- Home

- »

- Communication Services

- »

-

Near Field Communication Market Size, Share Report, 2030GVR Report cover

![Near Field Communication Market Size, Share & Trends Report]()

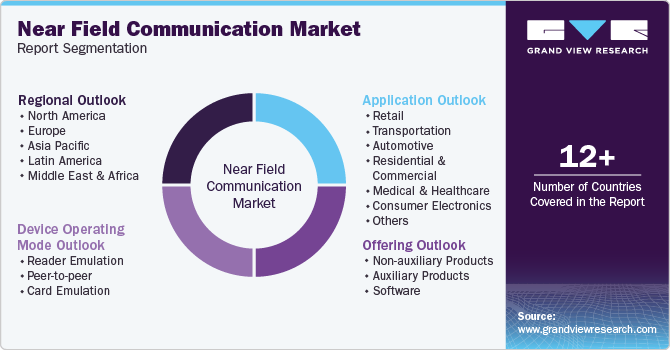

Near Field Communication Market Size, Share & Trends Analysis Report By Device Operating Mode (Reader Emulation, Card Emulation, Peer-to-peer), By Offering (Non-auxiliary, Auxiliary), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-261-7

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

NFC Market Size & Trends

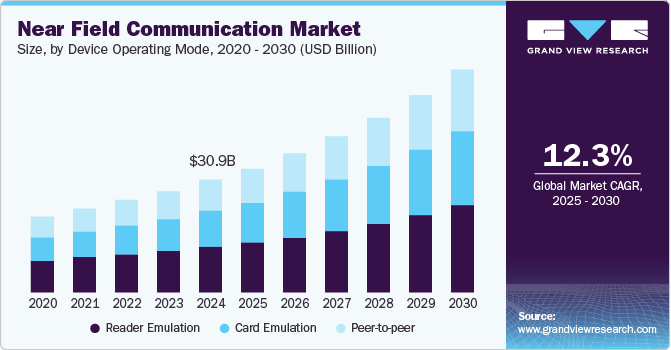

The global near field communication market size was valued at USD 30.85 billion in 2024 and is projected to grow at a CAGR of 12.3% from 2025 to 2030. The leading factor driving industry expansion is the continued growth in the popularity and use of contactless payment solutions, which has considerably increased transactional convenience for both customers and businesses. According to the Connected Experience Report published by SharpEnd in April 2024, organizations are aiming to significantly increase their investments in NFC technology over the coming years. 85% of the brands surveyed stated that they are aiming to integrate near field communication (NFC) technology into their products, with an objective to create personalized customer experience and interactive experience for better brand engagement. The survey also found that the alcoholic beverages sector accounted for the largest proportion of businesses using NFC in their marketing programs.

The increasing adoption of smartphones globally and the frequent use of data transfer tools highlight the importance of near-field communication technology, ensuring seamless and secure transfer of files and documents. NFC is a substantially better and faster technology compared to its conventional counterparts, as it requires only around 100 milliseconds to establish a reliable connection. The modernization of the transportation sector and the rapid emergence of smart ticketing solutions have presented another potential avenue for industry growth. This technology ensures smooth ticketing as well as access management in public transportation networks, enhancing its appeal. Commuters, using their NFC-enabled smart cards or smartphones, can tap on readers at entrance points validate their tickets and gain access to various services. Contactless operation prevents the need to produce physical tickets, reducing line times and creating a comfortable boarding experience for passengers. For instance, the Netherlands has implemented the OVpay contactless payment system for public transport that enable passengers to avail train, metro, and bus services by using their preferred payment methods. The service was launched nationwide in June 2023 in partnership with MasterCard and is expected to introduce a subscription feature in the next phase.

Governments and non-government organizations are aiming to introduce innovations in near-field communications, ensuring further improvements in application areas. For instance, in July 2024, the NFC Forum, an organization that develops and regulates standards for NFC technology, published an overview of the ‘NFC Multi-Purpose Tap’ concept. This next-generation solution is expected to bring more value to consumers and businesses by supporting several actions with a single tap. This helps to optimize convenience in use cases such as point-to-point receipt delivery, identification, loyalty, and total-journey transit ticketing. Some notable examples cited by the organization includes simultaneously receiving retail payments and adding promotions and loyalty points, applying best fare pricing and concessions while purchasing travel tickets, and receiving details regarding the reuse and recycling of a product at the time of purchase.

Device Operating Mode Insights

The reader emulation segment accounted for the largest revenue share of 40.8% in the global NFC market in 2024. Increasing the use of NFC readers to improve customer experience while also helping businesses to enhance their efficiency and productivity is expected to aid segment growth. The NFC reader mode is a hardware mode that enables an NFC device to communicate with a passive NFC tag. This helps the device to easily detect the presence of an NFC tag, seamlessly connect to this tag, and perform NFC operations by using a set of pre-programmed NFC chip commands. NFC readers can effectively communicate between devices, read, and write tags and cards, and can also function with NFC-enabled smartphones. This mode is highly suited for applications such as e-transactions, toll fare collections, network authentication, and e-ticketing for mass transit and public events.

The card emulation segment is anticipated to advance at the fastest CAGR during the forecast period in this market. In this mode, the NFC device functions as a contactless card that can efficiently communicate with a contactless reader device. The widespread use of mobile phones and wearables emulating the functioning of contactless banking cards or tickets is the primary factor driving segment demand. Some notable features of card emulation include SIM card emulation, which allows the carrier’s SIM card to function as a payment card, and host card emulation, which enables a device application to carry out the functions of chip-based security technology to make payments. In August 2024, Apple announced that it would be allowing third-party applications to support contactless payment transactions and other functions using the NFC and Secure Element APIs, starting with iOS 18.1. Other expanded areas of use indicated by Apple include car keys, student IDs, hotel keys, home keys, and event tickets.

Offering Insights

The non-auxiliary products segment accounted for a leading revenue share in the global market in 2024. The rapidly growing use of technologies such as NFC tags, NFC readers, and NFC ICs and antennas has led to the high contribution of this segment. For instance, NFC tags have a wide range of uses, including making contactless payments, wherein these tags securely store credit and debit card information. Moreover, they can be integrated into posters that can be read through a user’s smartphone and generating a response in an appropriate application. In recent years, laundry tracking has been made relatively convenient by using waterproof NFC tags that can monitor individual clothing items. Similarly wedding invites are also increasingly leveraging these solutions to create novelty invitations compared to conventional invitations. Meanwhile, NFC antennas are used to enable short-range wireless communications between NFC-enabled devices, ensuring secure transactions and data exchange, as well as wireless charging.

The software segment is anticipated to expand at the fastest CAGR from 2025 to 2030. The rising use of NFC-enabled smartphones and other devices and technological advancements are expected to boost the contribution of this segment in the coming years. NFC software plays an important role in enabling secure, efficient, and convenient communication between devices. The increasing versatility and incorporation of NFC technology in areas such as payments, data exchange, and marketing has made it an integral part of existing smartphone applications. The popularity of payment processing software such as Google Pay and Apple Pay across both developed and emerging economies, along with the use of various data-sharing applications that utilize near-field communication technology, is expected to encourage the development of innovative software solutions that can enhance the functioning of these applications.

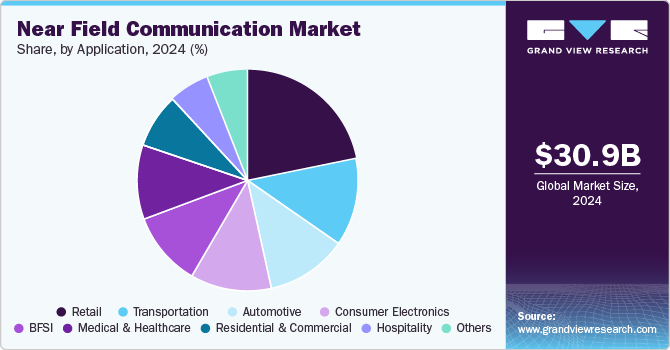

Application Insights

The retail segment accounted for a leading revenue share in the global market in 2024 on account of the rapidly growing usage of contactless payment solutions in this industry. Growing focus among retailers towards offering seamless and convenient experiences to customers by accelerating the checkout process and offering loyalty rewards to ensure customer retention has driven substantial demand for this communication technology over the past few years. NFC can facilitate effective implementation of loyalty programs by allowing customers to store and manage their loyalty cards in mobile wallets. Retailers can also use NFC tags or stickers that customers can scan to earn points or redeem rewards. Additionally, NFC tags are very useful in driving in-store promotions and marketing, as these tags can be placed on product packaging, shelves, or smart posters, allowing customers to access promotional content, product information, or coupons by tapping their phones.

The BFSI segment is anticipated to advance at the fastest CAGR from 2025 to 2030. The increasing demand to improve customer experience and convenience in banking processes, coupled with a strong focus on ensuring the privacy and safety of client data, has compelled market players to develop robust NFC-based solutions. Besides allowing contactless payments, the technology can be used to verify customer identity and prevent financial fraud. The implementation of NFC mobile transactions has led to reduced reliance on the manual handling of physical cards and cash, thus minimizing the risk of errors that could otherwise prove damaging to the financial institution’s credibility and loss-bearing for the customers. NFC technology can be seamlessly integrated with a bank's existing infrastructure. This reduces the need for manual record-keeping and physical documentation leading to an efficient and cost-effective operational model.

Regional Insights

North America near field communication market accounted for a leading revenue share of 32.9% in the global NFC market in 2024. The region is a leading adopter of smartphones and related technologies, such as mobile payments, that has created a well-established and highly competitive market for NFC companies. In Canada and the U.S., digital wallets such as Apple Pay and Google Pay have become widely preferred options for consumers, leading to the extensive utilization of near-field communication technology. A study conducted by Interac, an interbank network in Canada, found a year-on-year increase of 53% between August 2022 and July 2023 with regards to Interac Debit contactless payments conducted at point-of-sales using a mobile device. This highlights the significance of wireless technologies such as NFC in establishing secure and efficient transaction pathways.

U.S. Near Field Communication Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024, led by the growing implementation of NFC technology across verticals such as retail, healthcare, and transportation. The modernization of the transport infrastructure in the economy with the aim of enhancing customer convenience has driven the need to introduce modern ticketing solutions. These solutions help in addressing the drawbacks of physical ticketing, aiding the implementation of NFC-enabled solutions. Besides this factor, widespread digitalization of the country's retail industry has also necessitated the adoption and use of convenient payment solutions among consumers, aiding industry expansion.

Europe Near Field Communication Market Trends

Europe accounted for a significant revenue share in the global market in 2024, aided mainly by the increasing popularity of contactless payment trends in regional economies such as Germany, France, and the U.K. A report published by the European Central Bank in November 2023 stated that around 54% of all card-based payments in this region were contactless during the second half of 2022, highlighting the strong growth potential of this industry.

Asia Pacific Near Field Communication Market Trends

The Asia Pacific region is anticipated to witness the fastest growth in the near field communication market during the forecast period, aided by the rapid urbanization in developing economies such as India and China, coupled with the well-established payment infrastructure in the developed nations of Japan and Australia. Governments across the region are promoting cashless transactions to enhance financial inclusion, which supports the growth of NFC technology. In China, technology-based companies such as Xiaomi, Huawei, and Alipay have promoted extensive use of NFC through their products and services. For instance, Xiaomi uses NFC in its smartphones and other products to realize mobile payments, secure access to different services, and smart home control. With the use of these devices spreading across other economies in the region, the incorporation of NFC is expected to gain a strong pace in Asia Pacific in the coming years.

South Korea is anticipated to advance at the fastest CAGR in the regional market from 2025 to 2030. The implementation of favorable government initiatives to drive the adoption of NFC across various applications, coupled with the presence of companies such as Samsung, SK Telecom, and Korea Telecom, has helped drive advancements in this industry. The popularity of contactless payment among consumers in the economy has further enabled market expansion, with major card networks such as MasterCard and Visa playing a major role in this regard. Reports have stated that the food services, health & social welfare, transportation, and education sectors significantly contribute to the demand for NFC in South Korea.

Key Near Field Communication Company Insights

Some of the major companies involved in the global NFC market include Broadcom, Qualcomm Technologies, and STMicroelectronics.

- Broadcom is a global designer, developer, and supplier of a range of semiconductor devices and solutions. The company operates via two divisions – Infrastructure Software and Semiconductor Solutions. Broadcom provides STB (set-top box) SoCs, wireless LAN access point SoCs, customized silicon solutions, RF semiconductor devices, and fiber optic components.

- QUALCOMM is involved in developing and commercializing wireless technologies for global markets and operates via three segments – Qualcomm Technology Licensing (QTL), Qualcomm Strategic Initiatives (QSI), and Qualcomm CDMA Technologies (QCT). The QCT division is involved in the development and supply of ICs and system software to be utilized in wireless data and voice communications, as well as computing, networking, multimedia, and positional location offerings.

Key Near Field Communication Companies:

The following are the leading companies in the near field communication market. These companies collectively hold the largest market share and dictate industry trends.

- NXP Semiconductors

- Broadcom

- Qualcomm Technologies, Inc.

- SAMSUNG

- Texas Instruments Incorporated

- STMicroelectronics

- Infineon Technologies AG

- Sony Corporation

- Rambus.com

- Apple Inc.

Recent Developments

-

In July 2024, NXP Semiconductors and the BMW Group received the CCC Digital Key certification from the Car Connectivity Consortium, which forms standards to advance the development of vehicle-to-device (V2D) connectivity solutions. NXP has been certified for its secure element (SE) and NFC chipsets in its digital key offering, which allows the use of an NFC-enabled device to access and start a car.

-

In April 2024, STMicroelectronics introduced its ST25R100 near-field communication (NFC) reader, which offers low power and high signal quality operations through the integration of advanced features.

Near Field Communication Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 34.26 billion

Revenue forecast in 2030

USD 61.23 billion

Growth rate

CAGR of 12.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device operating mode, offering, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

NXP Semiconductors; Broadcom; Qualcomm Technologies, Inc.; SAMSUNG; Texas Instruments Incorporated; STMicroelectronics; Infineon Technologies AG; Sony Corporation; Rambus.com; Apple Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Near Field Communication Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global near field communication market report based on device operating mode, offering, application, and region

-

Device Operating Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Reader Emulation

-

Peer-to-peer

-

Card Emulation

-

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Non-auxiliary Products

-

NFC ICs & Antennas

-

NFC Tags

-

NFC Readers

-

-

Auxiliary Products

-

NFC Micro-SD Cards

-

NFC SIM/UICC Cards

-

NFC Covers

-

-

Software

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

Transportation

-

Automotive

-

Residential & Commercial

-

Medical & Healthcare

-

Consumer Electronics

-

BFSI

-

Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."