- Home

- »

- Healthcare IT

- »

-

AI In Cancer Diagnostics Market Size, Industry Report, 2030GVR Report cover

![AI In Cancer Diagnostics Market Size, Share & Trends Report]()

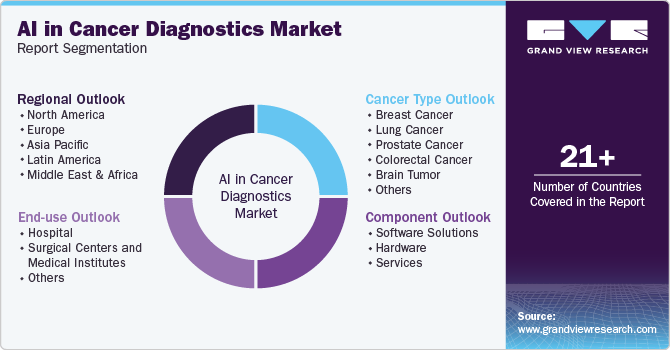

AI In Cancer Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software Solutions, Hardware, Services), By Cancer Type, By End-use (Hospitals, Surgical Centers and Medical Institutes), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-988-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

AI In Cancer Diagnostics Market Summary

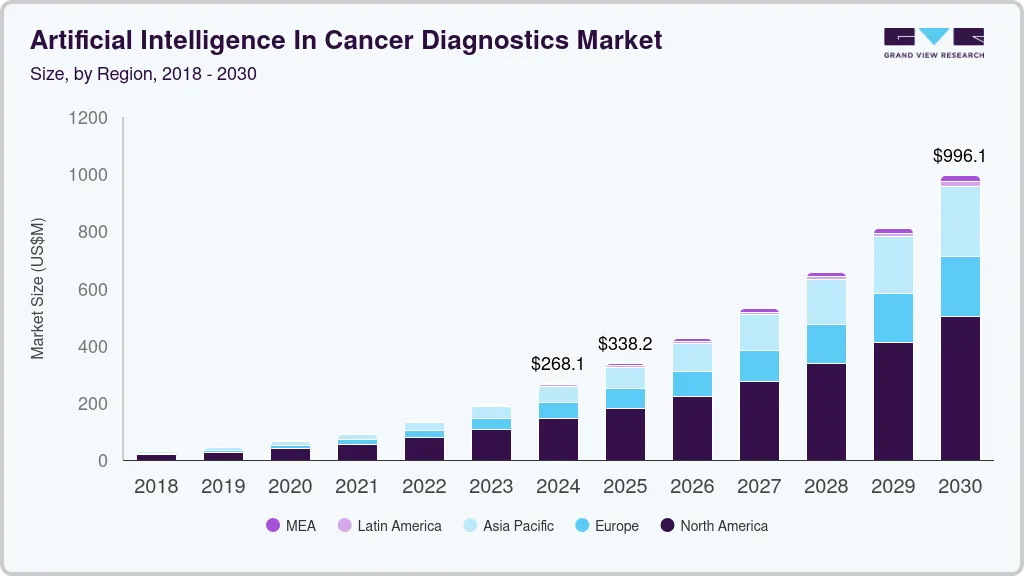

The global artificial intelligence in cancer diagnostics market size was estimated at USD 268.1 million in 2024 and is projected to reach USD 996.1 million by 2030, growing at a CAGR of 24.1% from 2025 to 2030. The growth is attributed to the rising healthcare IT expenditure globally, the shortage of healthcare professionals, and the increasing demand for early detection and classification of diseases.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, U.S. held the largest revenue share in 2024.

- In terms of segment, the software solutions dominated the market with a revenue share of 44.39% in 2024.

- Surgical centers and medical institutes are expected to exhibit the highest CAGR from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 268.1 Million

- 2030 Projected Market Size: USD 996.1 Million

- CAGR (2025-2030): 24.1%

- North America: Largest market in 2024

Moreover, growing government initiatives coupled with the rising number of startups & collaborations and increasing venture capital funding. Cancer diagnosis and treatment have significantly developed over the last decade. The increasing use of technologically advanced solutions for detecting cancer, majorly at early stages, contributes to market growth.

Researchers have been developing artificial intelligence (AI) based tools that have great potential in making imaging more accurate, faster, and informative. The use of AI in oncology is growing, thereby providing healthcare institutions and professionals with better tools for cancer management. Constantly emerging solutions with the help of AI and a better diagnosis rate are anticipated to support adoption, thereby improving the competitive landscape. For instance, as per an article published in News Medical in November 2022, a novel AI-based blood testing technology, DELFI, successfully detects more than 80% of liver cancers.

The U.S. government launched the Cancer Moonshot initiative to minimize cancer-related mortality by half within 25 years. To encourage investment in AI data analysis, the Moonshot program aims to establish a nationwide ecosystem for sharing and analyzing data that includes patients, doctors, and researchers. To expedite research efforts and remove roadblocks to progress by improving data availability, Cancer Moonshot is expected to encourage cooperation among researchers, physicians, philanthropies, patients & patient advocates, and biotechnology & pharmaceutical businesses.

In pathology, which comprises large datasets of multiple types and subtypes of disease biomarkers and specimens, it can be particularly exhausting and complicated for a human pathologist to keep up with changes. AI-based systems can work constantly and can be trained to document & study several specimens. Moreover, integrating AI in pathology with large datasets of biomarkers and genomics can help reduce the pathologist’s role in providing an accurate & efficient diagnosis. Researchers emphasize that AI-based pathology tools could help clinicians competently diagnose and treat cancers that might go undetected by traditional methods.

For instance, in January 2024, researchers at Perelman School of Medicine (University of Pennsylvania) introduced Inferring Super-Resolution Tissue Architecture (iStar) to deliver detailed views of individual cells and a comprehensive understanding of a patient’s gene function. It helps clinicians detect cancer cells that might go unnoticed through traditional pathology and imaging methods.

Furthermore, the COVID-19 pandemic accelerated the adoption of AI technologies in healthcare, driving demand for advanced solutions to improve diagnostic accuracy and efficiency. AI and machine learning (ML) algorithms were widely integrated to detect cancer biomarkers and diagnostic findings rapidly. These systems were trained on datasets, including pathological results, chest CT images, MRI scans, symptoms, and exposure history, enabling faster and more accurate cancer diagnosis.

Case Study

-

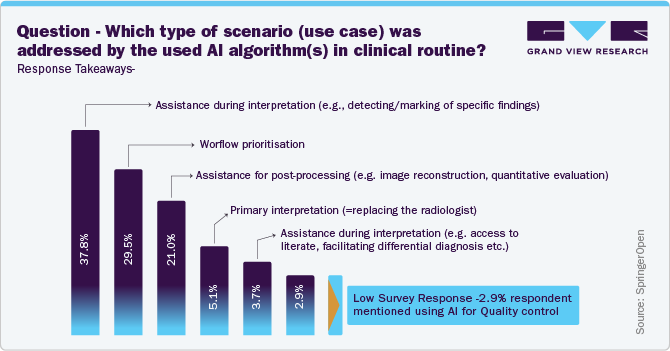

As noted below in the bar chart, a survey was conducted in June 2022 among members of the European Society of Radiology (ESR) about their practical experience with AI-powered tools.

-

The data reveals that a total of 276 people with hands-on clinical experience in AI were surveyed. The survey indicates the number of respondents who use one or more algorithms to assist with either diagnostic interpretation or workflow prioritization.

The figure above illustrates various use case scenarios, with the most frequent one being the assistance during detection or marking of specific findings such as nodules, embolic, and others.

Market Concentration & Characteristics

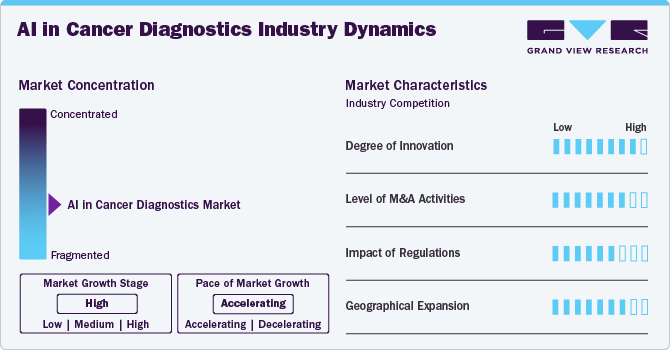

Technological advancements driven by the increasing demand for early and accurate cancer detection, improving patient outcomes, further results in significant innovations. The growing availability of large medical datasets and advancements in ML algorithms enhance AI's ability to analyze complex imaging and clinical data. In September 2024, Ibex Medical Analytics introduced new advancements to its AI-driven product platform, developed in collaboration with expert pathologists worldwide. The platform's widely deployed AI algorithms, already known for accuracy and robustness in clinical pathology, have been refined using large, diverse datasets and insights from international experts. Validated by live customers and clinical studies, the improved algorithms offer enhanced reliability and versatility across various tissue types, including breast, prostate, and gastric, identifying numerous tissue morphologies.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in June 2024, Quest Diagnostics acquired PathAI, Inc. Diagnostics from PathAI, Inc. The acquisition aims to accelerate the adoption of AI and digital pathology, enhancing the accuracy and efficiency of cancer and disease diagnosis.

The industry has a significant impact of regulations, which are overlooked by several regulatory bodies, as per the region. For instance, the FDA issued a guidance draft in April 2023 to establish a regulatory framework for AI/ML-based devices. The draft outlines the least burdensome approach for continuously improving ML-based Device Software Functions (ML-DSF). The aim is to enhance patient access to secure and effective AI/ML-based devices, ensuring the promotion and protection of general health.

The industry's regional expansion activities are moderate, driven by an increasing demand for AI in cancer diagnostics market in the emerging nations. For instance, in March 2018, Microsoft announced expansion of its healthcare initiative in India by using AI. The new initiative by Microsoft and Apollo Hospital was to create new machine learning AI algorithms in cardiology segment to help doctors structure data and use algorithms to begin treatment while the disease is in the nascent stage.

Component Insights

Based on component, the software solutions segment dominated the market with a revenue share of 44.39% in 2024 and is expected to witness the fastest growth rate during the forecast period. The market growth can also be attributed to rising number of entrepreneurial startups that provide innovative solutions for treatment and accurately predicting cancer. For instance, Concr, a UK-based startup, offers a software platform that uses a machine learning technique that works on a deep understanding of scientific projection to predict tumor progression and helps accurately predict cancer evolution in response to treatment.

Services segment is anticipated to grow at a significant CAGR over the forecast period. Growth of the services segment can be majorly attributed to rising need for integration and implementation of AI solutions, support & maintenance, training, and education. In addition, rising adoption of AI platforms has driven the demand for support and maintenance services imperative to keep the devices functional.

Cancer Type Insights

Based on cancer type, breast cancer had a significant revenue share of 19.41% in 2024. According to the data published by the American Cancer Society, breast cancer is the most common type of cancer in the U.S., except for skin cancer. Breast cancer affects about one in three women in the U.S. Moreover, according to WHO, in 2020, over 2.3 million breast cancer cases were detected. It resulted in approximately 685,000 deaths globally. The rising demand for early cancer diagnosis is one of the key factors propelling market growth. Furthermore, WHO has recommended that countries promote programs for early detection of breast cancer, which will help detect at least 60% of early-stage breast cancer.

Brain Tumor segment is expected to grow at the fastest CAGR during the forecast period. According to an article by International Association of Cancer Registries, more than 28,000 new cases of brain tumors are reported every year in India, driving the segment growth. Furthermore, the availability of various AI solutions for diagnosing several types of brain tumors is expected to further drive the adoption of these solutions. For instance, Deep Convolutional Neural Network is an AI algorithm that aids physicians in predicting and diagnosing more than 10 types of brain tumors within minutes at the patient’s bedside with improved accuracy as compared to other conventional techniques.

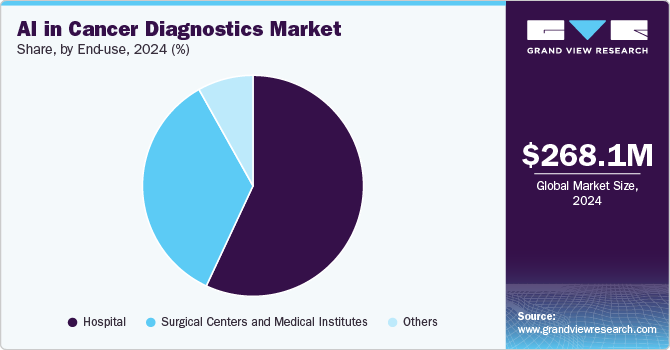

End-use Insights

Hospital segment dominated the market with the largest revenue share of 56.95% in 2024. Technological advancements in the healthcare sector have increased over recent years. The market dominance is attributed to the rising adoption of AI-powered solutions by hospitals, the increasing number of companies entering the market to cater to cancer care in hospitals, and positive responses from patients, the market is anticipated to grow significantly during the forecast period. For instance, in February 2024, Qritive collaborated with Metropolis Healthcare in Rajiv Gandhi Cancer Institute and CŌRE Diagnostics (India) to offer its Pantheon Image Management System (IMS) and other AI-powered tools in cancer management.

Surgical centers and medical institutes segment is expected to grow at the fastest CAGR from 2025 to 2030. AI and machine learning-powered algorithms hold numerous applications in surgery & surgical simulation. In surgical centers, it is useful in preoperative planning of cancer surgeries, such as brain surgery, dermatoscopy, and robotic-assisted surgery. Medical institutes utilize these platforms for training and assessment of students. Thus, these are some factors driving the adoption of AI-powered platforms by surgical centers and medical institutes.

Regional Insights

North America AI in cancer diagnostics market dominated in 2024 with the largest share of 54.74%. Growing government initiatives and business strategies, including mergers & acquisitions, portfolio expansions, and collaborations by market players to promote AI implementation in the oncology field, are contributing to the accelerated growth in the region. For instance, in May 2021, the U.S. government initiated AI.gov, a dedicated website aimed at soliciting ideas regarding the regulation, development, and application of AI in the U.S. This platform was introduced under the administration of President Joe Biden.

U.S. AI in Cancer Diagnostics Market Trends

The AI in cancer diagnostics market in the U.S. held the largest revenue share in 2024. This can be attributed to rising demand for AI to transform the world of medicine and assist healthcare professionals in reshaping the diagnosis & treatment of cancer. Increase in demand for AI in medical imaging is also boosting the market growth. The AI-powered medical imaging systems produce scans that assist radiologists in identifying patterns & indicating treatments for patients affected with cancer.

Europe AI in Cancer Diagnostics Market Trends

The AI in cancer diagnostics market in Europe is poised to grow at a significant CAGR over the forecast period. Healthcare systems in Europe are overburdened due to increasing costs, rising incidence of cancer cases, increasing demand for healthcare facilities, and stagnating or shrinking healthcare workforce. The industry also faces issues due to structural inefficiencies in certain European countries. The move to value-based healthcare is expected to strengthen patient outcomes at a more sustainable cost. Incorporating AI into innovative medical technologies can help address the pressing healthcare issues. In addition, increasing investments in AI in healthcare are driving the market growth.

The AI in cancer diagnostics market in the UK is expected to grow significantly over the forecast period. The UK government is spearheading initiatives to promote AI applications in various aspects of oncology. For instance, in October 2023, the government granted USD 22.7 million to 64 NHS trusts in England, facilitating AI applications in diagnosing and treating lung cancer. These AI tools aid NHS staff in analyzing X-rays and CT scans, supporting clinicians with quicker and more precise diagnoses, given the monthly volume of over 600,000 chest X-rays in England.

The AI in cancer diagnostics market in Germany is expected to grow substantially over the forecast period. Several investments in the field of AI in healthcare have positively influenced market growth. For instance, investments by venture capital firm High-Tech Gründerfonds, which has made around 489 investments worth USD 942 billion in high-tech startups in areas such as robotics & virtual reality, have fueled growth of the market. Moreover, Merantix, a Germany-based AI research lab, builds machine learning companies in several fields, including healthcare. The company has developed an AI algorithm that analyzes mammogram X-rays and detects abnormalities & signs of cancer with reliable accuracy.

Asia Pacific AI in Cancer Diagnostics Market Trends

The AI in cancer diagnostics market in Asia Pacific is expected to grow significantly over the forecast period. Increasing patient pool, growing acceptance of cloud computing, and rising number of government programs supporting AI are among the factors primarily driving the market growth. For instance, in June 2020, the Australian government granted St Vincent’s Institute of Medical Research a fund of around USD 2.3 million for breast cancer screening research using AI solutions.

The AI in cancer diagnostics market in China is poised to grow substantially over the forecast period. China is increasing application of AI in healthcare system, which is rapidly improving disease diagnosis and treatment accuracy in country-level hospitals. Various startups are investing in AI in healthcare to enhance this sector for patients and doctors. For instance, Beijing-based startup PereDoc has developed AI software that can parse CT scans and discover potential nodules, especially in lung scans.

Key AI In Cancer Diagnostics Company Insights

The global AI in cancer diagnostics market is highly competitive, with the presence of key players such as Cancer Center.ai, Microsoft, Tempus AI, Inc., and FLATIRON HEALTH, among others. Key players are involved in new product launches, acquisitions, and partnerships to gain a competitive edge in the market.

Key AI In Cancer Diagnostics Companies:

The following are the leading companies in the AI in cancer diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- EarlySign

- Cancer Center.ai

- Microsoft

- FLATIRON HEALTH

- PathAI, Inc.

- Therapixel

- Tempus AI, Inc.

- Paige AI Inc.

- Kheiron Medical Technologies Limited

- SkinVision

Recent Developments

-

In October 2024, Microsoft introduced innovations within Microsoft Cloud for Healthcare to improve care experiences, improve team collaboration, and empower healthcare workers. Developed in partnership with Paige.ai and Providence, the AI models help healthcare organizations integrate and analyze diverse data types, such as genomics, medical imaging, and clinical records, for improved clinical and operational insights.

““The development of foundational AI models in pathology and medical imaging is expected to drive significant advancements in cancer research and diagnostics. These models can complement human expertise by providing insights beyond traditional visual interpretation and, as we move toward a more integrated, multimodal approach, will reshape the future of medicine.”

~Carlo Bifulco, MD, chief medical officer of Providence Genomics and a co-author of the Prov-GigaPath study

-

In September 2024, PathAI, Inc. introduced MET Predict on the AISight Image Management System (IMS). This AI-powered algorithm aids pathologists in identifying non-small cell lung cancer (NSCLC) tumors that may exhibit MET exon 14 skipping (METex14) or MET amplification directly from H&E whole slide images.

“The integration of MET Predict into AISight marks a significant leap forward in utilizing AI to enhance the efficiency of NSCLC tumor assessments, particularly in identifying those with potential genetic alterations. By providing rapid and precise biomarker insights directly from H&E images, MET Predict equips pathologists with the essential information needed to drive timely and accurate NSCLC evaluations.”

-Andy Beck, MD, PhD, co-founder and CEO of PathAI, Inc.

-

In October 2022, Tempus AI, Inc. launched Tempus AI, Inc.+, enhancing collaborative precision oncology research using real-world data. Tempus AI, Inc.+ houses multiple, renowned healthcare & research institutes to advance research.

AI In Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 338.18 million

Revenue forecast in 2030

USD 996.12 million

Growth rate

CAGR of 24.12% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, cancer type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

EarlySign; Cancer Center.ai; Microsoft; FLATIRON HEALTH; PathAI, Inc.; Therapixel; Tempus AI, Inc.; Paige AI Inc.; Kheiron Medical Technologies Limited; SkinVision

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Artificial Intelligence (AI) In Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global AI in cancer diagnostics market report based on component, cancer type, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software Solutions

-

Hardware

-

Services

-

-

Cancer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Cancer

-

Lung Cancer

-

Prostate Cancer

-

Colorectal Cancer

-

Brain Tumor

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Surgical Centers and Medical Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global artificial intelligence in cancer diagnostics market was valued at USD 268.06 million in 2024, and it is expected to reach 338.18 million in 2025.

b. The global artificial intelligence in cancer diagnostics market is expected to grow at a compound annual growth rate of 24.12% from 2025 to 2030 to reach USD 996.12 million by 2030.

b. North America held the largest revenue share of 54.74% in 2024. This is attributed to the growing government initiatives and business strategies, including mergers & acquisitions, portfolio expansions, and collaborations by market players to promote AI implementation in the oncology field, are contributing to the accelerated growth in the region.

b. Some key players operating in the AI in cancer diagnostics market include Medial EarlySign; Cancer Center.ai; Microsoft; Flatiron Health, Inc.; PathAI; Therapixel; Tempus; Paige AI Inc.; Kheiron Medical Technologies Limited; SkinVision

b. Key factors that are driving the market growth are growing cancer prevalence, increasing healthcare IT expenditure, advancements in AI algorithms, and the increasing demand for early detection and classification of diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.