue share of 41.50% in 2025. The region's growth is driven by the widespread adoption of catheter ablation procedures, the presence of advanced healthcare infrastructure, and strong reimbursement support for arrhythmia treatments. Continuous technological advancements in electrophysiology devices, combined with the high prevalence of lifestyle-related cardiac conditions, further boost market demand. In August 2025, OMRON Healthcare issued an urgent alert highlighting rising deaths from arrhythmias, heart failure, and hypertensive heart disease. New research revealed heart attack deaths fell 89% since 1970, while deaths from other heart diseases surged 81%. OMRON emphasized the importance of early AFib detection and home blood pressure monitoring to mitigate risks.

U.S. Atrial Fibrillation Market Trends

The U.S. atrial fibrillation industry dominated the North American region in 2025, due to a high incidence of atrial fibrillation cases, rapid adoption of minimally invasive ablation technologies, and robust clinical guidelines supporting early intervention. The growing elderly population and increasing availability of remote cardiac monitoring solutions are further contributing to the market growth. In March 2025, according to the American Heart Association, approximately 5 million Americans were living with atrial fibrillation (AFib), with projections surpassing 12 million by 2030. AFib is associated with a fivefold increased risk of stroke and accounts for 12-20% of ischemic strokes.

Europe Atrial Fibrillation Market Trends

The atrial fibrillation industry in Europe is expected to grow significantly over the forecast period. This is attributed to the rising focus on early detection programs, increasing utilization of advanced mapping and navigation systems in ablation procedures, and strong collaborations between healthcare institutions and medical device companies. In July 2025, Radboudumc and Philips initiated a study during the Netherlands' 4Days Marches to assess the impact of prolonged walking on atrial fibrillation using the Philips ePatch wearable Holter monitor. Sixty participants with AFib wore the patch for continuous heart rhythm monitoring during the event. The research aims to better understand how physical exertion influences AFib episodes while leveraging AI-enabled diagnostics for real-time insights.

The atrial fibrillation industry in the UK is expected to grow significantly during the forecast period, as the National Health Service (NHS) implements initiatives to reduce AFib-related stroke risks through better screening and treatment pathways. In December 2024, a trial was launched using an AI tool developed by the University of Leeds and Leeds Teaching Hospitals NHS Trust to detect atrial fibrillation (AF) before symptoms appear. The algorithm scans medical records for risk factors like age, heart failure, hypertension, and diabetes. AF affects 1.6 million people in the UK, with thousands more undiagnosed, contributing to around 20,000 strokes annually.

Asia Pacific Atrial Fibrillation Market Trends

The Asia Pacific atrial fibrillation industry is expected to register the fastest CAGR over the forecast period. This growth is driven by improving access to advanced healthcare technologies, a large pool of undiagnosed patients, and increasing investments in expanding electrophysiology labs across emerging economies. In March 2025, The Lancet Regional Health - Southeast Asia reported that AF prevalence in Southeast Asia is rising faster than global trends, with poor anticoagulation control (TTR 39.2%) and limited DOAC use (under 7%). The article emphasized unmet needs in screening, treatment access, and integrated care, signaling strong market potential for advanced AF management solutions in the region.

China atrial fibrillation industry is anticipated to register considerable growth during the forecast period. The market growth is attributed to the country's rapidly aging population, increasing prevalence of cardiovascular diseases, and growing investments in modernizing hospital infrastructure. Rising collaborations between domestic medical device manufacturers and international firms are expected to enhance access to innovative arrhythmia treatment solutions. In June 2024, an article published in the International Journal of Cardiology focused on a nationwide Chinese study that revealed that only 55.3% of atrial fibrillation (AF) patients and 8.2% of non-AF adults in China are aware of AF. The study highlighted significant urban-rural disparities and low awareness of AF diagnostic methods and outcomes.

Latin America Atrial Fibrillation Market Trends

The Latin America atrial fibrillation industry is anticipated to witness considerable growth over the forecast period. Factors such as increasing awareness about atrial fibrillation management, growing adoption of advanced diagnostic technologies, and improving healthcare infrastructure in countries like Brazil and Argentina are driving market expansion. However, disparities in healthcare access and affordability challenges across the region may act as barriers to widespread adoption. In February 2025, researchers from the Federal University of Rio de Janeiro and D'Or Institute published a study identifying interleukin-1 beta (IL-1β) as a direct trigger for atrial fibrillation. The study demonstrated that IL-1β influences heart rhythm by activating macrophages, paving the way for targeted AF therapies.

Argentina atrial fibrillation industry is anticipated to register considerable growth during the forecast period due to rising awareness initiatives about early detection of cardiac arrhythmias and increasing adoption of advanced electrophysiology procedures in private healthcare settings. In July 2025, an article published in The Lancet Regional Health - Americas noted Argentina has the lowest age-standardized incidence and prevalence of atrial fibrillation (AF) in the Americas. However, limited screening practices may underestimate true AF burden, signaling untapped opportunities for diagnostic technologies and treatment expansion in Argentina's AF market.

Middle East And Africa Atrial Fibrillation Market Trends

The Middle East and Africa atrial fibrillation industry is anticipated to witness considerable growth over the forecast period driven by rising prevalence of lifestyle-related cardiovascular disorders, ongoing investments in modernizing healthcare infrastructure, and growing focus on improving access to specialized cardiac care services. In March 2025, Bayer and Al-Dawaa Medical Services launched the “Protect Your Heart” campaign in Saudi Arabia to promote early detection of cardiovascular diseases. The initiative focuses on pharmacist training, digital self-assessment tools, and public awareness, aligning with Saudi Vision 2030 healthcare goals.

UAE atrial fibrillation industry is anticipated to register considerable growth during the forecast period, as the country accelerates its efforts to develop world-class cardiac care centers and promote early diagnosis through public health screening programs. In November 2024, Sheikh Shakhbout Medical City (SSMC) in Abu Dhabi performed the UAE’s first pulse field ablation procedure for atrial fibrillation, successfully treating two complex cases. The innovative, non-thermal technique reduces the risk of collateral tissue damage compared to traditional ablation methods.

Key Atrial Fibrillation Company Insights

Key participants in the atrial fibrillation industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and expanding their business footprints.

Key Atrial Fibrillation Companies:

The following are the leading companies in the atrial fibrillation market. These companies collectively hold the largest market share and dictate industry trends.

- AtriCure Inc.

- Boehringer Ingelheim GmbH

- Boston Scientific Corporation

- Bristol- Myers Squibb Corporation

- Cardio Focus Inc.

- Sanofi Aventis

- Biosense Webster Inc.

- Endoscopic Technologies Inc.

- Abbott (St. Jude Medical Inc.)

- Johnson & Johnson

Recent Developments

-

In May 2025, Abbott introduced the TactiFlex Sensor Enabled Ablation Catheter, designed with a flexible tip and contact force technology to enhance atrial fibrillation (AFib) ablation procedures. The catheter aims to improve accuracy, provide greater stability during heartbeats, and shorten procedure durations. Abbott also emphasized its seamless integration with the EnSite X EP System for precise cardiac mapping and therapy delivery.

-

In December 2024, BTL successfully treated the first six atrial fibrillation patients in a first-in-human study using its next-generation pulsed-field ablation (PFA) catheter. The trial, conducted in Prague, showcased the device’s potential to make AF treatment safer and more efficient. The Easy Pulz catheter demonstrated promising early results in collaboration with global cardiac experts.

-

In May 2024, Saint Luke’s Mid America Heart Institute and Story Health launched a comprehensive digital health program to support atrial fibrillation (AFib) patients. The program focuses on continuous patient engagement between visits, integrating virtual care, AI-driven monitoring, and health coaching to optimize treatment and stroke prevention.

Atrial Fibrillation Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 32.45 billion

Revenue forecast in 2033

USD 65.33 billion

Growth rate

CAGR of 10.52% from 2026 to 2033

Actual data

2021 - 2025

Forecast data

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AtriCure Inc.; Boehringer Ingelheim GmbH; Boston Scientific Corporation; Bristol-Myers Squibb Corporation; Cardio Focus Inc.; Sanofi Aventis; Biosense Webster Inc.; Endoscopic Technologies Inc.; Abbott (St. Jude Medical Inc.); Johnson & Johnson.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Atrial Fibrillation Market Report Segmentation

This report forecasts revenue growth and provides a global, regional, and country level analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global atrial fibrillation market report based on treatment, end use, and region:

-

Treatment Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmacological Treatment

-

Anti-arrhythmic Drugs

-

Anticoagulant Drugs

-

-

Non-Pharmacological Treatment

-

Catheter Ablation

-

Radiofrequency

-

HIFU

-

Cryoablation

-

Microwave

-

Laser

-

-

Maze Surgery

-

Electric Cardioversion

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global atrial fibrillation market size was estimated at USD 29.52 billion in 2025 and is expected to reach USD 32.45 billion in 2026.

b. The global atrial fibrillation market is expected to grow at a compound annual growth rate of 10.52% from 2026 to 2033 to reach USD 65.33 billion by 2033.

b. North America dominated the atrial fibrillation market with a share of 41.50% in 2025. This is attributable to the presence of high procedure volumes supported by the presence of sophisticated healthcare infrastructure, high patient awareness, and healthcare expenditure levels.

b. Some key players operating in the atrial fibrillation market include AtriCure Inc., Boehringer Ingelheim GmbH, Boston Scientific Corporation, Bristol-Myers Squibb Corporation, Cardio Focus Inc., Sanofi Aventis, Biosense Webster Inc., Endoscopic Technologies Inc., Abbott (St. Jude Medical Inc.), and Johnson & Johnson.

b. The atrial fibrillation market is driven by a growing disease burden, rapid technological evolution in treatment and diagnostics, and the shift toward remote patient monitoring. Companies capable of integrating these advancements into comprehensive care solutions are likely to lead market growth as clinical practices adapt to more efficient and patient-centric models. Strategic collaborations and acquisitions aimed at expanding access to innovative therapies will further accelerate market competitiveness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.