Industry Insights

The global Bluetooth beacons market size was estimated at USD 109.9 million in 2016. Growing number of mobile app companies tapping the proximity solutions market, along with increasing investments in the beacon technology, is expected to propel the industry growth.

The introduction of beacons technology has revolutionized the adopters’ operations by driving a new level of customer engagement through personalization. The growth prospects can be attributed to the surging eminence of location-based marketing in the retail industry. Combining the benefits of physical shopping experience with digital ecosystem has become important for brick-and-mortar retailers. Moreover, investments in proximity solutions are witnessing an upward swing, thereby reducing their marketing and advertising costs.

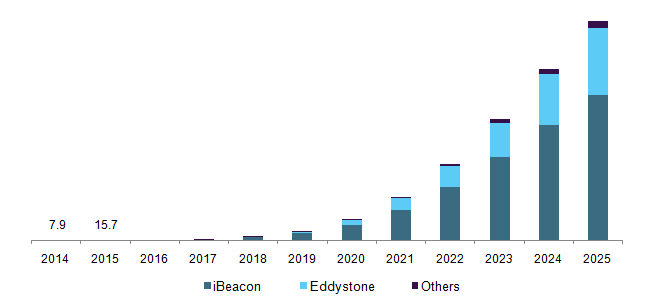

U.S. Bluetooth beacons market, by technology, 2014 - 2025 (USD Million)

The Bluetooth industry has undergone a transformation in the recent years, leading to growth and maturation of the beacons industry. Bluetooth is replacing legacy technologies such as Near Field Communication (NFC) and ZigBee to strengthen beacon solutions. The beacon industry is adapting to accommodate more complex industrial applications. As the initial applications were limited to retail and marketing, the industry is expected to move toward a fragmented market where beacons can specialize in a particular industry vertical.

Furthermore, as beacon solution providers are becoming stable to provide a steady stream of products, several new players are turning toward software solutions, leaving infrastructure and hardware for a relatively smaller group of companies. This industry fragmentation is pivotal to the beacons growth as upcoming beacon products require more nuanced solutions.

Technology Insights

The iBeacon technology dominated the industry in 2016. This growth can be attributed to the need for providing location-based alerts and information to nearby smartphones compatible with the iBeacon protocol. The widespread adoption of products, such as iPads and iPhone, is expected to propel the segment growth over the forecast period.

Furthermore, iBeacons facilitate proximity-based marketing to target customers with personalized messages based on their purchase history. The growing prominence of iBeacon has led to the introduction of several new protocols such as Eddystone and AltBeacon. Moreover, unlike iBeacon, the open source framework of these protocols is expected to drive the industry growth over the next few years.

The large-scale beacon deployment on airports and stadiums is projected to augment the growth of these protocols. Moreover, the extension of Eddystone’s support on Android Chrome browser is expected to propel the industry demand for Android-based proximity solutions. It also enables to track the location and health of beacons with crowd-sourced solutions. Google differentiated its beacon platform from Apple’s iBeacon by positioning the protocol as an open source framework.

End-use Insights

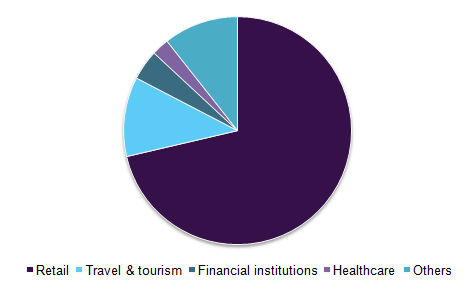

The retail segment captured a revenue share of over 65% in 2016 owing to increasing beacon deployment for enhancing customer experience. Retailers are engaged in improving customer experience by installing in-store beacons to send promotional messages, thereby boosting their sales and efficiency. Bluetooth beacons offer great opportunities for brick-and-mortar retailers as compared to online retailers for increasing their profit margins.

Global Bluetooth beacons market, by end use, 2016 (%)

Brick-and-mortar stores are leveraging technologies such as big data and Bluetooth Low Energy (BLE) to achieve higher conversion rates and greater operating efficiency. For example, Carrefour has deployed an extensive network of iBeacons in all its hypermarket chains in Romania, which monitors consumer behavior and keeps them informed about the products from each department.

Healthcare is another promising sector expected to portray the fastest growth to address the growing need for responding to emergency situations. Though the adoption of beacons in healthcare is in its nascent stage, there exists considerable growth potential on account of the growing need to address streamlining of patient monitoring and management processes. Hospitals are leveraging the technology to provide customized solutions according to the patients’ history and current health conditions.

Regional Insights

North America dominated the Bluetooth beacons market in 2016 due to continuous adoption of the technology in hospitality and retail industries. Offering coupons and increasing trade promotions are becoming a norm in order to drive store sales in the competitive marketplace. This has enabled retailers to provide personalized offers and coupons.

For instance, in stores such as Walmart, Lord & Taylor, Sephora, and Urban Outfitters, shoppers are receiving targeted messages on their smartphones alerting them about personalized coupons. Alex and Ani installed beacons in its stores to optimize product placement and store layouts. The beacon notifies customers about the product information instead of sending promotional messages and coupons.

The MEA region contributed significantly to the industry growth in 2016 due to the increase in organized retail formats along with the increasing smartphone penetration. The need to drive store sales is expected to contribute to the regional growth. Furthermore, beacon deployments are expected to rise with increasing installations at airports and financial institutions.

Bluetooth Beacons Market Share Insight

The key players in the market include Kontakt.io, Onyx Beacon Ltd., Estimote, Inc., Bluvision, Inc., and Accent Advanced Systems, SLU. Key manufacturers are showcasing beacon technology by deploying pilot designs and leveraging mobile adoption. Moreover, vendors are focusing on offering a beacon platform, which assists in both beacon management and campaign. Solution providers are forming partnerships with application developers and end-use industries to expand their product reach. The shifting focus of providing high-quality hardware and the ability and expertise to safely manage large beacon fleets are the key underlying trends among solution providers.

Report Scope

|

Attribute

|

Details

|

|

Base year for estimation

|

2016

|

|

Forecast period

|

2017 - 2025

|

|

Market representation

|

Revenue in USD Million, shipments in Million Units, and CAGR from 2017 to 2025

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, and MEA

|

|

Country scope

|

U.S., Canada, UK, Germany, China, India, Japan, Brazil, and Mexico

|

|

Report coverage

|

Revenue forecast, company share, competitive landscape, growth factors, and trends

|

|

15% free customization scope(equivalent to five analyst working days)

|

If you need specific market information that is not currently within the scope of the report, we will provide it to you as a part of the customization

|

Segments Covered in the Report

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global Bluetooth beacons market based on technology, end use, and region.

-

Technology Outlook (Revenue, USD Million; 2014 - 2025)

-

End-Use Outlook (Revenue, USD Million, 2014 - 2025)

-

Retail

-

Travel & tourism

-

Healthcare

-

Financial institutions

-

Others

-

Regional Outlook (Volume, Million Units; Revenue, USD Million; 2014 - 2025)

-

North America

-

Europe

-

Asia Pacific

-

Latin America

- MEA