- Home

- »

- Clinical Diagnostics

- »

-

Breast Cancer Core Needle Biopsy Market Size Report, 2030GVR Report cover

![Breast Cancer Core Needle Biopsy Market Size, Share & Trends Report]()

Breast Cancer Core Needle Biopsy Market Size, Share & Trends Analysis Report By Technology, By End-use (Hospitals & Diagnostic Laboratories, Academic & Research Institutes), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-161-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

The global breast cancer core needle biopsy market was valued at USD 776.97 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. The market is rapidly expanding, driven by factors such as the increasing prevalence of breast malignancies and advancements in imaging technologies and biopsy techniques. Core needle biopsies offer multiple advantages over traditional surgical procedures, including less invasive procedures, faster recovery, and cost-effectiveness. With its crucial role in early detection and improved patient outcomes, the demand for core needle biopsies is expected to rise further as global awareness about early detection increases.

In 2021, the World Health Organization (WHO) introduced the Global Breast Cancer Initiative (GBCI) Framework, an innovative and proactive strategy designed to tackle the escalating challenge of cancer. This pioneering framework presents a visionary roadmap with the ambitious goal of saving 2.5 million lives from breast cancer by 2040. With over 2.3 million cases occurring annually, breast cancer is the most prevalent among adults and remains the primary cause of female cancer-related deaths in a striking 95% of countries.

The impact of the disease extends beyond individual patients, leaving a profound and devastating legacy for future generations. Shockingly, a poignant study conducted by the International Agency for Research on Cancer in 2020 revealed that approximately one million children were orphaned due to cancer, with a significant 25% of these cases directly associated with breast cancer.

In low-resource settings, the conventional approach of mastectomy for breast tumor treatment is being replaced by less invasive lumpectomy, this is due to advancements in diagnostic techniques such as mammography and biopsy. Researchers are actively working on innovative solutions for early detection, including the development of a reusable, cost-efficient, and sterile core biopsy device in Johns Hopkins University, which won the Lemelson-MIT prize. Core needle procedure, widely used for analyzing non-palpable tumors, allows for precise tissue sample extraction with an impressive accuracy rate of approximately 90%.

The integration of molecular analyses with core needle biopsy techniques enables the profiling of proteins and genetic alterations in tumor tissues, facilitating personalized treatment strategies and evaluating individual responses to therapy. The PrecisionCore device, combining advanced imaging technology with core needle biopsy procedures, offers real-time ultrasound guidance and precise targeting capabilities, enabling accurate tissue sample extraction. These developments hold great promise in improving breast-related malignancies diagnosis and treatment outcomes in low-resource settings.

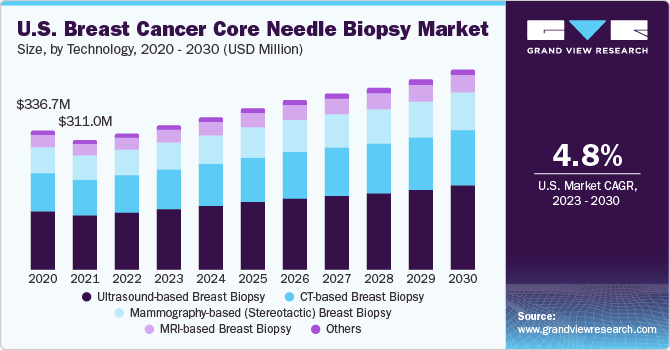

Technology Insights

Ultrasound-based breast biopsy segment held the largest share of 41.26% in the global market in 2022 and is estimated to expand at the fastest CAGR over the forecast period. The dominance of the segment is attributed to the increasing adoption of ultrasound-based biopsies due to its superior benefits. In addition, an increasing number of product launches along with product approvals are also expected to have a positive impact on the segment growth.

For instance, in April 2021, Mammotome announced the launch of its advanced HydroMARK breast biopsy site marker which enables long-term visibility of ultrasound. Furthermore, in August 2022, TransMed7, LLC introduced its first breast biopsy device, called SpeedBird. The device enables image-guided biopsy with better ease. Such industrial developments are also expected to drive the segment growth.

The CT-based segment held the second largest market share and the growth is attributed to the rising technological advancements in CT breast biopsy and the growing accessibility of the technology. Moreover, increasing research and development activities are also estimated to have a positive impact on the segment growth. FDG PET/CT and FES PET/CT have also been proven to augment the treatment and diagnostic landscape for metastatic breast malignancies.

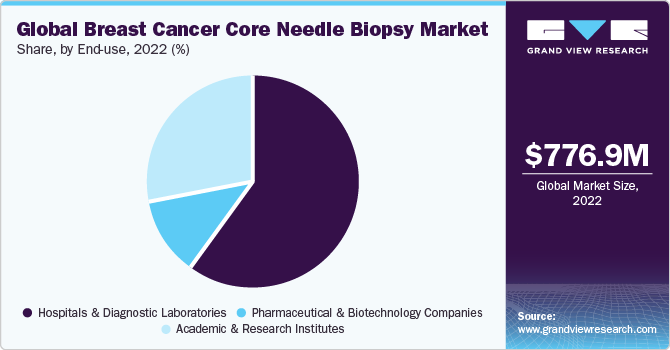

End-use Insights

The hospitals & diagnostic laboratories segment held a significant share of 59.38% in the market in 2022. A growing number of patient visits in hospitals coupled with the increasing adoption of novel instruments and equipment in facilities are expected to offer a favorable environment for segment growth. Moreover, the segment is also projected to register the fastest CAGR during the forecast period due to rapidly increasing installation of biopsy instruments. For instance, in July 2021, five major hospitals in the U.S. installed GE Healthcare’s advanced biopsy solution, Serena Bright. Such developments are expected to have a positive impact on segment growth.

The academic & research institutes segment is estimated to expand at substantial growth over the forecast period. Increasing investments in academic centers to boost research activities is likely to accelerate the segment growth. For instance, in October 2023, the Bren Simon Comprehensive Cancer Center and Indiana University Melvin received funding of USD 2.2 million for metastatic breast cancer research.

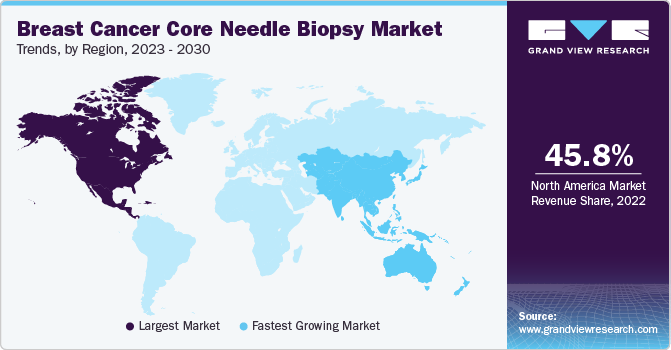

Regional Insights

North America accounted for the largest share of the market for breast cancer core needle biopsy in 2022 of around 45.83% of the global market size. This strong market leadership reflects the region's advanced healthcare systems, extensive research capabilities, and focused efforts to raise awareness among patients, all of which work together to improve the early detection and effective management of breast cancer. Notable medical institutions and diagnostic centers in the United States and Canada consistently emphasize the importance of regular screenings. For instance, the Mayo Clinic, recognized as a Specialized Program of Research Excellence (SPORE) for breast cancer research by the National Cancer Institute, highlights the significance of such efforts. These initiatives not only lead to higher adoption rates but also position North America at the forefront of this market.

One key aspect of North America's leadership in breast cancer core needle biopsies involves incorporating artificial intelligence (AI) into diagnostic processes. Throughout the region, AI-powered tools are used to assist pathologists in accurately interpreting biopsy results, reducing subjectivity and potential errors. This technological advancement enhances diagnostic accuracy and underscores the region's commitment to innovative solutions for better healthcare outcomes. Asia Pacific is expected to expand at the fastest rate during the forecast period. This can be attributed to the increasing prevalence of the disease and the rising demand for novel technologies.

Key Companies & Market Share Insights

The market is experiencing notable growth driven by the increasing demand for core needle biopsy procedures in breast cancer diagnosis and treatment. This presents significant opportunities for major players to capitalize on. Key market participants are proactively pursuing strategic initiatives such as mergers, acquisitions, and collaborations to enhance their market share and cater to the rising demand for core needle biopsy products and services.

For instance, in January 2023, NovaScan, a Chicago-based oncology company, launched a human GI clinical trial for its nsCanary device at the Texas International Endoscopy Center. The nsCanary device aims to aid clinicians in detecting cancer in tissue obtained from different methods, including EUS, fine needle biopsy, biopsy forceps, and polypectomy snare, with the goal of advancing cancer diagnostics and enhancing treatment decisions in gastrointestinal conditions.

Key Breast Cancer Core Needle Biopsy Companies:

- Intact Medical Corporation

- Ethicon Surgical Technologies

- Gallini SRL

- Leica Biosystems Nussloch GmbH

- Hologic, Inc.

- Argon Medical Devices

- Encapsule Medical Devices LLC

- Cook Medical Incorporated

- Becton, Dickinson and Company

- C.R. Bard, Inc.

Breast Cancer Core Needle Biopsy Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 822.01 million

Revenue forecast in 2030

USD 1.15 billion

Growth rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Intact Medical Corporation; Ethicon Surgical Technologies; Gallini SRL; Leica Biosystems Nussloch GmbH; Hologic, Inc.; Argon Medical Devices; Encapsule Medical Devices LLC.; Cook Medical Incorporated; Becton, Dickinson and Company; C.R. Bard, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

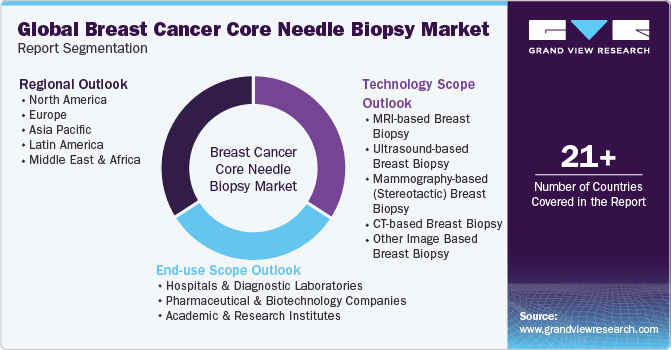

Global Breast Cancer Core Needle Biopsy Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global breast cancer core needle biopsy market report based on technology, end-use, and region.

-

Technology Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

MRI-based Breast Biopsy

-

Ultrasound-based Breast Biopsy

-

Mammography-based (Stereotactic) Breast Biopsy

-

CT-based Breast Biopsy

-

Other Image Based Breast Biopsy

-

-

End-use Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Diagnostic Laboratories

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutes

-

-

Regional Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global breast cancer core needle biopsy market size was estimated at USD 776.97 million in 2022 and is expected to reach USD 822.01 million in 2023.

b. The global breast cancer core needle biopsy market is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 1.15 billion by 2030.

b. North America dominated the breast cancer core needle biopsy market with a share of 45.83% in 2022. This is attributable to region's advanced healthcare systems, extensive research capabilities, and focused efforts to raise awareness among patients, all of which work together to improve the early detection and effective management of breast cancer

b. Some key players operating in the breast cancer core needle biopsy market include Intact Medical Corporation, Ethicon Endo Surgery, Galini SRL, Leica Biosystems Nussloch GmbH, Hologic Inc., Argon Medical Devices, Encapsule Medical Devices LLC., Cook Medical Incorporated, Becton & Dickinson Company, C.R. Bard, Inc

b. Key factors that are driving the market growth include increasing prevalence of breast malignancies and advancements in imaging technologies and biopsy techniques

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."